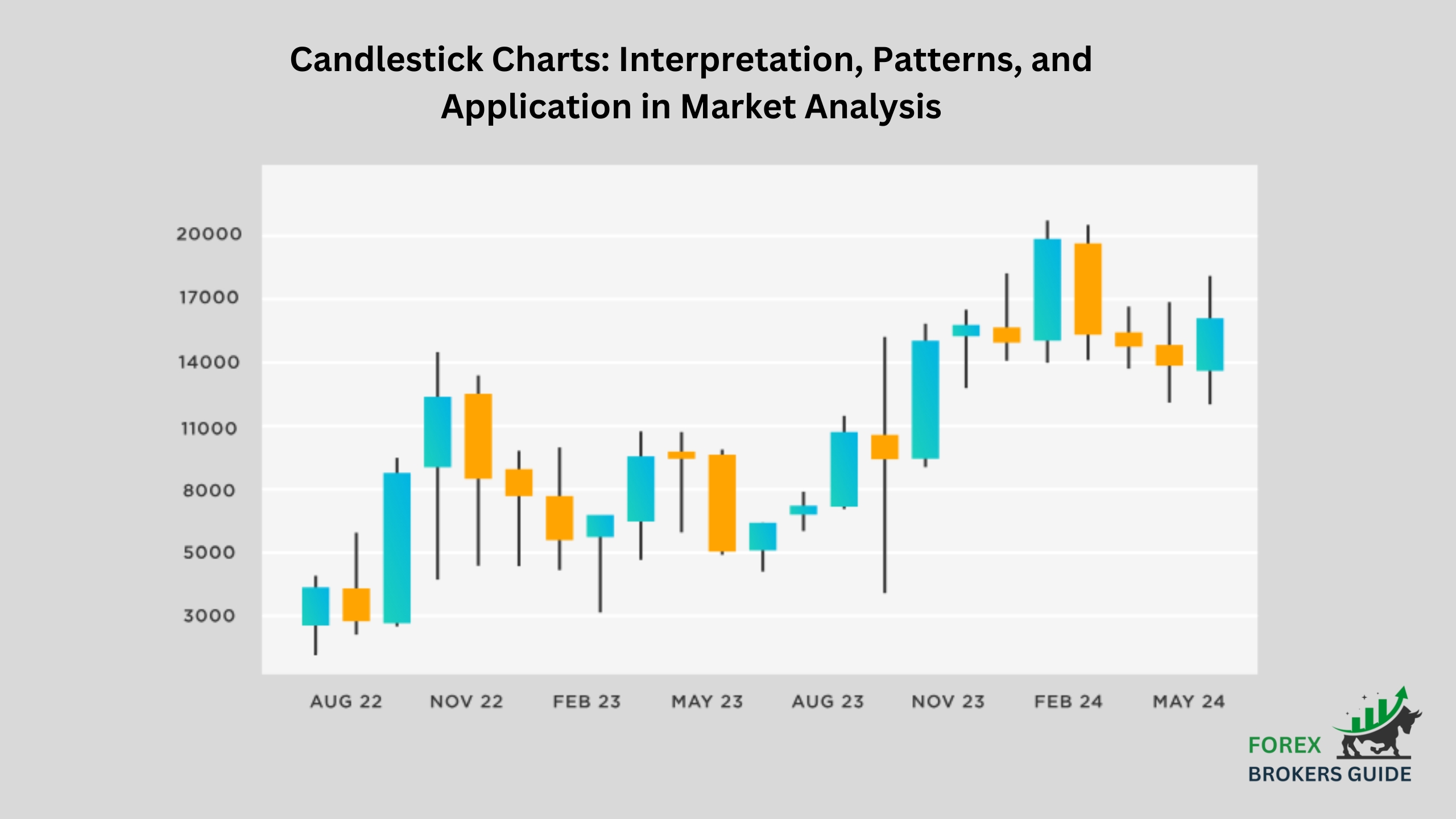

Candlestick charts are a cornerstone of technical analysis in the financial world. They offer a visually intuitive way to represent price movements of a security (stock, currency, commodity) over a specific timeframe, be it minutes, hours, days, or even weeks. Each candlestick depicts four key data points: the open, high, low, and closing prices within that timeframe.

The importance of candlestick charts lies in their ability to condense a wealth of information into a single chart, allowing traders to quickly identify trends, potential reversals, and underlying market sentiment. The body of the candlestick reflects the relationship between the opening and closing prices. A filled body (black or red) indicates a close lower than the open (downtrend), while a hollow body (white or green) signifies a close higher than the open (uptrend). The wicks (or shadows) extending above and below the body represent the intraday high and low, respectively. By analyzing the size, color, and position of these elements, traders can glean valuable insights into market psychology and price action, ultimately aiding in making informed trading decisions.

Table of Contents

What are Candlestick Charts, and how do they represent price movements in Forex Trading?

In Forex trading, candlestick charts are a visual representation of price movements for a currency pair over a chosen time period. Each candlestick condenses four key data points: the open, high, low, and closing prices within that timeframe. By analyzing the body (open vs. close) and wick (high and low) of the candlestick, forex traders can quickly grasp the price action, identify potential trends or reversals, and gauge market sentiment. This visual language allows them to make informed decisions about entering or exiting trades.

The body of the candlestick, whether filled or hollow, reveals the relationship between the open and close. A filled body (typically black or red) signifies a close lower than the open, reflecting a downtrend. Conversely, a hollow body (usually white or green) indicates a close higher than the open, suggesting an uptrend. The wicks or shadows protruding from the body represent the intraday high and low, respectively. By analyzing the size, color, and position of these elements, forex traders can decipher trends, potential reversals in price direction, and even underlying market sentiment. This visual language empowers them to make informed decisions about entering or exiting trades within the dynamic world of forex.

Decoding the Different Parts of a Candlestick (open, close, high, low).

Candlestick charts, with their visual simplicity, offer a wealth of information for forex traders. Each candlestick serves as a microcosm of price action within a specific timeframe, typically ranging from minutes to weeks. To fully grasp the story a candlestick tells, it’s crucial to understand its key components:

- Open: This is the opening price of the security (currency pair in forex) for the timeframe represented by the candlestick. The open price is depicted by the horizontal line at the leftmost end of the candlestick body.

- High: This represents the highest price the security reached during the timeframe. It’s visualized by the upper wick (or shadow) extending above the body of the candlestick. The longer the upper wick, the greater the difference between the open and the highest price reached within that period.

- Low: This signifies the lowest price the security touched during the timeframe. It’s depicted by the lower wick (or shadow) extending below the body of the candlestick. The length of the lower wick reflects the difference between the open and the lowest price reached.

- Close: This is the closing price of the security for the timeframe. It’s represented by the horizontal line at the rightmost end of the candlestick body. The relationship between the open and close prices determines the color and fullness of the body:

- Filled Body (Red or Black): If the close is lower than the open, the body is filled (usually red or black), indicating a downtrend during that timeframe.

- Hollow Body (Green or White): Conversely, if the close is higher than the open, the body is hollow (usually green or white), signifying an uptrend.

How do the Colors and Shapes of Candlesticks reflect Price Action (uptrend vs. downtrend)?

Forex traders rely on candlestick colors and shapes to decipher price action at a glance. The body’s color is a clear indicator of the trend: a filled body (red or black) signifies a downtrend as the close is lower than the open. Conversely, a hollow body (green or white) reflects an uptrend with the close exceeding the open. These colors are complemented by the wicks or shadows. A long upper wick relative to the body suggests a failed attempt by buyers to push prices higher, potentially hinting at a weakening uptrend or a reversal. On the other hand, a long lower wick indicates sellers were unable to sustain a price drop, possibly revealing underlying buying pressure or a potential trend shift. By combining these visual cues, forex traders can quickly grasp the price movement within the timeframe and make informed decisions about entering or exiting trades.

What are some of the most popular Candlestick Reversal and Continuation Patterns?

The world of candlestick analysis offers a vast library of patterns, but some hold particular weight for forex traders. Popular reversal patterns include bearish engulfing (a large bearish candle engulfing a smaller bullish candle) signaling a potential trend reversal downwards, and the hammer (a small body with a long lower wick), which might indicate buying pressure emerging after a downtrend. Continuation patterns, on the other hand, suggest a pause before the prevailing trend resumes. Examples include the bullish flag (a brief consolidation period with prices moving within a narrow range, shaped like a flag), and the rising wedge (prices contained within an upward-sloping channel), which might indicate a temporary pause before the uptrend continues. By recognizing these patterns and understanding their implications, forex traders can enhance their ability to identify potential entry and exit points within the dynamic forex market.

How can Forex Traders use other Technical Indicators to Confirm Candlestick Signals?

Candlestick patterns are powerful tools for forex traders, but they shouldn’t exist in isolation. To truly unlock their potential, forex traders should combine them with technical indicators for stronger signals and more informed decisions. These indicators can act as confirmation tools, like a bearish engulfing pattern coinciding with a downtrend signal on the RSI for a potential sell trade. They can also help identify divergences between price and indicator movement, like a price making new highs while the RSI forms lower highs, hinting at a potential reversal despite the candlestick pattern.

Furthermore, indicators like RSI can reveal overbought or oversold conditions, pinpointing potential reversal areas where a bullish engulfing pattern might be a stronger signal for a trend shift upwards. Finally, indicators like moving averages can highlight support and resistance levels that often coincide with candlestick reversal patterns, like a bearish engulfing forming at a resistance level, strengthening the case for a downtrend. Remember, the key isn’t relying on any single tool, but seeking confluence – the more signals (candlestick patterns, price action, and technical indicators) that align, the stronger the trade setup becomes, empowering forex traders to navigate the dynamic world of forex with greater confidence.

Analyzing Candlestick Patterns across different timeframes for a broader perspective

Forex traders shouldn’t limit themselves to analyzing candlestick patterns in a single timeframe. For a more well-rounded perspective, examining them across different timeframes is crucial. Higher timeframes, like daily or weekly charts, provide the big picture – the prevailing trend and overall market structure. This context helps us understand whether a candlestick pattern on a lower timeframe, like an hourly chart, suggests a potential trend reversal or simply a continuation within the established direction. Conversely, lower timeframes offer finer details on price action.

Candlestick patterns on these timeframes can pinpoint potential entry points aligned with the broader trend identified on higher timeframes. Additionally, they can act as confirmation signals for patterns seen on higher timeframes, solidifying the trading strategy. By incorporating this multi-timeframe analysis, forex traders can move beyond isolated signals and gain a comprehensive understanding of potential price movements, ultimately making more informed entry and exit decisions within the dynamic forex market.

How to Identify and Avoid Misleading Candlestick Formations (false breakouts)?

Candlestick charts are a powerful tool for forex traders, but they can also be susceptible to misleading formations. False breakouts, where the price pierces a support or resistance level but quickly reverses, can lure traders into unprofitable positions. Here’s how to identify and avoid these deceptive patterns:

- Confirmation from Multiple Timeframes: Analyze the suspected breakout across different timeframes (daily, hourly, etc.). A strong breakout on a lower timeframe might fizzle out on a higher timeframe, indicating a potential false breakout. Look for consistency in the breakout across timeframes for increased confidence.

- Volume Analysis: False breakouts often lack significant trading volume behind them. While price might pierce a level, low volume can suggest a lack of conviction from market participants, potentially signaling a false breakout. Conversely, strong breakouts typically see a surge in volume, reflecting increased buying or selling pressure.

- Price Action at the Level: Scrutinize the price action at the support or resistance level. False breakouts often see the price quickly retrace back below/above the level after a brief pierce. Conversely, a genuine breakout might see the price struggle to revisit the broken level for a sustained period, suggesting a shift in market sentiment.

- False Breakouts vs. Retracements: Differentiate between false breakouts and healthy retracements. In a strong trend, a shallow retracement that breaches a support/resistance level before quickly reversing might be a normal pullback within the trend, not a true breakout. Consider the overall trend strength and the depth of the retracement when evaluating a potential breakout.

- Confirmation from Technical Indicators: Technical indicators can offer additional insights. For example, a breakout that coincides with a bearish divergence on a momentum indicator (like RSI) might suggest a false breakout despite the price action. Conversely, a breakout with a confiration signal from an indicator (like increased volume on a breakout above a moving average) can strengthen the case for a genuine breakout.

How do Fundamental Factors and Market News Impact Candlestick Formations?

While candlestick charts offer valuable technical insights, they exist within a larger economic context. Fundamental factors like interest rate decisions, economic data releases, and geopolitical events can significantly impact price movements and, consequently, candlestick formations. For example, strong positive economic data might trigger a surge in buying pressure, reflected in bullish candlestick patterns on the chart. Conversely, unexpected negative news could lead to a wave of selling, potentially resulting in bearish candlestick formations. By staying informed about fundamental factors and how they might influence market sentiment, forex traders can gain a more holistic understanding of price movements and make better-informed trading decisions based on the combined technical and fundamental picture.

How to Incorporate Candlestick Analysis into a comprehensive Forex Trading Strategy?

Transforming from a basic chartist to a well-rounded forex trader involves incorporating candlestick analysis into your trading arsenal. Here’s a step-by-step approach:

- Diagnose the Big Picture: Analyze higher timeframes to identify the dominant trend – uptrend, downtrend, or consolidation. This sets the overall market direction.

- Spot In-Trend Opportunities: Shift to lower timeframes and seek candlestick patterns that resonate with the bigger trend. Look for bearish engulfing patterns for potential sell trades within a downtrend, or identify bullish flag patterns for potential buy entries aligned with an uptrend.

- Confirmation is King: Don’t be fooled by candlesticks alone. Utilize technical indicators like RSI or moving averages to confirm the candlestick signals. This confluence strengthens your trading conviction.

- Prioritize Risk Management: Always remember to implement stop-loss orders to limit potential losses, especially during market volatility or when confirmation signals are weak.

- Stay Informed Fundamentally: The world doesn’t revolve around charts alone. Major economic news and events can significantly impact the trend and potentially influence candlestick formations. Stay informed to gain a holistic understanding of the market.

Where can Forex Traders find resources to improve their Candlestick Charting Skills?

Equipping yourself with the ability to decipher candlestick charts is a transformative step for any forex trader. The path to mastering this skill is paved with a wealth of educational resources. Many online forex brokers offer comprehensive educational sections, including video tutorials, articles, and even live webinars specifically dedicated to candlestick charting. Delving into these resources equips you with a strong foundation. Beyond brokers, reputable forex trading websites and blogs are a treasure trove of knowledge.

Explore articles and tutorials on candlestick analysis, where you can delve deep into various patterns, technical analysis strategies, and practical tips gleaned from experienced traders. Additionally, numerous books dedicated to technical analysis and candlestick charting offer in-depth explanations and practical guidance, providing a structured learning path for those who prefer a more traditional format. Finally, consider enrolling in online courses specifically designed to teach candlestick charting and technical analysis for forex trading. These courses offer a more immersive learning experience and can provide a valuable roadmap to mastering this essential forex trading skill. By diligently tapping into these resources and honing your candlestick charting abilities, you’ll be well on your way to navigating the ever-changing forex market with greater confidence and a sharper edge.