In the fast-paced world of forex trading, breakouts signal potentially significant shifts in price movement. They occur when the price decisively breaks above resistance levels (in uptrends) or below support levels (in downtrends). These breakouts hold the potential to signal the continuation of a prevailing trend or a trend reversal, making them valuable tools for forex traders.

Understanding how breakouts work is essential. Imagine a price trapped within a defined range for a period of time, bumping against resistance levels on the upside and finding support below. A breakout signifies a forceful movement by buyers or sellers that pushes the price through this established range. A confirmed breakout with strong volume suggests a higher likelihood that the price movement will continue in the breakout direction, creating opportunities for traders to capitalize on the trend.

Table of Contents

What are Breakouts in Forex Trading, and Why are they important?

Breakouts are pivotal moments in forex trading, acting as signposts for potential trend continuations or reversals. They occur when the price decisively breaches established boundaries. In uptrends, this means the price forcefully breaks above resistance levels. Conversely, in downtrends, a breakout signifies a price plunge below support levels. This forceful movement by buyers or sellers suggests a potential shift in market sentiment, pushing the price out of its established trading range.

Why are breakouts important? They offer valuable insights for forex traders, empowering them to navigate the dynamic forex market:

- Identifying Trend Shifts: A confirmed breakout can be a game-changer. It can signal the continuation of a prevailing trend, allowing traders to ride the wave. For instance, a confirmed uptrend breakout might be a good opportunity to enter long positions. Conversely, a confirmed breakout in a downtrend might signal a trend reversal, prompting traders to enter short positions to capitalize on the price decline.

- Capitalizing on Price Movements: Breakouts often precede significant price movements in the breakout direction. By identifying and confirming breakouts, traders can position themselves to potentially profit from these substantial trends. Imagine a breakout in an uptrend – by recognizing and capitalizing on this opportunity, a trader could potentially enjoy significant gains as the price continues its upward climb.

How do breakouts indicate Potential Continuations of Existing Trends?

Breakouts, those decisive price movements in forex trading, hold immense value for identifying potential continuations of existing trends. They occur when the price decisively breaks above resistance levels in uptrends or below support levels in downtrends. By understanding how breakouts signal trend continuation, forex traders can position themselves to potentially capitalize on these extended price movements.

Imagine an uptrend where the price has repeatedly encountered resistance at a specific level. A confirmed breakout above this resistance signifies a crucial turning point. Buyers have finally overpowered sellers, pushing the price through this established barrier. This surge in buying pressure often indicates a continuation of the uptrend, with the price likely to target even higher levels.

A confirmed breakout can also reflect a broader shift in market sentiment. When the price decisively breaks a resistance level, it suggests growing confidence among market participants in the uptrend’s continuation. This influx of buying pressure fuels the trend’s momentum, potentially leading to further price increases.

However, not all breakouts are created equal. It’s crucial to consider volume alongside the price action. A confirmed breakout with high trading volume strengthens the case for a trend continuation. High volume suggests greater conviction behind the price movement, indicating a higher likelihood that the breakout is genuine and the trend will persist.

While breakouts themselves offer valuable insights, incorporating technical indicators can provide additional confirmation. For instance, a confirmed breakout coinciding with a rising moving average or a bullish signal from an indicator like MACD strengthens the case for a trend continuation. By understanding these factors and potential false breakouts, especially in volatile markets, forex traders can leverage breakouts to effectively navigate existing trends and make informed trading decisions.

Are there different Types of Breakouts relevant to Forex Trading Strategies?

Yes, there are two main types of breakouts relevant to forex trading strategies:

- Continuation Breakouts: These occur within established trends and signal a potential continuation of the uptrend (price breaking above resistance) or downtrend (price breaking below support). They offer opportunities to ride the prevailing trend by entering long positions in uptrend breakouts or short positions in downtrend breakouts.

- Reversal Breakouts: These signal a potential shift in the trend’s direction. A price breaking above resistance in a downtrend or below support in an uptrend suggests a possible trend reversal. Forex traders can capitalize on this by entering short positions after a bullish breakout in a downtrend or long positions after a bearish breakout in an uptrend.

Which Technical Indicators can help Identify Potential Breakouts in Forex Charts?

Discerning potential breakouts in the forex market is crucial for capitalizing on significant price movements. Here are some technical indicators that act as valuable tools in a forex trader’s toolkit:

- Moving Averages: These act as a trend filter, highlighting the prevailing direction. A confirmed breakout with the price decisively moving above a rising moving average in an uptrend or below a falling moving average in a downtrend strengthens the breakout’s legitimacy. This convergence of price action and moving average direction suggests a powerful trend continuation signal.

- Volume Analysis: Not all breakouts are created equal. Volume plays a critical role in assessing the strength behind a breakout. High trading volume accompanying a breakout suggests greater conviction from market participants, increasing the likelihood of a genuine breakout leading to a sustained price move. Conversely, low volume breakouts might be deceptive and could fizzle out quickly, warranting caution from traders.

- Relative Strength Index (RSI): This indicator helps assess overbought or oversold conditions. A breakout above resistance with the RSI still in neutral territory suggests room for further upside potential. This indicates healthy buying pressure and a potential trend continuation. However, a breakout with an overbought RSI (above 70) might signal a potential failed breakout, where the price might struggle to sustain the move due to excessive buying pressure.

- Moving Average Convergence Divergence (MACD): This indicator gauges momentum and potential trend reversals. Bullish signals from MACD coinciding with a breakout in an uptrend or bearish signals aligning with a breakout in a downtrend can offer additional confirmation of the breakout’s legitimacy. By incorporating these signals alongside price action analysis, traders can gain valuable insights into the strength and direction of the breakout.

How can Forex Traders confirm the legitimacy of a Breakout Signal?

Breakout signals in Forex Trading hold the potential for significant profits, but not all breakouts are created equal. To avoid getting caught in a false breakout and incurring unnecessary losses, forex traders should employ a multi-step approach for confirmation.

The first step is to analyze the price action itself. Look for a decisive price movement, where the price forcefully breaks above resistance levels in uptrends or below support levels in downtrends. This forceful move suggests a strong push by buyers or sellers, potentially overcoming the established trading range. A weak breakout, where the price struggles to break through the level, might be a false signal and should be treated with caution.

Next, consider volume analysis. High trading volume accompanying the breakout strengthens the case for its legitimacy. Imagine a breakout on low volume – this might indicate a lack of conviction from market participants, and the breakout could fizzle out quickly. Conversely, high volume suggests strong market participation and increased buying or selling pressure, making the breakout more likely to be genuine and lead to a sustained price movement.

Finally, incorporate technical indicators to add another layer of confirmation. While not a guaranteed predictor, technical indicators can offer valuable insights. Look for signals that align with the breakout direction. For instance, a confirmed breakout in an uptrend might be further validated by a rising moving average or a bullish RSI signal. Conversely, a downtrend breakout could find support from a falling moving average or a bearish signal from the MACD indicator.

What are False Breakouts, and How can forex traders avoid them?

False breakouts in forex trading are deceptive signals where the price appears to break above resistance in uptrends or below support in downtrends, but then quickly reverses back within the established trading range. These can be costly for traders who enter positions based on the initial breakout signal.

To avoid false breakouts, forex traders can:

- Focus on decisive breakouts: Look for strong price movements that clearly overcome resistance or support levels.

- Analyze volume: High volume accompanying a breakout strengthens its legitimacy, while low volume might indicate a false breakout.

- Use confirmation from technical indicators: Look for signals like moving averages or momentum indicators that align with the breakout direction.

- Employ stop-loss orders: These automatically exit a trade if the price moves against you, limiting potential losses from false breakouts.

How to use Breakouts for Entry Points and Confirm them with Additional Tools?

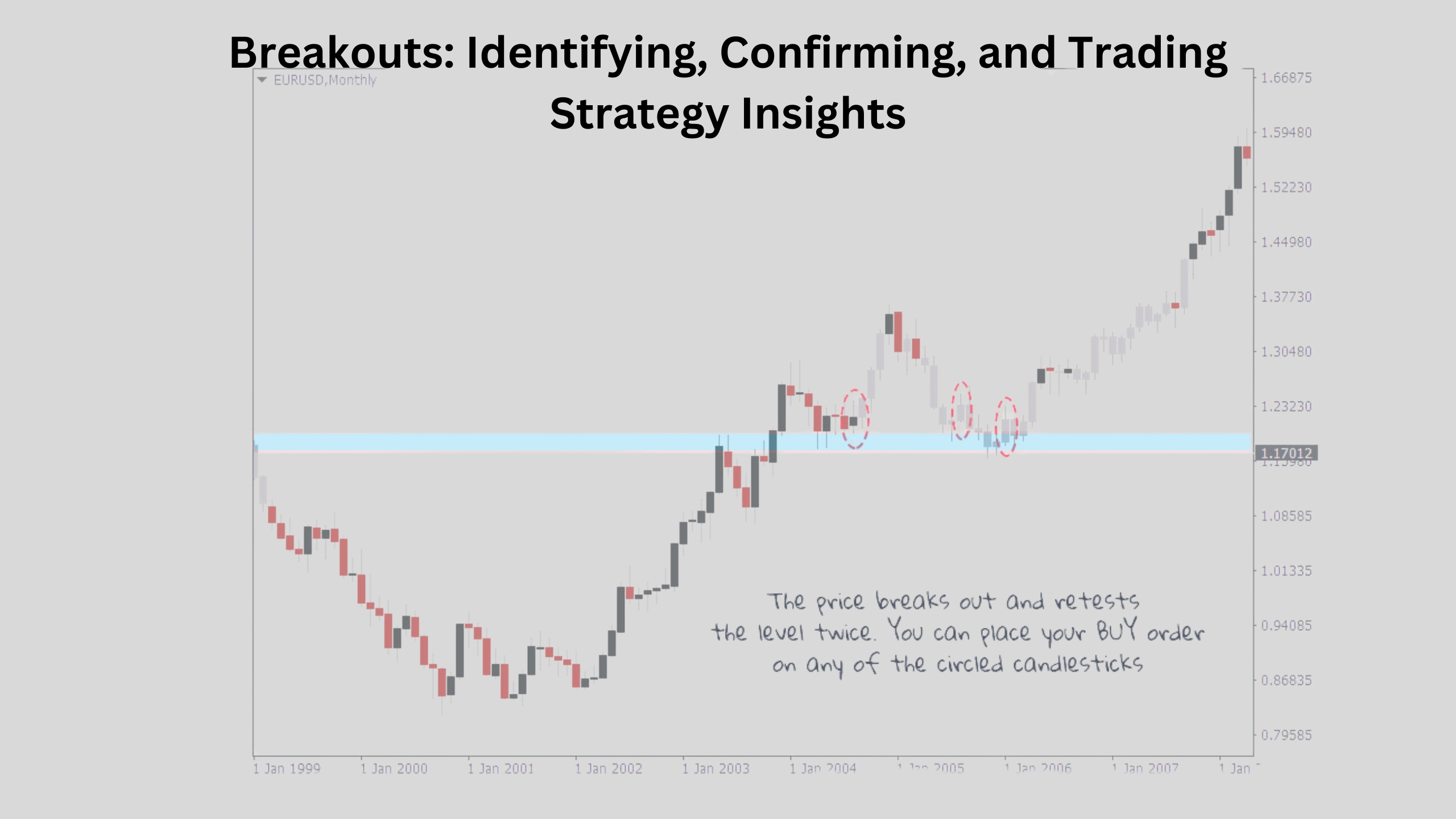

Breakouts in forex trading signal potential trend shifts and can be used to identify entry points. However, to avoid chasing false signals, confirmation is key. Look for decisive price movements above resistance in uptrends or below support in downtrends. Then, confirm the breakout’s legitimacy with high volume and technical indicators that align with the trend direction, like rising moving averages in uptrends. This combined approach strengthens your entry point confidence and helps you potentially capitalize on significant price movements. Remember, always manage risk with stop-loss orders in forex trading.

What Risk Management Strategies are Crucial for Trading Breakouts in Forex?

Breakouts offer opportunities, but also carry risk. Here are crucial risk management strategies for forex traders during breakouts:

- Stop-Loss Orders: These automatically exit your trade if the price moves against you, limiting potential losses from false breakouts or unexpected price reversals.

- Position Sizing: Don’t risk a large portion of your capital on a single breakout trade. Maintain a reasonable position size to minimize potential losses and protect your overall trading capital.

- Volatility Awareness: Breakouts can occur during volatile periods. Be aware of increased volatility and adjust your risk management accordingly, potentially using tighter stop-loss orders.

- Confirmation Strategies: Don’t rely solely on the breakout itself. Implement confirmation techniques like volume analysis and technical indicators to increase your confidence in the breakout’s legitimacy before entering a trade.

- Risk-Reward Ratio: Consider the potential reward (profit target) compared to the risk (stop-loss distance) before entering a breakout trade. Aim for trades with a favorable risk-reward ratio, where the potential profit outweighs the potential loss.

How can Forex Traders set Realistic Profit targets when trading Breakouts?

Setting realistic profit targets for breakout trades in forex requires a balance between potential gains and risk management. Here’s how forex traders can approach this:

- Consider Historical Volatility: Analyze the currency pair’s historical volatility to understand the typical price movements following breakouts. This helps set realistic expectations for potential profit targets.

- Technical Indicators: Some technical indicators, like Fibonacci retracements or price projections, can provide potential target zones based on historical price movements. However, these should be used as guidelines, not guarantees.

- Risk-Reward Ratio: Focus on trades with a favorable risk-reward ratio. Before entering a trade, determine your stop-loss placement and aim for a profit target that offers at least double the potential risk. This ensures you’re aiming for a greater potential profit compared to the potential loss if the breakout fails.

- Trailing Stops: Implement trailing stop-loss orders to lock in profits as the price moves in your favor. This helps secure gains while allowing for some profit-taking if the price reverses.

How can Specific Price Action Patterns around breakouts strengthen trade signals?

Setting realistic profit targets for breakout trades in forex requires a balance between potential gains and risk management. Here’s how forex traders can approach this:

- Consider Historical Volatility: Analyze the currency pair’s historical volatility to understand the typical price movements following breakouts. This helps set realistic expectations for potential profit targets.

- Technical Indicators: Some technical indicators, like Fibonacci retracements or price projections, can provide potential target zones based on historical price movements. However, these should be used as guidelines, not guarantees.

- Risk-Reward Ratio: Focus on trades with a favorable risk-reward ratio. Before entering a trade, determine your stop-loss placement and aim for a profit target that offers at least double the potential risk. This ensures you’re aiming for a greater potential profit compared to the potential loss if the breakout fails.

- Trailing Stops: Implement trailing stop-loss orders to lock in profits as the price moves in your favor. This helps secure gains while allowing for some profit-taking if the price reverses.

How does Volatility play a role in Breakout Confirmation and Trading Strategies?

Volatility plays a crucial role in both confirming breakouts and developing breakout trading strategies in forex:

- Confirmation: High volatility can accompany a breakout, but not all high-volatility breakouts are genuine. Look for sustained increased volume alongside the breakout. This suggests strong conviction behind the price movement, strengthening the breakout’s legitimacy. Conversely, breakouts during low volatility periods might be deceptive and fizzle out quickly.

- Trading Strategies: Volatility can impact your entry and exit points. During periods of high volatility, consider using tighter stop-loss orders to manage risk due to the increased chance of price swings. Conversely, moderate volatility might allow for wider stop-loss placements to offer the price more room to move in the breakout direction.

How can Forex Traders use Volume Analysis to Confirm the Strength of a Breakout?

Volume analysis is a critical weapon in a forex trader’s arsenal for confirming the strength of a breakout. Here’s why:

- High Volume Validation: The ideal scenario is a breakout accompanied by a significant surge in trading volume compared to the average volume for that currency pair. This surge suggests strong market participation. Imagine a forceful price movement above resistance in an uptrend, accompanied by a spike in volume. This indicates a wave of buying pressure, potentially pushing the price further in the uptrend direction. High volume strengthens the case for a genuine breakout, increasing the likelihood of a sustained price move.

- Low Volume Caution: Conversely, breakouts with low trading volume should be approached with caution. A breakout might appear on the chart, but if it’s not backed by significant volume, it could be a deceptive signal. Low volume suggests a lack of conviction from market participants. The price might struggle to maintain the breakout, potentially reversing back into the previous trading range. While low volume doesn’t guarantee a false breakout, it warrants caution and potentially using additional confirmation tools before entering a trade based solely on the breakout signal.

What are the Limitations of Relying Solely on Breakouts for Trading Decisions?

Volume analysis is a critical weapon in a forex trader’s arsenal for confirming the strength of a breakout. Here’s why:

- High Volume Validation: The ideal scenario is a breakout accompanied by a significant surge in trading volume compared to the average volume for that currency pair. This surge suggests strong market participation. Imagine a forceful price movement above resistance in an uptrend, accompanied by a spike in volume. This indicates a wave of buying pressure, potentially pushing the price further in the uptrend direction. High volume strengthens the case for a genuine breakout, increasing the likelihood of a sustained price move.

- Low Volume Caution: Conversely, breakouts with low trading volume should be approached with caution. A breakout might appear on the chart, but if it’s not backed by significant volume, it could be a deceptive signal. Low volume suggests a lack of conviction from market participants. The price might struggle to maintain the breakout, potentially reversing back into the previous trading range. While low volume doesn’t guarantee a false breakout, it warrants caution and potentially using additional confirmation tools before entering a trade based solely on the breakout signal.

How do Different Market Conditions (trending vs. ranging) Impact the significance of Breakouts?

Market conditions significantly impact the significance of breakouts in forex trading:

- Trending Markets: In established trends (up or down), breakouts hold greater weight. A confirmed breakout above resistance in uptrends or below support in downtrends suggests a continuation of the prevailing trend. These breakouts offer opportunities to capitalize on the trend’s momentum by entering long positions in uptrend breakouts or short positions in downtrend breakouts.

- Ranging Markets: Breakouts in these sideways markets are less clear-cut. The price might repeatedly test both resistance and support zones, creating consolidation phases. Here, confirmation from price action and additional technical indicators like Bollinger Bands becomes crucial for identifying potential breakouts or breakdowns from the range. Breakouts in ranging markets can be trickier, so exercising caution and seeking additional confirmation is essential.

How can Forex Traders incorporate Breakouts into a Comprehensive Trading Strategy?

Breakouts, those decisive price movements in forex, can be powerful allies within your overall trading strategy. Here’s how to effectively integrate them:

The foundation lies in understanding the prevailing trend – uptrend, downtrend, or ranging market. This context helps interpret breakouts as potential trend continuations or reversals. Look for strong price movements that decisively overcome resistance levels in uptrends or support levels in downtrends. Weak breakouts might be deceptive, so focus on clear and forceful moves.

Confirmation is key. Don’t rely solely on the breakout itself. High trading volume accompanying the breakout suggests strong market participation, increasing its legitimacy. Additionally, incorporate technical indicators like rising moving averages in uptrends to further validate the breakout’s direction.

Remember, risk management is paramount. Always implement strategies like stop-loss orders to limit potential losses, especially during volatile breakouts. Setting realistic profit targets is crucial as well. Consider historical volatility and aim for a favorable risk-reward ratio where potential profit outweighs potential loss.

Finally, adapt to market conditions. Breakouts hold greater weight in trending markets. In ranging markets, where the price consolidates within a defined range, use additional confirmation tools like Bollinger Bands to identify valid breakouts from these phases.

Candlestick Charts: Interpretation, Patterns, and Application in Market Analysis

28 May 2024[…] Confirmation from Technical Indicators: Technical indicators can offer additional insights. For example, a breakout that coincides with a bearish divergence on a momentum indicator (like RSI) might suggest a false breakout despite the price action. Conversely, a breakout with a confiration signal from an indicator (like increased volume on a breakout above a moving average) can strengthen the case for a genuine breakout. […]