The On-Balance Volume (OBV) is a technical momentum indicator designed by Joe Granville in 1963 to predict changes in trend using volume flow. This indicator focuses on measuring buying and selling pressure by incorporating volume data. The OBV creates a running total of volume, assigning different weights to bullish and bearish days. When the closing price rises, the OBV increases by the corresponding day’s volume; conversely, when the close falls, it decreases.

To calculate the OBV, traders assess whether the security closed higher or lower than the previous close. If the close is higher, the current volume is added to an ongoing total; if the close is lower, the current volume is subtracted. This process is repeated for each period, creating a cumulative total. Higher closes with increased volume result in additions, while lower closes lead to subtractions. The OBV line can be analyzed independently or with a price. Divergences between the price direction and OBV direction may signal potential reversals.

The OBV provides several benefits, such as assessing actual supply and demand imbalances not evident on a price chart. Incorporating volume into trend analysis, it enhances the reliability of signals. Traders can compare the OBV line to the asset’s price to identify divergences, pinpoint major peaks or troughs as reversal indicators, or confirm the direction of existing trends. When combined with price action, the OBV offers a comprehensive view of overall market participation, reinforcing the understanding of price movements.

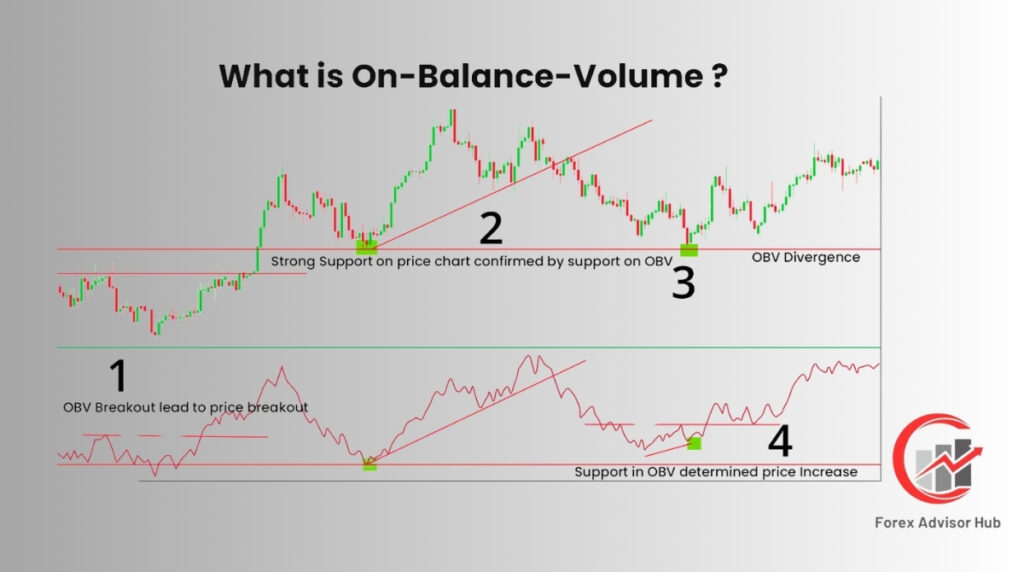

What is On-Balance-Volume?

On-Balance-Volume (OBV) is a technical trading momentum indicator developed by Joe Granville in the 1960s. It utilizes volume flow to forecast changes in stock prices, operating on the principle that volume changes tend to precede price changes. The OBV calculates a running total by adding or subtracting volume based on whether the closing price is higher or lower than the previous close. When the closing price rises, the day’s volume is added, and when it falls, the volume is subtracted.

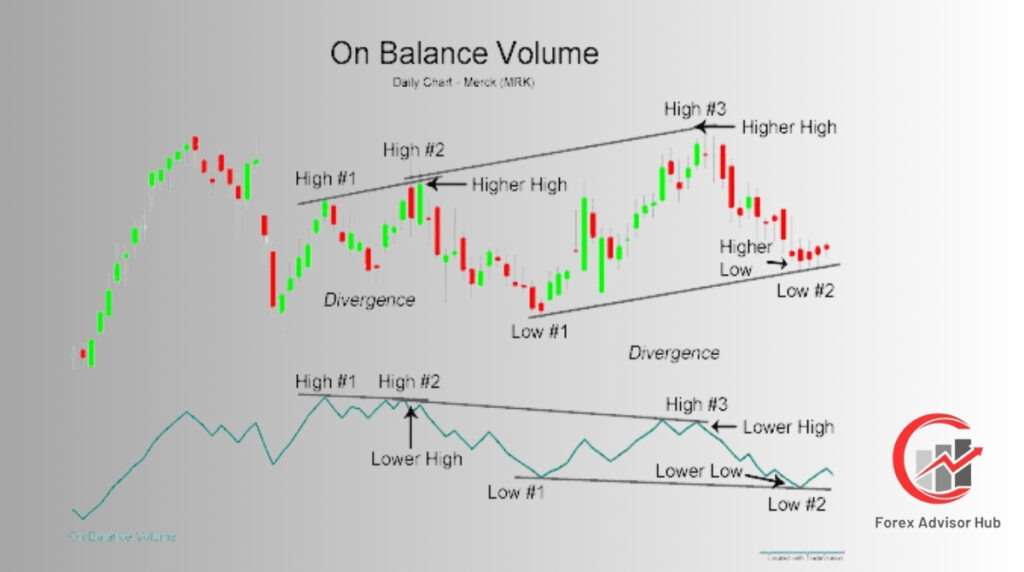

Traders interpret OBV signals to identify the accumulation (buying) or distribution (selling) of a stock, gauging bullish or bearish sentiment. Rising OBV confirms an uptrend, signaling bullish sentiment, while falling OBV confirms a downtrend, indicating a bearish sentiment. Divergences between OBV and price can predict reversals, such as a bearish divergence preceding a downward reversal.

Three key signals traders look for with OBV include confirmation of an uptrend when OBV rises along with the price, confirmation of a downtrend when OBV falls along with the price, and divergence between OBV and price signaling a potential trend reversal. This divergence may indicate underlying weakness or accumulation, providing insights into potential reversals.

OBV tracks positive and negative trading volume, focusing solely on the direction and ignoring the magnitude of price changes. It is most effective on stocks with sustained moves rather than those with frequent fluctuations. Traders often use OBV on longer timeframes, such as weeks or months, and may incorporate a moving average of OBV for smoother trend analysis. However, it is crucial to integrate OBV into a comprehensive trading strategy that considers multiple technical and fundamental signals for optimal decision-making.

How does On-Balance-Volume (OBV) work?

On-Balance-Volume (OBV) functions by monitoring cumulative positive and negative volume flow to assess whether a stock is experiencing accumulation (buying) or distribution (selling). This evaluation helps identify bullish or bearish trends and potential reversals. OBV analyzes volume dynamics as prices fluctuate, aiming to reveal whether traders are accumulating or distributing a stock.

The cumulative total in OBV provides a smoothed representation of volume flow into (accumulation) or out of (distribution) a stock over time. Rising OBV indicates positive volume flow and signals a bullish sentiment, while falling OBV reflects negative volume flow and suggests bearish sentiment.

OBV transforms absolute volume data into a relative form by distinguishing between up-volume and down-volume days. Up-volume days contribute to the running total, while down-volume days subtract from it. The resulting running total offers insights into the balance of positive or negative volume, hence the name On-Balance-Volume.

Notably, OBV disregards the magnitude of price changes, focusing solely on the direction of the close relative to the prior close to influence its readings. Therefore, OBV is most effective with sustained directional moves and exhibits greater significance over longer timeframes (weeks, months) compared to very short-term periods.

How does On-Balance-Volume differ from other types of Volume Oscillators?

On-Balance-Volume (OBV) sets itself apart from other Volume Oscillators through its focus on the cumulative total of positive and negative volume flow over time, offering a unique perspective compared to oscillators like Chaikin Money Flow, Volume Weighted Average Price, and the Accumulation/Distribution Line.

Cumulative Approach vs. Smoothing Formulas

The primary distinction lies in OBV’s calculation method, maintaining a running total by adding or subtracting each period’s full volume based on price direction. This cumulative approach results in a smoother-flowing line, contrasting with other oscillators that employ more complex formulas with some form of smoothing average, leading to increased volatility.

Sensitivity and Real-Time Reaction

Due to its straightforward summing of volume, OBV remains sensitive to the latest volume changes and reacts in real-time. This sensitivity makes it a valuable tool for gauging sustained buying or selling pressure in clear trends, with its steady slope reflecting conviction and signaling a trend’s strength.

Divergence Clarity and Trend Confirmation

OBV proves effective in spotting trend reversals through clear peaks or troughs during sustained trends, allowing for precise identification of non-confirmations when the price reaches new extremes. Other bounded oscillators, like Chaikin Money Flow, may lack the visual clarity to identify such divergences but excel in pinpointing overbought/oversold levels.

Breakout Strategies and Support/Resistance Levels

OBV’s unbounded range is advantageous for breakout strategies, providing well-defined support and resistance levels during sustained trends. In contrast, other oscillators with bounded ranges lack clear breakout points, as their values fluctuate within an expected range, making breakout signals less actionable.

Integration with Other Indicators

Traders often use OBV in conjunction with other volume oscillators, leveraging its trend perspective alongside the ability of other oscillators to capture short-term fluctuations. While OBV is considered more of a leading indicator, reacting earlier to subtle buying/selling imbalances, other oscillators offer better resistance to whipsaws, thanks to their smoothing capabilities.

Visual Clarity and Leading Indicator Status

OBV’s simple line chart provides easy visual trend analysis, allowing traders to quickly assess the slope and identify sustained momentum or divergence. Its sensitivity enables early reactions to market shifts. However, integrating it with other indicators is recommended to navigate potential whipsaws and enhance overall analysis.

What is the importance of On-Balance-Volume (OBV)?

The significance of On-Balance-Volume (OBV) lies in its ability to depict cumulative money flow, aiding in the identification and confirmation of emerging or existing trends in price movement. As a potent momentum indicator based on volume, OBV holds a crucial role in technical analysis, offering insights into crowd psychology and shifts in supply and demand that impact price dynamics.

Confirmation of Price Trends

OBV’s primary importance is evident in its role of confirming the strength or weakness of an ongoing price trend. During an unfolding trend, OBV provides valuable clues about the conviction driving the market. Rising prices aligned with rising OBV validate the dominance of buyers, propelling the market higher. Conversely, falling prices accompanied by declining OBV confirm sellers’ control, exerting downward pressure. The steep slope of OBV in the direction of the trend signifies robust and sustained conviction behind the price movement, while sideways OBV amidst a trend indicates potential fatigue and diminishing enthusiasm. Analyzing OBV trends empowers traders with confidence in assessing the sustainability of price movements.

Early Detection of Reversals

Divergences between OBV and price serve as a crucial signal for potential market reversals. As smart money initiates position unloading in anticipation of weakness, OBV either flattens out or moves counter to the prevailing price trend. This divergence signals a loss of confirmation and hints at impending exhaustion. For instance, a flattening OBV amid rising prices indicates subdued buying enthusiasm, suggesting fewer buyers are driving the uptrend. This negative divergence raises the likelihood of a reversal, enabling traders to prepare early for impending trend changes.

Precursor to Breakouts

OBV plays a vital role in anticipating breakouts by surging ahead of significant price moves. Surges in OBV precede breakouts, reflecting the building enthusiasm before the actual price movement. An OBV breakout above a previous high signifies robust buying conviction, potentially driving an upside breakout in prices. Conversely, OBV breaking down from a low indicates substantial distribution, fueling a downside break. Given that OBV reacts faster than price, it provides an early signal of increasing enthusiasm before the technical breakout, offering traders a strategic advantage in positioning ahead of new trends.

In essence, OBV breakouts not only confirm the emergence of high conviction behind new trends but also empower traders with timely insights for informed decision-making in dynamic markets.

What is the Formula for On-Balance-Volume (OBV)?

The formula for calculating On-Balance Volume (OBV) is straightforward and involves adding or subtracting the current period’s volume based on the relationship between the current and previous closing prices. This simple yet effective formula captures the essence of OBV’s cumulative approach to tracking volume and price movements.

The calculation is expressed through the following steps:

- If the Close > Previous Close:

- OBV = Previous OBV + Current Period’s Volume

- If the Close < Previous Close:

- OBV = Previous OBV – Current Period’s Volume

- If the Close = Previous Close:

- OBV = Previous OBV

Here, the variables represent the following:

- Previous OBV: The OBV from the previous period.

- Current Period’s Volume: The volume for the current period.

- Close: The closing price for the current period.

- Previous Close: The closing price from the previous period.

In simpler terms, the OBV adds the volume on days when the closing price is up, subtracts the volume when the closing price is down, and remains unchanged when the closing price is the same as the previous close.

The initial OBV value starts at zero, and with each period’s volume being added or subtracted, a running total is calculated and visually represented as a line on a chart. Rising OBV levels indicate heightened buying pressure, while falling OBV levels signify increased selling pressure. This dynamic interplay between volume and price changes allows traders to gauge the strength and direction of market sentiment.

How to Calculate On-Balance-Volume (OBV)?

To compute On-Balance-Volume (OBV), a systematic process is followed, involving the addition or subtraction of volume based on the relationship between the current and previous closing prices. This cumulative approach is integral to OBV, providing valuable insights into market sentiment and potential trend reversals.

The process begins with the preparation of data, including closing prices and trading volumes, organized chronologically in a spreadsheet. The initial OBV value is set at zero, serving as the baseline from which subsequent OBV values are derived. The sequential calculation involves comparing the current closing price to the previous period’s close. If the current close is higher, the volume of the current period is added to the existing OBV; if lower, the volume is subtracted; and if identical, the OBV value remains unchanged.

It is crucial to review and error-check the calculations periodically, ensuring accurate comparisons and corrections for any discrepancies. Once OBV calculations are complete, a chart is created with price plotted against OBV values. This chart aids in analyzing how OBV responds to price trends, identifying periods of robust buying or selling pressure, and spotting divergences indicating potential trend weakness.

How to Integrate OBV Signals?

Furthermore, the integration of OBV signals with other indicators, such as momentum oscillators, enhances the precision of entry and exit points. Long-term OBV peaks and troughs play a significant role in identifying key support and resistance levels, contributing to a comprehensive analysis of market dynamics. By diligently following these steps, traders can calculate and interpret On-Balance-Volume effectively, empowering them to gauge market sentiment and make informed trading decisions.

What is the Formula for On-Balance-Volume (OBV)?

The formula for calculating On-Balance Volume (OBV) is straightforward, involving the addition or subtraction of volume based on the relationship between the current and previous closing prices. Specifically, the OBV for the current period is determined by three conditions:

- If the current close is higher than the previous close, the OBV is calculated as the sum of the previous OBV and the current period’s volume.

- If the current close is lower than the previous close, the OBV is calculated as the difference between the previous OBV and the current period’s volume.

- If the closing prices are identical, the OBV remains unchanged, equal to the previous OBV.

It is calculated using a simple formula that adds volume on up days and subtracts volume on down days.

The formula for calculating On-Balance Volume is as stated below.

Let OBV = Previous OBV + Current Period’s Volume if Close > Previous Close

OBV = Previous OBV – Current Period’s Volume if Close < Previous Close

OBV = Previous OBV if Close = Previous Close

Where,

Previous OBV = The OBV from the previous period

Current Period’s Volume = The volume for the current period

Close = The closing price for the current period

Previous Close = The closing price from the previous period

How to Calculate On-Balance-Volume (OBV)?

To calculate the On-Balance-Volume (OBV), follow a systematic process that involves several key steps. First, gather the necessary data, including the closing price and trading volume for each relevant period, whether daily, weekly, or on an intraday basis. Organize this data chronologically in a spreadsheet, creating separate columns for date, closing price, volume, and OBV.

Initiate the OBV calculation by setting the initial value to zero, establishing a baseline OBV from which subsequent calculations will build. Proceed to evaluate each period systematically by comparing the current closing price to the previous period’s close. If the current close is higher than the previous close, add the volume of the current period to the existing OBV from the preceding row, reflecting an increase in OBV and indicating buying pressure.

More over

Conversely, if the current close is lower than the previous close, deduct the current period’s volume from the previously computed OBV, reflecting a decrease in OBV and indicating selling pressure. Maintain the OBV value from the previous row if the current close is identical to the previous close. Repeat this process sequentially for each period, applying the appropriate addition, subtraction, or retention of OBV based on the relationship between the current and previous closing prices and the corresponding volume.

Exercise precision in each calculation, as errors can accumulate. Regularly review the calculations to ensure that OBV increments and decrements correctly based on changes in closing prices. Once the OBV calculations are complete, visualize the data by creating a chart with the price plotted as a line and the OBV values represented as a column or line.

Evaluate how OBV responds to price trends – rising prices accompanied by increasing OBV indicate robust buying pressure, while falling prices coupled with decreasing OBV signify substantial selling pressure. Identify potential divergences, such as OBV recording new highs while the price fails to confirm, signaling diminishing enthusiasm. Enhance OBV signals by incorporating other indicators like momentum oscillators to refine entry and exit points. Leverage long-term OBV peaks and troughs to identify critical support and resistance levels in the market.

How to use On-Balance-Volume (OBV) in Trading?

Utilize On-Balance-Volume (OBV) as a strategic tool in your trading endeavors by employing a comprehensive approach that incorporates trend analysis, momentum shifts, divergences with price, and volume surges on breakouts. This dynamic indicator can confirm price trends and signal potential reversals, aiding in the identification of optimal trade entry, exit, and risk management strategies.

- Choose the Appropriate Timeframe and Asset Class: Select the timeframe and asset class that align with your trading style and objectives. Whether engaged in intraday trading or swing trading, OBV can be effectively applied across various liquid markets such as stock indices, forex pairs, commodities, and cryptocurrencies.

- Plot Historical OBV Values Alongside Price: Calculate OBV values based on historical price and volume data. Visualize OBV as a line or histogram on the price chart to facilitate the identification of convergences, divergences, momentum shifts, and trading signals.

- Identify Areas of Convergence/Divergence: Analyze the relationship between On-Balance Volume and price action to assess the strength and direction of trends. Recognize uptrends with rising OBV confirming purchasing pressure and potential bearish divergences indicating weakening buying enthusiasm.

- Look for OBV to Lead or Confirm Price Breaks: Leverage OBV as an early indicator of impending breakouts or breakdowns. Rising OBV prior to a breakout suggests developing momentum, while continuously falling OBV in a range-bound market may precede a breakdown.

- Use OBV Highs and Lows for Support and Resistance: Define potential support and resistance levels by observing OBV highs and lows. Peaks and troughs in OBV during uptrends and downtrends transform into resistance and support zones, respectively.

What are steps to use On-Balance-Volume (OBV) in Trading

- Trade in the Direction of OBV Trends: Capitalize on extended moves driven by an imbalance of buying or selling pressure by trading in the direction of OBV trends. Enter long positions during uptrends with increasing OBV and short positions during sustained downtrends.

- Combine OBV Signals with Other Indicators: Enhance the robustness of signals by combining OBV with other indicators such as RSI and moving averages. Utilize these additional tools to gauge overbought or oversold conditions and determine the directional bias of volume trends.

- Set Appropriate Stop Losses Based on Recent OBV Levels: Inform stop-loss placement based on OBV levels. Place stops just below key support levels on OBV for long trades and above OBV resistance for short trades to manage downside risk effectively.

- Track OBV Divergences and Failure Swings: Monitor divergences between OBV and price, especially lower highs on OBV during new price highs. Bearish divergences signal weakening upside momentum, often foreshadowing a potential reversal.

- Analyze Volume Surges on Breakouts for Added Conviction: Gain confidence in the validity of price moves by analyzing volume surges on breakouts. Significant increases in OBV during breakouts confirm strong buying pressure, providing assurance of high-probability moves.

By integrating these strategies, traders can harness the full potential of On-Balance-Volume as a versatile and powerful tool in their trading toolkit.

How can OBC be used to identify trends in the market?

On-Balance-Volume (OBV) proves instrumental in identifying trends within the market by employing volume to validate and confirm price movements. The indicator is particularly adept at signaling potential trend reversals ahead of actual price shifts. Notably, OBV often reaches its peaks or troughs before corresponding price highs or lows. When OBV peaks and subsequently declines while the price continues to rise, it suggests diminishing buying enthusiasm and foreshadows a potential exhaustion of the ongoing uptrend. Conversely, if OBV hits a bottom and starts to rise while the price is still declining, it signifies renewed accumulation and hints at a forthcoming bullish reversal.

Traders keen on anticipating trend reversals leverage custom OBV divergence thresholds to trigger automated alerts, allowing them to capitalize on high-probability reversals. By identifying peaks and troughs in OBV ahead of visible price actions, traders gain early warnings of trend shifts, enabling more precise timing of entries and exits. Beyond reversal signals, OBV is valuable for assessing the strength of breakouts and breakdowns. A substantial surge in OBV accompanying a breakout indicates strong buyer commitment, reinforcing the legitimacy of the emerging uptrend. Conversely, pronounced volume surges during breakdowns signal robust selling pressure, affirming the initiation of a new downtrend. In essence, OBV serves as a strategic ally for traders seeking to navigate market trends and make well-informed decisions.

What is the best trading strategy for On-Balance-Volume (OBV)?

The most effective trading strategies for On-Balance-Volume (OBV) revolve around key scenarios, including divergences from price, breakouts from trading ranges, and confirmation of price patterns and indicators.

Divergences between price and OBV serve as potent trade signals. A bullish divergence occurs when the price records a lower low, but OBV establishes a higher low. This discrepancy suggests a decline in selling pressure, signaling a potential reversal in the downtrend and providing a favorable buying opportunity. Conversely, a bearish divergence materializes when the price achieves a higher high, but OBV registers a lower high, indicating diminishing buying pressure and signaling a potential reversal in the uptrend. This prompts traders to consider selling or shorting the stock.

Breakouts in OBV from a trading range signal shifts in sentiment that can lead to corresponding price breakouts. An OBV breakout to new highs reflects robust buying pressure, presenting an opportune time to buy. Conversely, an OBV breakdown to new lows outside its range indicates heightened selling pressure, signaling a potential bearish price breakout and prompting traders to consider selling or shorting the stock.

Traders also leverage OBV to confirm price chart patterns and indicators. For instance, if OBV confirms a pattern like a double bottom with a higher low, it increases the likelihood of a bullish breakout. The confirmation of rising purchase volume by OBV reinforces the upward trend, providing a high-probability buying signal.

Additionally, OBV is instrumental in identifying weakness and potential breakdowns when it breaches support levels. If OBV, used to validate upward-sloping trend lines or moving averages, breaks down, it confirms weakness and signals an opportune time to sell. By complementing and enhancing trading signals through confirmation or deviation from price patterns and indicators, OBV assists traders in making well-informed entry and exit decisions.

Can On-Balance-Volume (OBV) work in conjunction with Moving Averages?

Indeed, On-Balance-Volume (OBV) can be effectively employed in tandem with Moving Averages. OBV, functioning as a technical analysis indicator, assesses buying and selling pressure by accumulating volume data on up and down days within a specified timeframe. Simultaneously, Moving Averages serve to smooth out price fluctuations over a defined window of time, aiding in the identification of trends and potential support or resistance levels. Combining OBV with Moving Averages enhances the overall analysis, offering a more comprehensive understanding of market momentum and prevailing trends.

What are the advantages of On-Balance-Volume (OBV)?

On-Balance-Volume (OBV) offers several advantages as a technical analysis tool, incorporating volume analysis to enhance trading insights. These advantages include:

- Identifies Trend Strength and Weakness: OBV discerns whether volume aligns with the price trend, indicating trend strength or weakness. Rising OBV during an uptrend signals strong buying interest, validating trend strength. In contrast, a flat or declining OBV during an upswing indicates diminishing excitement and potential trend fatigue.

- Signals Potential Trend Reversals: An advantageous feature of OBV is its ability to provide early warnings of potential trend reversals. The indicator may start curving downward ahead of a price peak, signaling a loss of buyer interest. Early reversal indications occur when OBV falls below its uptrend line before the price does, providing valuable insights.

- Incorporates Volume Analysis: By focusing on volume changes, OBV fills a crucial gap in many indicators. It analyzes whether heavy or light volume is propelling trends, offering a reflection of true conviction behind price movements. Volume confirmation is essential for validating price breakouts and breakdowns.

- Simple to Use: OBV’s simple construction using price and volume data makes it easy to calculate and interpret. Traders can seamlessly integrate OBV into their charting setups, requiring no complex mathematics for analysis.

- Works on All Timeframes: OBV is adaptable across various timeframes, from intraday to monthly charts. It caters to the needs of both intraday traders seeking volume insights and swing traders assessing volume alignment with multi-week trends.

Advantages of On-Balance-Volume (OBV)

- Identifies Support and Resistance: OBV movements help identify potential support or resistance levels. Peaks or bottoms in OBV highlight areas of supply and demand, providing traders with key zones where reactions may occur.

- Suitable With Other Indicators: OBV complements other price-based indicators, such as moving averages. It may confirm or diverge from signals provided by price indicators, offering additional insights. The focus on volume adds a valuable dimension to technical analysis.

- Confirms Breakouts and Breakdowns: OBV plays a crucial role in confirming the validity of breakouts and breakdowns. Rising OBV during upside breakouts signifies strong buying interest, while OBV confirmation is essential for validating the credibility of price moves.

OBV’s simplicity, adaptability, and ability to provide insights into volume dynamics make it a valuable tool for traders employing technical analysis in various markets and timeframes.

What are the disadvantages of On-Balance-Volume (OBV)?

On-Balance-Volume (OBV) comes with several disadvantages that traders should be aware of:

- Lagging Indicator: OBV, like many technical indicators, relies on past price action, leading to a lag in responding to current price movements. This delay can hinder its effectiveness for very short-term traders, as OBV may not promptly capture imminent reversals at major tops and bottoms.

- No Clear Trading Signals: Unlike oscillators with clear overbought or oversold levels, OBV is a volume-based trend-following tool that does not provide direct buy or sell signals. Traders need to visually interpret its pattern relative to price, introducing subjectivity and challenges in decision-making.

- Vulnerable to False Signals: OBV patterns are susceptible to false signals, especially during choppy market conditions. Temporary price spikes on low volume may incorrectly influence the OBV line, leading to whipsaws above or below its moving average. Interpretation requires a certain level of experience.

- Flat Trading Ranges: In tight trading ranges, OBV tends to move directionally without exhibiting a clear trend. This limitation makes OBV less effective in range-bound market conditions, where it may struggle to provide meaningful insights.

- Ignores Intrabar Movements: OBV only considers the closing price of each period in relation to the previous close, overlooking intrabar movements. For intraday traders, this simplistic construction may not capture the nuances within each bar, limiting its effectiveness.

Some other drawbacks of On-Balance-Volume (OBV):

- No Standard Parameter Settings: Unlike some indicators with set time periods or intervals, OBV lacks standard parameter settings. Traders cannot customize OBV to adapt to specific market conditions or trading strategies, limiting its flexibility.

- Difficult to Combine Signals: Since OBV analyzes volume, combining it with purely price-based indicators can be challenging. Traders must determine how to weigh OBV signals against other technical indicators independently, as OBV does not seamlessly integrate into the overall toolkit.

- Limited Use Case: OBV is primarily suited for trend identification and may be less useful in oscillating markets or for precise entry and exit timing. It does not provide overbought/oversold guidance or assistance in setting price targets, resulting in a relatively confined use case.

Using OBV in conjunction with price-based indicators can enhance its effectiveness, making it a valuable component within a broader trading approach.

Is On-Balance-Volume (OBV) a good indicator?

Yes, on-balance volume (OBV) is a moderately useful indicator with merits and limitations that traders should be mindful of. Effectively utilizing OBV requires a comprehension of signal interpretation and appropriate integration with price analysis. OBV proves valuable in confirming trends and offering early warnings of potential reversals. The growth of OBV in harmony with an uptrend validates buying conviction and upward momentum. Additionally, the divergence between OBV and price frequently serves as a signal for an upcoming reversal. Observing OBV peak and curve down ahead of price often provides traders with crucial indications of an impending trend change.

Is On-Balance-Volume (OBV) an oscillator?

No, On-Balance Volume (OBV) is not an oscillator. It operates as a volume-based trend-following indicator rather than exhibiting oscillatory behavior with cyclical highs and lows. Oscillators such as RSI, Stochastics, and MACD, on the other hand, fluctuate within specific numerical bands, typically ranging from zero to 100 or -100 to 100. These oscillators employ mathematical formulas to transform price data into horizontal trading ranges, where readings above 70-80 suggest overbought conditions and levels below 30-20 indicate oversold conditions.

Is OBV a lagging indicator?

Yes, On-Balance Volume (OBV) is regarded as a lagging indicator. Its lagging nature stems from its construction, which relies on past price action rather than forecasting future movements. Like many technical indicators, OBV exhibits some degree of lag as it analyzes historical price data to generate signals. However, compared to leading indicators such as moving averages, OBV tends to have a more delayed reaction to changes in market conditions.

What is the difference between On-Balance-Volume and Money Flow Index?

On-Balance Volume (OBV) and Money Flow Index (MFI) differ in their fundamental characteristics and the insights they provide in technical analysis.

OBV operates as a trend-following indicator, tracking cumulative volume flow by adding up volume on up days and subtracting on down days over a specified period. Its slope confirms trends, with rising OBV validating uptrends and falling OBV confirming downtrends. In contrast, MFI functions as an oscillator, measuring overbought and oversold conditions based on a complex calculation involving open, high, low, and close prices.

While OBV lacks a bounded range and is considered a lagging indicator reacting to past volume, MFI oscillates between 0-100, providing readings above 80 for overbought and below 20 for oversold conditions. MFI’s smoothed calculations make it more of a leading indicator, often topping or bottoming ahead of price movements.

OBV is suitable for swing trading time frames like daily or weekly charts, showing trend directionality in extended moves. On the other hand, MFI adapts to both short and long-term timeframes, making it versatile for intraday scalping to long-term investing.

Divergences between the indicators and price can signal potential reversals, but MFI divergences are generally more pronounced at cycle turning points due to its mean-reverting nature. Both indicators offer valuable insights, each with its unique characteristics in aiding traders and investors.