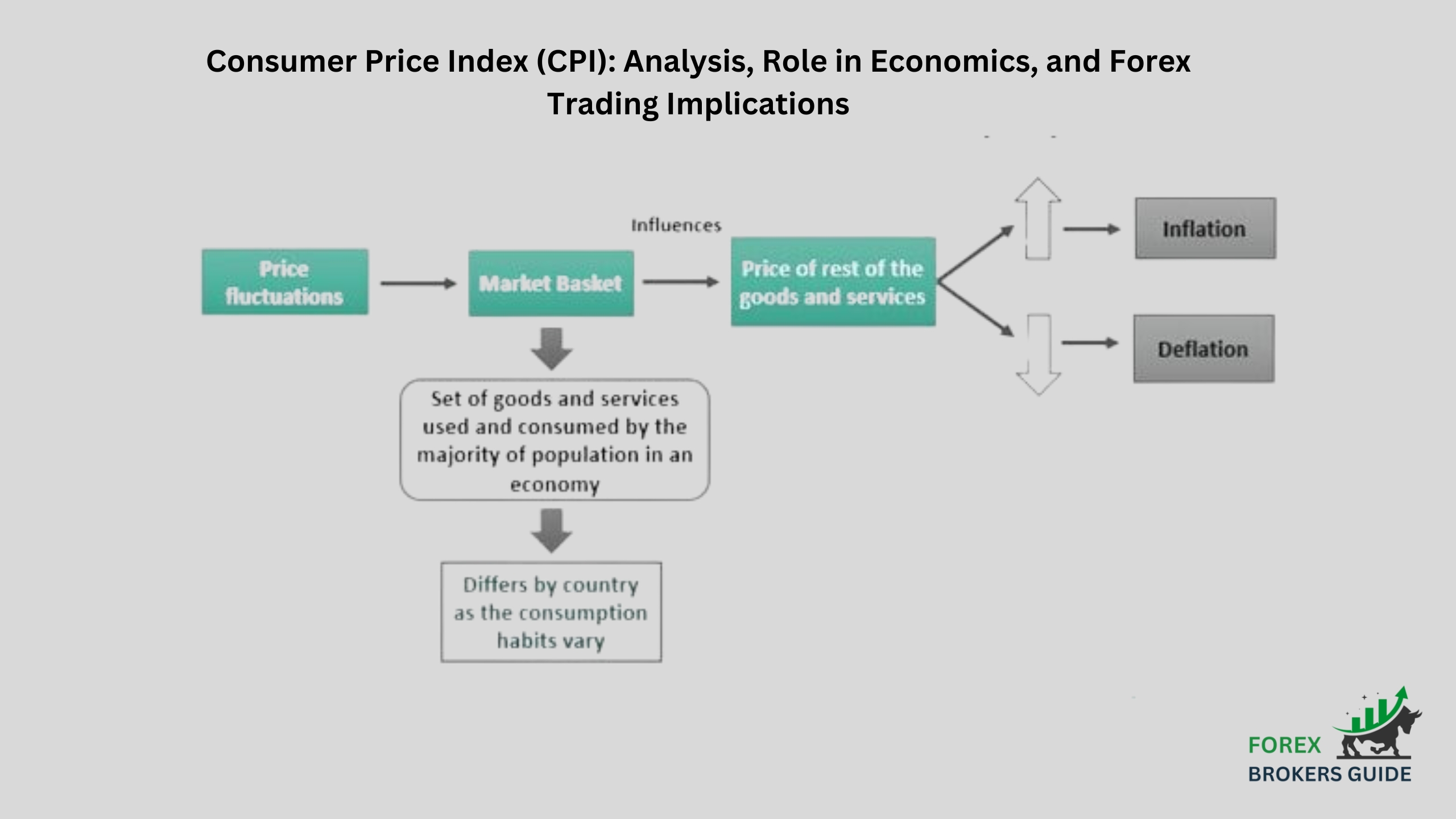

The Consumer Price Index (CPI) is a key economic indicator that tracks changes in the average price of a basket of goods and services purchased by typical consumers. Essentially, it measures inflation, which reflects the decrease in purchasing power of a currency over time. The CPI is calculated by collecting price data for various items like groceries, transportation, and housing, then weighting them based on their importance in a typical consumer’s budget. By comparing the CPI from one period to the next, economists and policymakers can gauge the overall rate of inflation.

Understanding the CPI is crucial for several reasons. It helps central banks determine monetary policy, with low and stable inflation being a primary goal. It also informs wage negotiations and government spending decisions. In the forex market, the CPI plays a significant role. A rising CPI indicates potential currency depreciation as inflation erodes its buying power. Conversely, a stable or falling CPI might suggest currency appreciation, attracting foreign investment seeking a more stable environment. By monitoring CPI releases and analyzing them alongside other economic data, forex traders can make informed decisions about entering or exiting positions in the ever-fluctuating currency market.

What is the Consumer Price Index (CPI) and how is it calculated?

The Consumer Price Index (CPI) is a key economic statistic that reflects the average change in prices for a basket of goods and services commonly purchased by consumers. In simpler terms, it tracks inflation, which is the decrease in the purchasing power of a currency over time.

Imagine you’re tracking your grocery bill each month. Over time, you notice you’re spending more for the same basket of groceries. This essentially reflects inflation. The CPI works similarly, but on a much larger scale. It tracks the prices of a wide range of goods and services, not just groceries, to understand how inflation is impacting the overall cost of living for consumers.pen_spark

The CPI is calculated by following these steps:

- Selecting a Representative Basket: Government agencies, like the Bureau of Labor Statistics (BLS) in the United States, identify a basket of goods and services that reflects the typical consumption patterns of a country’s urban population. This basket encompasses a wide range of items, from essential groceries and transportation costs to housing and recreation expenses. The relative weight assigned to each item within the basket corresponds to its importance in the average consumer’s budget. For instance, essential goods like food and housing might have a higher weighting compared to entertainment expenses (think groceries: 20%, transportation: 15%, housing: 35%, entertainment: 10%).

- Data Collection: Once the basket is established, the data collection phase begins. Government agencies or independent contractors gather price data for each item in the basket from a variety of retail outlets and service providers across different geographical locations. This ensures the CPI reflects price changes experienced by a broad segment of the population.

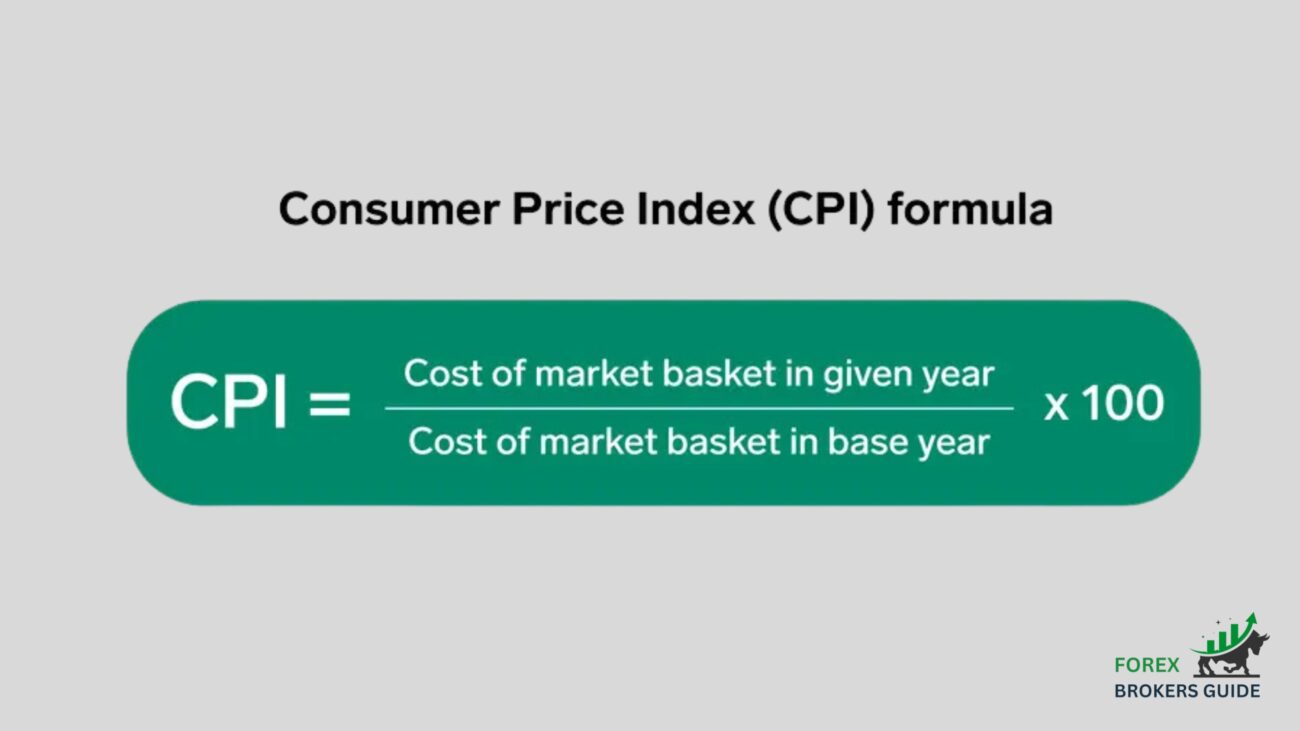

- Price Comparison and Index Calculation: With price data collected for a specific period, typically a month, statisticians compare these prices to a chosen base period (often set at 100). This comparison reveals the percentage change in the average price of the basket over time. Here’s the formula used for calculating the CPI for a specific item:CPI (Current Period) for Item X = (Price of Item X in Current Period / Price of Item X in Base Period) x 100For example, if a gallon of milk cost $3.00 in the base period and $3.50 in the current period, the CPI for milk in the current period would be:CPI (Current Period) for Milk = ($3.50 / $3.00) x 100 = 116.67This indicates a 16.67% increase in the price of milk since the base period.

- Weighted Average and CPI Calculation: We don’t simply average the price changes of all items. We take a weighted average of these individual price changes using the weights assigned to each item in the basket. This gives more significance to price changes of essential goods that consumers spend more on. The resulting weighted average reflects the overall change in the price of the entire basket, which is the CPI for that period.

What Basket of goods and Services does the CPI track to measure Inflation?

The Consumer Price Index (CPI) relies on a meticulously chosen basket of goods and services to accurately reflect inflation and its impact on consumer spending. This basket isn’t static; it’s regularly reviewed and updated to ensure it aligns with changing consumption patterns. Here’s a closer look at what typically finds its way into the CPI basket:

Essentials Driving Daily Life:

- Food and Beverages: This category forms a significant portion of the CPI basket, as it reflects the cost of essential food items like groceries, meat, dairy products, and non-alcoholic drinks. Price fluctuations in these essential goods significantly impact household budgets.

- Housing: Shelter costs are another major component of the CPI basket. This includes rent, homeowner’s equivalent rent (for homeowners), utilities like electricity and gas, and housing maintenance expenses.

Transportation Needs:

- Transportation: The CPI tracks the cost of getting around, encompassing expenses like gasoline prices, public transportation fares, car repairs, and vehicle insurance. Fluctuations in fuel costs can have a ripple effect on overall inflation.

How does the CPI differ from other inflation metrics, such as producer price index (PPI)?

While both the Consumer Price Index (CPI) and the Producer Price Index (PPI) serve as inflation gauges, they offer distinct perspectives on price changes within an economy. Understanding these differences is crucial for a nuanced grasp of inflationary pressures.

Focus and What it Captures:

The CPI and PPI differ fundamentally in their focus. The CPI tracks changes in the prices of a basket of goods and services purchased by consumers. This reflects the overall inflation impacting household budgets and everyday living expenses. Imagine you’re tracking your grocery bill – the CPI paints a similar picture, but on a much larger scale, encompassing a wide range of essential and non-essential goods and services, including food, housing, transportation, healthcare, recreation, and education.

On the other hand, the PPI measures the average change in selling prices received by domestic producers for their output. This essentially reflects inflation at the wholesale level, focusing on price changes experienced by businesses before goods reach consumers. The PPI tracks prices for a narrower range of items, typically focusing on raw materials, intermediate goods, and finished goods at the wholesale level.

Timeline of Price Changes and Impact on Designs:

The CPI and PPI also differ in the timeline of price changes they capture. The CPI reflects price changes experienced by consumers, which can sometimes lag behind producer price changes. This is because businesses might absorb some of the initial cost increases before passing them on to consumers. The PPI, however, provides an earlier glimpse into potential inflationary pressures, as it tracks price changes at the producer level. This can be a leading indicator of future CPI trends.

These distinctions influence how these metrics are used in economic decision-making. The CPI is a key metric for central banks when determining monetary policy. Rising CPI often prompts interest rate hikes to curb inflation and protect consumer purchasing power. The PPI, on the other hand, is more relevant to businesses, helping them understand their input costs and adjust pricing strategies accordingly. It can also be used by financial analysts to anticipate future trends in consumer inflation.

How does the CPI help policymakers assess price stability and guide monetary policy decisions?

The Consumer Price Index (CPI) serves as a crucial compass for policymakers, particularly central banks, in navigating the complexities of inflation and maintaining price stability. By tracking changes in the average price of a basket of goods and services commonly purchased by consumers, the CPI provides valuable insights into inflationary pressures within an economy. This information directly influences monetary policy decisions aimed at achieving price stability, a key objective for fostering sustainable economic growth.

Gauging Inflationary Pressures:

The CPI acts as a primary gauge of inflation. By monitoring changes in the CPI over time, policymakers can assess the extent to which prices are rising or falling. This allows them to identify potential inflationary threats before they spiral out of control and erode the purchasing power of a currency.

Targeting Price Stability:

Central banks typically establish a target inflation rate, which represents the desired level of moderate and sustainable price increases within an economy. The CPI helps policymakers evaluate how close they are to achieving this target. If the CPI consistently exceeds the target, indicating excessive inflation, central banks might take steps to curb price increases.

Monetary Policy Levers:

The CPI directly influences the tools used by central banks to manage inflation. One key tool is the federal funds rate, which is the interest rate at which banks lend reserves to each other overnight. By raising the federal funds rate, central banks can make borrowing more expensive, thereby slowing down economic activity and dampening inflationary pressures. Conversely, lowering interest rates can stimulate borrowing and spending, potentially leading to higher inflation.

Balancing Growth and Stability:

Policymakers use the CPI to strike a delicate balance between promoting economic growth and maintaining price stability. While a certain level of inflation is generally considered healthy for economic growth, excessive inflation can erode consumer confidence and discourage investment. The CPI helps policymakers implement monetary policies that foster growth without letting inflation spiral out of control.

Beyond Headline Numbers:

While the headline CPI number is a critical indicator, policymakers often delve deeper into the data. They might analyze specific components of the CPI basket, such as food or energy prices, to understand how different sectors are contributing to overall inflation. This granular analysis allows for more targeted policy interventions.

Limitations and Communication:

It’s important to acknowledge that the CPI has limitations. It might not fully capture the impact of changes in quality or the substitution of goods by consumers. Additionally, the time lag between price changes at the producer level and the consumer level can complicate policy decisions. Effective communication is crucial. Central banks must clearly explain their inflation targets and how they are using the CPI data to guide monetary policy decisions to maintain public trust and confidence in the economy.

What are the Potential Economic Consequences of High or Low Inflation as measured by the CPI?

The Consumer Price Index (CPI) is a key economic indicator that tracks changes in the prices of a basket of goods and services consumers purchase. It acts as a compass for policymakers, especially central banks, to assess price stability and guide monetary policy decisions.

- Gauging Inflation: The CPI helps policymakers identify inflationary pressures before they spiral out of control.

- Targeting Price Stability: Central banks aim for a moderate and sustainable level of inflation, and the CPI helps them track progress.

- Monetary Policy Levers: The CPI influences tools like federal funds rate adjustments to curb inflation or stimulate growth.

High vs. Low CPI: Navigating the Consequences

- High CPI (Inflation): Erodes purchasing power, discourages investment, prompts interest rate hikes, and widens income inequality.

- Low CPI (Deflation): Leads to stagnant wages and demand, burdens debtors, disincentivizes investment, and causes asset price deflation.

How do changes in the CPI impact Consumer Purchasing Power and overall Economic Activity?

The Consumer Price Index (CPI) serves as a window into inflation’s grip on the economy, directly influencing both consumer purchasing power and overall economic activity. Here’s a closer look at this ripple effect:

A rising CPI signifies an increase in the average price of goods and services. This translates to a decrease in consumer purchasing power. With each dollar worth less, consumers can afford fewer goods and services, forcing them to make tough choices about their spending. Groceries might take a larger chunk of the budget, leaving less for discretionary spending on entertainment or travel. Savings also take a hit as inflation erodes the real value of saved money over time. This decline in purchasing power can lead to a decrease in overall consumer demand, potentially triggering a slowdown in economic activity.

Businesses are caught between rising input costs, reflected in the PPI (Producer Price Index), and consumer price sensitivity. If they raise prices in line with their own cost increases (as measured by the PPI), they risk deterring customers due to decreased purchasing power. However, absorbing these cost increases can squeeze profit margins. Businesses might resort to cost-cutting measures like reducing employee hours or delaying hiring, potentially leading to increased unemployment and dampening economic growth.

High inflation creates uncertainty for businesses. Rapidly rising prices make it difficult to accurately predict future costs and returns on investment. This uncertainty can discourage businesses from investing in expansion plans, new equipment, or hiring additional employees. This lack of investment can stifle innovation and hinder long-term economic growth.

Central banks closely monitor the CPI to assess inflationary pressures. When the CPI rises too rapidly, policymakers might raise interest rates to curb inflation. While this can help stabilize prices, it also makes borrowing more expensive for businesses and consumers, potentially leading to a slowdown in economic activity.

The goal is to achieve a moderate and stable inflation rate, as measured by the CPI. This creates a more predictable economic environment, allowing consumers to plan their spending and businesses to make informed investment decisions. This fosters a climate conducive to sustainable economic growth, where both consumers and businesses can thrive.

How does inflation, as measured by the CPI, Influence the value of a Currency in the Forex Market?

The Consumer Price Index (CPI) plays a crucial role in the foreign exchange market (forex market), influencing the value of a currency. Understanding how inflation, measured by the CPI, impacts currency valuation is essential for forex traders and anyone interested in global economic dynamics.

A rising CPI indicates inflation, which translates to a decrease in a currency’s purchasing power within its own economy. This essentially means that each unit of currency buys less. In the forex market, this decline in purchasing power can lead to a depreciation of the currency’s value relative to other currencies.

Forex market participants consider inflation when making investment decisions. If a country experiences high inflation, as measured by the CPI, investors might become less interested in holding that currency. This is because their investments lose value over time as inflation erodes the purchasing power of their returns. This reduced demand for the currency in the forex market can lead to a decline in its exchange rate compared to other currencies with lower inflation.

Central banks often respond to high inflation by raising interest rates. This aims to curb inflation by making borrowing more expensive and encouraging saving. Higher interest rates can attract foreign investors seeking better returns on their investments. This increased demand for the currency in the forex market can lead to an appreciation of its value.

However, there’s a balancing act at play. While higher interest rates can attract investment and strengthen the currency, they can also slow down economic growth. Conversely, low inflation might suggest a stagnant economy, potentially leading to decreased foreign investment and a weaker currency.

Forex traders don’t solely rely on the headline CPI figure. They also analyze specific components within the CPI basket, like food or energy prices, to understand how different sectors are contributing to overall inflation. This granular analysis helps them make more informed decisions about currency valuations.

How can Forex Traders use CPI data releases to anticipate potential Interest Rate adjustments by Central Banks?

For forex traders, the Consumer Price Index (CPI) is a crucial piece of the economic data puzzle. By analyzing CPI data releases, traders can gain valuable insights into potential interest rate adjustments by central banks, which significantly impact currency valuations in the foreign exchange market (forex market). Here’s how:

Central banks have a primary objective: maintaining price stability. The CPI serves as a key gauge of inflation within an economy. When the CPI rises consistently above a central bank’s target rate, it signals rising inflation. This inflationary pressure can prompt central banks to raise interest rates to curb inflation.

By raising interest rates, borrowing becomes more expensive. This discourages excessive spending and investment, ultimately aiming to slow down economic activity and dampen inflationary pressures. However, for forex traders, the bigger picture involves the impact on currency valuation. Higher interest rates can make a particular currency more attractive to foreign investors seeking better returns on their investments. This increased demand for the currency in the forex market can lead to an appreciation of its value relative to other currencies.

Forex traders meticulously track CPI data releases and analyze the inflation trends they reveal. By understanding a central bank’s target inflation rate and historical responses to rising CPI, traders can anticipate potential interest rate hikes. This anticipation allows them to position themselves in the forex market accordingly. For instance, if a country’s CPI consistently exceeds its central bank’s target, and the central bank has a history of raising rates in response to inflation, traders might buy that currency in anticipation of its value appreciating due to potential future interest rate hikes.

Savvy forex traders don’t just focus on the headline CPI figure. They delve deeper into the data, analyzing specific components of the CPI basket, like food or energy prices. This granular analysis helps them understand which sectors are driving inflation and how it might influence central bank policy decisions. Additionally, traders consider other economic data points alongside the CPI, such as unemployment rates and economic growth figures, to gain a more comprehensive view of the overall economic health.

What Trading Strategies can Forex Traders employ to capitalize on, or hedge against, fluctuations in Inflation as measured by the CPI?

The Consumer Price Index (CPI) is a critical tool for forex traders navigating the ever-changing tides of inflation. By analyzing CPI data releases, traders can anticipate potential interest rate adjustments by central banks, which significantly impact currency valuations. When a country’s CPI consistently exceeds its central bank’s target, it signals rising inflation. This can prompt central banks to raise interest rates to curb inflation. Anticipating this move, traders can buy the currency in question. The expected interest rate hike can attract foreign investment seeking better returns, leading to an appreciation of the currency’s value.

On the other hand, forex traders can also leverage the CPI to hedge against inflation. Currencies from countries with a history of low and stable inflation rates tend to hold their value better as inflation erodes the purchasing power of other currencies. Additionally, traders can employ strategic currency pairing. This involves buying a currency from a country with low inflation and strong economic fundamentals, while simultaneously selling a currency from a country with high inflation. This strategy helps offset potential losses from the high-inflation currency with potential gains from the low-inflation currency. By understanding how the CPI influences inflation and central bank policies, forex traders can make informed decisions and potentially capitalize on, or hedge against, fluctuations in inflation within the forex market.

What are some Limitations of relying solely on CPI data for making forex trading decisions?

The Consumer Price Index (CPI) is a valuable tool for forex traders, offering insights into inflation and its potential impact on currency valuations. However, relying solely on CPI data for trading decisions has limitations. Here’s why a more comprehensive approach is crucial:

Limited Scope: The CPI focuses on a basket of goods and services consumed by average households. It might not fully capture price changes in specific sectors that can significantly impact certain currencies. For instance, a surge in oil prices, a key export for a particular country, might not be fully reflected in the headline CPI figure. This can lead to blind spots for traders who solely rely on the CPI.

Time Lag: The CPI reflects historical data, tracking price changes that have already occurred. In a fast-paced market, this time lag can be problematic. By the time a trader reacts to a high CPI reading, the market might have already priced in potential interest rate hikes or currency depreciation.

Market Psychology and External Events: Forex markets are influenced not just by economic data, but also by investor sentiment and unforeseen global events. A positive economic report can be overshadowed by geopolitical tensions, leading to unexpected currency fluctuations. Dependence solely on the CPI can leave traders vulnerable to these unpredictable shifts in market psychology.

Central Bank Independence: While central banks often raise interest rates in response to high inflation, their decisions are not solely driven by the CPI. Other economic factors like unemployment rates and economic growth figures also play a role. Additionally, central banks might be hesitant to raise rates if they believe it could stifle economic growth. Traders relying solely on the CPI could miss these nuances in central bank policy decisions.

Incomplete Picture of Inflation: The CPI is just one measure of inflation. Alternative measures, like producer price indexes (PPI), which track wholesale price changes, can offer valuable insights. Additionally, core CPI figures, excluding volatile food and energy prices, can provide a more stable view of underlying inflation trends.

How can Forex Traders differentiate between a temporary and a sustained rise or fall in inflation based on CPI data?

Forex traders can leverage the CPI to distinguish temporary from sustained inflation trends. Analyzing CPI data over several months reveals consistent upward or downward movements. Focusing on core CPI isolates underlying inflationary pressures. Additionally, considering factors like supply chain disruptions or central bank pronouncements on the data’s cause and potential response helps traders assess the likelihood of inflation persisting and its impact on currency valuations.

What factors, besides the headline CPI number, should forex traders consider when analyzing inflation data?

Beyond the headline CPI figure, forex traders should delve deeper into the data. Analyzing core CPI, monitoring trends over time, and considering factors like supply chain disruptions or central bank commentary on the data’s cause and potential response provide a more comprehensive picture of inflation’s trajectory. This allows traders to make informed decisions about the likelihood of inflation persisting and its impact on currency valuations.

How do unexpected CPI figures impact Market Sentiment and Currency Volatility?

Unexpected CPI figures can trigger significant shifts in market sentiment and currency volatility. A higher-than-expected CPI reading can spark fears of rising inflation, prompting investors to sell riskier assets and seek safe havens like low-inflation currencies. This sudden shift in demand can lead to increased volatility in the forex market. Conversely, a lower-than-expected CPI figure might suggest weaker-than-anticipated inflation, potentially leading investors back to riskier assets and causing fluctuations in currency valuations as market sentiment adjusts.

What resources are available to Forex Traders to stay informed about upcoming CPI Releases and Inflation Forecasts?

Staying ahead of the curve in the forex market hinges on timely information about inflation. Forex traders have an arsenal of resources at their disposal to ensure they’re informed about upcoming CPI releases and inflation forecasts. Online economic calendars, readily available from financial institutions and forex brokers, provide a schedule of upcoming data releases, including historical data for context. Central bank websites, like the Fed or ECB, publish their inflation targets and forecasts, offering valuable insights into their expectations and potential policy responses. Financial news websites and apps keep traders updated with real-time data releases and expert analysis on how the market is reacting. Additionally, many forex brokers provide research tools and reports from in-house analysts, offering in-depth perspectives on upcoming CPI releases, inflation forecasts, and their potential impact on specific currencies. By utilizing this comprehensive range of resources, forex traders can stay informed and make strategic decisions based on the ever-evolving inflation landscape.

News Trading: How to Leverage Economic Announcements for Strategic Trades

14 June 2024[…] reports, including the Consumer Price Index (CPI) and the Producer Price Index (PPI), are also vital to traders. These indicators measure the […]