The foreign exchange market, with its ever-shifting currency values, presents both opportunities and challenges for traders. To navigate this dynamic environment effectively, having a toolbox of powerful order types is crucial. One such order, the One-Cancels-the-Other (OCO), offers a strategic approach to trade execution.

An OCO order essentially combines two conditional orders into a single instruction. This means you can set up two opposing price targets – one for a buy and one for a sell – and the platform will automatically execute whichever condition is met first. The beauty of this order type lies in its ability to automate your trading strategy and manage risk, ensuring you don’t miss an entry point while safeguarding your capital. Let’s delve deeper into how OCO orders function, their strategic advantages in forex trading, and how they can be implemented to enhance your trading experience.

What is a One-Cancels-the-Other (OCO) Order in Forex Trading?

A One-Cancels-the-Other (OCO) order is a powerful tool that automates your entry and exit points based on pre-defined conditions. It essentially combines two conditional orders into one, ensuring you don’t miss an opportunity while managing risk.

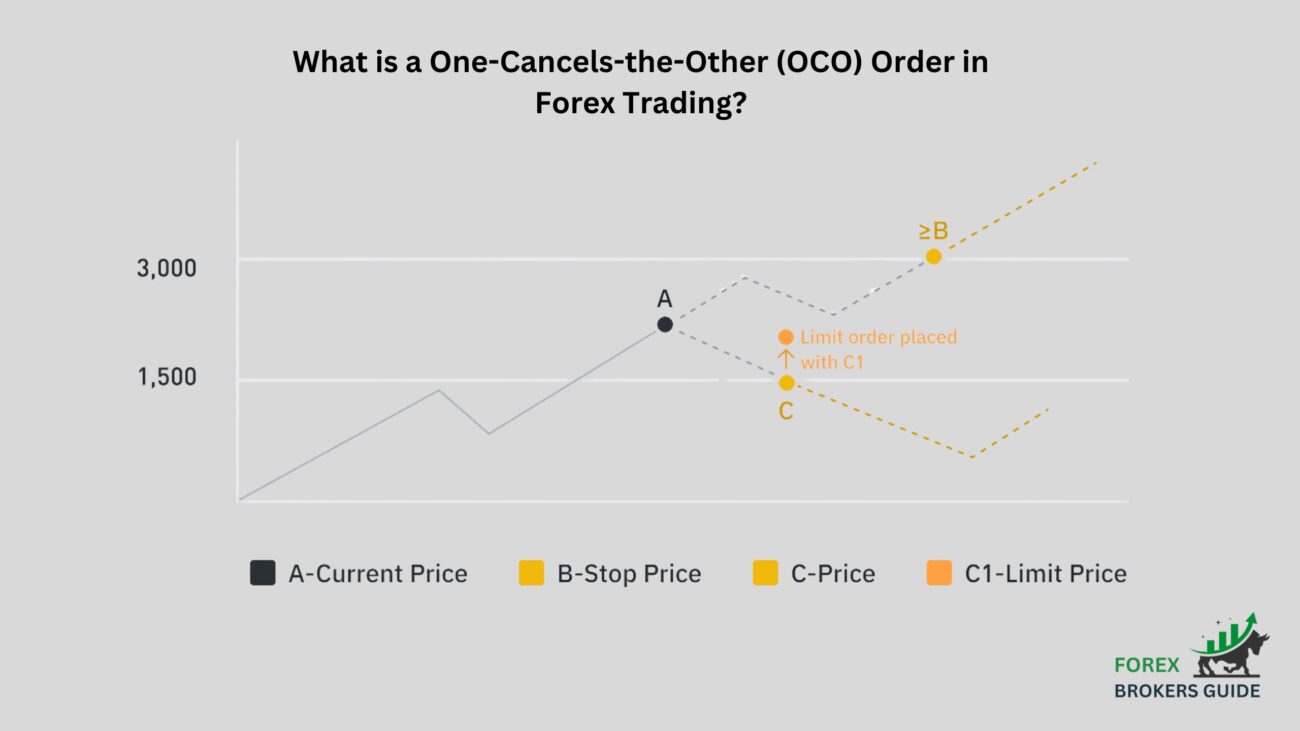

In essence, an OCO combines two conditional orders into one. You set a buy stop and a sell limit within the OCO. The buy stop triggers a buy trade if the price reaches a specific level, while the sell limit automatically exits the trade if the price moves in the opposite direction. Crucially, whichever condition is met first cancels the other order.

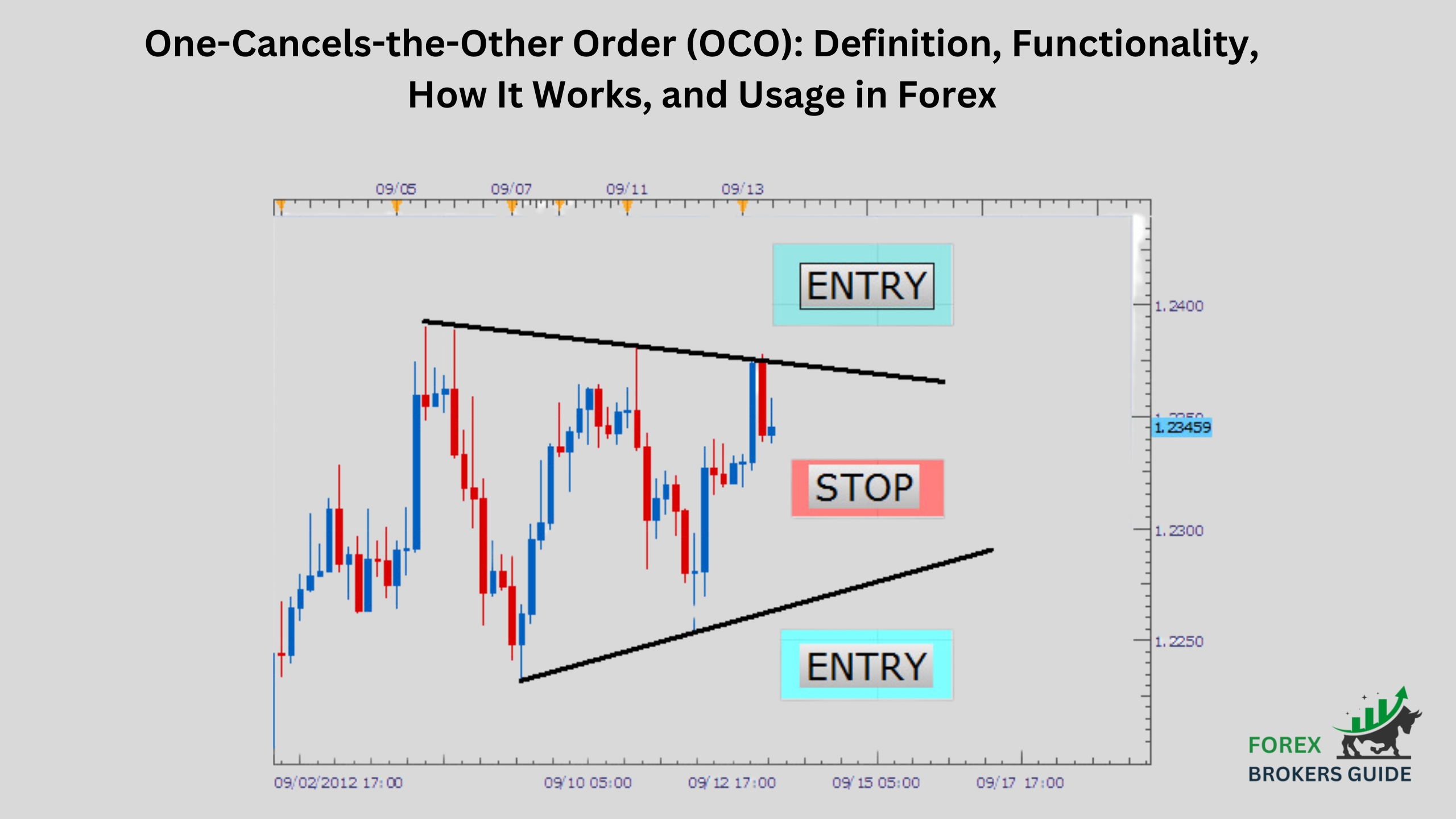

Imagine you’re bullish on a currency pair but cautious about potential dips. An OCO lets you set a buy stop to enter the trade if the price breaks bullish resistance. Simultaneously, a sell limit within the OCO exits the trade if the price falls below support. This way, you capture a potential breakout while limiting downside risk. OCO orders streamline your trading by automating execution based on predefined conditions, freeing you from constantly monitoring the market. Let’s explore the advantages and how to leverage OCO orders effectively in your forex trading strategy.

How does an OCO order differ from a Standard Limit Order or Stop-loss Order?

While OCO orders share similarities with standard limit orders and stop-loss orders, a key distinction lies in their automation and bundled nature. Here’s a quick breakdown:

- Standard Orders: Both limit orders and stop-loss orders are individual instructions. A limit order gets filled only at your specified price or better, while a stop-loss order activates a market order (filled at the next available price) when the price reaches your stop level. You need to manually close your position with a separate order if the price moves favorably.

- OCO Orders: An OCO combines two conditional orders – typically a buy stop and a sell limit – into a single package. The automation aspect is crucial. Once triggered, whichever condition of the OCO is met first gets filled, and the other order automatically cancels. This eliminates the need for manual intervention and ensures you don’t miss an entry point while safeguarding your capital.

How does an OCO Order Function?

One-Cancels-the-Other (OCO) orders combine automation and risk management in forex trading. They bundle a buy stop and a sell limit into one instruction. The buy stop triggers a buy trade if the price reaches a specific level, while the sell limit automatically exits the trade if the price falls below another level. Crucially, whichever condition is met first cancels the other, ensuring you don’t miss an entry point while safeguarding your capital. This automates your strategy and frees you from constantly monitoring the market.

What are the Two Component orders typically used within an OCO order in Forex?

An OCO order functions like a two-sided coin in the forex market. It comprises two essential component orders working in tandem:

- Buy Stop: This acts as the entry trigger. You set a price level above the current market price. If the price action climbs and reaches this predetermined level, the buy stop swings into action, automatically initiating a buy trade in the currency pair. This is ideal for capitalizing on potential breakouts or bullish continuations you’ve identified through technical analysis.

- Sell Limit: This serves as your automated exit strategy. You define a price level below the current market price. If the price movement takes an unexpected turn and dips to this level, the sell limit within the OCO order kicks in. It automatically places a sell order, exiting your position and potentially mitigating losses if the trade goes against your initial prediction.

What are the Benefits of using OCO Orders in Forex Trading?

One-Cancels-the-Other (OCO) orders offer a valuable solution by automating entry and exit points while managing risk. Let’s delve into the key benefits they bring to forex traders:

- Enhanced Efficiency: OCO orders eliminate the need for constant market monitoring. By setting pre-defined conditions for entry (buy stop) and exit (sell limit) within a single order, you can automate your trading strategy. This frees you up to focus on other aspects of your trading activity or simply enjoy peace of mind without missing potential opportunities.

- Improved Risk Management: One of the most significant advantages of OCO orders lies in their ability to manage risk. The built-in sell limit acts as a safety net. If the price movement goes against your initial prediction, the OCO automatically exits your position, potentially limiting losses. This is particularly beneficial in volatile market conditions where sudden price swings can occur.

- Disciplined Trading: OCO orders promote disciplined trading by preventing emotional decisions. By pre-defining your entry and exit points, you avoid the temptation to hold onto a losing position or miss an entry due to hesitation. The automated execution ensures you stick to your trading plan and maintain discipline.

- Capitalizing on Breakouts: The buy stop component of an OCO order allows you to capitalize on potential breakouts. By setting a buy stop above a resistance level, you can automatically enter a trade if the price surges, capturing the breakout and potentially profiting from the upward momentum.

When might a forex trader consider using an OCO Order?

One-Cancels-the-Other (OCO) orders aren’t a one-size-fits-all solution, but they excel in specific situations within the dynamic world of forex trading. Here are some scenarios where OCO orders can become your strategic ally:

- Capitalizing on Breakouts: When you identify a potential breakout on a currency pair, using an OCO order can be a wise move. You can set a buy stop above a resistance level. If the price surges and triggers the buy stop, you enter the trade automatically, capturing the breakout and potentially profiting from the upward momentum. Simultaneously, the sell limit within the OCO safeguards your position. If the breakout falters, and the price falls below your predetermined level, the sell limit automatically exits the trade, potentially limiting your losses.

- Managing Volatile Markets: Forex markets can be notoriously volatile, with sudden price swings a frequent occurrence. OCO orders offer a layer of protection in such scenarios. By setting a buy stop and a sell limit within the OCO, you define your entry and exit points beforehand. This allows you to automate your trading strategy and potentially avoid the emotional decisions that can arise during periods of high volatility.

- Trading without Constant Monitoring: The beauty of OCO orders lies in their ability to automate your trading strategy. Once you’ve established the buy stop and sell limit within the OCO, the platform continuously monitors the market price for you. This frees you from the need for constant market surveillance, allowing you to focus on other aspects of your trading activity or simply enjoy peace of mind without missing potential breakout opportunities.

- Maintaining Trading Discipline: Emotions can be a trader’s worst enemy. OCO orders help promote disciplined trading by pre-defining your entry and exit points. This removes the temptation to hold onto a losing position in the hope that the price will miraculously recover. Similarly, it prevents hesitation that might cause you to miss an entry point due to second-guessing. The automated execution based on pre-defined conditions ensures you stick to your trading plan and maintain discipline.

How can OCO orders help with Risk Management and automated trade execution?

One-Cancels-the-Other (OCO) orders emerge as a valuable tool on both these fronts. Here’s how OCO orders can be your strategic partner:

Risk Management on Autopilot:

- Built-in Safety Net: The key strength of OCO orders in risk management lies in the automatic exit strategy they provide. The sell limit component acts as a pre-defined safety net. If the price movement takes an unexpected turn and dips below your predetermined level, the OCO order automatically exits your position by placing a sell order. This helps limit potential losses if the trade goes against your initial prediction. This is particularly beneficial in volatile markets where sudden price swings can catch traders off guard.

- Disciplined Approach: Emotions can cloud judgment and lead to impulsive decisions. OCO orders promote disciplined trading by pre-defining your exit point. By setting a sell limit within the OCO, you remove the temptation to hold onto a losing position in the hope that the price will miraculously recover. This ensures you stick to your trading plan and avoid letting emotions dictate your actions.

Automation for Streamlined Trading:

- Reduced Monitoring: Constantly monitoring the market can be time-consuming and mentally draining. OCO orders free you from this burden. Once you’ve established the buy stop and sell limit within the OCO, the platform continuously monitors the market price for you. This allows you to automate your trading strategy and focus on other aspects of your trading activity or simply enjoy peace of mind. You won’t miss potential entry or exit points due to a lack of constant monitoring.

- Automated Execution: The beauty of OCO orders lies in their ability to automate trade execution based on pre-defined conditions. If the price reaches the buy stop level first, the OCO order automatically triggers a buy trade, capitalizing on the potential breakout you anticipated. There’s no need for manual intervention, ensuring you capture the opportunity without hesitation.

Are there any limitations or drawbacks to using OCO Orders?

While OCO orders offer a compelling package of automation and risk management in forex trading, it’s essential to acknowledge their limitations to make informed decisions about their use in your strategy. Here are some potential drawbacks to consider:

Missed Opportunities: The pre-defined nature of OCO orders can restrict your ability to adapt to changing market conditions. If the price movement deviates significantly from your initial expectations, the OCO order might exit your position prematurely, causing you to miss out on potential profits.

Limited Flexibility: OCO orders typically combine a buy stop and a sell limit. While these work well for breakout or reversal strategies, they might not be suitable for all trading scenarios. For instance, a more complex strategy might require additional order types beyond the two offered within an OCO.

Slippage Risk: The automated execution of OCO orders doesn’t guarantee fulfillment at the exact price you specify, especially in volatile markets. Slippage, the difference between your requested price and the actual filled price, can occur. This can be a disadvantage if the price moves rapidly against your entry or exit points.

Over-reliance on Automation: While OCO orders automate trade execution, they shouldn’t replace your fundamental analysis and technical expertise. It’s crucial to understand the underlying market forces and trends before using OCO orders to execute your trading strategy.

How do OCO Orders compare to other conditional Order Types in Forex Trading?

One-Cancels-the-Other (OCO) orders carve out a unique niche within the forex trader’s arsenal of conditional orders. While they share characteristics with other order types, understanding the key distinctions is crucial for strategic implementation. Here’s a breakdown of how OCO orders compare to some popular conditional orders:

Stop-Loss Orders

Both OCO orders and stop-loss orders aim to be your risk management buddies, automatically exiting a position when the price reaches a pre-defined level. However, their execution styles differ. A stop-loss order, once triggered, transforms into a market order, meaning it gets filled at the next available price, which might not be your ideal level. OCO orders offer more control in this aspect. The sell limit within the OCO ensures the exit happens at your predetermined price or better, potentially limiting losses more effectively.

Limit orders

Limit orders, including buy limits and sell limits, are triggered only when the price reaches a specific level or surpasses it in your favor. This guarantees you enter or exit a trade at your desired price point. OCO orders share some common ground with limit orders here. The sell limit within the OCO acts similarly, guaranteeing an exit at your predetermined price or better. However, OCO orders add another layer by including a buy stop, offering the possibility of automated entry alongside the exit strategy.

Take-profit orders, similar to sell limit orders within OCOs, aim to secure profits by automatically exiting a position when the price reaches a specific target level. The key difference lies in order placement. A take-profit order is typically placed independently after entering a trade, while the sell limit within an OCO is set up simultaneously with the buy stop. This combined approach of OCO orders allows for a more comprehensive strategy, defining both entry and exit points upfront in a single instruction.

Can OCO orders be combined with stop-loss and take-profit orders for a more comprehensive trading strategy?

OCO orders are a powerful tool for forex traders, but their potential goes further. By combining them with stop-loss and take-profit orders, you can build a more comprehensive strategy. Trailing stop-loss orders within the OCO offer extra protection, while separate take-profit orders at various levels allow you to capture profits at different stages. This combination automates core aspects of your trading plan, manages risk, and maximizes potential profits. Remember to experiment with a demo account before using real capital.