Stepping into the fast-paced world of forex trading can feel overwhelming at first. Every decision seems to matter, and there are lots of new terms to learn. One important concept that new traders often miss is lot size. It’s not just about how much money you’re spending; it actually sets the amount of currency you’re buying or selling in a single trade.

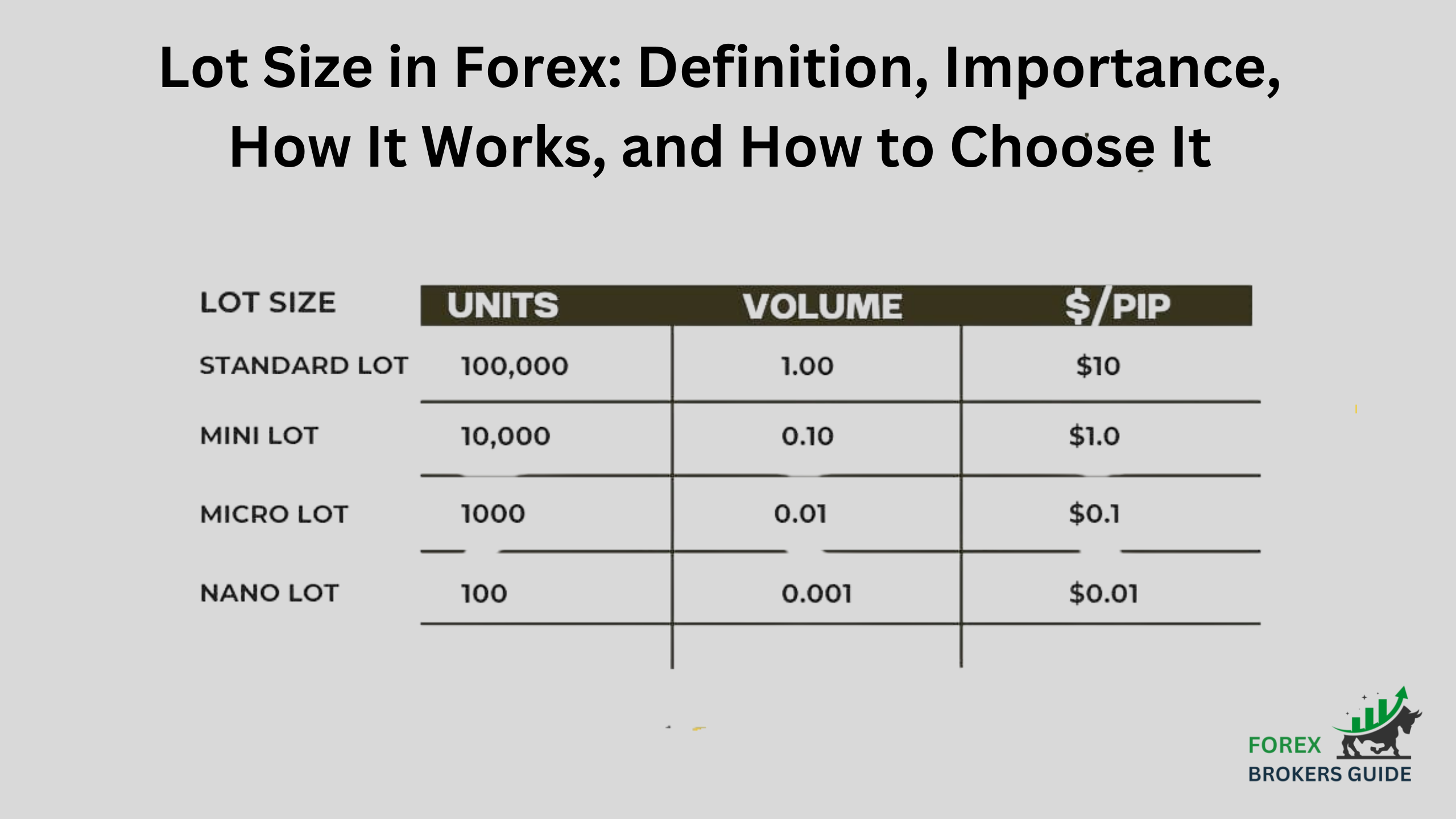

Think of it like buying groceries in bulk. A standard lot size in forex is like buying a giant pack of something, say 100,000 apples (or in forex, 100,000 units of the base currency in a currency pair). There are also smaller options like mini lots (10,000 units) and micro lots (1,000 units) for those who want to start with less.

Now, how does this lot size work in a trade? Imagine you buy 1 standard lot of EUR/USD (Euros versus US Dollars). This means you’re basically controlling a big chunk of Euros, 100,000 to be exact. Currency prices move in tiny amounts called pips. In most cases, a 1 pip move in EUR/USD means the value changes by $10. There’s also a spread, which is the difference between the buy and sell price. So, if the spread is also 1 pip, and the Euro gets stronger by 10 pips against the Dollar, you make $100 (10 pips * $10 spread). But if the Euro weakens by 10 pips, you lose $100. This is why understanding lot size is crucial. It directly affects how much money you can win or lose with each small movement in the market.

What is a Lot Size in Forex Trading?

Lot size in forex trading refers to the standardized unit that defines the exact amount of currency you’re buying or selling in a single trade. It’s not just a random number – it directly impacts the amount of money you risk and the potential profits you can earn. Think of it like buying in bulk: a standard lot size is like purchasing a large quantity of a particular currency, typically 100,000 units of the base currency in a currency pair (like Euros in EUR/USD).

How does a Lot Size Differ from the Number of Currency Units Traded?

While the number of currency units traded might seem interchangeable with lot size, there’s a key distinction. The number of currency units simply refers to the raw quantity you’re buying or selling, like saying “I bought 50,000 Euros.” Lot size, on the other hand, is a standardized unit that bundles a specific number of currency units.

Think of it like buying eggs. You could say you bought “12 eggs,” which is the number of units. But in most stores, you wouldn’t buy them individually; you’d likely buy a carton containing a standard amount, like 1 dozen (12 eggs). Similarly, a lot size in forex is like that carton – it’s a pre-defined package containing a specific number of currency units (usually 100,000 for a standard lot). This standardization makes trading more efficient and easier to compare positions.

Why is Choosing the Right Lot Size crucial for Forex Traders?

Choosing the right lot size in forex trading is critical because it directly impacts your risk exposure and potential rewards on every trade. Since lot size determines the amount of currency you control, a larger lot size means bigger potential profits but also magnifies potential losses with each market movement. Conversely, a smaller lot size limits your profit potential but also minimizes your risk. Selecting the right lot size allows you to trade within your risk tolerance and manage your account effectively. It’s like choosing the right size for your backpack before a hike – too small and you might not have enough supplies, too big and it could weigh you down.

New forex traders are particularly susceptible to the dangers of improper lot size selection. With the initial excitement of entering the market, it’s tempting to jump in with a large lot size hoping for quick gains. However, this can lead to significant losses if the market moves against you. By choosing a smaller lot size initially, beginners can get comfortable with the platform, practice their trading strategies, and manage their risk effectively while they learn the ropes. As their experience and account size grow, they can gradually increase their lot size for potentially larger profits.

How can Lot Size Impact Potential Profits and Losses?

Lot size directly affects your potential profits and losses in forex trading due to its influence on your exposure per pip movement. Here’s the breakdown:

- Larger Lot Size: Imagine buying a standard lot (100,000 units) of EUR/USD. With a 1 pip move (typically $10), a 10 pip gain translates to a $100 profit (10 pips * $10 spread). However, a 10 pip loss in the opposite direction would result in a $100 setback. This amplifies both potential gains and potential losses.

- Smaller Lot Size: Opting for a mini lot (10,000 units) of EUR/USD reduces the impact per pip. A 10 pip gain translates to a $10 profit, and a 10 pip loss translates to a $10 loss. While the potential profits are smaller, the risk of significant losses is also minimized.

What are the Standard Lot Sizes in Forex Trading?

Lot size, a fundamental concept in forex trading, dictates the exact amount of currency you control in a single trade. It’s not just a random number; it’s a standardized unit that significantly impacts your risk and potential rewards. Here’s a breakdown of why choosing the right lot size is crucial:

- Risk Management: Lot size directly affects your exposure per pip movement (the smallest measurable price change). Larger lots magnify both potential profits and losses. A beginner with a small account risking a large lot size could face significant setbacks with even minor market movements.

- Profit Potential: While larger lots offer the possibility of bigger profits, they also come with amplified risk. Conversely, smaller lots limit potential losses but also cap potential gains. Choosing the right size allows you to trade within your risk tolerance and manage your account effectively.

Think of it like choosing the right backpack for a hike. Too large and it weighs you down, too small and you lack essential supplies. Lot size selection works similarly – balance risk and reward based on your experience and comfort level.

How do these Different Lot Sizes Affect the Value of a Pip?

The value of a pip (percentage in point) in forex trading is determined by the exchange rate and the lot size you choose. Here’s why different lot sizes impact pip value:

- Lot size affects the dollar value per pip: The core concept is that a pip represents a fixed movement in the exchange rate of a currency pair (typically 0.01 or 1/100th of a unit of the quote currency). However, the impact of this movement on your account depends on the lot size.

- Standard Lot (100,000 units): In most currency pairs (except those with JPY as the quote currency), a 1 pip movement translates to a $10 change. This is because for a standard lot of 100,000 units, each pip movement represents a $0.0001 change in the exchange rate. Since there are 10 pips in a single cent ($0.01), a 1 pip movement translates to a $10 change (10 pips * $0.0001 per pip).

- Mini Lot (10,000 units): With a mini lot, the pip value is proportionally smaller. A 1 pip movement now represents a $1 change in your account value. This is because you’re controlling a smaller chunk of currency (10,000 units) and the $0.0001 change per pip applies to that amount.

- Micro Lot (1,000 units): For micro lots, the pip value shrinks even further. A 1 pip movement translates to a mere $0.10 change. This minimal impact allows beginners to experiment with forex trading while minimizing potential losses.

Remember, the Spread (difference between buy and sell price) also affects the effective pip value. However, the core principle remains: lot size dictates the dollar amount you gain or lose with each pip movement in the exchange rate.

What factors should a Trader Consider When Selecting a Lot Size?

Selecting the appropriate lot size in forex trading is crucial for managing risk and maximizing potential profits. Here are some key factors to consider when making this decision:

- Account Size: This is the primary factor. Beginners with smaller accounts shouldn’t jump into the deep end with standard lot sizes. Opting for micro or mini lots allows you to test the waters and practice your trading strategies without risking significant portions of your capital. As your account grows and your experience strengthens, you can gradually increase your lot size to capitalize on larger opportunities.

- Risk Tolerance: Your comfort level with potential losses is paramount. Are you a risk-averse trader who prioritizes minimizing losses? Then, sticking to smaller lot sizes is wise. Conversely, if you have a higher risk tolerance and are comfortable with the possibility of larger losses in exchange for potentially bigger profits, you might consider using larger lot sizes. Remember, responsible risk management is essential in forex trading.

- Trading Strategy: The strategy you employ can also influence your ideal lot size. Scalping strategies, which involve frequent entries and exits with small profit targets, often benefit from using smaller lot sizes to minimize risk on each individual trade. Conversely, longer-term positional trading strategies, where you hold positions for extended periods, might allow for using larger lot sizes to potentially capture bigger moves in the market.

By carefully considering these factors, you can select a lot size that aligns with your individual trading goals, risk tolerance, and account size. This will help you manage your exposure effectively and navigate the forex market with a more strategic approach.

How can a Trader’s Account Size, Risk Tolerance, and Trading Strategy Influence Lot Size Selection?

Selecting the right lot size in forex requires a balancing act between your account size, risk tolerance, and trading strategy. Beginners with smaller accounts and a conservative approach should use micro or mini lots to minimize risk. As your account grows and your risk tolerance increases, you can explore larger lot sizes. Similarly, scalping strategies benefit from smaller lot sizes due to frequent trades, while longer-term positioning can handle larger lots to capture bigger market movements. Choose your lot size wisely based on your individual circumstances.