Imagine you’re a traveler planning a trip to Europe. To exchange your US dollars (USD) for euros (EUR), you’ll need to be aware of the current exchange rate between these two currencies. The exchange rate tells you exactly how many US dollars you need to exchange for one euro. For instance, an exchange rate of EUR/USD 1.20 signifies that you would need to exchange 1.20 US dollars to acquire 1 euro. However, this exchange rate isn’t fixed – it’s constantly fluctuating based on a complex interplay of economic, political, and psychological factors. Understanding these determinants and how they influence exchange rate movements is crucial for navigating the ever-changing landscape of the forex market.

What is an Exchange Rate in Forex Trading?

The exchange rate serves as the cornerstone of every transaction. It’s the benchmark that translates the relative value of one currency against another, dictating how much of one currency you need to exchange to acquire a unit of another. Imagine you’re a tourist planning a European vacation. To convert your US dollars (USD) into euros (EUR) for spending, you’d need to be aware of the current exchange rate between these two currencies. The exchange rate essentially tells you the exact conversion rate: how many US dollars you need to exchange to get one euro. For instance, an exchange rate of EUR/USD 1.20 signifies that you would need to exchange 1.20 US dollars to acquire 1 euro.

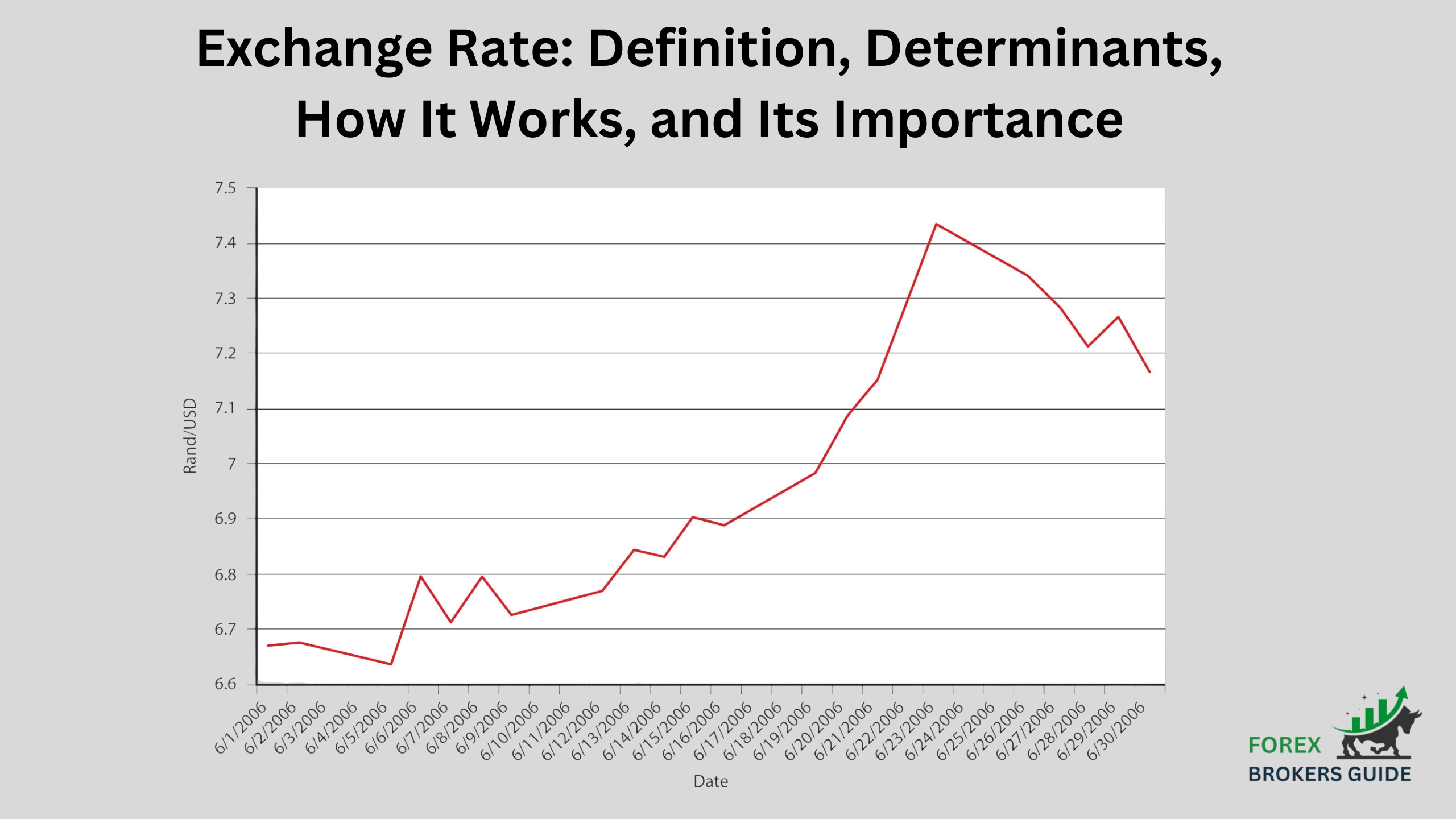

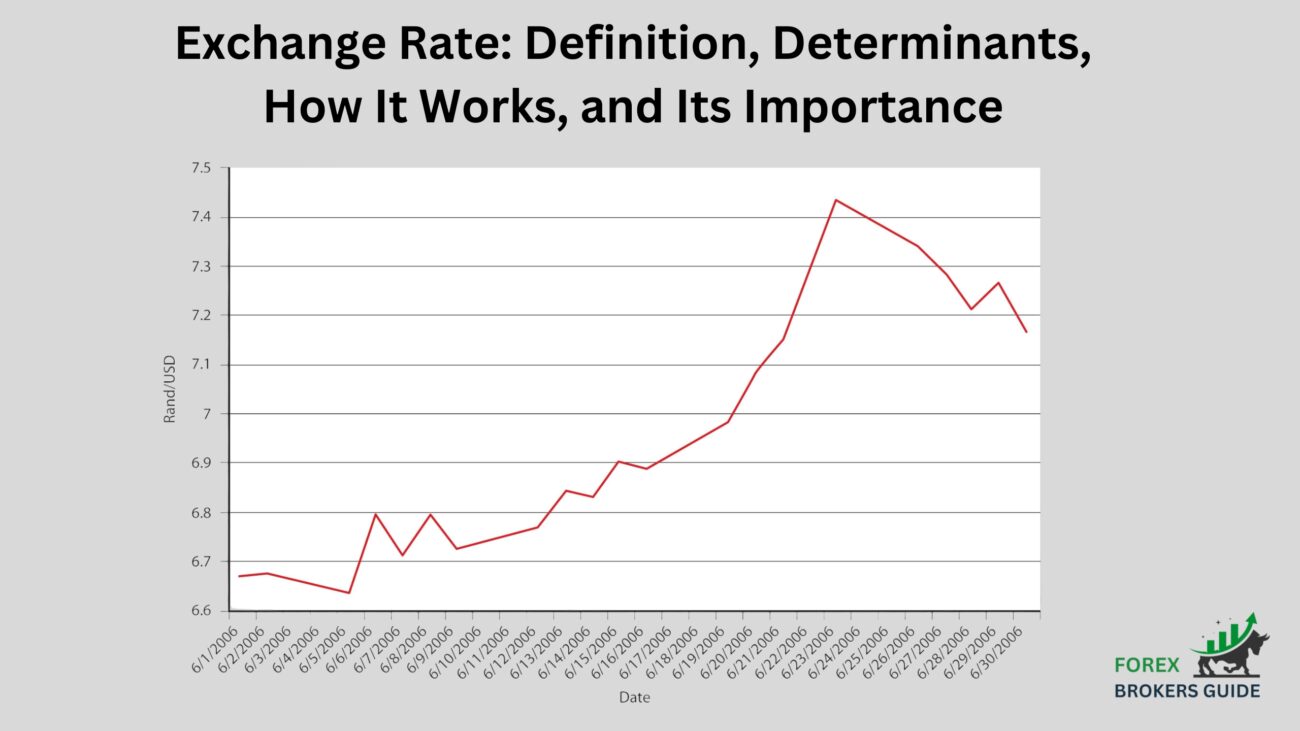

However, unlike a price tag at a store, the exchange rate isn’t fixed. It’s constantly in flux, influenced by a complex interplay of economic, political, and even psychological factors. Understanding these determinants and how they impact exchange rate movements is crucial for forex traders seeking to make informed decisions. By analyzing these factors and their influence on the exchange rate, traders can identify potential opportunities to buy or sell currencies at advantageous moments.

How are Exchange Rates typically Expressed (e.g., USD/EUR)?

The most common way to express an exchange rate is using a currency pair notation, where three letters represent the two currencies involved. The first three letters (e.g., USD) represent the base currency, which is the currency you’re giving up. The following slash (/) acts as a divider, and the final three letters (e.g., EUR) represent the quote currency, which is the currency you’re receiving.

Here’s how it works in practice:

- USD/EUR (US Dollar vs. Euro): This signifies the exchange rate for exchanging US dollars (USD) for euros (EUR). A rate of 1.20 USD/EUR means you need 1.20 US dollars to acquire 1 euro.

- GBP/JPY (British Pound vs. Japanese Yen): This represents the exchange rate for converting British pounds (GBP) into Japanese yen (JPY). A rate of 150 GBP/JPY indicates you need 150 British pounds to acquire 100 Japanese yen (as the yen is typically quoted in units of 100).

This currency pair notation allows for quick and clear communication of the exchange rate. By understanding the base and quote currency positions, you can instantly grasp the relative value of one currency against another. Some trading platforms might also display the exchange rate in a reversed format (e.g., EUR/USD), but the core concept remains the same – the position of the currencies indicates which one you’re giving up and which one you’re receiving.

What Factors determine Forex Exchange Rates?

Just like a complex musical composition relies on a harmonious blend of instruments, exchange rates are shaped by a symphony of economic, political, and even psychological factors. By recognizing these invisible forces and how they interact, forex traders gain valuable insights for navigating the ever-shifting currency landscape and making informed decisions about buying or selling currencies. This exploration will delve into the key instruments that make up this economic orchestra, allowing you to develop a deeper understanding of the factors that influence exchange rates and ultimately, navigate the dynamic waters of forex trading with greater confidence.

Here, we’ll delve into the key factors that play their roles in shaping forex exchange rates:

- The Maestro: Interest Rates

Central banks act like the conductors of the forex market, wielding interest rates as their primary instrument. Higher interest rates in a particular country tend to attract foreign investment seeking better returns. This increased demand for that country’s currency, like the US dollar (USD) if the US Federal Reserve raises rates, can lead to its appreciation relative to other currencies. Investors are essentially drawn to the promise of higher returns on their holdings denominated in that currency.

- The Inflationary Trumpet: The Impact of Inflation

Inflation, the rate at which the price of goods and services increases, plays a significant role, much like a blaring trumpet. Generally, a country with higher inflation experiences a depreciation in its currency. Imagine the euro (EUR) compared to the US dollar (USD). If inflation is significantly higher in the Eurozone, the purchasing power of the euro weakens. In simpler terms, each euro buys you fewer goods and services compared to the US dollar, leading to a depreciation of the euro.

- The Balance of Trade: A Delicate Melody

The balance of trade, often likened to a delicate melody, refers to the difference between a country’s exports and imports. A country with a consistent trade surplus, where exports exceed imports, experiences an inflow of foreign currency. This, like a harmonious tune, can lead to an appreciation of its domestic currency. Conversely, a persistent trade deficit, akin to a discordant note, can cause a depreciation as there’s a greater outflow of currency to pay for imports.

Remaining Instruments

The economic health, political stability, and global risk sentiment all play crucial roles in the forex market, much like the various sections of an orchestra. A strong and growing economy with low unemployment (rhythmic foundation) attracts investment and strengthens the currency. Political turmoil (unexpected shifts in the chorus) can lead to capital flight and currency depreciation. Finally, during economic crises (mood music), investors flock to safe-haven currencies, even if their economies aren’t the strongest, causing appreciation.

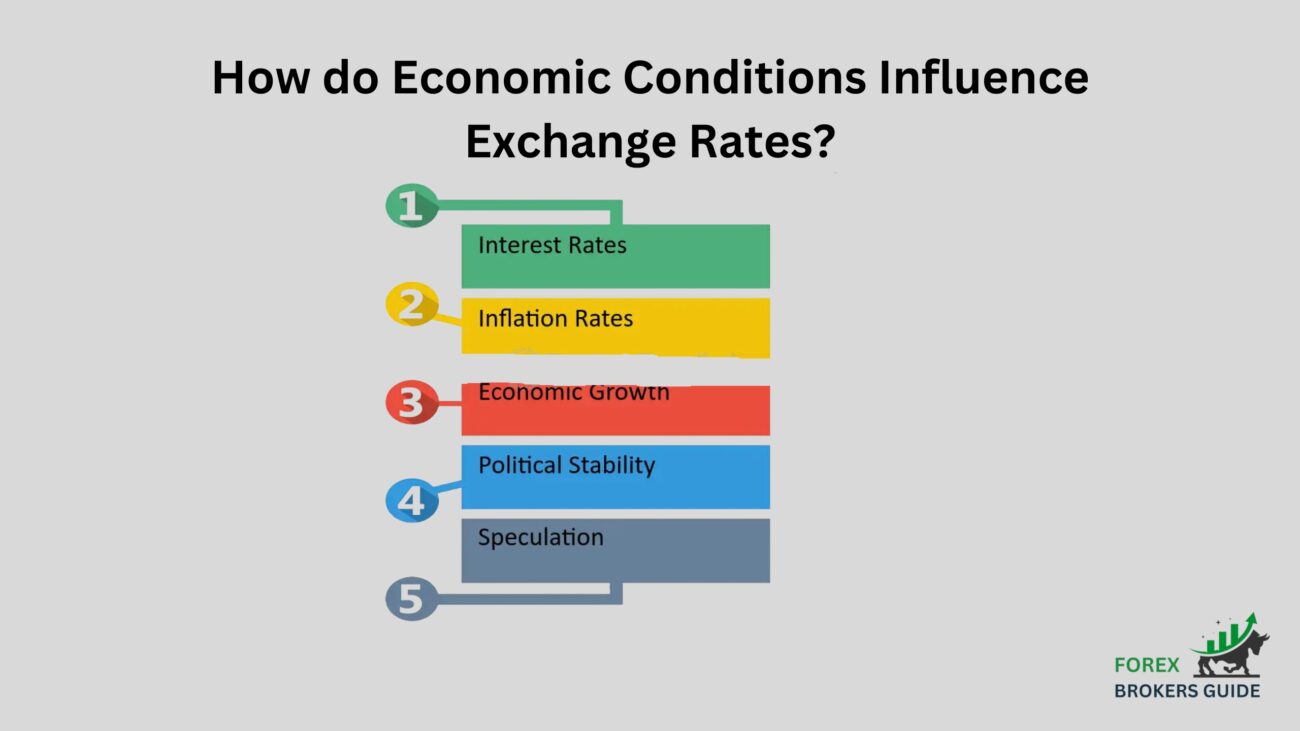

How do Economic Conditions Influence Exchange Rates?

Within the complex orchestra that shapes forex exchange rates, economic conditions play a central role, acting like the conductor’s baton that sets the overall pace and direction of the music. A strong and healthy economy is like a well-rehearsed orchestra, striking a harmonious balance that fosters a stable and appreciating currency. Conversely, a weak or troubled economy can disrupt the market symphony, leading to depreciation. Let’s delve deeper into how specific economic indicators influence the rhythm and melody of exchange rates:

- Interest Rates: As previously mentioned, central banks wield interest rates as a powerful tool to influence the forex market. Higher interest rates generally attract foreign investment seeking better returns on their holdings denominated in that currency. This increased demand for the currency, like a surge in violin strings, can lead to its appreciation. Imagine the US Federal Reserve raising interest rates. This could make US dollar-denominated assets more attractive to foreign investors, potentially causing the US dollar (USD) to strengthen against other currencies.

- Inflation: Inflation, the rate at which the price of goods and services increases, also plays a significant role. Countries with consistently high inflation typically experience a depreciation of their currency, much like a dissonant note disrupting the harmony. This is because inflation erodes the purchasing power of a currency. Imagine the euro (EUR) weakening against the US dollar (USD) due to higher inflation in the Eurozone. Each euro buys you fewer goods and services compared to the US dollar, making the euro less valuable in the forex market.

- Economic Growth: The overall health of a nation’s economy significantly impacts its exchange rate. A strong and growing economy with stable inflation and low unemployment is like a well-oiled orchestra, attracting foreign investment and leading to an appreciation of the domestic currency. Investors are drawn to the stability and growth potential of such economies, fueling demand for the currency. Conversely, a weak and sluggish economy with high unemployment can experience a depreciation of its currency, similar to a stumbling performance that discourages investment and weakens investor confidence in the currency.

- Balance of Trade: The balance of trade, representing the difference between a country’s exports and imports, also influences exchange rates. A country with a consistent trade surplus (exports exceeding imports) experiences an inflow of foreign currency, akin to a crescendo in the music. This increased demand for the domestic currency to pay for those exports can lead to its appreciation. On the other hand, a persistent trade deficit (imports exceeding exports) can lead to a depreciation of the currency as there’s a greater outflow of currency to pay for imports, draining demand for that currency in the forex market.

By understanding how these economic indicators interact and their individual impact on exchange rates, forex traders gain valuable insights for analyzing market movements. This knowledge allows them to identify potential opportunities and make informed decisions about buying or selling currencies based on the underlying economic conditions of the countries involved. Just like a skilled conductor can anticipate subtle shifts in the orchestra to maintain a harmonious performance, forex traders who can anticipate the economic factors influencing exchange rates can position themselves for success in the ever-evolving forex market.

How is the Exchange Rate for a Currency Pair Set?

The exchange rate between currencies holds immense significance. It dictates the relative value of one currency against another, impacting everything from the cost of your next vacation to the profitability of international trade deals. Unlike a fixed price tag, currency exchange rates are not set in stone. Instead, they exist in a state of constant flux, determined by a fascinating interplay of economic forces and market sentiment. This article delves into the intricate mechanisms that set the exchange rate for a currency pair, unveiling the factors that cause these values to rise, fall, and constantly evolve.

Supply and Demand: The core principle driving exchange rates is fundamental economics – supply and demand. Currencies, like any tradable asset, are subject to these forces. When the demand for a particular currency rises relative to another, its exchange rate increases. Conversely, a decrease in demand weakens the currency’s value. This dynamic supply and demand can be influenced by various factors like international trade flows, foreign investment decisions, and speculation in the forex market.

Interest Rates: The interest rate differential between two countries plays a significant role. Countries with higher interest rates tend to attract foreign investment seeking higher returns. This increased demand for the high-interest-rate currency strengthens its exchange rate compared to the lower-interest-rate currency.

Economic Stability: A country’s overall economic health significantly impacts its currency’s value. Factors like inflation, GDP growth, and political stability are all considered by investors. A strong, stable economy inspires confidence, leading to increased demand for that country’s currency and a stronger exchange rate. Conversely, economic instability can weaken a currency’s value.

Central Bank Intervention: While the forex market is primarily driven by market forces, central banks can intervene to influence exchange rates. They might buy or sell their own currency to manipulate supply and demand, aiming to achieve specific economic goals like promoting exports or curbing inflation.

Market Sentiment: Psychological factors and investor expectations also play a role. Positive news about a country’s economic prospects can boost investor confidence in its currency, leading to a rise in its exchange rate. Conversely, negative news or market anxieties can trigger a sell-off, driving down the currency’s value.

What happens when a Currency’s Exchange Rate Fluctuates?

The dynamic nature of the forex market means that currency exchange rates are constantly on the move. These fluctuations, while seemingly small numbers on a screen, can have significant ripple effects across the global economic landscape. Let’s explore the potential consequences of a currency’s exchange rate rising or falling:

- Impact on International Trade: When a country’s currency strengthens (appreciates), its exports become relatively more expensive on the global market. This can lead to a decrease in export volume, potentially impacting domestic businesses and jobs. Conversely, a weakening currency (depreciation) can make exports cheaper, potentially boosting export sales and benefiting domestic producers. However, a weaker currency can also make imports more expensive for the same country, impacting consumers and businesses reliant on imported goods.

- Investment Decisions: Exchange rate fluctuations can influence international investment decisions. A strong currency might attract foreign investors seeking a safe haven for their assets, potentially leading to increased capital inflows and boosting the domestic stock market. However, a weak currency might deter foreign investment as returns become less attractive when translated back to their home currency.

- Travel and Tourism: Currency fluctuations can impact the travel and tourism industry. A strong currency can make travel abroad more expensive for domestic residents, potentially leading to a decrease in outbound tourism. On the other hand, a weak currency can make a country a more attractive destination for foreign tourists, as their travel expenses become cheaper. This can benefit the tourism sector and generate revenue for the local economy.

- Inflationary Pressures: Currency depreciation can also trigger inflationary pressures within a country. As imported goods become more expensive due to the weaker currency, domestic prices might rise to reflect the increased costs. This can strain household budgets and erode purchasing power.

Why are Exchange Rates Important in International Trade?

The world of international trade thrives on a complex dance between nations, and a key player in this choreography is the exchange rate. These ever-shifting numbers, though seemingly innocuous on a screen, hold immense power, influencing the flow of goods and services across borders. Understanding exchange rates is crucial for businesses and economies alike, as they directly impact how countries interact in the global marketplace.

One of the primary ways exchange rates influence trade is by shaping the competitiveness of a nation’s exports. Imagine a scenario where a country’s currency strengthens. This means its exports become more expensive for foreign buyers, potentially making them less attractive compared to products from countries with weaker currencies. Conversely, a weaker currency can act as a price advantage, making a nation’s exports cheaper and potentially boosting export volumes. This delicate balance can tip the scales in favor of one country or another when businesses are sourcing materials or finished products.

Exchange rates also play a significant role in determining the cost of imported goods. A strong currency allows a country to import goods at a lower price. This benefits consumers who enjoy cheaper imported products and businesses that rely on these imports for their production processes. However, a weakening currency can lead to a rise in import costs, pushing up domestic prices for consumers. This can have a ripple effect, impacting everything from the cost of your morning coffee to the price tag on your favorite clothes.

Furthermore, exchange rate fluctuations can significantly influence a country’s trade balance, which is essentially the difference between the value of its exports and imports. A strong currency can lead to a trade deficit if exports become less competitive. Conversely, a weaker currency might encourage exports and potentially generate a trade surplus. Governments and central banks often strive to maintain a balance in exchange rates that promotes healthy trade flows without creating significant imbalances. This balancing act ensures that a country doesn’t become overly reliant on imports or exports, fostering a more sustainable and mutually beneficial global trade environment.

How do Exchange Rates Impact Global Investment Decisions?

Exchange Rates act as a powerful magnet, attracting or repelling investment flows across borders. These fluctuating numbers play a critical role in shaping the decisions of investors seeking profitable opportunities across the world. Here’s how exchange rates significantly impact global investment decisions:

- The Interest Rate Allure: A key factor driving investment decisions is the interest rate differential between countries. Countries with higher interest rates offer a more attractive return on investment, particularly for fixed-income assets like bonds. When a country’s currency strengthens (appreciates) relative to another, it effectively increases the return for foreign investors holding those assets in the stronger currency. This can lead to an inflow of foreign capital seeking higher returns, boosting the local stock market and potentially strengthening the currency further. Conversely, a weakening currency can make interest rates in that country less attractive to foreign investors, potentially leading to capital flight and a decline in the stock market.

- Currency Hedging and Risk Management: The volatility of exchange rates introduces an element of risk for global investors. Unexpected currency fluctuations can erode profits or lead to losses on investments. To mitigate these risks, investors often employ hedging strategies. These strategies involve using financial instruments like forward contracts or options that lock in exchange rates at a predetermined level. By hedging their investments, investors can protect themselves from adverse movements in the forex market and ensure a more predictable return on their investments.

- Currency Valuation and Investor Confidence: The overall health of a country’s currency can influence investor confidence. A strong and stable currency is often seen as a sign of a healthy economy with low inflation and political stability. This can attract foreign investors seeking safe havens for their assets, leading to increased investment in that country’s stock market and potentially further strengthening the currency. Conversely, a weak or volatile currency can signal economic instability and deter foreign investors, leading to capital flight and potentially harming the local stock market.