The forex market thrives on a constant exchange of currencies, and at the heart of every trade lie two critical prices: the bid and the ask. The bid price represents the price a forex broker, acting as a market maker, is willing to buy a specific currency from you. Imagine it as the “We Buy” sign at a currency exchange booth, but instead of exchanging physical bills, it’s a digital marketplace where bids and asks continuously fluctuate.

Understanding the bid price is fundamental to every forex trade. It’s the baseline price you receive when you sell a currency pair. This price plays a crucial role in two key aspects of your trading strategy:

- Entering Short Positions: If you believe a currency will weaken, you can enter a “short position” by selling it at the current bid price. Your potential profit hinges on the difference between the selling price (bid) and the eventual buying price (which could be lower if your prediction is correct).

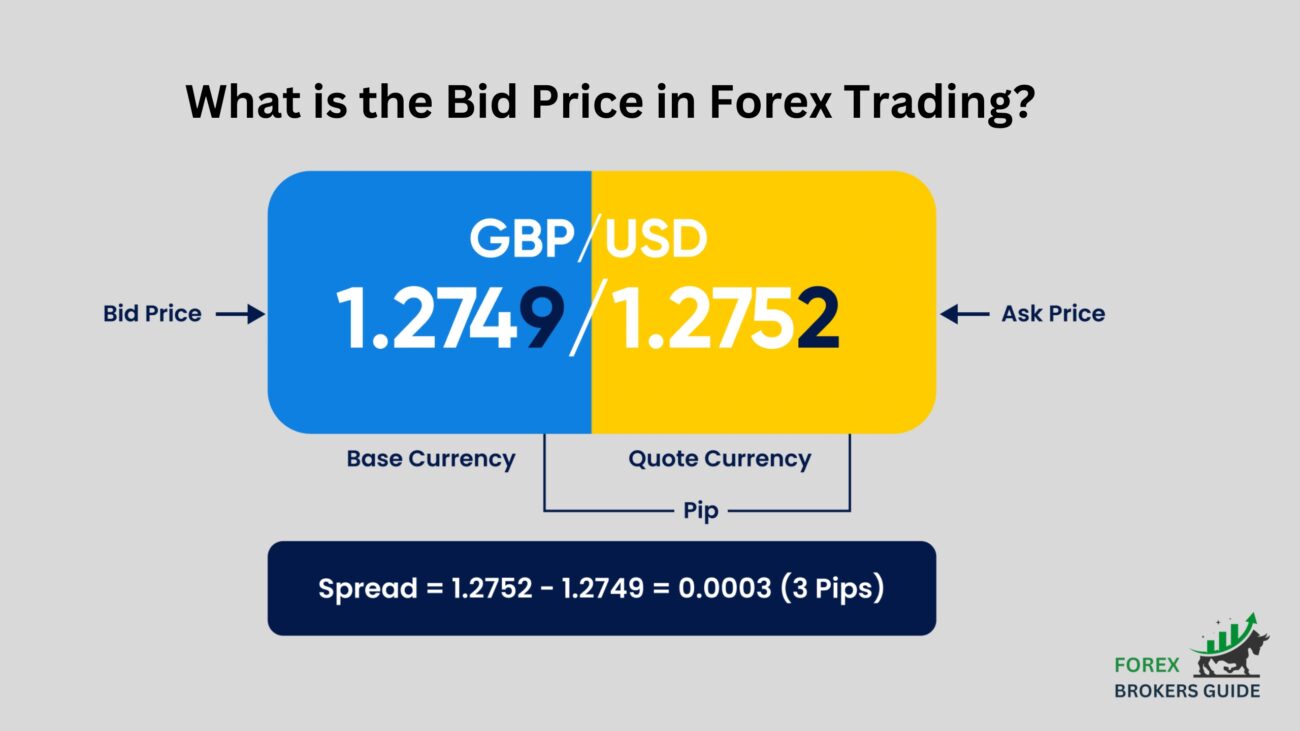

- Calculating the Spread: The difference between the bid and the ask price (the price at which the broker sells you currency) is known as the spread. A tight spread, where the bid price is close to the ask price, generally indicates higher market liquidity. This means there are more buyers and sellers willing to trade, potentially leading to smoother execution of your trades.

What is the Bid Price in Forex Trading?

The bid price in Forex Trading is the price a forex broker (market maker) is willing to buy a specific currency from you. It’s essentially your selling price when you decide to exit a long position or enter a short position (betting the currency will weaken).

Understanding the bid price is crucial because:

- It determines your potential profit in short positions (selling price – eventual buying price).

- It’s a key factor in calculating the spread (bid price vs. ask price, where brokers sell currency). A tighter spread (bid close to ask) often indicates higher market liquidity.

In short, the bid price is your selling reference point and a key element for informed trading decisions.

How does the Bid price differ from the Ask price?

The bid price and ask price are two sides of the same coin in forex trading, but with opposite purposes. The bid price is the price a broker will buy a currency from you (your selling price), while the ask price is the price the broker will sell you the same currency (your buying price).

This difference is crucial. When entering a long position (buying a currency pair), the ask price is your entry point. When exiting a long position or entering a short position (selling a currency pair), the bid price determines your selling price and potential profit. The spread, calculated as the difference between bid and ask price, represents the broker’s commission for the transaction.

What does the Bid Price represent in a Forex Transaction?

In a forex transaction, the bid price represents the price a forex broker (market maker) is willing to buy a specific currency from you. It’s essentially your selling price when you decide to exit a long position (selling currency you previously bought) or enter a short position (betting the currency will weaken).

Consider this scenario: you believe the Euro (EUR) will weaken against the US Dollar (USD). To capitalize on this prediction, you can enter a “short position” by selling Euros at the current bid price. Your potential profit hinges on the difference between the selling price (bid) and the eventual buying price (which could be lower if your prediction is correct). In essence, the bid price becomes your entry point for this short position.

Another key aspect related to the bid price is the spread. This refers to the difference between the bid and the ask price (the price at which the broker sells you currency). A tight spread, where the bid price is close to the ask price, generally indicates higher market liquidity. This means there are more buyers and sellers willing to trade, potentially leading to smoother execution of your trades and potentially lower transaction costs.

How is the Bid Price determined in the Forex Market?

The bid price in forex isn’t a set number, but a constantly changing value dictated by supply and demand for a currency pair. Think of it as an auction where forex brokers, acting as market makers, compete to buy your currency. The highest price they’re willing to pay at a given moment becomes the bid price. This reflects the collective buying pressure for that currency.

Several factors can influence this dynamic interplay:

- Economic Data Releases: Strong economic data for a country can increase demand for its currency, potentially pushing the bid price up. Conversely, weak data can trigger a sell-off, driving the bid price down.

- Geopolitical Events: Political instability or global conflicts can create risk aversion, causing investors to seek safe-haven currencies. This can raise the bid price of safe havens like the US Dollar (USD) while lowering the bid price of riskier currencies.

- Market Sentiment: The overall market mood can influence currency valuations. A positive sentiment might increase demand for riskier currencies, potentially raising their bid prices.

What factors can influence the Fluctuation of the Bid Price?

The bid price in forex is a dynamic creature, constantly influenced by a web of factors. Here’s the gist:

- Economic data: Strong economic data for a country can trigger a bidding war for its currency, pushing the bid price up. Conversely, weak data can lead to a sell-off, driving the bid price down.

- Geopolitical jitters: Political instability or global conflicts can make investors seek safe-haven currencies, causing their bid prices to rise while riskier currencies depreciate.

- Market sentiment: A positive market mood can increase demand for riskier currencies, potentially raising their bid prices. Conversely, a pessimistic mood can send investors fleeing to safe havens, pushing their bid prices up.

- Central bank actions: Interest rate hikes by a central bank can make a currency more attractive, raising the bid price. Conversely, rate cuts can make it less attractive, potentially lowering the bid price.

- Supply and demand imbalances: Even minor imbalances between buyers and sellers of a currency can cause bid price fluctuations.

How does the Bid Price Work when Buying a Currency Pair?

In forex trading, the bid price doesn’t directly come into play when you’re buying a currency pair. That’s because you purchase currencies at the ask price, which is the price the broker is willing to sell you the currency.

However, the bid price still holds indirect significance when buying:

- It Impacts the Spread: The spread is the difference between the bid and ask price. A tight spread, where the bid price is close to the ask price, generally indicates higher market liquidity. This translates to smoother execution of your trades and potentially lower transaction costs. Conversely, a wider spread can eat into your potential profits.

- It Reflects Underlying Market Sentiment: The bid price can offer clues about the overall market sentiment for a particular currency. A rising bid price might suggest increased demand for that currency, potentially indicating a bullish trend. Conversely, a falling bid price could signal weakening demand, potentially hinting at a bearish trend. While not a definitive predictor, understanding the bid price alongside other market indicators can help you make informed decisions when buying a currency pair.

How does the Bid Price impact Forex Trading Strategies?

The bid price, although not directly involved in purchasing a currency pair, significantly impacts forex trading strategies. When entering a short position (betting a currency will weaken), the bid price becomes your selling point. Your potential profit hinges on the difference between this selling price and the eventual buying price (which could be lower if your prediction is correct). Understanding the bid price allows you to calculate your potential profit margin and assess the risk-reward ratio of your short selling strategy.

Furthermore, the spread, calculated as the difference between the bid and ask price (price you buy at), represents the broker’s commission. A tight spread, where the bid price is close to the ask price, generally indicates higher market liquidity. This translates to lower transaction costs, allowing you to keep more of your profits. By monitoring the bid price and choosing brokers with tighter spreads, you can optimize your trading strategy for cost-efficiency.

The bid price also offers valuable insights into market sentiment for a particular currency. A rising bid price might suggest increased demand, potentially signaling a bullish trend. Conversely, a falling bid price could indicate weakening demand, hinting at a bearish trend. While not a foolproof predictor, understanding the bid price alongside other market indicators can help you identify potential trends and make informed decisions about entry and exit points for your trades.

Finally, stop-loss orders are crucial risk management tools. By setting a stop-loss order below the bid price when entering a long position (buying), you can automatically exit the trade if the price falls beyond a predetermined level. Similarly, when entering a short position, you can set a stop-loss order above the bid price to limit potential losses if the currency unexpectedly strengthens. By understanding the bid price, you can strategically place stop-loss orders to manage risk and protect your capital.

Can a Trader Benefit from the Bid Price in any way?

Yes, forex traders can benefit from the bid price even though they don’t directly buy at that price.

Here’s how:

- Short Selling Profits and Informed Decisions: When entering a short position (betting a currency weakens), the bid price becomes your selling point. Understanding the bid price allows you to calculate potential profit and make informed decisions. A rising bid price might suggest a less favorable environment for short selling, while a falling bid price could signal a better opportunity.

- Spread Management and Cost Efficiency: The spread, impacted by the bid price, influences your transaction costs. By monitoring the bid price and choosing brokers with tighter spreads, you can minimize costs and keep more of your profits.

- Strategic Stop-Loss Placement: Stop-loss orders limit potential losses. By understanding the bid price, you can strategically place them: below the bid price for long positions and above it for short positions.

How can Bid-Ask Spreads Impact Trading Profitability?

Bid-ask spreads can significantly impact your trading profitability in forex. Here’s why:

- Direct Cost: The spread is the difference between the bid price (where you sell) and the ask price (where you buy). This difference represents the broker’s commission for facilitating the trade. A wider spread means a larger chunk of your potential profit is eaten away by transaction costs.

- Reduced Flexibility: Tighter spreads offer greater flexibility, allowing you to enter and exit trades more quickly and capitalize on fleeting market opportunities. Wider spreads can restrict your ability to react swiftly to price movements and potentially limit your profit potential.

- Psychological Impact: Large spreads can be psychologically discouraging, especially for new traders. Seeing a significant portion of your potential profit vanish due to fees can lead to hesitation and missed opportunities.

Are there any trading strategies specifically focused on exploiting bid price movements?

No, most forex trading strategies don’t directly focus on exploiting bid price movements. The core reason lies in order execution.

Focus on Ask Price: When buying a currency pair, traders execute the trade at the ask price. This is the price the broker offers to sell you the currency. In contrast, the bid price represents the price the broker is willing to buy a currency from you (your selling price).

However, the bid price still holds some strategic value, particularly for short-term traders:

Short-Term Momentum and Reversals: Traders employing scalping or day trading strategies might use the bid price alongside other technical indicators to identify short-term momentum shifts and potential entry or exit points. For instance, a sudden surge in the bid price could signal increased buying pressure, potentially indicating an opportunity to enter a long position (buying) in anticipation of further price increases. Conversely, a sharp decline in the bid price could suggest weakening demand, hinting at a potential entry point for a short position (selling) before a price reversal.

Slippage: Definition, Causes, How It Works, and Strategies to Minimize Its Effects

17 May 2024[…] Spread: This is the inherent difference between the buy (bid) price and the sell (ask) price of a currency pair. It’s a fixed cost associated with every trade […]