A limit order acts as a specific instruction to your forex broker. Unlike market orders that prioritize immediate execution at any available price, limit orders prioritize price control over speed. You specify a desired price (limit price) for buying or selling a currency pair. The order will only be triggered if the market price reaches your limit price or surpasses it in a favorable direction (lower for buy orders, higher for sell orders). This allows you to exert greater control over your entry and exit points, aligning your trades with your trading strategy and risk management parameters.

Limit orders offer several advantages for forex traders. By specifying your desired price, you can avoid slippage, the difference between the quoted price and the actual filled price of your order. This is particularly beneficial in less volatile markets with tighter bid-ask spreads. Limit orders empower you to target specific entry and exit prices. Imagine you believe a currency pair is undervalued but poised for appreciation. A buy limit order placed at a specific price above the current market price ensures you only enter the position if the market agrees with your assessment. Similarly, limit orders can be used to lock in profits at a predetermined price point when exiting a position. Limit orders are also instrumental in setting stop-loss orders, which help mitigate potential losses. A stop-loss order placed below your entry price for a long position (buy order) or above your entry price for a short position (sell order) automatically exits your trade if the market moves against you, limiting your potential losses. By understanding these advantages and applications, forex traders can leverage limit orders effectively within their overall trading strategies.

Table of Contents

What is a Limit Order in Forex Trading?

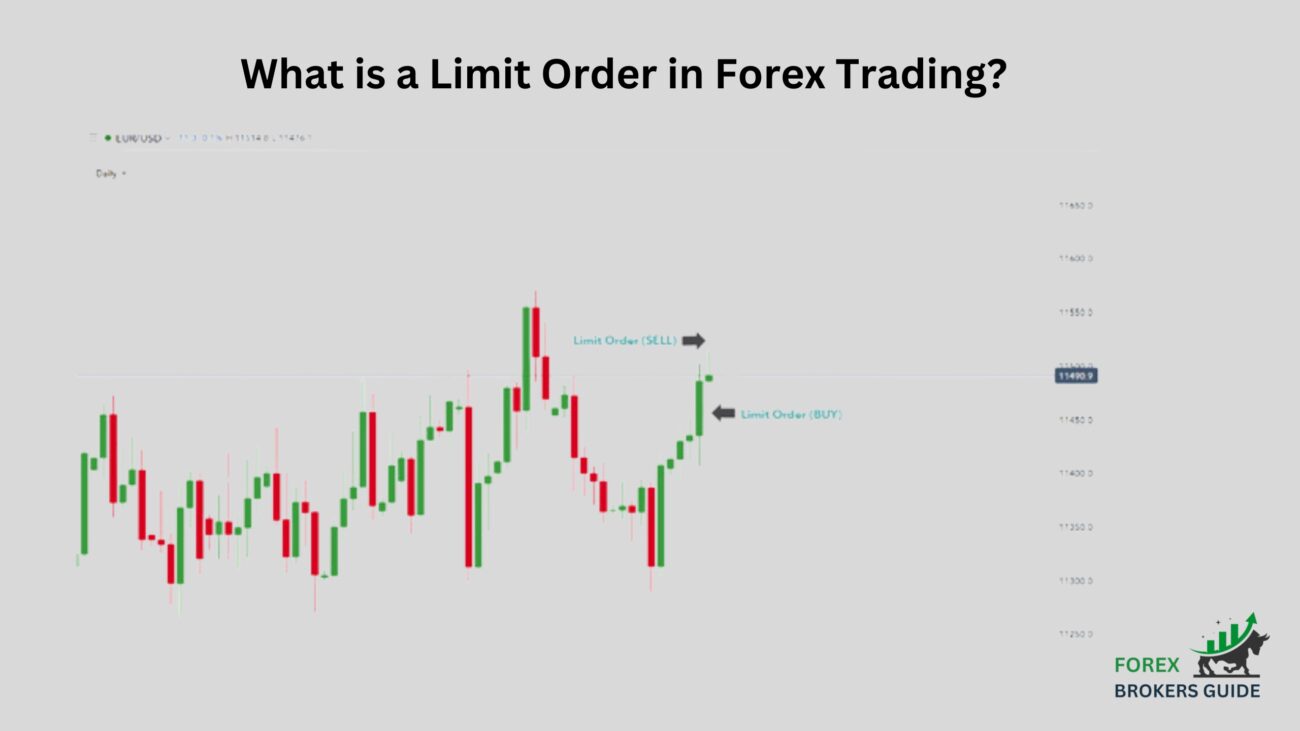

A limit order in forex trading is an instruction to your broker to buy or sell a currency pair at a predetermined price (limit price) or better. This differs from market orders, which prioritize immediate execution at the best available market price. With a limit order, you prioritize price control over speed. Your order sits patiently waiting for the market price to reach your desired level before being filled.

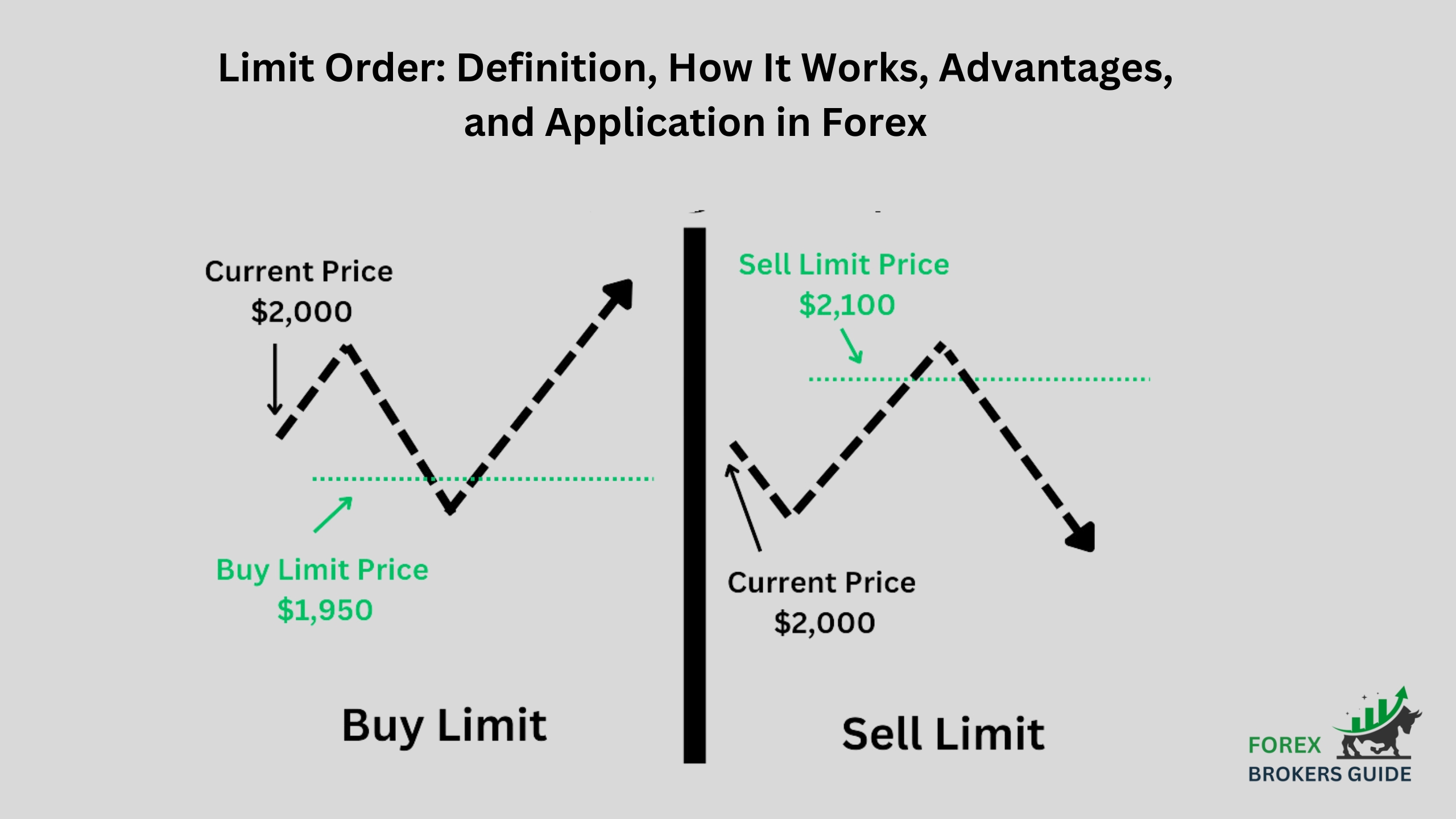

For instance, if you believe a currency pair is currently undervalued, you can place a buy limit order at a specific price above the current market price. This ensures you only enter the position if the market agrees with your assessment and the price rises to your desired level. Conversely, limit orders can be used to lock in profits at a predetermined price point when exiting a position by placing a sell limit order above your buy price. By understanding the mechanics of limit orders, forex traders can make informed decisions about when to leverage them for a more controlled and potentially more profitable trading experience.

How does a Limit Order differ from a Market Order in terms of Price Execution?

Market orders prioritize immediate execution above all else. When you place a market order, you instruct your broker to buy or sell a specific currency pair at the best available market price at the exact moment you submit the order. This ensures your trade is filled instantly, regardless of the specific price. Imagine a sudden surge in a currency pair you believe will continue to rise. A market buy order gets you into the position immediately, potentially allowing you to capture profits before the price climbs further. However, the exact price at which your market order is filled might differ slightly from the price you see quoted on your trading platform. This difference, known as slippage, is the inherent cost of prioritizing immediate execution in a fast-moving market.

Limit orders, on the other hand, offer greater control over the price at which your trade is executed. Here, you specify a desired price (your limit price) for your order. The order will only be triggered if the market price reaches your limit price or surpasses it in a favorable direction (lower for buy orders, higher for sell orders). This allows you to ensure you only enter or exit a position at a price that aligns with your trading strategy. For instance, if you believe a currency pair is currently slightly undervalued but has the potential for appreciation, a buy limit order placed at a specific price above the current market price ensures you only enter the position if the market agrees with your assessment and the price rises to your desired level.

How are buy Limit Orders and Sell Limit Orders used in Forex Trading?

Buy limit orders are ideal for capitalizing on anticipated price increases in a currency pair. Imagine you believe a particular currency pair is currently undervalued but poised for significant growth. By placing a buy limit order at a specific price slightly above the current market price, you essentially instruct your broker to purchase the currency pair only if the price reaches your desired level. This ensures you don’t overpay for your entry, potentially increasing your profit potential if the price continues to rise as predicted. Buy limit orders can also be used to accumulate positions gradually. By placing a series of strategically spaced buy limit orders at progressively higher prices, you can enter the market at favorable entry points as the price climbs.

Sell limit orders are instrumental in securing profits and managing risk within your forex trading strategy. Imagine you’ve established a long position (bought a currency pair) and the price has moved in your favor. To lock in those profits and prevent potential losses if the price reverses, you can place a sell limit order at a specific price above your buy price. Your order will only be executed if the market price reaches your predetermined profit target. Sell limit orders can also be used as a risk management tool. By placing a sell limit order below your buy price (stop-loss order), you can automatically exit your position if the price moves against you, limiting your potential losses.

What is the Role of the Limit Price in a Limit Order?

The limit price in a limit order acts as a predefined threshold for trade execution in forex trading. It dictates the specific price at which you are willing to buy or sell a currency pair. Your order will only be filled if the market price reaches your limit price or surpasses it in a favorable direction (lower for buy orders, higher for sell orders). This allows you to exert greater control over your entry and exit points.

How do Limit Orders offer greater control over trade execution for Forex Traders?

Limit orders offer a crucial advantage: greater control over trade execution. Here’s how they achieve this:

- Dictating Entry and Exit Prices: Unlike market orders that prioritize immediate execution at the best available price, limit orders allow you to set a specific price (limit price) for your trade. This empowers you to enter or exit a position only if the market price reaches your desired level, ensuring your trade aligns with your trading strategy. Imagine you believe a currency pair is undervalued but hesitant to buy at the current price. A buy limit order placed slightly above the market price ensures you only enter the position if the price validates your analysis and rises to your preferred level.

- Minimizing Slippage: Slippage, the difference between the price you see quoted and the price your order is actually filled at, can eat into your profits. Limit orders help mitigate this by ensuring your trade is only executed at your designated price or better. This is particularly beneficial in less volatile markets with tighter bid-ask spreads, where slippage is less likely but can still impact your returns.

- Risk Management: Limit orders play a vital role in managing risk. By placing a stop-loss order, a type of limit order, below your entry price for a long position (buy order) or above your entry price for a short position (sell order), you can automatically exit your trade if the market moves against you. This helps limit potential losses and adheres to predefined risk parameters within your trading strategy.

How can Limit Orders help Minimize Slippage in Volatile Market Conditions?

Volatile market conditions, where prices fluctuate rapidly, can be particularly tricky for traders seeking to enter or exit positions at specific prices. This is where limit orders come to the rescue, offering a valuable tool to minimize slippage, the difference between the bid/ask price you see quoted and the price your order is actually filled at.

In a volatile market, market orders, which prioritize immediate execution at the best available price, can be risky. The rapid price swings can cause your order to be filled at a price significantly different from the price you saw when you placed it. This slippage can eat into your profits, especially for short-term trades.

Limit orders, on the other hand, help mitigate this risk by allowing you to dictate the price at which your trade is executed. By setting a specific limit price, your order remains inactive until the market price reaches your desired level or surpasses it in a favorable direction (lower for buy orders, higher for sell orders). This ensures you only enter or exit a position at a price you’re comfortable with, minimizing the impact of slippage on your trades.

Imagine a scenario where you believe a currency pair is about to experience a sharp upward trend. Placing a buy limit order slightly above the current market price ensures your order is only filled if the price rises to your desired level. This control over price execution helps you avoid potential slippage that could occur if you placed a market order in such a volatile market.

While limit orders offer a solution to slippage, they do come with a trade-off. Your order might not be filled at all if the market price doesn’t reach your limit price, potentially leading to missed opportunities. However, by understanding the strengths and weaknesses of limit orders, forex traders can leverage them strategically to minimize slippage and achieve their trading goals even in volatile market conditions.

When might a Forex Trader use a Buy Limit Order?

Forex traders have a valuable tool in their arsenal when it comes to entering long positions (buying a currency pair): the buy limit order. This order type prioritizes price control over immediate execution. By specifying a desired price (limit price), the trader dictates the exact level at which they want to buy the currency pair. The order remains inactive until the market price reaches the limit price or dips below it. This ensures the trader only enters the position if their analysis is correct and the price moves in their favor. This approach is particularly useful for capitalizing on anticipated price increases or for buying at a specific price point to potentially improve overall entry price.

When might a Forex Trader use a Sell Limit Order?

When holding a long position (owning a currency pair) in forex, sell limit orders become a valuable tool for profit-taking and risk management. Imagine you’ve bought a currency pair and the price has moved in your favor. To secure those profits and prevent potential losses if the price reverses course, you can place a sell limit order at a specific price above your buy price. This ensures your position is automatically sold if the market reaches your desired profit target, effectively locking in your gains. Sell limit orders can also be used as stop-loss orders, placed below your buy price to automatically exit your position if the price moves against you. This helps limit your potential losses and adheres to your predefined risk management strategy.

How can Limit Orders be integrated into various Trading Strategies?

Limit orders become versatile tools when integrated into various forex trading strategies. Their strength lies in controlling entry and exit points. For trend followers, buy limit orders placed above potential breakouts ensure entry only if the trend strengthens. Conversely, sell limit orders below support levels confirm downtrends before entering short positions. In range-bound markets, limit orders hug support and resistance, allowing traders to capitalize on price bounces within the defined range. Value investors can leverage limit orders by placing buys slightly above current prices, ensuring entry aligns with their undervalued currency assessment. This control over execution empowers forex traders to tailor their actions to specific strategies and potentially enhance their overall trading performance.

One-Cancels-the-Other Order (OCO): Definition, Functionality, How It Works, and Usage in Forex

14 May 2024[…] OCO orders share similarities with standard limit orders and stop-loss orders, a key distinction lies in their automation and bundled nature. Here’s a […]