Imagine yourself amidst the vibrant chaos of a global bazaar. Exotic spices from India mingle with handcrafted souvenirs from Morocco, currencies from every corner of the world constantly changing hands. This is the exciting realm of forex trading, where traders capitalize on the ebb and flow of international exchange rates. But unlike simply buying a trinket with local currency, forex allows you to control much larger positions in a currency pair with a smaller investment. This financial sorcery? It’s called margin trading.

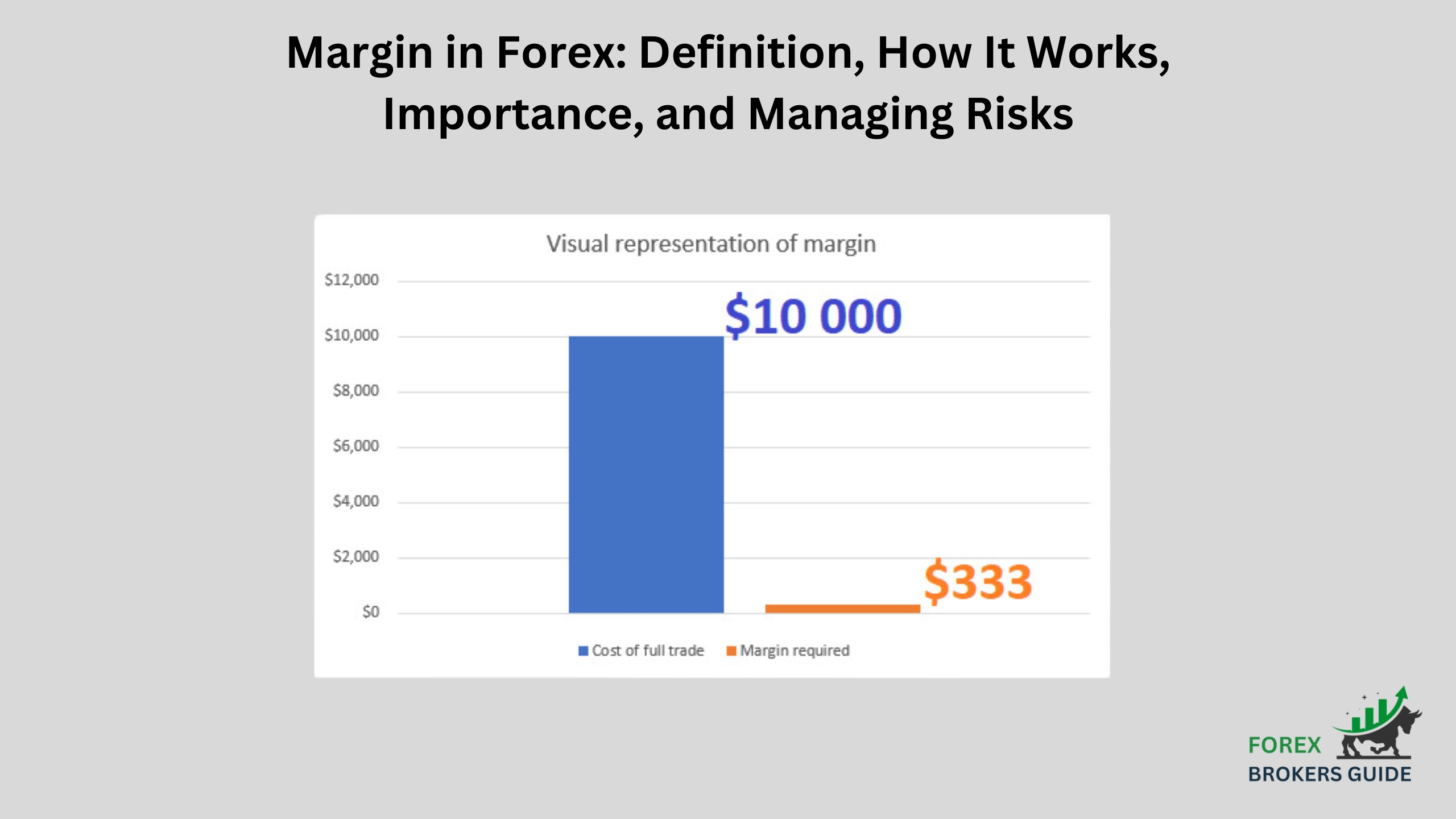

Think of it like this: you spot a magnificent hand-woven Persian rug, a masterpiece priced at $10,000. Your pockets hold a mere $2,000, far from enough to claim it as your own. In a traditional store, you might walk away empty-handed. But with margin trading in forex, it’s like putting a down payment on the rug. You use your $2,000 as margin, essentially borrowing the remaining $8,000 from your broker, to control the entire $10,000 value of the rug (represented by a currency pair). This leverage allows you to potentially magnify your gains if the value of the rug (currency pair) increases. However, it also amplifies potential losses if the value goes down.

Throughout this journey, we’ll unveil the inner workings of margin, illustrate its application with real-world examples, and equip you with strategies to navigate the associated risks. So, tighten your metaphorical currency belt and get ready to explore the power of leverage in the dynamic world of forex trading!

What is Margin in Forex Trading?

Margin trading is a cornerstone concept in the fast-paced world of forex. It allows traders to control significantly larger positions in a currency pair compared to the amount of capital they actually have. This financial leverage, provided by forex brokers, is what makes margin trading so appealing. But remember, leverage is a double-edged sword – it can magnify both your potential profits and potential losses.

In simpler terms, margin acts as a security deposit you provide to your forex broker when opening and maintaining a position. Imagine it like a down payment on a house. You don’t need the full purchase price upfront, but you do need to put up some capital to secure the deal. Similarly, the margin serves as a guarantee for your broker, ensuring you have some “skin in the game” while leveraging their funds.

Forex brokers don’t just hand out leverage willy-nally. They set minimum margin requirements, which dictate the minimum amount of capital you need to have in your account to open a position. These requirements can vary depending on several factors:

- The Broker: Different brokers have different risk tolerances and may have varying margin requirements.

- The Currency Pair Traded: More volatile currency pairs might have higher margin requirements to mitigate risk.

- Market Conditions: During times of high market volatility, brokers might increase margin requirements to protect themselves and their clients.

How Does Margin differ from a Full Purchase of a Currency Pair?

Full purchase involves buying the entire value of the EUR/USD position upfront. You own the Currency Pair outright, and any profits or losses are based solely on your initial investment. There’s no leverage involved, so your potential gains and losses are proportional to the amount you invested.

The key difference lies in capital requirements and risk exposure. A full purchase requires a significantly larger upfront investment compared to margin trading. However, you avoid the risks associated with leverage, such as margin calls. A margin call occurs when your account equity falls below a certain threshold due to losses, and your broker forces you to deposit additional funds to maintain your position.pen_spark

The choice between margin trading and a full purchase depends on your risk tolerance and trading goals. Margin trading can be attractive for those with limited capital who want to potentially amplify their returns. However, it requires a more sophisticated risk management strategy due to the leverage involved. A full purchase might be better suited for beginners or those who prioritize lower risk and prefer clear ownership of their positions.

How is Margin Calculated in a Forex Transaction?

Calculating margin in forex is a straightforward process. Here’s the key formula:

Margin = (Position Size x Contract Size) / Leverage

Let’s break it down:

- Position Size: This represents the amount of currency you want to control in a trade. It’s typically measured in lots (standard lot = 100,000 units of currency).

- Contract Size: This depends on the currency pair you’re trading. Most major pairs (except those with JPY as the quote currency) have a contract size of $100,000.

- Leverage: This is the ratio provided by your broker, indicating how much control you gain over a position with your initial margin deposit. Common leverage ratios in forex include 50:1, 100:1, and 200:1.

Example:

Imagine you want to buy 1 standard lot (100,000 units) of EUR/USD with a leverage of 100:1. Your broker uses a contract size of $100,000 for this currency pair.

Calculation:

Margin = (1 lot x $100,000) / 100:1 = $1,000

Therefore, in this scenario, you would need a minimum of $1,000 as margin to control a $100,000 position in EUR/USD.

What is the Role of Leverage in Margin Trading?

Leverage is the lifeblood of margin trading. It essentially allows traders to fight with a bigger weapon – controlling a larger position in a currency pair with a smaller initial investment. Imagine buying a car. With traditional financing, you’d need the full purchase price upfront. Leverage in forex is like a down payment; you put up a fraction of the cost (margin) and borrow the rest from your broker. This borrowed capital amplifies your potential returns – a small upward movement in the currency pair’s value can translate to significant profits. However, this amplification works both ways. If the market moves against you, your losses are also magnified, potentially exceeding your initial investment. This is why responsible use of leverage is paramount.

Understanding leverage ratios and employing sound risk management strategies are crucial to navigating the potential pitfalls of margin trading. Just like wielding a powerful weapon, leverage requires discipline and caution to maximize its benefits and minimize its risks.

Why is Margin Trading a popular option for Forex Traders?

Margin trading reigns supreme in the fast-paced world of forex due to its ability to amplify potential profits. Unlike traditional methods requiring full upfront investment, margin trading allows traders to control larger positions with a smaller initial investment. This leverage acts like a financial amplifier, multiplying potential gains even with minor market movements. This flexibility is particularly attractive for traders with limited capital, granting them access to the forex market and the chance to achieve significant returns.

However, the allure of margin trading comes with a double-edged sword. While leverage amplifies profits, it also magnifies losses. Responsible risk management practices are crucial to navigate this inherent risk. By employing stop-loss orders and maintaining a healthy margin ratio, traders can mitigate potential losses and ensure long-term success in the ever-dynamic forex market.

What are the Potential Benefits of using Margin in Forex?

Margin trading in forex offers a unique set of advantages that attract traders seeking to boost their profit potential and enhance their overall trading experience. Here’s a closer look at some key benefits:

- Amplified Profits: Margin’s core appeal lies in its ability to leverage your capital. By controlling larger positions with a smaller investment, you can magnify potential gains. Even minor price movements in the right direction can translate into significant returns, making margin trading particularly attractive for those with limited capital.

- Increased Flexibility and Strategic Options: Leverage unlocks greater flexibility in your trading strategies. You can capitalize on a wider range of opportunities, from short-term scalping to longer-term trend following. This empowers both experienced traders seeking to enhance returns and novice traders exploring various strategies.

- Accessible Entry Point for New Traders: Unlike traditional methods requiring a large upfront investment, margin trading allows new participants to enter the forex market with a smaller initial investment. This accessibility fosters a more dynamic and competitive market environment, while providing valuable hands-on experience for beginners to develop their trading skills.

- Portfolio Diversification: Margin trading allows you to explore a wider range of currency pairs and trading strategies. This diversification not only helps spread risk but also opens doors to potential profits across different market conditions. By leveraging your capital strategically, you can create a more well-rounded and potentially more profitable trading portfolio.

How can Margin Trading Magnify both Profits and Losses?

Margin trading’s double-edged sword lies in its ability to magnify both profits and losses through leverage. Imagine you have $1,000 and want to buy Euros (EUR) expecting their value to rise against the US Dollar (USD). With traditional forex trading, your $1,000 limits your purchase. However, with a 50:1 leverage offered by your broker, you can control a $50,000 position in EUR/USD by putting up only $1,000 as margin. If the EUR appreciates by 1% against the USD, your $50,000 position translates to a $500 profit – a significant return on your $1,000 investment. This is the allure of margin trading: amplifying potential profits.

However, the magnifying glass of leverage cuts both ways. If the USD strengthens instead, a 1% decline in EUR/USD wipes out $500 from your position. Remember, you only invested $1,000 initially. In a worst-case scenario, with high leverage, a continued decline could even lead to losses exceeding your initial investment. This is the risk of margin trading – magnified losses.

To navigate this risk-reward balance, consider using smaller leverage ratios, especially when starting. Employing stop-loss orders can also help mitigate potential losses by automatically exiting a position when it reaches a predetermined price point. By understanding the risks and implementing sound risk management strategies, traders can harness the profit potential of margin trading while keeping losses under control.

What are the Key Strategies for Managing Margin Risk in Forex Trading?

Margin trading in forex presents exciting possibilities for amplified profits, but comes with the ever-present threat of magnified losses. Responsible risk management is paramount to navigate this potential minefield. Margin risk refers to the possibility of losing more than your initial investment due to leverage. Here are some key strategies to mitigate this risk:

- Choosing Appropriate Leverage: Leverage is a double-edged sword. While it amplifies profits, it also amplifies losses. Beginners should opt for conservative leverage ratios (e.g., 10:1 or 20:1) to limit potential losses while getting comfortable with margin trading. As you gain experience, you can gradually increase leverage if your risk tolerance allows.

- Stop-Loss Orders: Your Trading Ally: Stop-loss orders are your safety net in margin trading. These automatic orders instruct your broker to sell your position if the price reaches a predefined level, limiting potential losses if the market moves against you. Setting appropriate stop-loss levels helps ensure you don’t lose more than you can afford.

- Portfolio Diversification is Key: Don’t put all your eggs in one basket. Spread your trades across different currency pairs and potentially uncorrelated asset classes. This diversification helps mitigate risk by reducing the impact of losses in any single position on your overall portfolio.

- Monitor Your Margin Like a Hawk: Keep a close eye on your margin requirements and account balance. Your broker will issue a margin call if your account equity falls below a certain threshold due to losses. Maintaining a healthy margin ratio (account equity divided by used margin) ensures you have sufficient buffer to absorb potential losses without triggering a margin call.

How can Stop-loss orders and Margin Maintenance Requirements Help Mitigate Risk?

While margin trading in forex offers the potential for amplified profits, it also carries the inherent risk of magnified losses due to leverage. This is where proactive risk management becomes essential. Two key strategies can significantly mitigate margin risk: stop-loss orders and margin maintenance requirements.

Imagine you buy EUR/USD expecting it to rise. A stop-loss order acts as a safety net. It instructs your broker to automatically sell your position if the price falls to a predetermined level, limiting your potential losses if the market moves against you.

For example, let’s say you set a stop-loss at $1.1000 for a EUR/USD position bought at $1.1050. If the price drops to $1.1000, the stop-loss is triggered, limiting your loss to $50 per lot traded. Without a stop-loss order, a continued decline could lead to much larger losses. Stop-loss orders essentially function as automated exit strategies, helping you avoid emotional decisions during volatile market conditions.