Pending orders empower traders to take control of entry and exit points, offering an advantage over relying solely on current market prices. In essence, a pending order instructs your broker to automatically execute a trade when specific price conditions are met. This allows you to set your desired entry or exit level in advance, freeing you from constant market monitoring and potentially missing out on profitable opportunities. There are several types of pending orders, each catering to different strategies. Buy limit/sell limit orders are used to enter a trade at a more favorable price than the current market price.

Buy stop/sell stop orders are used to enter trades when the price breaks through a specific level, anticipating a continuation of the trend. By strategically incorporating pending orders into your forex trading strategy, you can automate entry and exit points, eliminate the need for constant monitoring, set risk management parameters, and promote disciplined trading through stop-loss orders that define your maximum acceptable loss. Remember, pending orders are a powerful tool, but they require careful planning and integration with your overall trading strategy.

What is a Pending Order in Forex Trading?

A pending order is an instruction given to your broker to automatically execute a trade when specific price conditions are met. This allows you to set your desired entry or exit point in advance, rather than relying on the current market price.

Imagine you have a strong feeling the EUR/USD will fall. With a pending order, you can avoid being glued to the screen, waiting for the price to dip to your desired level. You can simply set a buy limit order at a specific lower price. If the price dips to your designated level or below, the order is automatically triggered, and you buy euros at your preferred price. This eliminates the need for constant monitoring and ensures you enter the trade at your desired price point.

How does a Pending Order differ from a Market Order or a Limit Order?

While all three (pending orders, market orders, and limit orders) are instructions given to a broker for forex trades, they differ in their execution and purpose:

- Market Orders: Market Orders are the simplest and most immediate way to enter or exit a trade. When you place a market order, your broker executes the trade at the best available price in the current market. This means you get the trade filled quickly, but you don’t have any control over the exact price at which it’s executed. Market orders are ideal for situations where you prioritize speed over price precision, such as exiting a losing position quickly.

- Limit Orders: Limit Orders allow you to specify a predetermined price at which you want to enter or exit a trade. There are two types of limit orders:

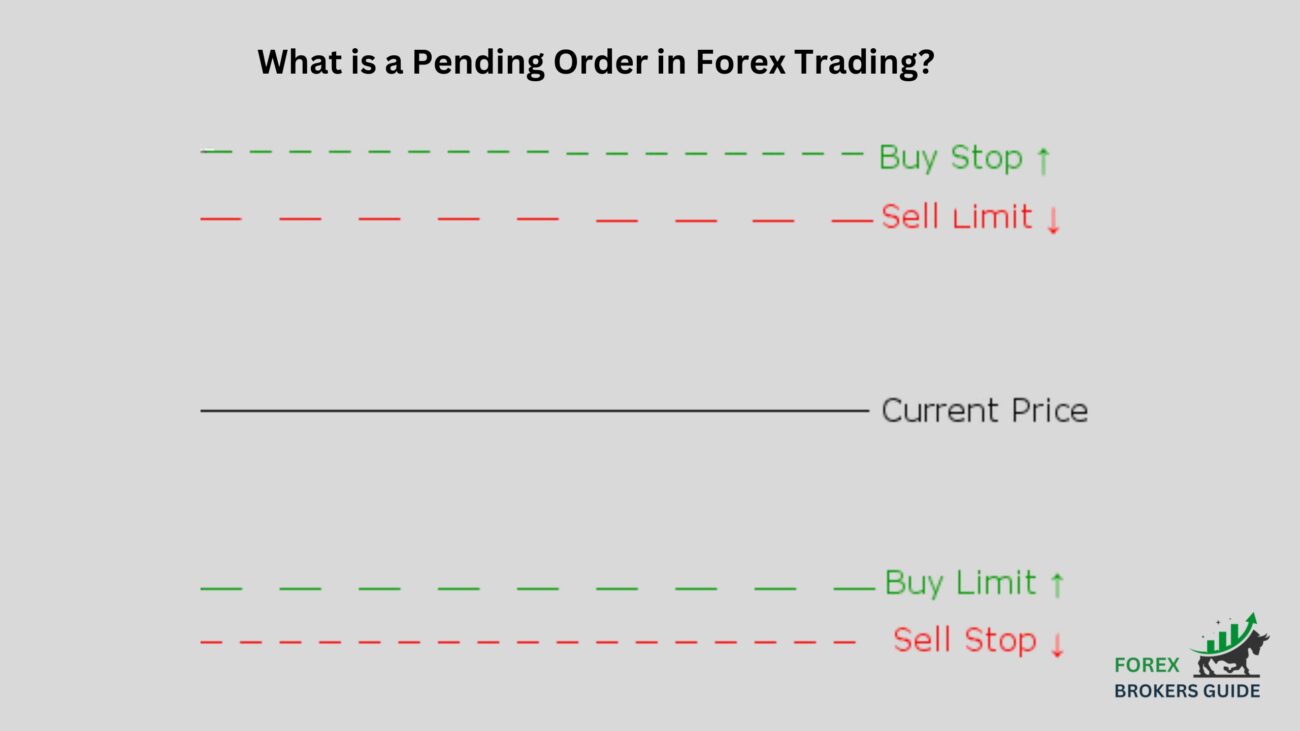

- Buy Limit: This order gets triggered only if the price falls to your designated level or below. This is useful if you believe the price will decline and want to buy at a more favorable price than the current market price.

- Sell Limit: This order gets triggered only if the price rises to your designated level or higher. This is useful if you want to lock in profits by selling at a specific price target if the price goes up.

- Pending Orders: This is a broader category that encompasses both buy stop and sell stop orders, which differ from limit orders in their execution trigger. While limit orders are triggered when the price reaches your desired level, pending orders (specifically buy stop and sell stop) are triggered when the price moves past your designated level in anticipation of a continued trend.

- Buy Stop: This order gets triggered only if the price rises above your designated level. This is used if you believe the price will continue to rise after a breakout and want to enter the trade at the start of the uptrend.

- Sell Stop: This order gets triggered only if the price falls below your designated level. This is used if you believe the price will continue to fall after a breakdown and want to enter a short position to capitalize on the downtrend.

Here’s a table summarizing the key differences:

| Feature | Market Order | Limit Order | Pending Order (Buy Stop/Sell Stop) |

|---|---|---|---|

| Execution Trigger | Current market price | Predetermined price | Price movement past a designated level |

| Control over Price | No | Yes | No (targets trend continuation) |

| Priority | Speed | Price precision | Trend continuation |

What are the different Types of Pending Orders commonly used in Forex Trading?

Pending orders offer a solution, allowing you to set your desired price level in advance rather than relying solely on the current market price. Unlike market orders that execute immediately, pending orders instruct your broker to automatically execute a trade when specific price conditions are met. This frees you from constant monitoring and potentially captures fleeting opportunities.

There are two main categories of pending orders commonly used in forex trading:

1. Limit Orders: These orders are ideal for entering a trade at a more favorable price than the current market price. There are two types:

- Buy Limit: This order is triggered only if the price dips to your designated level or below. Imagine you believe the EUR/USD will fall. You can place a buy limit order at $1.1000. If the price weakens to $1.1000 or lower, the order is triggered, and you buy euros at your desired price.

- Sell Limit: This order is triggered only if the price rises to your designated level or higher. For instance, you might buy USD/JPY at the current price, anticipating a rise. You can place a sell limit order at 135.00. If the price reaches 135.00 or higher, the order is triggered, and you lock in profits by selling your USD/JPY position.

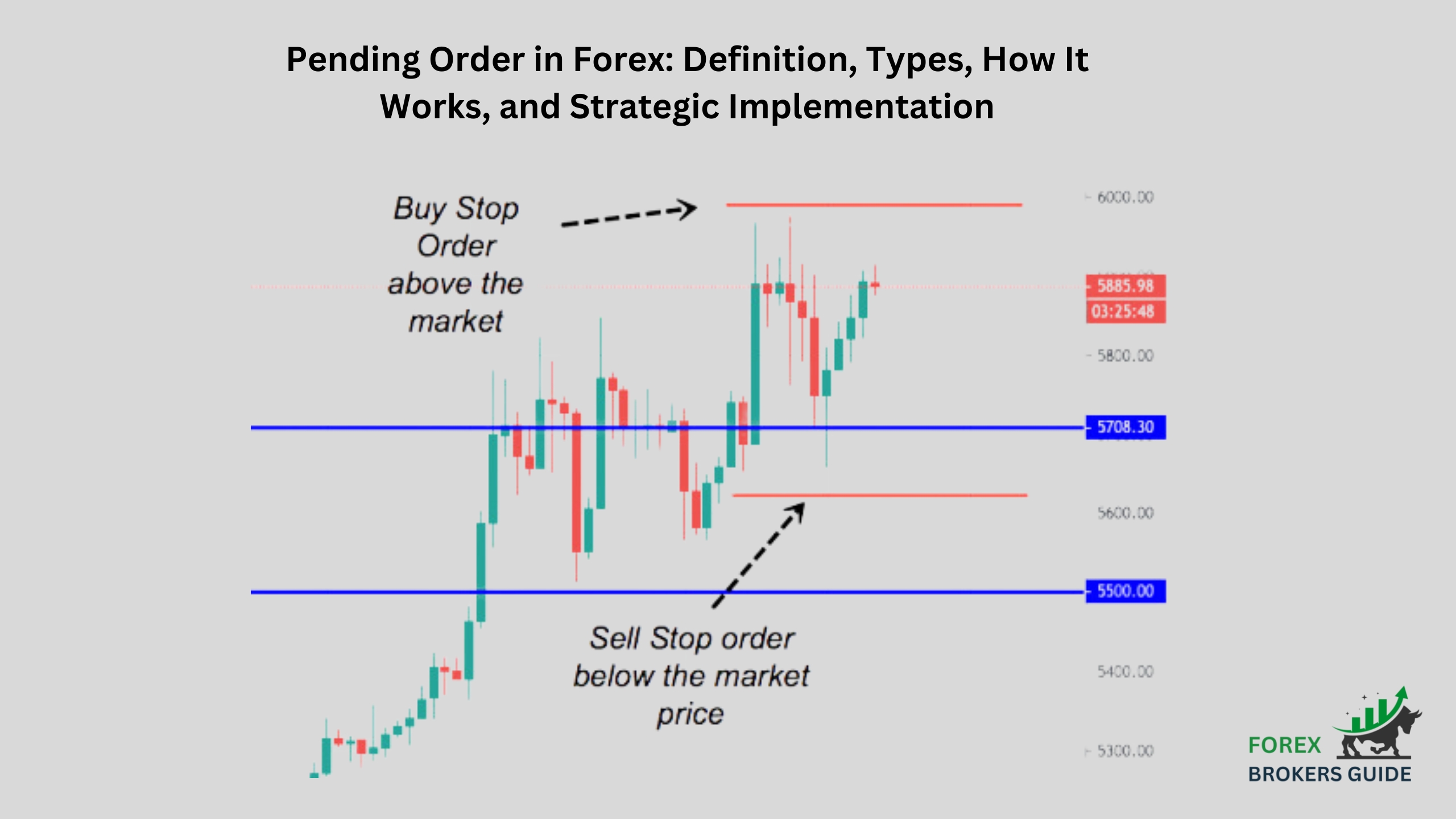

2. Stop Orders: Used to enter a trade when the price breaks through a specific level in anticipation of a continuing trend, stop orders come in two forms:

- Buy Stop: This order is triggered only if the price surpasses your designated level. Imagine USD/JPY is breaking above a resistance level at 132.00. You can place a buy stop order at 132.50. If the price surges above 132.50, the order is triggered, and you buy USD/JPY as the uptrend progresses.

- Sell Stop: This order is triggered only if the price falls below your designated level. Let’s say EUR/USD is experiencing a downtrend and breaks below a support level at $1.1100. You can place a sell stop order at $1.1050. If the price weakens below $1.1050, the order is triggered, and you enter a short position on EUR/USD to capitalize on the downtrend.

How do Entry and Exit Orders (buy/sell) interact with Price Direction (stop/limit)?

Entry Orders (Buy/Sell): These define when you want to initiate a trade, specifying whether you want to buy a currency pair (going long) or sell it (going short).

- Buy Order: This instructs your broker to purchase a currency pair, anticipating its value will increase.

- Sell Order: This instructs your broker to sell a currency pair (often one you’ve previously bought), anticipating its value will decrease.

Price Direction (Stop/Limit): This aspect determines the specific price conditions that trigger your entry or exit orders. There are two main categories:

- Stop Orders: These focus on price movement relative to a specific level.

- Buy Stop: This order gets triggered only if the price rises above your designated level. It’s used to capitalize on potential breakouts from support levels or enter trades when a trend resumes after a consolidation period.

- Sell Stop: This order gets triggered only if the price falls below your designated level. It’s used to enter short positions (selling borrowed currency) when a downtrend breaks a resistance level or to limit potential losses on existing long positions.

- Limit Orders: These focus on achieving a specific price target for entry or exit.

- Buy Limit: This order is triggered only if the price falls to your designated level or below. It allows you to buy a currency pair at a more favorable price than the current market price.

- Sell Limit: This order is triggered only if the price rises to your designated level or higher. It allows you to lock in profits by selling a currency pair at a predetermined price target.

Interaction Between Entry and Price Direction:

The interplay between entry orders and price direction allows for targeted execution based on your trading strategy. Here are some common scenarios:

- Buying a Downtrend (Buy Stop): You believe a downtrend is nearing its end and a reversal is imminent. You place a buy stop order above a recent swing low. If the price breaks above this level, signaling a potential reversal, the buy stop is triggered, and you enter a long position.

- Selling a Breakout (Sell Limit): You identify a strong uptrend and anticipate a potential breakout from a resistance level. You place a sell limit order above the resistance level. If the price breaks above this level, confirming the breakout, the sell limit is triggered, and you exit your long position (or initiate a short position) to capture profits or limit risk.

- Profit Taking with a Buy Order and Sell Limit: You buy a currency pair at the current market price. To lock in profits if the price rises, you place a sell limit order at a specific price target. This ensures you capture profits if the price reaches your target level.

How are Pending Orders Triggered and Executed in Forex Trading?

pending orders are triggered by specific price movements relative to a predetermined level you set. These price movements can be directional (going above or below a level) or target-based (reaching a specific price). When the designated price condition is met, the pending order automatically transforms into a market order and is executed at the best available price in the market at that moment. This allows you to automate entry or exit points based on your strategy, eliminating the need for constant monitoring and potentially capturing fleeting opportunities. Remember, execution price might differ slightly from your designated level due to market fluctuations.

What factors can influence the fill price of a Pending Order?

Pending orders offer the benefit of automatic execution at specific price conditions, the actual fill price might differ slightly from your designated level due to several factors in the dynamic forex market:

Market Liquidity: The ease with which a currency pair can be bought or sold significantly impacts fill prices. Highly liquid currency pairs like EUR/USD tend to have tighter spreads (the difference between the buy and sell price) and more readily available quotes, ensuring a fill price closer to your designated level. Conversely, less liquid currency pairs might experience wider spreads and potentially larger deviations from your desired price when the order is triggered.

Market Volatility: Periods of high market volatility, characterized by rapid price swings, can influence fill prices. If your pending order is triggered during a volatile period, the market price might have moved considerably since it last reached your designated level. This could result in a fill price that deviates slightly from your original target.

Order Type: The specific type of pending order you use can also influence the fill price. Market orders, for instance, are filled at the best available price in the market at the moment of execution, which might differ slightly from your desired price due to factors like market depth. Limit orders, on the other hand, guarantee execution only at your designated price or better, but there’s a chance the order might not be filled at all if the price doesn’t move in your favor.

Order Size: The size of your pending order, particularly for less liquid currency pairs, can also play a role in the fill price. Large orders might have a slightly larger impact on the market price when executed, potentially causing a minor deviation from your designated level.

How can Pending Orders be used to automate trading strategies based on technical analysis or price targets?

Pending orders are a powerful tool for forex traders who want to automate their trading strategies based on technical analysis or price targets. By setting specific entry and exit conditions in advance, traders can free themselves from constant market monitoring and potentially capture profitable opportunities even when they’re away from the screen.

Technical Analysis:

Technical analysts use various tools and indicators to study historical price charts and identify potential future price movements. Pending orders can be seamlessly integrated with technical analysis to automate entry and exit points based on these predictions. Here are a few examples:

- Support and Resistance Levels: Technical analysts often identify support and resistance levels, which are price zones where the price tends to bounce off. A trader can place a buy stop order slightly above a support level, anticipating a price breakout and potential uptrend. Conversely, a sell stop order can be placed below a resistance level to capitalize on a potential downtrend if the price breaks through that level.

- Moving Averages: Moving averages smooth out price fluctuations and help identify trends. A trader can place a buy stop order above a rising moving average to capture an ongoing uptrend or a sell stop order below a falling moving average to capitalize on a downtrend.

Price Targets:

Traders can also leverage pending orders to automate entries and exits based on predetermined price targets. This is particularly useful for profit-taking strategies or minimizing potential losses. Here’s how:

- Take-Profit Orders: After entering a long position (buying a currency pair), a trader can set a sell limit order at a specific price target above the entry price. This ensures profits are automatically locked in if the price reaches the target level.

- Stop-Loss Orders: Stop-loss orders are a crucial risk management tool. A trader can place a sell stop order below their entry price for a long position or a buy stop order above their entry price for a short position. If the price moves against their prediction, the pending stop-loss order is triggered, automatically exiting the trade and limiting potential losses.

Benefits of Automation:

By incorporating pending orders into their strategies, forex traders can enjoy several benefits:

- Reduced Emotional Trading: Automating entries and exits based on pre-defined conditions can help traders avoid emotional decisions that might lead to poor trading choices.

- Improved Discipline: Pending orders enforce discipline by ensuring trades are executed only when specific criteria are met.

- Time Efficiency: Traders don’t need to be glued to the screen constantly monitoring the market. They can set their orders and focus on other aspects of their trading strategy.

When might a Forex Trader use a Buy Stop or Sell Stop Order?

Forex traders primarily leverage buy stop and sell stop orders to capitalize on trends and breakouts, allowing them to enter trades in anticipation of continued price movements. Here’s a deeper look at the situations where each order might be employed:

Buy Stop Orders:

Imagine a strong uptrend experiencing a brief consolidation period. A trader anticipating the uptrend’s resumption can place a buy stop order above a recent swing high. If the price decisively breaks above this level, confirming the uptrend’s continuation, the buy stop is triggered, initiating a long position (buying the currency pair).

Breakout Strategies:

When a currency pair confined within a support and resistance range breaks above resistance, it signifies a potential shift in momentum. A trader can place a buy stop order slightly above the resistance level. If the price decisively breaches resistance, the buy stop is triggered, allowing the trader to enter a long position and capture potential gains from the breakout.

Fading Corrections:

Strong uptrends often experience temporary price dips (corrections) before resuming their upward trajectory. A trader can position a buy stop order slightly above a support level within the uptrend channel. If the price dips and finds support before rallying back above the buy stop level, the order is triggered, offering a potentially favorable entry point for a long position.

Sell Stop Orders:

In a robust downtrend, a trader might anticipate its continuation after a short-lived bounce. They can place a sell stop order below a recent swing low. If the price decisively breaks below this level, confirming the downtrend’s extension, the sell stop order is triggered, initiating a short position (selling a borrowed currency pair from the broker).

Breakdown Trading:

Similar to using buy stops for breakouts, sell stop orders can be utilized to capitalize on potential downtrends. If a currency pair breaks below a support level within a trading range, a sell stop order can be placed slightly below that support level. If the price decisively breaks below support, the sell stop is triggered, allowing the trader to enter a short position and profit from the potential downtrend.

Trailing Stops:

Traders can leverage sell stop orders as trailing stops for existing long positions. This strategy involves placing a sell stop order a specific distance below the current market price and incrementally moving it down as the price falls. This approach secures profits while allowing for some price fluctuations.

When might a Buy Limit or Sell Limit Order be more suitable?

While buy stop and sell stop orders focus on profiting from breakouts and trend continuations, buy limit and sell limit orders take center stage in different situations. These orders prioritize entering a trade at a specific price, offering greater control over entry points compared to market orders. Here’s a closer look at the situations where each might be more suitable:

Buy Limit Orders for Favorable Entry and Support Levels:

Imagine a scenario where you believe a currency pair, like EUR/USD currently trading at $1.1500, is overvalued and likely to decline before reversing. A buy limit order allows you to wait for a pullback to a more attractive price level before entering a long position (buying). You can place a buy limit order at $1.1000. If the price dips to your designated level or lower, the buy limit order is triggered, and you buy euros at a potentially more favorable price.

Technical analysis often identifies support levels, areas where the price tends to find buyers and bounce back up. A buy limit order can be strategically placed slightly below a support level, anticipating the price to decline towards that level before reversing. If the price dips and finds support, triggering your buy limit order, you enter a long position with the potential for a price increase.

Sell Limit Orders for Profit Taking and Resistance Levels:

After entering a long position (buying a currency pair), a sell limit order can be a valuable tool to lock in profits at a predetermined price target. For instance, you buy USD/JPY at 130.00, anticipating a rise. You can place a sell limit order at 135.00. If the price reaches your target level, the sell limit order is triggered, automatically selling your USD/JPY position and securing profits.

Resistance levels represent areas where the price tends to face selling pressure and might reverse lower. A sell limit order can be strategically placed slightly above a resistance level, anticipating the price to rise towards that level before encountering resistance and potentially falling back down. If the price reaches the resistance level, triggering your sell limit order, you can enter a short position (selling a borrowed currency pair) or exit your existing long position to capitalize on a potential price decline.

Price uncertainty plays a role when deciding between limit orders and market orders. Buy and sell limit orders are ideal when you have a strong conviction about a specific price level you want to enter or exit at. However, if your primary focus is on entering the trade quickly, a market order might be more suitable.

Remember, there’s no guarantee that your limit order will be filled, especially for less liquid currency pairs. The price might not reach your designated level before reversing course.

How can Pending Orders be combined with Stop-loss and Take-profit Orders for comprehensive Risk Management?

Pending orders, when strategically combined with stop-loss and take-profit orders, offer a powerful approach to create a comprehensive risk management framework. Here’s a breakdown of how these order types work together to safeguard your capital.

Precise Entry and Exits with Pending Orders:

Pending orders like buy stops and sell stops empower traders to automate entry points based on specific price movements. This eliminates the need for constant monitoring and ensures trades are initiated only when the price reaches a predetermined level aligned with their analysis. This targeted entry approach minimizes the risk of entering a trade prematurely.

Imagine a scenario where a currency pair is experiencing a strong uptrend. A trader can place a buy stop order above a recent swing high, anticipating a breakout and continuation of the uptrend. By using a buy stop order, the trader avoids the risk of entering the trade too early and potentially missing out on the breakout or entering a losing position if the uptrend fails to materialize.

Stop-Loss Orders

Stop-loss orders are the cornerstone of any risk management strategy. They instruct your broker to automatically exit a trade if the price moves against your prediction, limiting potential losses to a predefined amount. This protects your capital from excessive losses if the market moves against your analysis.

For instance, a trader enters a long position (buying) at $1.1000 on EUR/USD. They can place a stop-loss order below $1.0900. If the price falls below $1.0900, the stop-loss order is triggered, automatically selling their position and limiting the loss to $100 per pip (assuming a standard mini lot size).

Take-Profit Orders

Take-profit orders allow traders to lock in profits when the price reaches a predetermined target level. This prevents greed from overriding their trading strategy and ensures they capture a portion of the gains. By setting a take-profit order, traders avoid the risk of holding onto a winning position for too long, potentially giving back some of the profits if the price reverses course.

Continuing with the EUR/USD long position example, the trader might place a take-profit order at $1.1200. If the price rises to $1.1200, the take-profit order is triggered, automatically selling their position and securing a profit of $200 per pip.