The Parabolic SAR (Stop And Reverse) stands as a pivotal technical indicator designed to ascertain trend direction and detect possible reversals. Originating from the technical analysis endeavors of J. Wells Wilder in the late 1970s, the Parabolic SAR employs a unique approach by plotting “stop and reverse” points that trail behind or scoop up beneath price spikes in upward or downward movements.

Calculation of the Parabolic SAR involves referencing prior highs and lows on a chart over a period. The indicator establishes a trailing stop-and-reverse point, positioned below recent lows in an uptrend or above highs in a downtrend. The SAR value either remains constant or moves incrementally in the trend’s direction during each period. A change in the SAR dots’ direction indicates a potential trend reversal, signaling that recent price action has breached significant support or resistance levels.

The Parabolic SAR holds several key advantages, such as its capacity to filter out whipsaws, providing reversal signals after robust momentum shifts. This feature aids traders in recognizing potential trend changes at an early stage. The indicator’s adaptive nature is notable, as it closely trails asset prices during strong trends and adjusts more conservatively in range-bound periods. As a result, the Parabolic SAR proves versatile in analyzing both trending and sideways markets, offering valuable trading alerts when used in conjunction with other technical tools.

What is a Parabolic SAR?

Parabolic SAR (SAR standing for “stop and reverse”) serves as a crucial technical indicator for analyzing price trends and momentum in securities trading. Developed by J. Welles Wilder in the 1970s, it joins the ranks of other popular tools like the Relative Strength Index (RSI) and Average True Range (ATR).

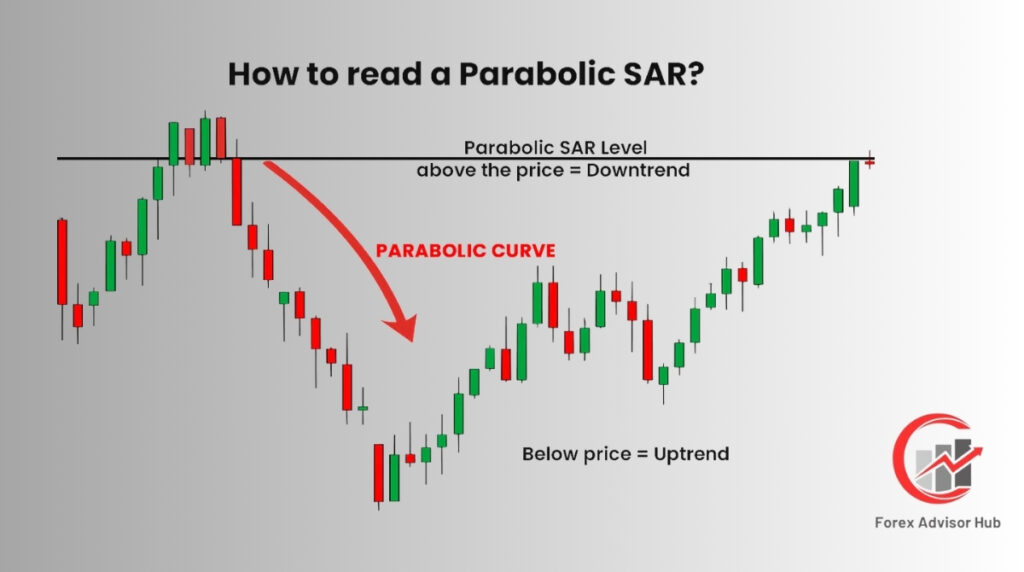

The Parabolic SAR appears on a price chart as a series of dots, positioned either above or below the price bars. These dots signify the prevailing trend direction. In an uptrend, the dots are below the price bars, while in a downtrend, they hover above.

The name “stop and reverse” encapsulates the indicator’s primary function of pinpointing potential turning points in the trend. During an uptrend, the SAR dots emerge below the price bars, progressively moving further down as the uptrend persists. The reversal signal triggers when the dots shift above the price bars, indicating a potential shift to a downtrend.

Conversely, in a downtrend, SAR dots initially appear above the price bars. As the downtrend weakens, the dots descend closer to prices. When the dots flip below the price bars, it signifies the end of the downtrend and the commencement of an upward move.

What does the Parabolic Indicates?

The “parabolic” attribute in the indicator’s name derives from the parabolic curve employed in dot placement. As prices extend in one direction, the SAR dots accelerate exponentially in that direction, creating the characteristic parabolic effect.

The Parabolic SAR calculation involves several key factors, including the starting point, increment, acceleration factor, and maximum increment. The calculation steps through each period, adjusting the SAR value based on these factors. It accurately reflects trend momentum, accelerating rapidly during a strong trend and eventually reversing as the trend weakens.

Traders utilize the Parabolic SAR in various ways. It helps identify trend direction, with dots below indicating an uptrend and dots above denoting a downtrend. Flipping of SAR dots signals trend reversals. Traders often set stop-loss orders slightly below SAR dots in an uptrend and above in a downtrend. Additionally, the indicator assists in timing entry and exit points aligned with the emerging trend.

The Parabolic SAR is most effective in strongly trending markets. In choppy or ranging conditions, the frequent flipping of SAR dots can generate false signals. Traders often incorporate additional filters or indicators to enhance signal accuracy in such situations.

How to read a Parabolic SAR?

The Parabolic SAR (Stop And Reverse) is a technical indicator developed by J. Wells Wilder in the late 1970s. It serves the purpose of identifying the direction of trends and potential reversal points in securities trading. This indicator is known for its ability to provide visual cues on price charts through a series of dots, either above or below the price bars.

The placement of these dots is crucial for interpreting the prevailing trend. When the dots are positioned below the price bars, it suggests an uptrend, whereas dots above the price bars indicate a downtrend. The term “stop and reverse” in Parabolic SAR highlights its function of identifying potential turning points in the trend.

The calculation of Parabolic SAR involves factors such as the starting point (the lowest or highest price at the beginning of an uptrend or downtrend), the increment (the amount the SAR moves each period), the acceleration factor (governing the rate of increment increase), and maximum increment (putting a cap on the SAR increment).

How SAR dot accelerate?

As the price moves further in one direction, the SAR dots accelerate at an exponentially increasing rate, creating a parabolic curve. This acceleration reflects the indicator’s responsiveness to trend momentum, slowing down and eventually reversing when the trend weakens, signaling a potential trend change.

Traders commonly use the Parabolic SAR to identify the trend direction. During an uptrend, they observe the SAR dots below the price bars, and in a downtrend, the dots appear above the bars. The distance between the SAR dots and price bars is monitored to gauge the strength of the trend. Wider spacing indicates a strong trend, while narrowing spacing suggests a potential weakening and impending reversal.

One of the critical signals provided by the Parabolic SAR is the flip of dots from one side of the price bars to the other. This flip acts as a “stop and reverse” signal, indicating a potential trend reversal. Traders use this signal to adjust their positions in alignment with the emerging trend.

Additionally, the SAR dots’ acceleration, speed, and interaction with key support or resistance levels offer further insights into trend dynamics. Monitoring the SAR’s rate of change adds an extra layer to identifying trends and potential reversals. Traders may also adjust the sensitivity of the SAR by modifying the Acceleration Factor and Maximum Acceleration settings.

In summary, the Parabolic SAR is a versatile indicator that provides valuable information about trend direction, strength, and potential reversals. Its visual representation on price charts, along with its unique “stop and reverse” function, makes it a popular tool among traders for trend analysis and decision-making.

How is Parabolic SAR used in Technical Analysis?

In technical analysis, the Parabolic SAR serves various purposes, including identifying trend direction, recognizing reversals, timing entries, setting stops, monitoring momentum, assessing trend strength, and evaluating volatility. A fundamental application is swiftly determining the prevailing price trend by observing the position of SAR dots relative to price bars. Uptrends are signaled when dots are below bars, while downtrends are indicated when dots appear above bars.

Traders leverage the SAR’s unique “stop and reverse” feature to identify potential turning points in trends. When SAR dots transition from below to above price bars, it suggests an uptrend turning into a decline, and vice versa. These flip signals provide early warnings of waning momentum, enabling traders to adjust stops or close positions before a confirmed reversal.

The Parabolic SAR establishes objective criteria for trade entries, especially in systematic and rules-based trading strategies. SAR flip breakouts are commonly used, and the acceleration function aids in dynamically updating stop-loss levels to secure profits and limit losses. Trailing stops are adjusted higher in uptrends as SAR dots accelerate from price bars, aligning with trend momentum.

For short trades, new stop-losses are often placed slightly above flipped SAR dots to protect positions when a reversal signal occurs and a downtrend emerges. The SAR contributes to objective stop placement, eliminating emotional biases. Monitoring the speed of SAR dots provides insights into trend momentum. Accelerating dots indicate strengthening momentum, while deceleration signals fading momentum. Changes in SAR acceleration help traders discern shifts in supply and demand throughout a trend’s progression.

What are the key features of Parabolic SAR?

The Parabolic SAR, or Stop And Reverse, is a technical indicator developed by J. Welles Wilder to help traders identify trend direction and potential reversals. Represented as dots above or below price bars, the SAR indicates uptrends when below bars and downtrends when above.

A distinctive feature of the SAR is its dynamic speed adjustment, reflecting changes in trend momentum. The “stop and reverse” function, where dots flip sides, signals potential trend reversals, providing traders with early warnings of shifts in market sentiment.

Customizable parameters, such as the acceleration factor and maximum acceleration rate, enhance the SAR’s adaptability to different market conditions and time frames. This flexibility makes it suitable for various trading strategies.

The SAR generates objective entry and exit signals based on clear criteria, reducing emotional decision-making. Its role in adaptive stop placement, trend strength evaluation, and signal generation contributes to its effectiveness in technical analysis. Traders often incorporate the SAR into their toolkit for making well-informed trading decisions.

What is the formula of a Parabolic SAR?

The SAR formula includes two components – the SAR value and the Extreme Point (EP).

The SAR value represents the actual dotted lines that appear on the chart below the price bars in an uptrend and above the bars in a downtrend. It is calculated as stated below.

SAR(current) = SAR(previous) + AF * [EP – SAR(previous)]

Where,

SAR(current) = The current SAR value

SAR(previous) = The SAR value in the previous period

AF = The Acceleration Factor

EP = The Extreme Point

The SAR value starts at the initial low or high when entering a trade. It then steps further away from the price at an accelerating rate as the trend extends.

The Extreme Point is the highest high or lowest low achieved by the price during the current trend. It is constantly updated to the most recent swing high/low. The EP anchors the SAR by providing a reference point for its trailing calculation. As the EP moves further from the price bars, it allows the SAR to accelerate at a faster rate.

The Acceleration Factor controls the speed at which the SAR values step away from the price. It begins at a minimum value and increases by an Increment value at each SAR step. The increment determines the rate of AF acceleration. Larger Increment values cause quicker acceleration, and smaller values slow the acceleration rate.

For the AF to gradually start following the new trend when it reverses and a new EP emerges, it is reset to minimal values.

This dynamic acceleration and deceleration in reaction to the trend is what gives the Parabolic SAR its adaptiveness. The values trail quickly during strong trends but react slowly when trends weaken and reverse approach.

How to Calculate a Parabolic SAR?

The Parabolic SAR formula comprises the SAR value and the Extreme Point (EP). The SAR value, representing the dots on the chart, is calculated using the formula: SAR(current) = SAR(previous) + AF * [EP – SAR(previous)]. Here, SAR(current) is the current SAR value, SAR(previous) is the SAR value in the previous period, AF is the Acceleration Factor, and EP is the Extreme Point.

The SAR value initiates from the initial low or high when entering a trade and moves away from the price at an accelerating rate as the trend extends. The Extreme Point is the highest high or lowest low during the current trend, continuously updated to the most recent swing high/low, anchoring the SAR by providing a reference point for its trailing calculation.

The Acceleration Factor controls the speed of SAR values to the price, starting at a minimum value and increasing by an Increment value at each SAR step. The Increment determines the rate of AF acceleration, with larger values causing quicker acceleration and smaller values slowing the rate. For the AF to follow the new trend gradually after a reversal, it is reset to minimal values, ensuring the SAR adapts dynamically to changing market conditions.

How to Calculate a Parabolic SAR?

To calculate a Parabolic SAR manually, follow these steps:

- Identify the Initial Extreme Point: Find the lowest low for long trades or the highest high for short trades at the beginning of the trend to determine the initial Extreme Point (EP).

- Enter Initial SAR Value: Enter the initial SAR value, which is the EP low point for uptrends or EP high point for downtrends.

- Calculate the AF Increment: Determine the increment amount for the Acceleration Factor (AF), commonly 0.02, 0.04, or 0.06.

- Add Increment to AF: Start with the AF minimum (e.g., 0.02) and add the increment at each step to increase the AF value (e.g., 0.02 + 0.04 = 0.06).

- Find the New Extreme Point: Determine whether the current period’s high/low surpasses or falls short of the preceding EP, updating the new extreme accordingly.

- Calculate the New SAR Value: Use the SAR formula: SAR(current) = SAR(previous) + AF * [EP – SAR(previous)] to accelerate the SAR value toward the current EP.

- Trail Stop Level: Set a stop order at the current SAR value to follow the trend as SAR accelerates and trails further from the price bars.

- Reset AF on Reversal: Reset the AF to minimal levels when the SAR flips above or below the price action to slow down the new SAR direction.

- Repeat the Process: Recalculate the SAR at each new period by repeating steps 5-8, allowing the SAR to adaptively accelerate and decelerate based on new EPs.

- Optimize Parameters: Adjust starting AF, Increment, and other inputs to optimize SAR sensitivity for different instruments and timeframes.

By practicing these steps, traders can gain a solid understanding of how to manually calculate Parabolic SAR values, providing flexibility in applying SAR analysis to various trading objectives.

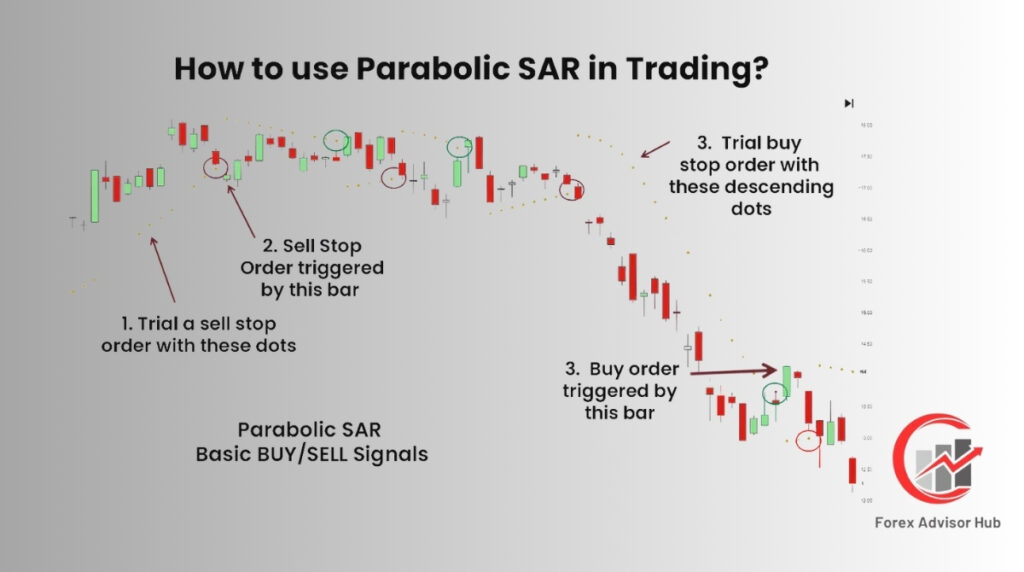

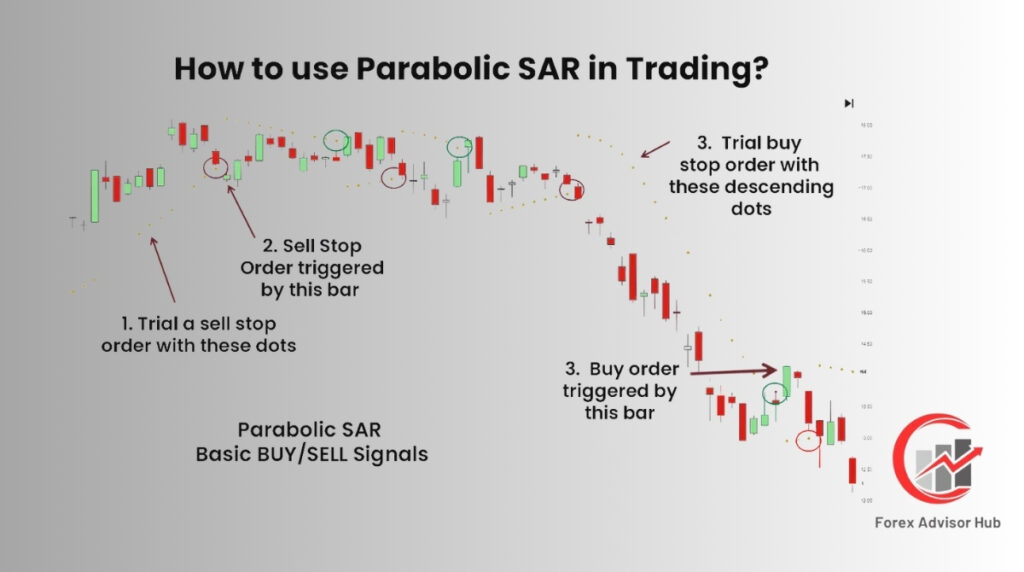

How to use Parabolic SAR in Trading?

To use Parabolic SAR effectively in trading, traders can implement various strategies for trend identification, reversal signals, adaptive stop trailing, momentum analysis, parameter optimization, and quick visual market assessments.

Identify Trend Direction: Quickly determine the prevailing trend by observing the placement of SAR dots relative to the price bars. Dots below the bars indicate uptrends, while dots above suggest downtrends.

Signal Trend Reversals: Utilize SAR flips, where dots transition from one side of the price to the other, as signals for potential trend reversals. Implement these flips as trade entry triggers aligned with the new trend direction.

Adaptively Trail Stops: Leverage SAR values to dynamically trail stop-loss orders. Set stops just beyond the current dot’s position, allowing SAR to accelerate away and lock in gains as the trade progresses.

Analyze Momentum Changes: Assess trend momentum by observing the speed of SAR movement. Faster dot acceleration indicates strong momentum, while slowing dots suggest weakening strength. Monitor changes in SAR speed for momentum evaluation.

Set Clear Exit Rules: Establish clear exit rules based on SAR signals. Exit trades in line with SAR flips through the price bars, preventing potential losses as the trend weakens or reverses.

Adjust Input Parameters: Fine-tune SAR sensitivity by adjusting input parameters. Optimizing parameters enhances the accuracy of SAR signals, making it more effective in different market conditions.

Utilize Visual Guidance: Leverage the visual representation of SAR directly on the price chart for quick assessments of market bias, strength, reversals, volatility, and momentum. The intuitive display aids traders in making informed decisions.

By incorporating these strategies into a trading plan, traders can enhance the effectiveness of Parabolic SAR as a versatile tool for trend analysis, signal generation, and risk management.

What trading strategy works well with Parabolic SAR Trading?

Trading strategies that complement Parabolic SAR are diverse, leveraging its adaptive signals for effective decision-making. Trend-following strategies find synergy with Parabolic SAR’s ability to confirm trend direction. Traders employing trend strategies benefit from entering positions aligned with the SAR-defined trend and exiting when the SAR flips back.

Breakout trading strategies capitalize on price surges beyond support or resistance levels. Parabolic SAR’s quick acceleration during trend breakouts provides confidence in the validity of the move. Traders use SAR signals to enter breakout trades and trail stop-losses for optimal gain protection.

Reversal strategies, which aim to identify trend turning points, align well with Parabolic SAR. The SAR’s flips above or below price action serve as clear signals for potential trend reversals. Traders incorporating SAR flips gain objective technical signals and visually recognize reversal patterns.

Momentum trading strategies benefit from Parabolic SAR’s adaptability to changing momentum strength. The SAR’s dynamic speed adjustment, reflecting momentum, helps traders identify opportunities to enter or exit positions based on the pace of the trend.

Volatility expansion trading involves monitoring SAR’s trail speed to gauge changing market volatility. SAR’s acceleration in response to increasing volatility provides insights for deploying strategies suited to evolving market conditions.

Pattern breakout systems, focusing on chart patterns like triangles or rectangles, integrate well with Parabolic SAR. SAR dots accelerate when price breaks out of these patterns, confirming valid breakouts and assisting traders in entering positions aligned with the emerging trend direction.

In summary, Parabolic SAR proves versatile for various trading strategies, offering adaptive signals for trend confirmation, reversal identification, volatility assessment, and breakout validation. Traders can seamlessly incorporate SAR into their strategies to enhance decision-making and maximize trading effectiveness.

Which timeframe is best for Parabolic SAR?

For optimal Parabolic SAR trading, timeframes such as the hourly, 4-hour, and daily are considered most effective. These timeframes strike a balance between smoothing out lower timeframe noise and providing timely signals for actionable decision-making. Smaller timeframes like the 1-minute and 5-minute charts tend to introduce excessive sensitivity, leading to potential whipsaws and premature signals due to constant price changes.

Conversely, longer timeframes such as monthly and weekly charts are better suited for long-term trend analysis, but the signals may lag or flip infrequently, missing opportunities in short-term market swings. The hourly, 4-hour, and daily timeframes offer an optimal environment for Parabolic SAR trading, providing early identification of quality trend moves and reversals.

Several factors contribute to the effectiveness of the hourly, 4-hour, and daily timeframes for SAR trading. These intermediate timeframes effectively smooth out market noise and fluctuations, offering a clearer picture of the underlying trend. Daily charts, in particular, deliver timely signals for early reversal identification, allowing traders to capitalize on moves before they fully develop.

The adaptability of SAR to these timeframes is notable, with the acceleration factor responding appropriately to multi-hour and multi-day swings in momentum. SAR values trail extended swings effectively, facilitating logical stop placement. The visual SAR signals maintain objectivity, aiding traders in making informed decisions without being influenced by emotional misreads.

Traders can optimize input parameters over days and weeks to fine-tune SAR sensitivity, ensuring that the indicator aligns with their specific trading objectives. Additionally, executing trades based on daily signals is practical for most investors, eliminating the need for rapid intraday exits. In summary, the hourly, 4-hour, and daily timeframes offer an ideal setting for Parabolic SAR trading, combining reliability, precision, and controlled risk.

How do traders use Parabolic SAR to identify trend reversals?

Traders leverage Parabolic SAR to identify trend reversals using various signals such as SAR dot flips above or below the price, crossovers of key levels, slowing SAR velocity, divergence with price momentum, and evaluating the context of volatility. A primary application of the Parabolic SAR is to discern moments when momentum is diminishing, signaling an increased likelihood of a trend reversal. The unique mechanism of the SAR provides objective indications of shifts in control between buyers and sellers.

One of the most straightforward signals for a SAR reversal is the flip of dots from one side of the price bars to the other. For instance, when the SAR flips above the bars, it suggests emerging weakness and exhaustion of the upside momentum in the ongoing uptrend. Traders often interpret these flips as signals to exit trades aligned with the prior trend.

Some traders prefer confirmation of a reversal by waiting for a SAR flip above or below a moving average line or another indicator threshold. This approach creates a crossover system that enhances precision. For instance, SAR dots flipping above a moving average crossover in an uptrend provide additional confidence for exit signals.

In addition to marking potential reversals, traders monitor the speed of the SAR dots leading up to the flip. A rapid acceleration of SAR followed by a sudden deceleration serves as a warning sign of waning momentum just before the crossover. This dynamic reflects the ongoing struggle between buyers and sellers. Recognizing this slowing velocity further strengthens the entry signals for reversals in the new direction.

How can Parabolic SAR be used with other Indicators?

Parabolic SAR is effectively used in conjunction with indicators such as moving averages, oscillators, volume tools, chart patterns, volatility metrics, candlestick patterns, and support/resistance levels to enhance confirmation and strengthen the reliability of trading signals. Combining Parabolic SAR with other indicators creates a more comprehensive analytical approach, maximizing its effectiveness.

Overlaying Parabolic SAR with moving averages, particularly the widely used 50-day and 200-day simple moving averages, offers valuable trend filters and identifies potential reversal signals when the SAR dots cross above or below these averages.

Incorporating momentum oscillators like RSI, Stochastics, and MACD alongside SAR signals aids in refining the timing and confirmation of trend reversals. Oscillators provide insights into overbought/oversold conditions and divergence from price movements.

Volume analysis is crucial for confirming the conviction behind SAR reversals. Observing increased volume during SAR flips emphasizes significant turning points, while low volume near SAR signals may indicate potential false reversals.

Chart patterns such as head and shoulders, flags, and wedges, which signify consolidations or reversals, can be confirmed by the Parabolic SAR. The dots accelerate rapidly when prices break out of these patterns, validating the direction of the trend.

Utilizing volatility indicators like Average True Range (ATR) helps quantify changes in volatility. Monitoring volatility levels provides context on the magnitude of SAR-driven price swings and potential reversals.

Candlestick formations like doji, engulfing, or shooting star candles, which suggest intraday reversals, gain additional verification when the SAR dots change direction simultaneously with these patterns.

Horizontal support and resistance levels serve as crucial indicators of potential turning points. SAR dots accelerating above resistance or below support act as high-probability signals for reversals from key zones.

Does Parabolic SAR be used in conjunction with Fibonacci Retracement?

Yes, traders effectively use the Parabolic SAR indicator in conjunction with Fibonacci retracement levels. Fibonacci retracements are instrumental in identifying potential support and resistance zones based on percentage retracement levels of previous significant swings, typically referencing key swing highs and lows. As the Parabolic SAR trails price action and accelerates during trend developments and reversals, integrating Fibonacci retracements with SAR signals provides traders with enhanced insights for making informed decisions regarding entries, exits, and stop placements.

For example, when there is an upward reversal, the SAR dots quickly accelerate below the price bars. This SAR flip becomes a valuable piece of evidence, particularly if it aligns with a substantial Fibonacci support level, indicating that the swing low is potentially acting as resistance in the context of a counter-trend rebound.

What is the success rate of Parabolic SAR?

The success rate of the Parabolic SAR is contingent on its adept utilization within a comprehensive trading strategy. While the indicator offers valuable signals when employed judiciously, it is imperative not to solely depend on its signals in isolation. Realistic evaluation of both the strengths and limitations of the Parabolic SAR is crucial for effective use. The indicator’s adaptability in terms of adjustable inputs permits traders to optimize sensitivity and performance across various instruments and timeframes. However, it’s essential to recognize that there is no universal set of parameters that guarantees a 100% success rate for signals. The overall success of the Parabolic SAR hinges significantly on the broader trading approach integrated into the trading strategy.

What are the Advantages of Parabolic SAR?

The Parabolic SAR offers traders a versatile and adaptive tool for trend and momentum analysis, providing advantages across various markets and timeframes. Here are the key advantages:

Versatile Analysis Applications:

The Parabolic SAR is a multifaceted technical analysis tool that aids traders in identifying clear uptrends and downtrends. It offers objective entry and exit triggers, dynamically trailing prices for adaptive stop-loss levels. The indicator’s ability to assess changes in momentum and its optimizable input values make it a valuable tool for traders of different styles. The visual display directly on the price chart provides clear and actionable signals.

Adaptive Formula:

A notable advantage lies in the dynamic and responsive nature of the Parabolic SAR. Its momentum-based formula enables it to adjust its pace, quickening during new trends and slowing as trends mature or fade. This adaptability allows the indicator to closely follow prices during low volatility periods and maintain a looser trail in high volatility conditions. The Parabolic SAR effectively mirrors the strength or weakness of trends, making it valuable for timing entries and exits.

Universal Utility:

The Parabolic SAR exhibits effectiveness across diverse markets, including forex, stocks, indices, commodities, and cryptocurrencies. Its sensitivity to momentum changes makes it suitable for various trading strategies, from short-term intraday scalping to long-term position trading. This versatility enables traders to apply a consistent approach across different asset classes, making it a robust indicator for different market environments.

Risk Management Functionality:

A crucial benefit of the Parabolic SAR is its ability to facilitate logical stop-loss placement and exit rule definition. As it trails prices, it dynamically sets stop-loss levels, removing emotional decision-making from trade management. This rules-based approach enforces trading discipline and consistency by trailing below profits in uptrends and above losses in downtrends.

Versatile Timeframe Usage:

The Parabolic SAR’s adaptability extends to its effective usage across a wide range of timeframes, from 1-minute charts to monthly charts. The indicator’s smooth settings on lower timeframes help filter out false signals, while its responsiveness on higher timeframes identifies reversals early. Traders can tune the sensitivity to match their preferred timeframe, making it suitable for intraday scalping, swing trading, or long-term investing.

The Parabolic SAR, with its visual display and versatile utility, enhances trading approaches and provides traders with a valuable analytical edge when combined with sound risk management practices.

What are the Disadvantages of Parabolic SAR?

The Parabolic SAR, while a useful indicator, comes with several potential disadvantages that traders should consider:

Lagging Signals:

The Parabolic SAR tends to provide late signals at major market turning points, making it a lagging indicator. This delay in identifying reversals impacts the timing of trades and may result in missed opportunities. Traders should be cautious and use additional confirming indicators to anticipate trend reversals more effectively.

Subject to Whipsaws:

The indicator is susceptible to generating whipsaw signals, particularly when using more sensitive settings. Excessive sensitivity can lead to frequent, nonsensical signals, causing repeated stop-and-reverse actions. Balancing responsiveness with the avoidance of whipsaws is crucial to ensuring meaningful signals and reducing unnecessary transaction costs.

Repainting Issues:

Parabolic SAR has a tendency to repaint historical values, causing signals plotted on past chart bars to shift as new price data emerges. This repainting can reduce the reliability of backtesting strategies, as prior signals may no longer be accurate. Traders need to exercise caution when relying on historical SAR signals and consider fixing values to prevent repainting.

No Trade Timing Precision:

The Parabolic SAR is better suited for determining directional bias rather than providing precise entry and exit points. It lags behind price action and does not offer real-time identification of exact peaks or troughs. Traders should use additional tools for more accurate timing of trades and consider the Parabolic SAR as a trend bias filter.

Vulnerable to Volatility:

The indicator may struggle during periods of extreme market volatility, as the SAR algorithm causes it to accelerate and deviate far from the current price. This can reduce the relevance of SAR signals until volatility stabilizes. Traders are advised to apply the Parabolic SAR during periods of relatively stable volatility rather than during unprecedented spikes.

Limited Customization:

The Parabolic SAR has limited customization options, with adjustments mainly revolving around the acceleration factor, maximum SAR step, and starting SAR value. Traders cannot modify the actual SAR formula to align with unique strategy rules or market conditions. While basic settings allow some sensitivity tuning, the lack of advanced customization limits the adaptability of the Parabolic SAR compared to other indicators.

Being aware of these disadvantages helps traders use the Parabolic SAR judiciously, integrating it into a broader trading strategy with risk controls. While the indicator has limitations, it can still provide valuable insights when used in conjunction with other tools and considerations.

Is the Parabolic SAR accurate?

The accuracy of the Parabolic SAR indicator is contingent on its utilization within a comprehensive trading strategy. When used in isolation, the SAR cannot deliver perfectly accurate signals. Nevertheless, when integrated and optimized effectively, the Parabolic SAR can contribute to gaining a trading edge.

The inherent flexibility of the SAR’s dynamic formula allows it to adapt to changing market conditions. It excels in early trend identification and promptly signals potential reversals when properly calibrated for a particular asset and time frame. The accuracy of these signals is closely tied to the chosen input parameters. Thorough testing and optimization are imperative to align the sensitivity of the SAR with the characteristics of different markets.

Traders need to recognize that while the Parabolic SAR is a valuable tool, achieving accuracy in trading requires a holistic approach that combines multiple indicators, risk management strategies, and market analysis. Relying on the SAR as part of a well-thought-out trading plan enhances its effectiveness and contributes to achieving more accurate decision-making.