Imagine yourself navigating the bustling streets of a foreign city. Shop signs flash in unfamiliar languages, and the cacophony of car horns and chattering crowds fills the air. Excitement mingles with a touch of trepidation – you’re here to explore, but the unfamiliar territory requires a keen eye for detail. This is akin to the world of forex trading, where currencies are constantly on the move, their values fluctuating like the ever-changing city scene.

In this dynamic marketplace, precision is your compass. Enter the mighty pip, the forex trader’s secret weapon. Think of it as a magnifying glass, allowing you to zoom in on the tiniest price movements in a currency pair. While seemingly insignificant at first glance (a pip typically represents a shift of 0.0001 for most currencies), these minuscule changes can accumulate over time, impacting your potential profits or losses. Just like navigating a foreign city, where every turn unveils a new detail, understanding pips equips you to track the intricate movements of the forex market and make informed decisions, transforming you from a wide-eyed explorer into a seasoned navigator of the currency exchange.

What is a Pip in Forex Trading?

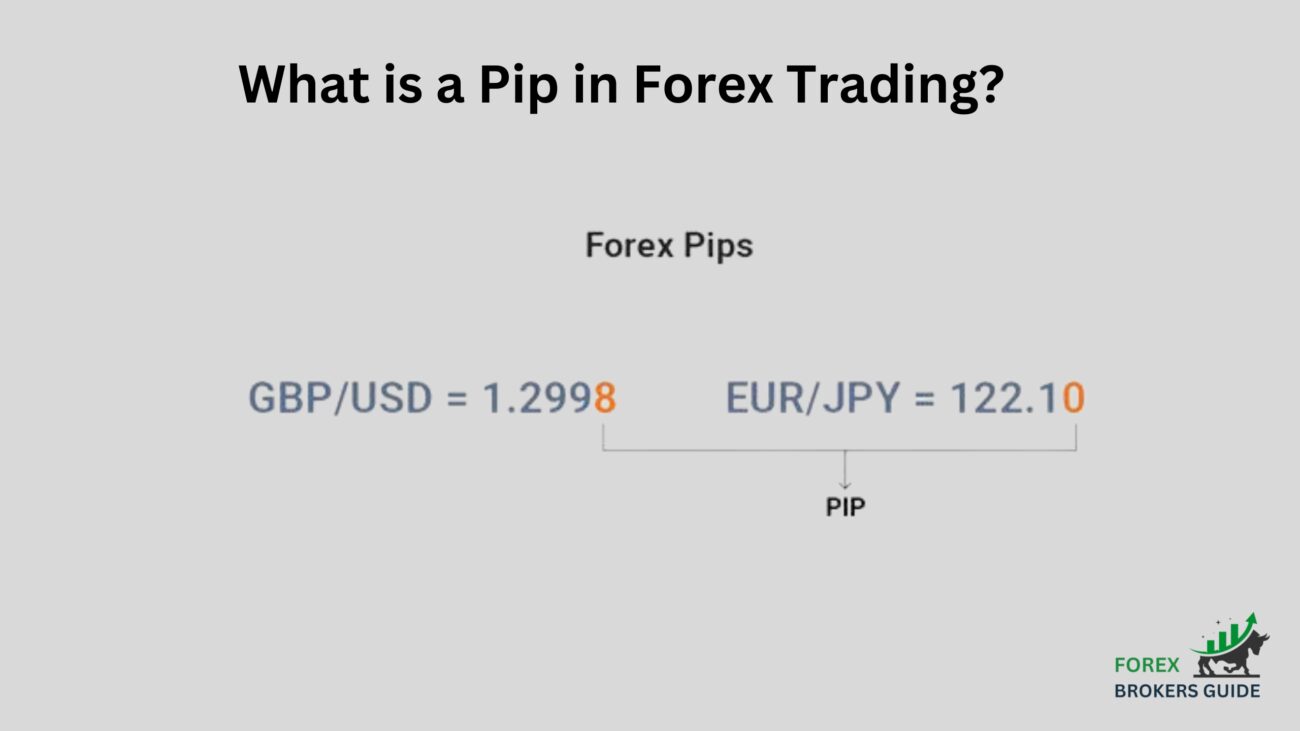

Pip, short for “percentage in point” or “price interest point,” represents the smallest measurable change in a currency pair’s exchange rate. Think of it as the microscopic unit that unveils the larger story. For most currency pairs, a pip translates to a movement of 0.0001, which is equivalent to one-hundredth of one percent. However, for certain currencies like the Japanese yen, which is typically quoted in units of 100, a pip translates to 0.01 (one yen).

While a single pip might seem like an insignificant blip on the radar, its importance in forex trading cannot be overstated. By understanding pips and their role in measuring even the most minute price movements, traders gain a vital edge in navigating the complexities of the market.

Are there different terms used for Pips?

“Pip” remains the dominant term used to describe the smallest measurable price movement in most currency pairs, there’s another term you might encounter: “point.” This is generally considered interchangeable with “pip” for most currencies. However, it’s important to be aware of a key distinction for the Japanese yen (JPY).

For most currency pairs, a pip represents a movement of 0.0001. However, the Japanese yen is often quoted in units of 100. In this case, a pip translates to 0.01 yen, which is ten times larger than the standard pip value. To avoid confusion, some forex platforms or brokers might use the term “point” specifically when referring to the 0.01 yen movement for the JPY currency pair.

Here’s a quick breakdown:

- Pip (or Point): Standard term for the smallest price movement (0.0001) in most currency pairs.

- Point (JPY): Sometimes used specifically for the 0.01 yen movement in Japanese yen (JPY) currency pairs.

How is the Pip Value for a Currency Pair Calculated?

A pip, short for “percentage in point” or “price interest point,” represents the smallest measurable change in a currency pair’s exchange rate. But how do you translate this tiny unit into a concrete value you can use for calculations?

Understanding pip value and how to calculate it for any currency pair is essential for forex traders. Here’s a breakdown of the process:

- Identify the Quoted Currency: In a currency pair, the quoted currency is like the price tag. It’s the second currency listed and the one you receive when you buy the base currency. For instance, in the EUR/USD pair, the US dollar (USD) is the quoted currency. This is the currency for which you’ll be calculating the pip value.

- Standard Pip Value vs. JPY Pip Value: Remember, the standard pip value for most currency pairs is 0.0001, representing a movement of one-hundredth of one percent. However, for certain currencies like the Japanese yen (JPY), which are often quoted in units of 100, a pip translates to 0.01 (one yen).

- The Pip Value Formula: Once you’ve identified the quoted currency and its corresponding pip value (standard or JPY), you can use the following formula to calculate the actual pip value in the quoted currency:

Pip Value (Quoted Currency) = Pip Value (Standard/JPY) / Exchange Rate

Let’s break down the formula and see it in action with an example:

- Scenario: You want to calculate the pip value in US dollars (USD) for the EUR/USD currency pair.

- Exchange Rate: The current exchange rate for EUR/USD is 1.20 (meaning 1 euro = 1.20 US dollars).

- Standard Pip Value: Since EUR/USD isn’t a JPY pair, we use the standard pip value of 0.0001.

Pip Value (USD) = 0.0001 (Standard Pip Value) / 1.20 (Exchange Rate) = 0.000083 USD

Therefore, in this example, a movement of one pip in the EUR/USD pair translates to a change of 0.000083 US dollars. This seemingly small value can accumulate over time, significantly impacting your profits or losses in forex trades.

By mastering the art of calculating pip value, you gain a valuable tool for navigating the forex market. You can use pip values to:

- Measure Potential Profits and Losses: Knowing the pip value allows you to calculate the exact amount you stand to gain or lose on a trade based on the pip movement in the currency pair.

- Calculate Margin Requirements: Forex brokers often require a margin deposit, a percentage of the total trade value, to control a larger position. Understanding pip value helps you determine the margin needed for your trades.

- Compare Transaction Costs: Forex brokers charge commissions or spreads for executing trades. By calculating the pip value, you can compare these costs across different brokers and ensure you’re getting the best deal.

How does the Quote Currency in a Pair Affect Pip Value?

The Quote Currency within a pair subtly influences the pip value. Imagine two seemingly identical twins, yet upon closer inspection, you discover subtle differences. The quoted currency acts like that hidden influence, shaping the value of a pip behind the scenes.

Here’s why the quoted currency plays a starring role:

- The Standard Pip Value: A Baseline Hero: Most Currency Pairs operate with a standard pip value of 0.0001, representing a movement of one-hundredth of one percent. This serves as the baseline hero in our story, the common ground for most pip calculations.

- The JPY Exception: A Yenny Twist: Enter the Japanese yen (JPY). Unlike most currencies, JPY pairs are often quoted in units of 100. This throws a curveball at the standard pip value. Here, a pip translates to 0.01 yen, ten times larger than the standard pip value. Imagine our baseline hero encountering a powerful foe – the JPY pip value with ten times the influence.

- The Exchange Rate: The Balancing Act: The exchange rate between the two currencies in a pair acts as the balancing force. Remember, the pip value is ultimately expressed in the quoted currency. So, for a non-JPY pair, the exchange rate doesn’t directly affect the pip value itself (which remains 0.0001). However, it determines how much that pip value is worth in the quoted currency.

Let’s illustrate this with an example:

- Scenario 1: EUR/USD (Standard Pip Value): Imagine the EUR/USD exchange rate is 1.20. We know the standard pip value is 0.0001. While the pip value itself remains 0.0001, applying the formula (pip value = standard pip value / exchange rate), we get a pip value of 0.000083 USD.

- Scenario 2: USD/JPY (JPY Pip Value): Now, consider USD/JPY with an exchange rate of 110 yen per USD. Since it’s a JPY pair, the pip value is 0.01 yen. Using the formula again (pip value = JPY pip value / exchange rate), we get a pip value of 0.000091 USD (approximately).

Notice how even though the pip value itself is larger for JPY pairs (0.01 yen compared to 0.0001), the final pip value in USD (the quoted currency) can be very close to the standard pip value due to the impact of the exchange rate.

Is there a difference in Pip Calculation for Currency Pairs involving the Japanese Yen (JPY)?

The world of forex trading can feel like a whirlwind of numbers and charts. But fear not, intrepid trader! Understanding pips, those tiny units that measure currency movements, is essential for navigating this dynamic market. However, when it comes to the Japanese Yen (JPY), things take a slight detour. Buckle up, because we’re diving into the unique pip calculation for JPY pairs!

Classic Pip

Imagine a ruler with super precise markings – that’s the standard pip value (0.0001) for most currency pairs. It allows you to track even the tiniest shifts in exchange rates, just like a jeweler meticulously examining a diamond. This trusty pip value is your go-to for most forex transactions.

JPY Twist

Now, the Japanese Yen throws a playful wrench into the mix. JPY pairs are often quoted in units of 100. This means a pip for a JPY pair translates to 0.01 yen, a whole ten times bigger than the standard pip value! Think of it like switching from millimeters to centimeters on your measuring tape – the units are larger, but you’re still measuring change.

The Exchange Rate

While the pip value itself is different for JPY pairs, the exchange rate plays a crucial role in how much that pip is actually worth. Remember, the pip value is ultimately shown in the quoted currency (the second currency listed in the pair). So, for non-JPY pairs, the exchange rate doesn’t directly affect the pip value (which remains 0.0001). However, it determines the value of that pip in the quoted currency.

A Real-World Example

Imagine you’re trading the EUR/USD pair, and the exchange rate is 1.20 (meaning 1 euro = 1.20 US dollars). Using the standard pip value, a 1 pip movement would be 0.0001 * 1.20 = 0.000083 USD.

Now, let’s switch to the USD/JPY pair with an exchange rate of 110 yen per USD. Since it’s a JPY pair, the pip value is 0.01 yen. But to see its value in USD (the quoted currency), we do 0.01 yen / 110 yen/USD = 0.000091 USD (approximately).

Why are Pips Important for Forex Traders?

Imagine you’re shopping at a giant international market, haggling over prices of exotic goods from all over the world. Prices change constantly, and even a tiny shift can mean the difference between a steal and a rip-off. That’s kind of how forex trading works, except instead of goods, you’re buying and selling currencies.

Here’s where pips come in. They’re like the tiniest markings on a measuring tape, so small you almost can’t see them. But in forex trading, these tiny markings are crucial. They let you track the slightest changes in how much one currency is worth compared to another.

Why are these tiny changes so important? Well, because in forex trading, even small movements can add up to big profits or losses. Pips help you figure out exactly how much you might make (or lose) based on how much a currency moves.

Another reason pips are important is because they help you manage your risk. When you trade currencies, you sometimes have to put up a deposit as a kind of guarantee. Pips help you understand how much deposit you need based on how much you’re trading and how the price might move.

Think of pips like the secret language of forex traders. By understanding them, you can learn the tricks of the trade, like how to spot good opportunities or find the best deals on fees. In short, pips are the building blocks of successful forex trading. They help you see the small stuff, understand the risks, and potentially make smarter choices when buying and selling currencies in this giant international marketplace.

How do Pips help Traders Measure Profitability and Potential Losses?

Pips are your secret weapon for measuring both potential profits and lurking losses. These aren’t bugs or insects, but rather the smallest measurable changes in a currency pair’s exchange rate.

Think of them as the hash marks on a ruler – so small they’re almost invisible, but crucial for gauging even the slightest movement. And in forex, even tiny movements can make a big difference to your bottom line.

How Pips Reveal Your Profit Potential

Imagine you buy Euros (EUR) with US Dollars (USD). If the Euro strengthens against the Dollar (EUR/USD price goes up), you stand to make a profit. Pips help you calculate the exact value of that profit. Here’s the breakdown:

- Multiply Pip Movement by Pip Value: Each currency pair has a specific pip value. For most pairs, it’s 0.0001 of the quoted currency (usually the second currency listed). So, if the EUR/USD price increases by 10 pips, that’s 10 x 0.0001 USD = 0.001 USD.

- Factor in the Number of Units Traded: The more Euros you bought, the bigger your potential profit. Let’s say you bought 10,000 Euros.

- Calculate Your Profit: Multiply the pip value change by the number of units traded: 0.001 USD/pip * 10,000 EUR = 10 USD. So, with a 10 pip increase, you might make a 10 USD profit.

The Flip Side

Pips aren’t just about sunshine and profits. They also help you understand potential losses. If the EUR/USD price falls by 10 pips, you would incur a loss of 10 USD based on the same calculation.

By understanding pips and their impact on your trades, you can make smarter choices:

- Set Realistic Profit Targets: Knowing how pip movements translate to profits allows you to set achievable goals for your trades.

- Manage Risk Like a Pro: Use pips to set stop-loss orders, which automatically exit a trade if the price moves against you by a predetermined amount (in pips), helping you minimize losses.

- Compare Trading Opportunities: Pips allow you to compare the potential profit (or loss) per pip movement across different currency pairs. This helps you choose opportunities that align with your trading goals.

How are Pips used to Set Stop-loss and Take-profit Orders?

Imagine you’re at a flea market, haggling for a vintage watch. You think you snagged a deal, but what if the seller suddenly jacks up the price? A stop-loss order in forex works in a similar way. It’s like telling your broker, “Hey, if the price of this currency falls by a certain amount (in pips), sell my holdings automatically.”

Here’s how pips help with stop-loss orders:

- Know Your Limits: Before you jump into a trade, decide how much you’re comfortable losing. Let’s say you buy Euros with US Dollars and you don’t want to lose more than $20 on the trade.

- Turning Dollars into Pips: Since each currency pair has a pip value (usually 0.0001 USD for most pairs), a $20 loss translates to finding out how many pips that equals. We do some quick math: $20 / 0.0001 USD/pip = 200,000 pips. (Though most platforms only allow you to set stop-loss in whole pips, so you’d round this down to 200,000 pips).

- Setting the Order: You tell your broker to sell your Euros if the price drops by 200,000 pips, effectively limiting your potential loss to $20.

Take-Profit Orders: Snatching Victory Before the Market Changes its Mind

Just like a stop-loss order protects you from losing too much, a take-profit order helps you grab your winnings and run. Imagine you buy a trendy handbag at a discount store, and then everyone starts wanting it! A take-profit order lets you lock in that profit in forex.

Here’s how pips play a role in take-profit orders:

- Setting Your Goal: Decide how much profit you want to make on your trade. Maybe you’re happy with a 10-pip profit on your Euros.

- Turning Profit into Pips: Similar to stop-loss orders, a 10-pip profit translates to 10 pips * 0.0001 USD/pip = $0.001 USD per Euro traded.

- Securing Your Win: You instruct your broker to sell your Euros once the price goes up by 10 pips, guaranteeing you that sweet $0.001 profit per Euro.

How can Pips be Used to Calculate Profit or Loss on a Closed Trade?

In forex trading, pips are tiny measurements used to set stop-loss and take-profit orders. These orders help manage risk and lock in profits.

- Stop-loss orders limit potential losses by automatically selling a currency if the price moves against you by a predetermined number of pips.

- Take-profit orders lock in gains by automatically selling a currency when the price reaches a desired profit level (also in pips).

By using pips for these orders, you can make informed decisions, avoid emotional trading, and potentially achieve your trading goals.

How do pips help traders evaluate the Impact of Trading Costs (Commissions and Spreads)?

By knowing the pip value for a specific currency pair (usually 0.0001 for most major pairs), traders can calculate the cost of commissions and spreads in terms of pips. This allows them to compare different brokers and choose the one with the most competitive rates. For example, if a broker charges a commission of $10 and the pip value for EUR/USD is 0.0001 USD, the commission translates to 10 USD / 0.0001 USD/pip = 100,000 pips. This helps traders assess if the potential profit from a trade outweighs the cost of these fees.

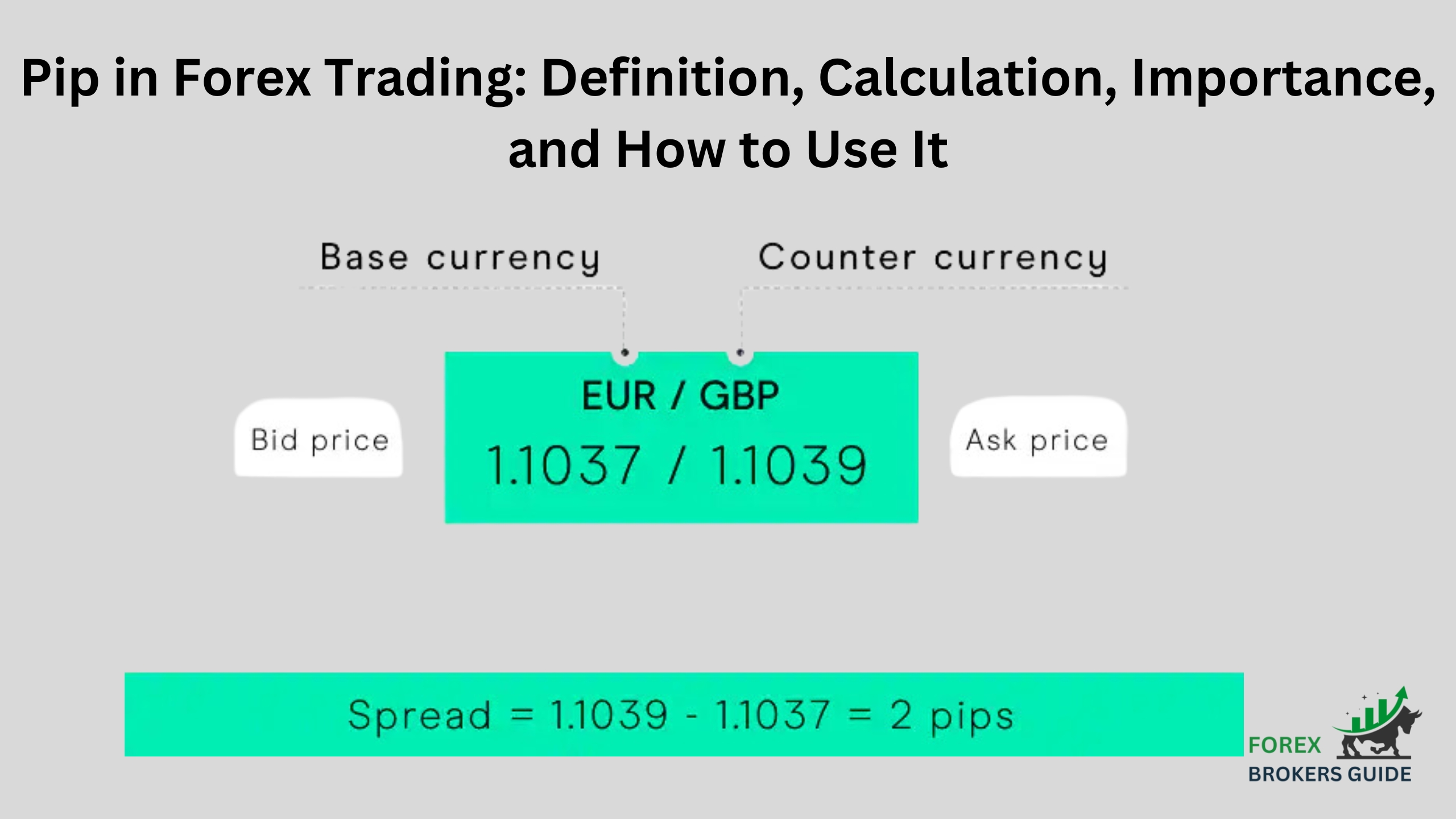

Furthermore, pips allow traders to factor in the spread when setting realistic profit targets. Since the spread represents the difference between the buying and selling price, it essentially eats into your potential profit. By knowing the spread in pips (the difference between the bid and ask price divided by the pip value), traders can adjust their profit targets accordingly, ensuring they account for these additional costs.

In essence, pips act as a magnifying glass for forex traders, allowing them to see the true impact of trading costs on their bottom line. By understanding how pips translate commissions and spreads, traders can make informed decisions about which brokers to use, set realistic profit expectations, and ultimately navigate the forex market with greater efficiency.