liquidity reigns supreme. It’s the lifeblood of smooth transactions, a measure of how easily an asset can be bought or sold at a fair price. Imagine a bustling marketplace overflowing with goods – that’s liquidity in action. For forex traders, where timing and execution are crucial, liquidity plays a central role in their success.

A highly liquid market boasts a vast pool of buyers and sellers willing to trade at current prices. This translates to tight spreads, the difference between the buying and selling price of a currency pair. Tight spreads signify low transaction costs for forex traders, allowing them to enter and exit positions efficiently. Conversely, a market with low liquidity suffers from a limited pool of participants. This can lead to wider spreads, increasing transaction costs and potentially impacting profit margins for traders. Beyond transaction costs, liquidity also influences market volatility. Highly liquid markets tend to be more stable, with price movements occurring in smaller increments due to the constant balancing act of supply and demand. Conversely, low liquidity can exacerbate price swings, making the market more volatile and potentially riskier for traders navigating the ever-changing forex landscape. Let’s dive deeper into the concept of liquidity, explore its importance in forex trading, and understand how it impacts your trading decisions.

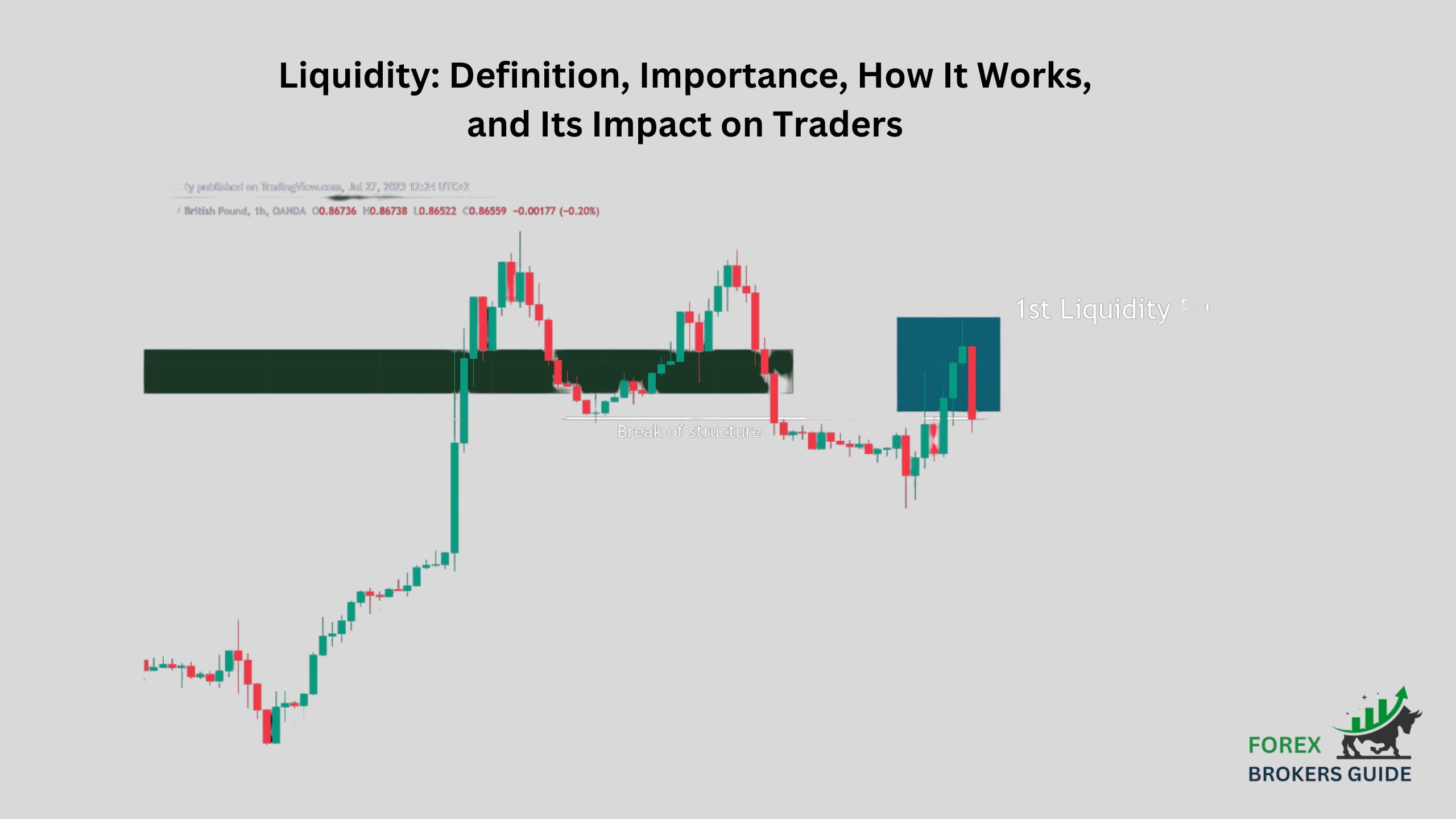

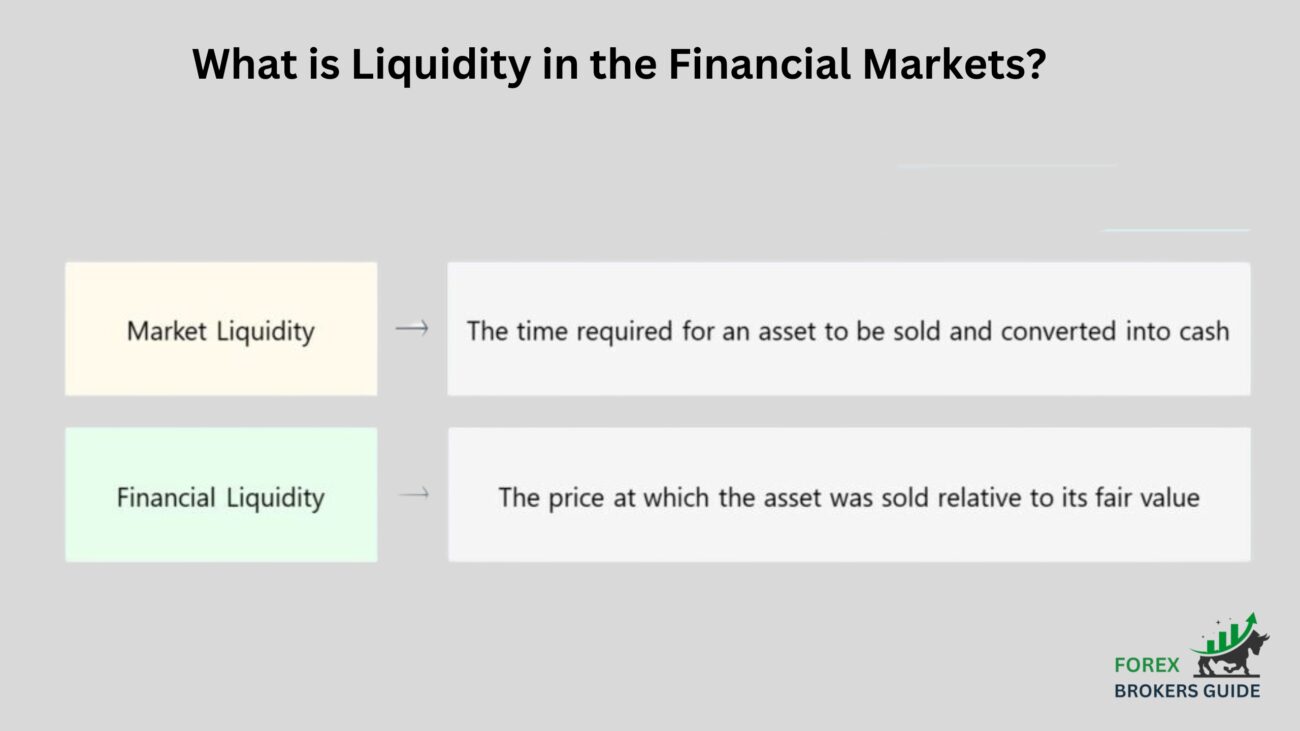

What is Liquidity in the Financial Markets?

Liquidity signifies the depth and breadth of a market, referencing both the number of participants willing to trade and the volume of assets being readily bought and sold. It essentially reflects the ease and speed with which an asset can be converted into cash at a fair market price. Imagine a thriving marketplace teeming with buyers and sellers actively exchanging goods. This bustling environment exemplifies a highly liquid market.

Consider the difference between buying and selling a common stock like Apple (AAPL) versus a rare collectible coin. AAPL is a highly liquid asset. Millions of shares trade hands daily, ensuring a readily available pool of buyers and sellers. This translates to tight bid-ask spreads (the difference between the buying and selling price) and the ability to enter or exit a position quickly with minimal impact on the price.

On the other hand, a rare collectible coin might be much less liquid. While valuable, there may be a limited number of potential buyers interested in this specific coin at any given time. This can lead to wider bid-ask spreads and difficulty finding a buyer quickly, potentially forcing you to accept a lower price if you need to sell urgently.

How Liquidity is Measured in Financial Markets?

Liquidity, the lifeblood of smooth transactions in financial markets, can be a complex concept to quantify. Unlike measuring physical properties like weight or length, liquidity is a multifaceted concept influenced by various factors. However, financial professionals and market participants rely on a combination of metrics to gauge the liquidity of an asset or market. Let’s delve into some key methods used to assess liquidity:

1. Transaction Cost Measures:

These metrics focus on the cost associated with buying or selling an asset. Tighter bid-ask spreads, the difference between the buying and selling price, indicate higher liquidity. A narrow spread signifies lower transaction costs for traders entering or exiting positions. Conversely, wider spreads suggest lower liquidity, as finding a counterparty willing to trade at your desired price might be more difficult.

Order book depth also plays a role. This refers to the number and size of buy and sell orders currently listed at different price levels in an electronic order book. A deeper order book with a significant volume of orders on both the buying and selling sides suggests higher liquidity. Imagine a marketplace teeming with buyers and sellers – a deeper order book reflects this bustling environment.

2. Volume-Based Measures:

Here, the focus shifts to the actual activity within a market. Trading volume, the total amount of an asset traded within a specific timeframe, is a straightforward indicator of liquidity. Higher trading volume suggests a more liquid market with a constant flow of buy and sell orders. The turnover ratio takes this concept a step further. It divides the average daily trading volume by the total outstanding shares (for stocks) or the average daily trading value by the total market capitalization (for markets). A higher turnover ratio indicates a larger portion of the asset is being actively traded, signifying higher liquidity.

3. Equilibrium Price-Based Measures:

These metrics look at how an asset’s price reacts to changes in the market. Implied volatility, a market-derived measure of expected future price fluctuations, can be an indicator of liquidity. Lower implied volatility suggests a more liquid market where prices are less likely to experience significant swings due to the constant balancing act of supply and demand.

4. Market-Impact Measures:

Finally, some metrics assess how easily a large order can be executed without affecting the market price. Order execution shortfall measures the difference between the requested order size and the actual amount filled at the desired price. A smaller shortfall indicates higher liquidity, as traders can execute their orders closer to their desired price point without significantly impacting the market.

Why is Liquidity so Important for the Smooth Functioning of Financial Markets?

Imagine a financial market sluggish and unresponsive, orders taking an eternity to fill, and prices fluctuating wildly. This nightmarish scenario highlights the critical role liquidity plays in ensuring the smooth operation of financial markets.

At its core, liquidity fosters efficient price discovery. A highly liquid market boasts a vast pool of buyers and sellers constantly interacting and placing orders. This continuous exchange of information leads to prices that accurately reflect current market sentiment. Without sufficient liquidity, price discovery becomes sluggish, and assets might not trade at their true fair value.

Furthermore, liquidity facilitates seamless execution of trades. Tight bid-ask spreads, a hallmark of a liquid market, translate to lower transaction costs for market participants. This allows traders, especially those in fast-paced environments like forex, to enter and exit positions quickly and efficiently without incurring excessive costs. Conversely, low liquidity can lead to wider spreads, potentially squeezing profits or creating challenges for traders looking to execute large orders.

Finally, liquidity promotes market stability. A deep and liquid market acts as a buffer against sudden shocks or imbalances in supply and demand. With a large pool of participants, temporary fluctuations can be absorbed more readily, preventing extreme price swings and fostering a more predictable trading environment.

What are the Factors that can influence Liquidity in the Forex Market?

The ever-churning forex market, the largest financial market globally, thrives on liquidity. But what exactly influences how easily and efficiently currencies can be bought and sold? Several factors play a currency pair’s liquidity game:

- Market Participants: The sheer number and diversity of participants in the forex market significantly impact liquidity. Major currencies like the US dollar (USD), Euro (EUR), and Japanese Yen (JPY) tend to be more liquid due to their involvement in a vast network of international trade and investment. A wider range of participants, from large banks and institutional investors to retail traders, contributes to a deeper order book and tighter spreads for these major currency pairs.

- Economic Factors: The economic health of the countries involved in a currency pair directly affects its liquidity. Currencies tied to strong, stable economies with robust growth prospects generally enjoy higher liquidity. Investors are more likely to trade these currencies, leading to a more active market with tighter spreads. Conversely, currencies from economies experiencing political or financial turmoil might see reduced liquidity as investors become more cautious.

- Trading Hours: Forex is a decentralized market operating 24/5, but liquidity can vary depending on the time zone. During overlap periods when major financial centers like London, New York, and Tokyo are open, trading activity and liquidity tend to be highest. Emerging market currencies might experience lower liquidity outside their respective trading hours due to a smaller pool of active participants.

- Central Bank Intervention: Central banks can influence forex market liquidity through their monetary policies. Interest rate decisions and quantitative easing programs can impact the attractiveness of a currency, potentially leading to increased or decreased trading activity and subsequent changes in liquidity.

- Volatility: While a certain level of volatility is inherent to the forex market, periods of excessive price swings can impact liquidity. During times of high volatility, traders might become more risk-averse, withdrawing from the market and leading to wider spreads. However, increased volatility can also attract short-term speculators, potentially boosting liquidity in the short term.

How does Liquidity affect the Bid-ask Spread in Forex Trading?

Transaction costs, including the bid-ask spread, can significantly impact your profits. This is where liquidity steps in, playing a critical role in determining the tightness of the spread – the difference between the price a seller is willing to accept (ask price) and the highest price a buyer is willing to pay (bid price) for a currency pair.

Imagine a bustling marketplace teeming with buyers and sellers for a particular good. This scenario reflects a highly liquid market in forex. With a vast pool of participants actively trading, there’s a constant flow of buy and sell orders at various price points. This competition among participants leads to tighter bid-ask spreads. Sellers are willing to offer slightly lower prices to attract buyers, while buyers are more likely to inch their bids closer to the asking price to secure a quicker trade. The result? Tighter spreads, translating to lower transaction costs for you, the forex trader.

Conversely, a market with low liquidity resembles a deserted marketplace. There are fewer participants, and orders might be sparse. In this scenario, sellers might be less willing to budge on their asking price, knowing it could take longer to find a buyer. Similarly, buyers with limited options might have to offer a wider spread to entice sellers. The consequence? Wider bid-ask spreads, eating into your potential profits.

What is the difference between Market Liquidity and Order Book Liquidity?

Market Liquidity

Imagine a bustling marketplace overflowing with currency traders. This scene represents market liquidity, the overall ease with which currencies can be traded at fair prices. It reflects the breadth and depth of the forex market, encompassing the number of participants and the total volume of currency transactions happening at any given time.

Factors like:

- Currency Pair: Major pairs like EUR/USD or USD/JPY enjoy higher market liquidity due to their involvement in global trade and investment.

- Economic Conditions: Currencies tied to strong, stable economies tend to be more liquid as investors are more confident trading them.

Market liquidity directly impacts the bid-ask spread, the difference between the buying and selling price of a currency pair. Tighter spreads signify higher market liquidity, translating to lower transaction costs for traders. Conversely, wider spreads indicate lower market liquidity, potentially squeezing profits.

Order Book Liquidity

While market liquidity offers a broad view, order book liquidity delves deeper. It focuses on the specific orders placed within the electronic order book for a particular currency pair. This book displays the number of buy and sell orders at various price levels, along with the sizes (volumes) of those orders.

Here, order book depth takes center stage. A deeper order book, with significant buy and sell orders on both sides, indicates higher order book liquidity. This abundance of orders at different price points signifies a higher chance of finding a counterparty to execute your trade quickly and at a desired price point.

Market liquidity and order book liquidity are like two sides of the same coin. A highly liquid market (many participants, high trading volume) will naturally translate to a deeper order book with numerous buy and sell orders. Conversely, a market with lower liquidity will likely have a less detailed order book with fewer orders.

Understanding both concepts empowers forex traders. By considering market liquidity, you can choose currency pairs with tighter spreads and lower transaction costs. By analyzing order book liquidity, you can gauge the ease of entering and exiting trades at your desired price point.

How can Currency Pairs be Categorized based on their Liquidity Levels?

not all currency pairs are created equal. Some boast deep liquidity pools, while others might be more shallow, impacting factors like transaction costs and trade execution speed. Here’s how currency pairs can be categorized based on their liquidity levels:

Major Currency Pairs

At the top of the forex hierarchy sit the major currency pairs. These pairs, typically involving the US dollar (USD), Euro (EUR), Japanese Yen (JPY), British Pound (GBP), and Swiss Franc (CHF), reign supreme in terms of liquidity. Several factors contribute to their dominance:

- Global Significance: These currencies represent the economies of major developed nations, making them integral to global trade and investment. This constant flow of activity fuels high trading volumes and deep liquidity.

- Central Bank Influence: The monetary policies of major central banks like the US Federal Reserve and the European Central Bank significantly impact global financial markets. This constant news flow and policy decisions attract a wider range of participants, further boosting liquidity for these currency pairs.

- 24-Hour Overlap: Major financial centers like London, New York, and Tokyo operate during different time zones, creating periods of overlap. This overlap ensures a near-continuous flow of trading activity and order submissions, maintaining high liquidity throughout the day.

The benefit for forex traders? Tight bid-ask spreads and the ease of entering and exiting positions due to the abundance of counterparties on the other side of the trade. Examples of major currency pairs with high liquidity include EUR/USD, USD/JPY, GBP/USD, and USD/CHF.

Minor Currency Pairs:

Beyond the major pairs lies the realm of minor currency pairs. These pairs often involve currencies from developed economies paired with each other (e.g., EUR/GBP) or with currencies of smaller economies (e.g., USD/AUD, USD/CAD). While not as liquid as major pairs, they still offer significant trading opportunities.

- Moderate Liquidity: Minor pairs generally experience lower trading volumes compared to majors. However, they still benefit from the underlying strength of the developed economies involved. This translates to moderate liquidity, with bid-ask spreads wider than major pairs but still manageable for most forex traders.

- Geographic Focus: Minor pairs can offer exposure to specific regions or economic developments. For instance, the AUD/USD (Australian Dollar/US Dollar) pair can reflect economic conditions in Australia and its ties to Asian markets.

While the ease of entering and exiting trades might be slightly less compared to major pairs, minor pairs can be attractive for traders seeking specific market exposures or potentially exploiting short-term inefficiencies.

Exotic Currency Pairs

At the fringes of the forex market lie exotic currency pairs. These pairs involve currencies from emerging markets (e.g., USD/TRY, EUR/CZK) or peg their value to a commodity like gold (e.g., XAU/USD). While offering unique diversification opportunities, exotic pairs come with significant liquidity challenges:

- Limited Participation: Emerging market currencies might have a smaller pool of active participants compared to established economies. This can lead to lower trading volumes and wider bid-ask spreads, potentially increasing transaction costs for traders.

- Market Volatility: Emerging markets can be more susceptible to political or economic turmoil, leading to increased volatility in their currencies. While volatility can present trading opportunities, it also carries higher risk, and low liquidity can exacerbate price swings.

Exotic currency pairs are best suited for experienced traders comfortable with higher risk profiles and who understand the specific economic factors influencing these markets.

How does Liquidity impact the Execution of trades in the Forex Market?

Imagine a bustling marketplace teeming with buyers and sellers, orders flying back and forth. This vibrant scene represents a highly liquid forex market, where executing trades is a seamless experience. Conversely, picture a deserted marketplace with sparse activity – this exemplifies a market with low liquidity, where executing trades can be a frustrating and costly endeavor.

What are the Risks associated with trading in low-liquidity Currency Pairs?

The foreign exchange market boasts a vast array of currency pairs, each offering unique trading opportunities. While major pairs like EUR/USD reign supreme in terms of liquidity, some traders might be tempted to venture into the realm of less-traded, exotic currency pairs. These pairs can offer the allure of diversification and potentially higher returns. However, before diving in, it’s crucial to understand the inherent risks associated with low-liquidity currency pairs.

1. Wider Bid-Ask Spreads: Liquidity and bid-ask spreads are two sides of the same coin. In a highly liquid market, numerous participants constantly buying and selling currencies create tight spreads. Conversely, low-liquidity markets suffer from wider bid-ask spreads. This translates to higher transaction costs for traders, potentially eating into any potential profits. Imagine trying to sell a rare antique – you might have to accept a significantly lower price than its perceived value due to the limited pool of interested buyers. Similarly, wider spreads in low-liquidity forex markets can act as a significant barrier to entry and exit, squeezing your profit margins.

2. Increased Price Volatility: Low-liquidity often coincides with higher price volatility. With fewer participants actively trading the currency pair, the impact of even small news events or order imbalances can be amplified, leading to sharp price swings. This volatility can be a double-edged sword. While it presents potential opportunities for short-term gains, it also carries a heightened risk of significant losses, especially for traders who lack a strong risk management strategy.

3. Order Execution Challenges: The ease of entering and exiting trades can be significantly hampered in low-liquidity markets. Due to the scarcity of counterparties, it might be difficult to find someone willing to take the other side of your trade at your desired price point. This can lead to order execution delays or force you to accept a less favorable price, impacting your trading strategy.

4. Lower Market Transparency: Low-liquidity currency pairs often suffer from a lack of readily available market information. Limited trading data and fewer analyst reports can make it challenging to conduct thorough technical and fundamental analysis. Without a clear understanding of the underlying factors influencing the price movements, traders might be more susceptible to making uninformed decisions and incurring losses.

5. Potential for Manipulation: In a market with a small pool of participants, there’s a greater risk of manipulation by larger players. These players could potentially exploit the limited liquidity to drive prices in a specific direction, creating artificial price movements that could mislead and harm smaller traders.

How can forex traders Identify and take advantage of periods of high liquidity?

The key lies in understanding the factors that influence liquidity and employing strategies to position yourself when the market is flowing freely.

1. Major Pairs

Your first line of defense is focusing on major currency pairs. These powerhouses, like EUR/USD, USD/JPY, GBP/USD, and USD/CHF, are the liquidity kings of the forex market. Their constant involvement in global trade and investment fuels high trading volumes, leading to a deep order book – a marketplace teeming with buy and sell orders at various price points. This translates to tight bid-ask spreads (the difference between buying and selling prices) and faster order execution, ideal conditions for capitalizing on fleeting market opportunities.

2. Economic Calendar and Central Bank Decisions

Economic data releases and central bank pronouncements act as catalysts for market activity, directly impacting forex liquidity. Strong economic data for a particular country can trigger a surge in interest for its currency, attracting more traders and boosting liquidity for the corresponding pair. Conversely, weak economic data or dovish central bank statements might trigger a flight from that currency, causing a decline in liquidity. Staying informed about the economic calendar and central bank meetings allows you to anticipate potential liquidity changes and adjust your trading strategy accordingly.

3. The Overlap Advantage

The beauty of the forex market lies in its 24/5 operation. However, activity isn’t uniform across all time zones. When major financial centers like London, New York, and Tokyo experience overlap, trading activity reaches its peak. This overlap creates a near-continuous flow of orders, pushing liquidity to its highest levels. Savvy traders can leverage this by scheduling their trades during these overlap periods, benefiting from tighter spreads and faster execution.

4. Market Indicators

The market itself offers valuable clues about current and future liquidity levels. Daily trading volume for a currency pair provides a straightforward measure of its activity. Higher volumes generally indicate higher liquidity. Additionally, order book depth, reflecting the number and size of buy and sell orders at various price levels, acts as a valuable tool. A deeper order book with significant volume on both sides suggests higher liquidity and a smoother trading experience.

5. Algorithmic Trading

For some traders, algorithmic trading strategies can be a valuable tool for capitalizing on periods of high liquidity. These involve using computer programs to execute trades based on pre-defined rules. The programs can be designed to identify and automatically enter or exit trades during periods of high liquidity, potentially improving efficiency and reducing the emotional aspects of trading.

How can Trading Strategies be adapted to different Liquidity Conditions in the Forex Market?

A strategy that thrives in a deep, fast-moving current might flounder in shallow, sluggish waters. Here’s how you can adapt your trading strategies to different liquidity conditions:

High Liquidity

Highly liquid markets, brimming with major currency pairs like EUR/USD or USD/JPY, offer a playground for scalping and day trading strategies. Tight bid-ask spreads and rapid order execution make these markets ideal for capitalizing on short-term price movements. You can leverage technical indicators and employ high-frequency trading techniques to capture fleeting opportunities.

Moderate Liquidity

Minor currency pairs, like USD/AUD or EUR/GBP, offer a balance between liquidity and market exposure. While not as fast-paced as major pairs, they still boast sufficient liquidity for most trading strategies. Here, swing trading strategies that take advantage of slightly larger price swings over a few days or weeks can be effective. Careful analysis of both technical and fundamental factors becomes crucial for identifying potential trading opportunities.

Low Liquidity

Exotic currency pairs or those involving emerging markets often navigate the shallow waters of low liquidity. Wide bid-ask spreads and potentially slower order execution necessitate a shift in strategy. Positional trading, where you hold positions for longer periods, might be more suitable. Fundamental analysis takes center stage, as you need to understand the underlying economic and political factors influencing these currencies. Additionally, meticulous risk management becomes paramount, as wider spreads and higher volatility can magnify potential losses.

Beyond the Pair

Remember, liquidity isn’t solely determined by the currency pair. Market conditions can also play a role. During major news events or central bank announcements, even highly liquid pairs might experience temporary dips in liquidity. Being aware of the economic calendar and global events can help you anticipate these periods and adjust your strategy accordingly.

What are Some Alternative Order Types that can be used to manage risk in Low-liquidity Environments?

The allure of potentially higher returns can tempt some forex traders to venture into the realm of low-liquidity currency pairs. However, navigating these markets requires a keen understanding of the inherent risks and a strategic approach to managing them. While traditional market orders might seem like the simplest option, alternative order types can offer greater control and potentially mitigate risk in low-liquidity environments.

Here are some valuable alternative order types to consider:

1. Limit Orders

A limit order allows you to specify the exact price at which you want to buy or sell a currency pair. This level of control becomes crucial in low-liquidity markets where wider bid-ask spreads can significantly impact your profits. With a limit order, you set a boundary – you’re only willing to buy if the price reaches your desired level or sell if it falls to your specified price. This ensures you don’t get caught in unfavorable price movements due to a lack of counterparties.

2. Stop-Loss Orders:

A stop-loss order acts as a safety net, automatically exiting your trade if the price moves against you in a low-liquidity market. This helps limit potential losses, especially when wider spreads can amplify price movements. By setting a stop-loss order at a predetermined price level, you can automate the risk management process and avoid the emotional temptation to hold onto a losing position.

3. Take-Profit Orders

Similar to stop-loss orders, take-profit orders allow you to lock in profits in a low-liquidity environment. You can set a price level at which your trade automatically closes, ensuring you capture your gains if the price moves in your favor. This is particularly valuable when order execution might be slower due to limited counterparties. By setting a take-profit order, you remove the need for constant monitoring and avoid the risk of missing out on potential profits due to delayed execution.

4. Trailing Stop-Loss Orders

A trailing stop-loss order adds an extra layer of sophistication to risk management. This dynamic order type automatically adjusts your stop-loss price as the market moves in your favor. For example, if you buy a currency pair and the price starts rising, the trailing stop-loss will automatically raise your stop-loss level, locking in profits while still providing protection against sudden price reversals. This is a valuable tool in low-liquidity environments where price movements can be unpredictable.

5. Iceberg Orders

An iceberg order allows you to display only a portion of your total order size to the market. This can be beneficial in low-liquidity environments where large orders might be difficult to fill at a favorable price due to limited counterparties. By displaying a smaller initial order, you can test the market depth and avoid causing significant price movements. Once the initial order is filled, the remaining portion of your order can be revealed at a potentially better price.

How can Technological Advancements Impact Liquidity in the Forex Market?

The ever-evolving realm of forex is not immune to the transformative power of technology. Advancements in recent years have significantly impacted the way currencies are traded, and one of the most crucial areas affected is liquidity. Here’s how technology is shaping the landscape of liquidity in the forex market:

Electronic Communication Networks (ECNs) create a marketplace for efficiency. These platforms aggregate quotes from various liquidity providers, offering traders a consolidated view of the market and the best possible bid and ask prices. This fosters greater competition among market makers, ultimately leading to tighter spreads and increased liquidity. Imagine a bustling marketplace where numerous vendors compete for your business, driving down prices and creating a more efficient environment – that’s the essence of ECNs in the forex market.

Algorithmic trading injects speed and precision. The rise of algorithmic trading, where computer programs execute trades based on pre-defined rules, has significantly impacted forex market liquidity. These algorithms analyze vast amounts of market data at lightning speed, identifying and capitalizing on fleeting arbitrage opportunities. This high-frequency trading activity injects additional volume into the market, contributing to increased liquidity, particularly for major currency pairs. However, it’s important to acknowledge that algorithmic trading can also contribute to short-term volatility, an aspect to consider when navigating the market.

Mobile trading platforms expand accessibility and participation. The proliferation of user-friendly mobile trading platforms has opened the doors of the forex market to a wider range of participants. These platforms offer convenient access to the market 24/5, allowing individuals to trade from anywhere in the world. This broader participation base translates to increased trading volume and potentially higher liquidity, particularly during off-exchange hours when traditional trading desks might be closed.

Big data and analytics unveil hidden patterns. The explosion of big data in the financial sector has empowered traders with a wealth of information. Advanced analytics tools can now sift through massive datasets, uncovering hidden patterns and trends in currency movements. This deeper understanding of market dynamics allows traders to make more informed decisions, potentially leading to increased trading activity and ultimately contributing to higher liquidity.

How does Liquidity Compare between the Forex Market and other Financial Markets?

The forex market stands out as the undisputed champion of liquidity. With an average daily turnover exceeding $7.5 trillion according to the Bank for International Settlements, it dwarfs the trading volume of all stock markets combined. This immense liquidity stems from several key factors. Unlike stock exchanges with limited trading hours, the forex market operates continuously, 24 hours a day, 5 days a week. This global reach ensures a constant flow of orders across different time zones, maintaining high liquidity throughout the day.

Furthermore, the absence of a central exchange in forex creates a vast network of participants, from major banks to individual traders. This decentralized structure fosters greater competition among market makers, leading to tighter bid-ask spreads and smoother trade execution. The forex market also attracts a diverse group of participants, including central banks, corporations, investment firms, hedge funds, and retail traders. This broad participation base injects significant volume into the market, further enhancing liquidity.

Stock markets offer a contrasting landscape. While individual stock liquidity varies greatly, they generally exhibit lower overall liquidity compared to forex. This difference can be attributed to several factors. Stock markets operate during specific hours, typically aligned with specific time zones. This restricts trading activity and can lead to lower liquidity, especially outside of peak trading periods.

Additionally, a company’s size, market capitalization, and trading volume significantly impact its stock’s liquidity. Large, well-established companies with high trading volumes tend to be more liquid, while smaller companies might face challenges with bid-ask spreads and order execution. Unlike the decentralized forex market, stock exchanges act as centralized hubs for trading. While this structure offers benefits like price transparency, it can also limit participation to some extent, potentially impacting liquidity.

Beyond forex and stocks, other financial markets fall on a spectrum of liquidity. Bond markets are generally less liquid than forex but more liquid than many individual stocks. Government bonds, due to their stability and high demand, tend to be more liquid than corporate bonds. Commodity markets also exhibit varying degrees of liquidity depending on the specific commodity. Heavily traded commodities like oil and gold exhibit higher liquidity, while less commonly traded commodities might be less liquid. Similarly, derivatives markets like options and futures contracts can offer varying degrees of liquidity depending on the underlying asset and market conditions.

The vast differences in liquidity between the forex market and other financial markets highlight the importance of considering this factor when choosing a trading arena. Forex’s exceptional liquidity makes it ideal for strategies that rely on frequent entries and exits, while less liquid markets might be better suited for longer-term investment strategies. By understanding how liquidity impacts different markets, you can become a more informed trader, able to select the most appropriate market for your specific goals and risk tolerance.

What are the Potential Consequences of a Lack of Liquidity in the Forex Market?

One of the most immediate consequences of dwindling liquidity is the widening of bid-ask spreads. Imagine a marketplace with limited vendors. Sellers become less willing to negotiate, and buyers have fewer options. This translates directly to the forex market. With fewer participants actively buying and selling currencies, the gap between the buying price (bid) and selling price (ask) widens significantly. This translates to higher transaction costs for traders, potentially eroding profits or making certain strategies less attractive.

Furthermore, a lack of liquidity can exacerbate market volatility. Think of a sparsely populated dance floor. Even a single enthusiastic dancer can cause noticeable ripples throughout the crowd. Similarly, in a less liquid market, even a relatively small trade can have an outsized impact on exchange rates. This increased volatility makes price movements more erratic and difficult to predict, potentially leading to unexpected losses for traders who are caught off guard by sudden shifts.

The efficiency of the forex market also suffers when liquidity dries up. Liquidity acts as the lubricant that allows orders to flow smoothly. When it’s scarce, entering and exiting positions can become an arduous task. Traders might find it challenging to get their orders filled at their desired price, especially for less liquid currency pairs. This can lead to frustration and missed opportunities, hindering the overall efficiency of the market and potentially causing traders to abandon their positions prematurely.

In extreme scenarios, a lack of liquidity can even contribute to flash crashes. If negative news or events trigger a sudden sell-off for a particular currency, the absence of enough buyers to absorb the selling pressure can lead to a rapid and dramatic decline in its value. Imagine a domino effect – the initial sell-off triggers further selling as traders panic, and the currency’s value plummets due to the lack of a strong counterbalancing force. This highlights the importance of proper risk management strategies, as flash crashes can be particularly damaging for traders caught on the wrong side of the market move.

The rise of algorithmic trading has also added a new layer of complexity to the impact of liquidity. These automated strategies rely on a certain level of liquidity to function effectively. When liquidity dries up, algorithms might struggle to execute trades efficiently. Imagine a high-speed race car stuck in traffic – its sophisticated engine is useless without the ability to move freely. Similarly, algorithmic trading strategies can falter in low-liquidity environments, potentially leading to losses or missed opportunities. This can disrupt the delicate balance between human and automated trading activity in the market.

What resources are available to Forex traders to stay informed about Liquidity Conditions?

For forex traders, staying informed about liquidity conditions is vital for navigating this dynamic market. Here’s a toolkit to keep you ahead of the curve:

- Economic calendars and news sources: Track upcoming economic data releases and follow financial news to understand how events might impact market activity and liquidity.

- Liquidity monitoring tools: Utilize order book depth indicators provided by brokers to assess real-time liquidity for specific currency pairs. Monitor market volatility indicators like ATR or Bollinger Bands to gauge potential challenges in entering and exiting positions during low-liquidity periods.

- Brokerage analysis and research: Leverage research reports and educational resources offered by forex brokers to gain insights from experienced analysts and develop strategies for navigating low-liquidity environments.

- Community forums and social media: While not a replacement for professional analysis, online forums and social media can offer real-time discussions and updates about market conditions, including observations on liquidity. However, ensure you follow credible sources with a proven track record.

Understanding Market Depth: Definition, Significance, and Trader Insights

17 May 2024[…] depth is intricately linked to, but distinct from, liquidity. Here’s how they […]

Hedging: Strategies, Importance, and Implementation in Risk Management

14 June 2024[…] disadvantage is the lack of liquidity. Because forward contracts are customized and traded OTC, they are not as liquid as standardized […]