The stochastic oscillator, developed by George Lane in the late 1970s, is a widely used technical indicator in the realm of technical analysis. It serves the purpose of interpreting price momentum and discerning potential overbought or oversold conditions within the market. This oscillator operates by comparing the closing price of a security with its price range over a specified time frame. An important aspect of the stochastic oscillator is its ability to provide signals based on readings above 80, indicating potential overbought conditions, or readings below 20, suggesting potential oversold conditions.

Calculation of the stochastic oscillator involves determining the %K value on a scale from 0 to 100. This value gauges the close’s position relative to the high-low range over the chosen time period. The %K calculation entails subtracting the closing price from the highest high over the specified period and then dividing the result by the difference between the highest high and the lowest low. The outcome is then multiplied by 100 to express it as a percentage, ranging between 0 and 100. Additionally, the stochastic oscillator computes another value known as %D, which represents a 3-period moving average of %K. This moving average smoothens fluctuations and aids in identifying trends in the data.

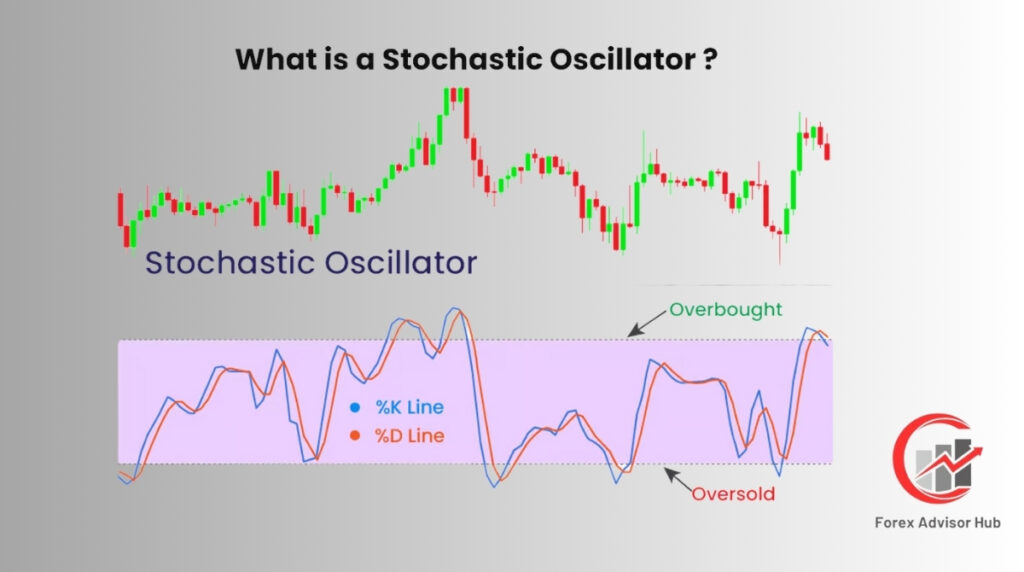

What is a Stochastic Oscillator?

The Stochastic Oscillator, developed by George C. Lane in the late 1950s, stands as a prominent technical momentum indicator widely used in the realm of technical analysis. It serves the crucial function of indicating the position of the closing price concerning the high-low range over a specified time frame. Recognized for its ability to identify overbought and oversold conditions within a security, the Stochastic Oscillator has become one of the most extensively used indicators in technical analysis.

Calculation of the Stochastic Oscillator involves two key lines: the %K line and the %D line. The %K line, representing the raw Stochastic value, measures the current close’s position relative to the total high-low range over the specified lookback period. On the other hand, the %D line is a 3-period simple moving average of the %K line, serving as a signal line to identify potential signals from %K crossovers.

The raw Stochastic Oscillator is computed using the formula %K = (Current Close – Lowest Low)/(Highest High – Lowest Low) * 100, with the %D line being the 3-period simple moving average of %K. Typically, a standard lookback period of 14 periods is used, where readings over 80 are considered overbought, and readings below 20 suggest oversold conditions.

Traders closely monitor the Stochastic Oscillator for crossover signals between the %K and %D lines, which serve as essential trade signals. A bullish crossover occurs when the %K line crosses above the %D line, indicating accelerating upside momentum and suggesting a buy signal. Conversely, a bearish crossover, signaling downside momentum and a potential sell signal, occurs when the %K line crosses below %D. These crossovers are especially potent when they occur in overbought or oversold territory.

The Stochastic Oscillator, an unbounded indicator that moves freely above 100 or below 0, provides valuable insights into momentum. High readings above 80 signify strong upward momentum, while low readings below 20 indicate robust downward momentum. Traders often use overbought or oversold readings as cues for potential reversals.

The Stochastic Oscillator has various versions like Fast Stochastic and Slow Stochastic. Full Stochastic and KDJ Indicator are also available. Traders can adjust sensitivity and signals according to their preferences. It works best in range-bound markets. Confirmation from other indicators is crucial.

Despite its effectiveness, the Stochastic Oscillator has some limitations, particularly during strong trends where it may stay overbought or oversold for extended periods. It is more effective in securities with oscillating patterns rather than those following clear directional trends. Traders can enhance the accuracy and timing of signals by combining the Stochastic Oscillator with chart patterns, support/resistance levels, moving averages, and other indicators within the broader context of technical analysis.

What is the other term for Stochastic Oscillator?

The Stochastic Oscillator is commonly known by an alternative term, the Stochastic Indicator. The use of both terms, Stochastic Oscillator and Stochastic Indicator, is interchangeable and widely accepted in discussions related to this momentum technical indicator. Initially introduced by George C. Lane, the indicator was initially referred to as Lane’s Stochastic Oscillator in his written works. The name “stochastic” has its roots in the Greek word “stochos,” which translates to “target.”

Lane created the indicator based on price behavior in trends. Prices close near highs in uptrends and lows in downtrends. The Stochastic Indicator compares the closing price to the range over a set period. Both terms, Stochastic Oscillator and Stochastic Indicator, are used interchangeably. They are widely recognized in financial markets and technical analysis.

What is the origin of Stochastic Oscillator?

The Stochastic Oscillator traces its origins to the late 1950s, attributed to the work of George C. Lane, a technical analyst employed at Investment Educators in New York. Lane designed the Stochastic Oscillator with the primary objective of identifying overbought and oversold conditions in the realms of commodities and stocks.

In 1960, George C. Lane introduced the Stochastic Oscillator in his book titled “How to Make Money in Commodities.” Within the pages of this book, Lane delves into his approach to technical analysis, emphasizing the use of oscillators. His fundamental belief was grounded in the idea that market prices exhibit oscillatory behavior, moving between overbought and oversold levels. Lane saw the Stochastic Oscillator as a tool to pinpoint these levels.

The term “Stochastic Oscillator” was coined by Lane, with “stochastic” referring to the stochastic process in probability theory. Lane’s choice of the term was influenced by the belief that market prices displayed somewhat random behavior in the short term but adhered to general patterns over more extended periods.

Lane’s book highlighted a key characteristic of the Stochastic Oscillator – its ability to reach oversold status before the actual bottom and overbought status before the top. This feature made it a valuable tool for identifying potential turning points ahead of the broader market.

During the 1960s and 1970s, the Stochastic Oscillator gained widespread popularity among technical analysts and traders. It emerged as one of the most widely adopted indicators for signaling overbought/oversold conditions and generating trade signals through crossovers.

Due to its incorporation of volatility in its formula, the Stochastic Oscillator demonstrated an ability to identify changes in trend earlier than many other indicators. Additionally, it could detect bullish and bearish divergences, further enhancing its utility. These advantages solidified the Stochastic Oscillator’s place as a valuable component in the toolkit of technical analysis.

Over the years, various iterations and adaptations of the Stochastic Oscillator have been developed, including fast and slow versions, full Stochastics, KDJ, and others. Despite these variations, the original Slow Stochastic maintained popularity, appreciated for its provision of smooth signals that helped avoid whipsaws.

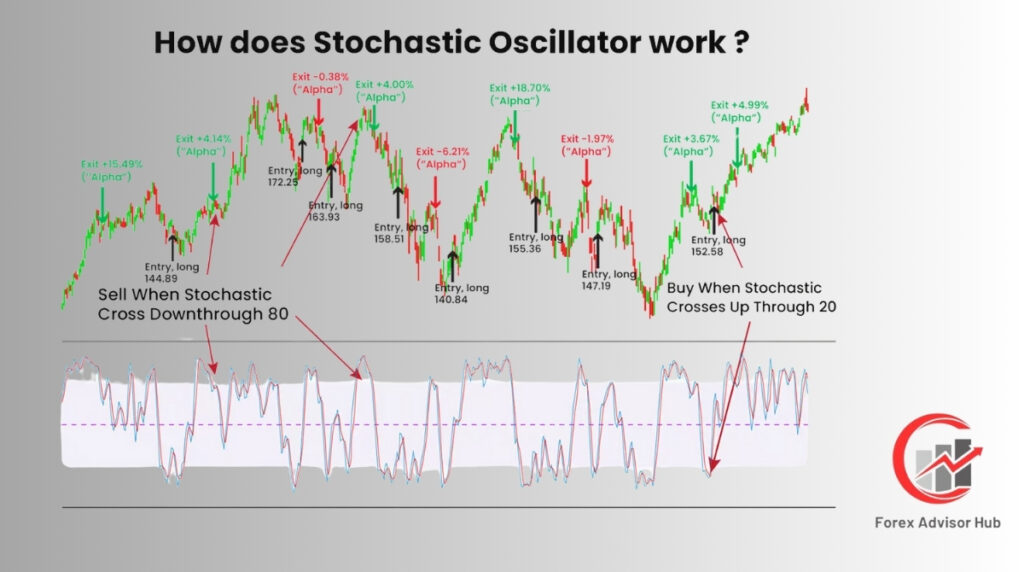

How does Stochastic Oscillator work?

The Stochastic Oscillator operates by assessing the position of the closing price relative to the recent trading range, enabling the identification of overbought and oversold levels within a security.

The %K line, representing the raw Stochastic value, is a key component in the calculation. It is determined by evaluating the closing price’s relation to the high-low range:

%K=(Highest High−Lowest LowCurrent Close−Lowest Low)×100

This formula subtracts the lowest low over the lookback period from the current closing price and divides the result by the difference between the highest high and lowest low. The outcome is a value oscillating between 0 and 100, with a standard lookback period of 14 bars.

The %D line acts as a signal line, representing a 3-period simple moving average of the %K line. This moving average smoothens the %K line’s fluctuations and reacts more slowly to price changes.

Readings above 80 on the %K line suggest overbought conditions, indicating the close is near the top of the recent range. Conversely, readings below 20 signify oversold conditions, suggesting the close is approaching the range’s bottom.

Approaching the 80 level indicates robust and potentially overextended upward momentum, suggesting a possible reversal to the downside. Conversely, nearing the 20 level signals dominant downside momentum, hinting at a potential reversal higher.

Traders commonly observe crossovers between %K and %D for trade signals. A bullish crossover occurs when %K surpasses %D, indicating accelerating upside momentum for a potential buy signal. Conversely, a bearish crossover happens when %K drops below %D, signaling a shift in momentum for a potential sell.

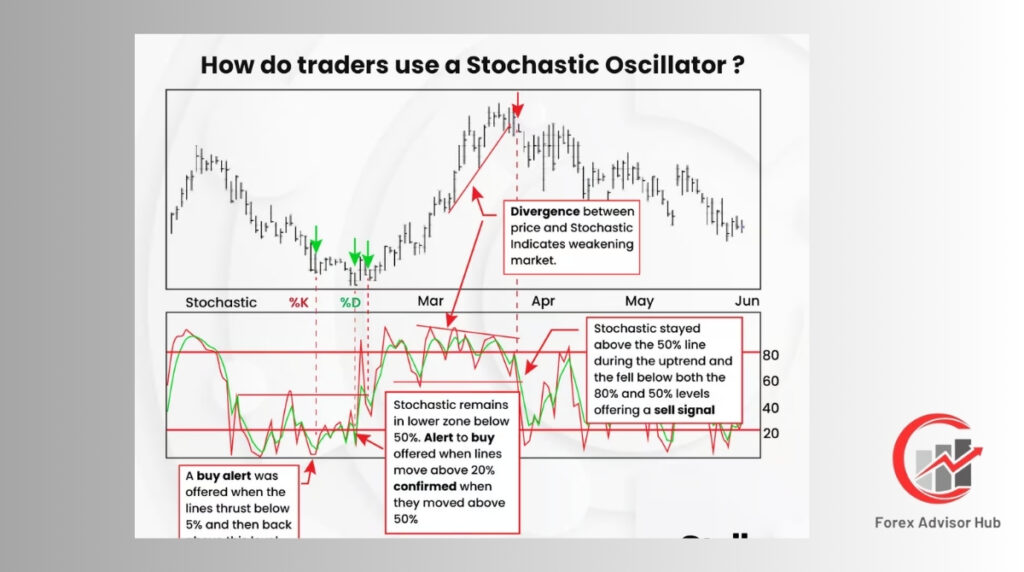

Apart from overbought/oversold levels and crossovers, traders also look for divergence between the Stochastic Oscillator and price. Diminishing momentum, indicated by the oscillator rising to new highs while the price does not follow suit, suggests a potential trend reversal.

The Stochastic Oscillator is most effective in ranging, non-trending markets. Its signals often precede those of other indicators, providing traders with an advantage in identifying shifts in supply and demand.

Traders have the option to utilize different versions of the Stochastic Oscillator based on their preferences. The Fast Stochastic, for instance, uses a 3-period moving average for %K smoothing, enhancing responsiveness to price changes. The Slow Stochastic considered the standard version, incorporates 3-period moving averages for both %K and %D, reducing the indicator’s erratic nature. The Full Stochastic includes a second Stochastic oscillator on the chart, aiding in the identification of long-term overbought and oversold levels. These variations offer traders flexibility in choosing a Stochastic Oscillator configuration that aligns with their trading style and market conditions.

What is the importance of a Stochastic Oscillator?

The Stochastic Oscillator is important in technical analysis. It identifies overbought/oversold conditions early. It indicates potential trend shifts through crossovers. This confirms divergences. It quantifies the closing price’s position relative to the recent high-low range on a scale from 0 to 100.

Readings surpassing 80 indicate an overbought condition, signifying the close’s proximity to the top of the trading range. Conversely, readings below 20 suggest an oversold condition, indicating the close’s proximity to the range’s bottom. Identifying these levels enables traders to strategically time their entries and exits. The Stochastic serves as an alert for potential reversals, indicating when long positions may be overextended or short positions oversold.

The Stochastic Oscillator often provides early signals for trend reversals compared to other indicators like moving averages, thanks to its incorporation of volatility in calculations. By assessing the close’s position relative to the high-low range, the Stochastic mirrors the speed of price action. This responsiveness allows it to anticipate trend reversals, turning lower or higher before the actual reversal occurs.

Traders leverage these early warnings from the Stochastic to enter trades ahead of time or safeguard profits in anticipation of trend exhaustion. Such early indications offer traders a valuable edge in timing their trades effectively.

Crossovers between the Stochastic lines furnish additional trade signals. A bullish crossover, occurring when %K crosses above %D, signals an acceleration in upside momentum, presenting a buying opportunity. Conversely, bearish crossovers, where %K moves below %D, indicate a strengthening downside momentum, suggesting a potential selling opportunity. While crossovers may produce whipsaws in ranging markets, their reliability increases when confirmed with other indicators or analytical techniques.

How is the Stochastic oscillator used in Technical Analysis?

The Stochastic Oscillator is a vital tool in technical analysis, employed to pinpoint overbought and oversold levels, time trade entries and exits using crossovers, validate divergences, and fine-tune parameters when integrated with other indicators. It serves as a reliable gauge for identifying overbought and oversold conditions, offering readings on a scale from 0 to 100.

In technical analysis, overbought conditions are signaled when the Stochastic crosses above 80, suggesting a potential exhaustion in the upside momentum, potentially leading to a stall or reversal in the rally. Conversely, oversold conditions are indicated when the Stochastic falls below 20, suggesting that the downside momentum may be nearing exhaustion. Traders keenly observe readings above 80 or below 20 as signals for potential shifts in the prevailing trend.

These overbought and oversold signals are instrumental in guiding traders to identify optimal entry and exit points for their trades. For instance, traders may look to initiate long positions when anticipating an oversold rally upon the Stochastic falling below 20. Subsequently, as the Stochastic rebounds back above 20, traders may consider exiting their positions to lock in profits. Conversely, short trades may be initiated when the Stochastic rises above 80, anticipating potential exhaustion in the uptrend. These positions are typically closed when the oscillator reverses below 80.

Moreover, traders rely on the crossover points between the %K and %D lines for additional trading signals. A bullish crossover occurs when the %K line crosses above the %D line, indicating a strengthening in upside momentum and presenting an opportunity for long-entry positions. Conversely, bearish crossovers, where the %K line crosses below the %D line, signal potential entry points for short trades. Traders utilize these crossovers to both time their entry into trades and determine optimal exit points, thereby enhancing their trading strategies and decision-making processes in technical analysis.

What are the different types of Stochastic Oscillators?

The Stochastic Oscillator comes in various types tailored to different trading preferences and market conditions. These include the Slow Stochastic, Fast Stochastic, Full Stochastic, Stochastic Momentum Index, and KDJ Indicator, each offering distinct advantages in technical analysis.

The Slow Stochastic Oscillator, originating from George Lane’s work, employs standard parameters with a 14-period %K line and a 3-period %D moving average. Its slower settings filter out noise, providing clearer overbought/oversold signals and reducing false positives.

In contrast, the Fast Stochastic Oscillator accelerates the indicator by employing shorter moving averages, typically utilizing a 3-period moving average for the %K line. This version reacts more swiftly to price changes, offering increased sensitivity.

The Full Stochastic Oscillator presents two Stochastic Oscillators on the chart simultaneously, representing both fast and slow versions. This dual perspective allows traders to assess short-term and long-term overbought/oversold conditions and identify divergences between the two oscillators.

The Stochastic Momentum Index integrates closing price momentum into its calculation, offering insights into trend strength and exhaustion earlier than traditional Stochastic Oscillators. This modification enhances adaptability to evolving market dynamics.

The KDJ Indicator combines Stochastic Oscillator principles with elements of the RSI indicator, incorporating momentum and signal lines to validate overbought/oversold levels. This hybrid approach provides traders with an alternative tool for pinpointing potential reversal points, leveraging the strengths of both indicators.

Additionally, traders often adjust the timeframe parameters of Stochastic Oscillators based on their chart timeframe preferences. For instance, hourly charts may utilize parameters like (10,5,5), while daily charts may opt for (14,3,3), optimizing signal relevancy.

Moreover, traders may customize overbought/oversold thresholds beyond the standard 80/20 levels, experimenting with variations such as 90/10, 70/30, or 60/40 to suit specific market conditions and trading strategies. These variations offer flexibility in adapting Stochastic Oscillators to diverse trading environments.

What is the formula of Stochastic Oscillator?

The Stochastic Oscillator formula involves two main components: the %K line and the %D line. The %K line represents the raw Stochastic value and ranges between 0 and 100. It is calculated using the formula:

%K = (Current Close – Lowest Low)/(Highest High – Lowest Low) x 100

This formula calculates where the current closing price stands relative to the highest high and lowest low over a specified lookback period. The %K line fluctuates based on these calculations, approaching 100 when the close is near the top of the range and 0 when near the bottom.

The %D line, acting as a signal line, is a simple moving average of the %K values. It helps smooth out the %K line to filter noise and provides additional trade signals. The formula for the %D line involves calculating a 3-period simple moving average of the %K line.

The default parameters for the Stochastic Oscillator are typically 14 periods for the %K lookback and 3 periods for the %D moving average. However, traders may adjust these parameters based on their preferences and market conditions.

In practical application, traders utilize the Stochastic Oscillator to identify overbought and oversold levels, time entries and exits using crossovers, and confirm trend reversals with divergences. Overbought conditions occur when the oscillator crosses above 80, signaling potential selling opportunities, while oversold conditions occur below 20, indicating potential buying opportunities.

Additionally, traders watch for crossovers between the %K and %D lines for trade signals. A bullish crossover, where %K crosses above %D, suggests increasing upside momentum and potential buying opportunities. Conversely, a bearish crossover, where %K crosses below %D, indicates increasing downside momentum and potential selling opportunities.

While the Stochastic Oscillator is effective in identifying overbought/oversold levels and generating trade signals, it is best used in conjunction with other technical analysis tools. Traders often combine it with indicators like moving averages or trendlines to enhance its effectiveness and reduce false signals.

Despite its versatility, the Stochastic Oscillator may produce prolonged overbought or oversold readings during strong trends, posing a challenge for traders. Adjusting the parameters and incorporating additional tools can help mitigate this drawback and improve the oscillator’s performance in different market conditions.

What are the key features of Stochastic Oscillator?

The Stochastic Oscillator boasts several key features that make it a valuable tool in technical analysis:

- Overbought and Oversold Levels: The oscillator identifies overbought conditions when readings exceed 80, suggesting a potential reversal, and oversold conditions when readings fall below 20, indicating a potential upward bounce.

- Momentum Swings: As a momentum indicator, the Stochastic Oscillator highlights momentum shifts, often preceding price reversals. Crossovers between the %K and %D lines serve as signals for momentum shifts.

- Confirmation Tool: It confirms price action and other technical indicators. For instance, overbought or oversold conditions in conjunction with price movements confirm potential reversals, enhancing the reliability of trading signals.

- Adjustable Parameters: Traders can customize the oscillator by adjusting parameters such as the lookback period. Shorter periods increase sensitivity, while longer periods provide smoother readings, catering to different market conditions.

- Range Trading Strategy: Suited for range-bound markets, it helps traders identify entry and exit points at potential turning points between defined highs and lows.

- Divergence: Divergence between the oscillator and price signals potential trend reversals, indicating a discrepancy between price action and momentum.

- Signal Line Crossovers: Crossovers between the %K and %D lines generate trade signals, with bullish crossovers indicating buy opportunities and bearish crossovers suggesting sell opportunities.

- Warning Tool: It cautions against counter-trend trading by highlighting overbought or oversold conditions, advising traders to avoid entering positions against the prevailing trend.

By leveraging these features, traders can effectively utilize the Stochastic Oscillator to make informed trading decisions and navigate various market conditions.

How do traders use a Stochastic Oscillator?

Traders utilize the Stochastic Oscillator primarily to pinpoint overbought and oversold levels within the market. By examining divergences and crossovers of the indicator’s lines, they can anticipate potential shifts in the price trend. To begin, traders incorporate the Stochastic Oscillator (%K and %D lines) onto their trading chart, typically with a setting of 14 periods for the %K and 3 periods for the %D.

Observing the oscillator positioned at the bottom of the chart allows traders to track its fluctuations alongside price movements. Overbought readings surpassing 80 and oversold readings dipping below 20 indicate potential exhaustion points for the prevailing price trend. For example, when encountering overbought conditions, it signals that the uptrend may be approaching its conclusion as buying momentum diminishes.

To bolster their analysis, traders seek confirmation from price action when the oscillator enters overbought or oversold territory. For instance, the emergence of bearish candlestick patterns near overbought levels heightens confidence in an imminent upside reversal. It’s prudent to wait for the oscillator to commence its descent out of the overbought zone before considering initiating a short trade. Entry points are determined based on the asset’s price movement, ensuring strategic trade execution.

What are the trading strategies used with Stochastic Oscillator?

The main trading strategies using the Stochastic Oscillator involve identifying overbought/oversold reversals, trading crossovers, spotting divergences, confirming trends and breakouts, and swing trading based on smoothed oscillator values.

1.Overbought/Oversold Reversals

One of the core strategies is to trade reversals when the indicator reaches overbought or oversold levels. Overbought readings above 80 indicate the uptrend is overextended and likely to reverse. Oversold readings below 20 sometimes signal the downtrend is exhausted and ready to bounce back up.

Traders watch for the oscillator to exit the overbought/oversold zone and then take a trade in the reversal direction. For instance, they will be ready to go short on weakness when the %K line falls below 80. The overbought/oversold levels identify opportune times to enter counter-trend trades.

2. Crossover Signals

The crossover of the %K and %D lines forms the basis for trades. A rising momentum and a chance to go long are indicated by an upside crossover, which occurs when %K crosses above %D. A downside crossover indicates waning momentum and favours a short position.

Simple crossover systems buy on bullish crossovers and sell on bearish crossovers. The crossovers identify turning points ahead of the price trend change. Moving average crossovers confirm the oscillator signals.

3. Divergence Trades

Divergences between price and oscillator signal loss of momentum. For instance, declining upward momentum is indicated when the price reaches a higher high, but the Stochastic creates a lower high. Traders watch for these momentum divergences and take trades in the direction of the developing divergence.

4. Riding Trends

While mainly a momentum oscillator, the Stochastic also helps identify and ride existing trends. When the indicator is trending strongly in overbought or oversold zones, it signals a strong underlying trend. Traders use pullbacks towards the %K/%D midpoint as opportunities to join the dominant trend direction.

5. Swing Trading

Adjusting the stochastic to slower settings creates smoother oscillator lines that are useful for swing trading. Identifying oversold readings near support and overbought readings near resistance provides swing trade opportunities. Divergences also flag potential swing trade reversal points.

6. Breakout Confirmation

Stochastic sometimes confirms breakouts when its value reflects the direction of the breakout. The validity of the breakout signal is increased if prices break support with %K below 50 or resistance with %K above 50. This confirmation technique applies to technical patterns and channel breakouts.

When is the best time to trade with a Stochastic Oscillator?

The Stochastic Oscillator is most effective when trading occurs within a consolidating range rather than during strong trends. Optimal trading opportunities arise when the oscillator reaches extreme levels of overbought (above 80) or oversold (below 20). These levels indicate exhausted momentum, suggesting that the price has likely extended too far.

As the oscillator reverses from these extreme levels back towards the middle ground, it signals a potential counter-trend reversal. For instance, a decline below 80 and subsequent downturn in the %K line may indicate a forthcoming positive reversal and selling opportunity.

However, it’s crucial to exercise caution, as markets may linger in overbought/oversold zones during robust trends. It’s prudent to wait for confirmation of the reversal through patterns or breaks of support/resistance. Prematurely trading against the trend should be avoided, but readiness is key once momentum visibly stalls.

Crossover points provide additional signals for trade entry when the %K line crosses above or below the %D line. Upward crossovers suggest bullish momentum is building, while downward crossovers indicate bearish momentum is strengthening. These crossovers precede full-price reversals, enabling traders to enter trades before the impending move. Confirming crossovers with other indicators enhances reliability, ensuring opportune moments to trade in the direction of the momentum shift.

Divergences occur when the price and oscillator move in opposite directions, signaling potential changes in momentum. For instance, a bullish divergence occurs when the Stochastic forms higher lows while the price records lower lows. These divergences serve as early indicators of impending trend changes. Once confirming signals materialize, such as an upside breakout, traders can enter trades aligned with the emerging momentum, leveraging the predictive power of divergences to anticipate reversals in advance.

Is Stochastic Oscillator effective?

Yes, the Stochastic Oscillator is effective in trading, providing valuable signals during price oscillations in a range or channel. Its effectiveness stems from its ability to identify overbought and oversold levels, along with early momentum shifts.

Is Stochastic Oscillator accurate?

Yes, the Stochastic Oscillator can be accurate in providing trading signals. But its accuracy is contingent upon proper usage and context. When used alone, it may generate false signals and whipsaws, especially in volatile trending markets. Without confirmation from price action or other indicators, relying solely on the Stochastic Oscillator for trading signals may result in low accuracy and frequent fakeouts.

What are the benefits of Stochastic Oscillator?

The Stochastic Oscillator offers several benefits for traders when used effectively:

Identifying Overbought/Oversold Levels: It helps identify overbought and oversold conditions, indicating potential reversals in price direction. Readings above 80 suggest overbought conditions, while readings below 20 indicate oversold conditions.

Signaling Momentum Shifts: The Stochastic Oscillator signals shifts in momentum before the price turns. Crossovers of the %K and %D lines indicate building momentum, allowing traders to enter trades earlier.

Confirmation Tool: It confirms price action and other technical signals, providing additional confidence in trade setups. Overbought/oversold readings often validate trading decisions at key support or resistance levels.

Flexible Parameters: Traders can adjust the %K and %D parameters to suit different securities and timeframes. Faster settings are suitable for volatile markets and short-term trading, while slower settings work well for trend identification.

Trend Identification: While primarily a momentum oscillator, the Stochastic also helps identify trends. Persistent overbought/oversold readings indicate strong trends, allowing traders to capitalize on trend-following strategies.

Swing Trading: Slow Stochastic settings smooth out noise, making it easier to spot turning points for swing trading opportunities.

Divergence Signals: Divergences between the Stochastic and price indicate waning momentum, often preceding trend reversals. Traders can use these divergences to anticipate potential reversals and adjust their trading strategies accordingly.

Overall, the Stochastic Oscillator assists traders in identifying market conditions, signaling potential trade opportunities, confirming signals, and managing risk effectively.

What are the limitations of Stochastic Oscillator?

The Stochastic Oscillator comes with several limitations that traders should be aware of:

False Signals in Trending Markets: The oscillator tends to stay overbought or oversold during strong trends, leading to false reversal signals and whipsaws, particularly when traded against the trend.

Lagging Indicator: Like other lagging indicators, the Stochastic trails behind current price action, with crossover signals occurring after much of the price move has already taken place.

No Clear Exit Signals: While useful for identifying potential entry points, the Stochastic does not provide clear signals for when to exit trades, necessitating the use of other indicators or methods for exit planning.

Repainting: Signals generated by the Stochastic are subject to repainting, as past signals may change or disappear with new price data, making it unreliable as a standalone tool.

Subject to Whipsaws: The Stochastic is prone to whipsaws, giving buying signals near temporary bottoms in downtrends and selling signals near temporary tops in uptrends, potentially leading to frequent and costly trades.

No Direction Bias: The oscillator itself lacks directional bias, requiring traders to determine market conditions and the larger trend context independently.

Requires Confirmation: Due to the potential for false signals, the Stochastic is most effective when confirmed with other indicators, enhancing the accuracy and timing of trading signals.

Overall, while the Stochastic Oscillator is a valuable tool for identifying potential trade opportunities, traders should be mindful of its limitations and use it in conjunction with other tools and analysis methods to improve its effectiveness.

Can Stochastic Oscillator work well with other Indicators?

Certainly, the Stochastic Oscillator can work synergistically with other technical indicators, enhancing the overall effectiveness of a trading strategy. By combining the Stochastic with complementary indicators, traders can improve the timing and accuracy of trade signals, ultimately leading to more confident trading decisions.

What is the difference between RSI and Stochastic Oscillator?

The main distinctions between the Relative Strength Index (RSI) and the Stochastic Oscillator lie in their methodologies, structure, parameters, and interpretations.

RSI measures momentum by assessing the speed and rate of price changes. It compares average closing prices of up and down periods over a set lookback window, often 14 bars. This creates an indexed range from 0 to 100. Values above 70 indicate overbought conditions. Values below 30 suggest oversold conditions.

In contrast, the Stochastic Oscillator assesses momentum by analyzing the closing price relative to the high-low range over a defined period. This comparison also yields a scale from 0 to 100, with readings above 80 considered overbought and those below 20 seen as oversold.

While the RSI comprises a single line reflecting momentum shifts, the Stochastic Oscillator consists of two lines—%K and %D. The %K line, more sensitive to price changes, oscillates rapidly, while the %D line smooths out noise through a moving average.

RSI commonly uses a fixed 14-bar lookback period. Traders can adjust it for responsiveness. Stochastic Oscillator has three adjustable parameters. These parameters allow customization for various assets and timeframes.

Interpretation-wise, both indicators identify overbought and oversold conditions, but the Stochastic emphasizes crossovers and divergence for trading signals. Traders use %K/%D crossovers to signal momentum shifts, while divergence between Stochastic and price often precedes reversals.

Overall, while RSI focuses on momentum and overbought/oversold levels, the Stochastic Oscillator incorporates crossovers and divergence for higher probability signals.