Gross Domestic Product (GDP) serves as a critical compass for traders. It reflects the total value of all goods and services produced within a country’s borders, offering a snapshot of the overall health and growth of its economy. Understanding how GDP impacts currency valuations empowers forex traders to navigate market movements and identify potential trading opportunities.

A strong and growing GDP, signifying a robust economy, typically leads to a rise in demand for a country’s currency. This increased demand stems from several factors. First, a thriving economy often attracts foreign investment, leading to an influx of foreign currency being exchanged for the domestic currency. Second, strong GDP growth can prompt central banks to raise interest rates to curb inflation. Higher interest rates can incentivize investors to hold the domestic currency for the attractive returns, further increasing its value. Conversely, a weak GDP suggests a sluggish economy, potentially leading to a depreciation of the currency.

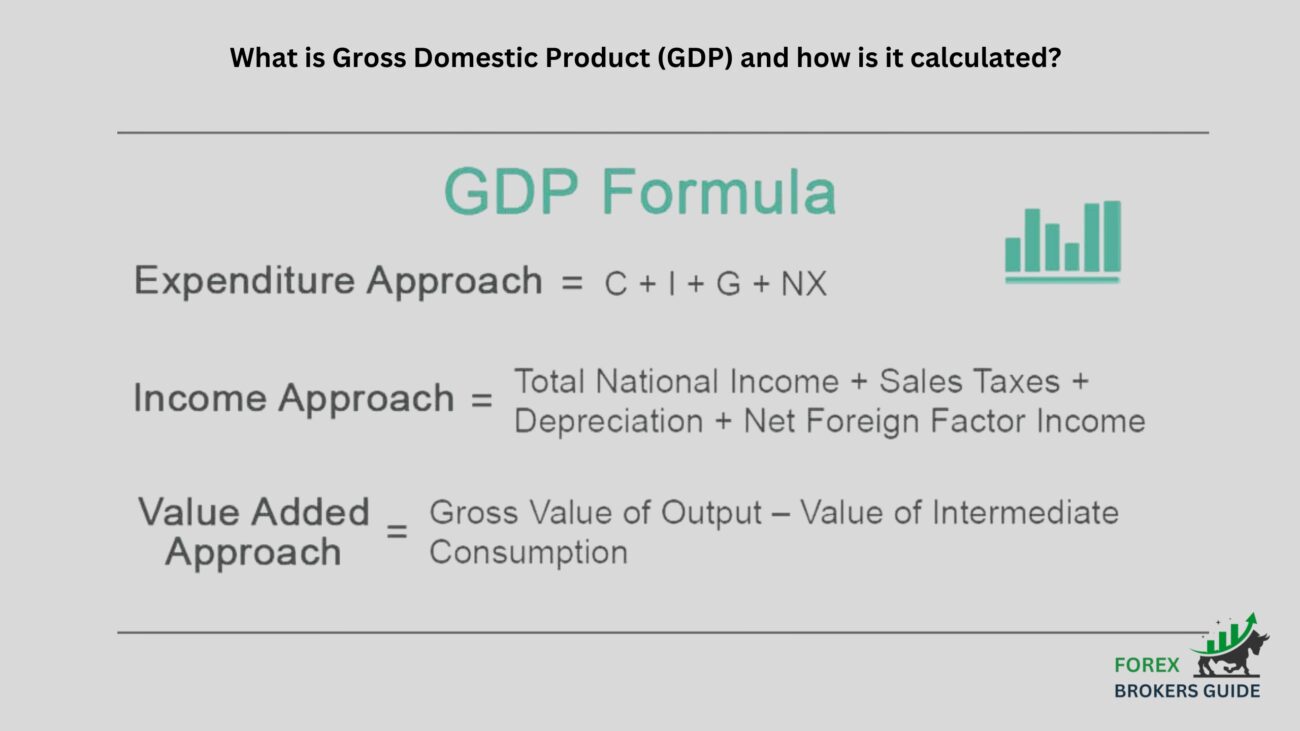

What is Gross Domestic Product (GDP) and how is it calculated?

Gross Domestic Product (GDP) is the total value of all final goods and services produced in a country over a specific period (usually a year). It’s essentially a giant tally of a nation’s economic output.

Gross Domestic Product (GDP) is the most comprehensive measure of a nation’s economic activity. It represents the total market value of all final goods and services produced within a country’s borders in a specific period, typically a year. Think of it as a giant shopping cart containing everything a country produced in a year – from cars and haircuts to healthcare services and software. But unlike a shopping cart that might have duplicate items (you might buy two apples), GDP only counts the final value of goods and services, not including intermediate goods used up in production.

There are two main ways to calculate GDP, each offering a different perspective:

- Expenditure Approach: This method sums up the final spending on goods and services by all sectors of the economy – consumers (household consumption), businesses (gross private investment), government (government spending), and the foreign sector (net exports, which is exports minus imports). In simpler terms, it looks at everything bought and sold within the economy.

- Production Approach: This method focuses on the value added at each stage of production. It essentially calculates the total market value of all goods and services produced by all businesses within the country, minus the cost of intermediate goods used up in the process. Imagine following a product from raw materials to the final good – the production approach only counts the value added at each stage, not the total cost of the raw materials.

What are the different components of GDP?

Understanding Gross Domestic Product (GDP) is crucial for forex traders, but to truly grasp its impact on currencies, we need to delve deeper into its components. GDP is like a giant engine driving a nation’s economy, and each component plays a vital role in its overall performance. Here’s a breakdown of the key players:

- Consumption: This represents the spending by households on final goods and services. It’s the largest component of GDP in most countries, reflecting consumer confidence and overall economic well-being. A surge in consumer spending often indicates a healthy economy, potentially leading to a rise in demand for the domestic currency.

- Investment: This encompasses businesses’ spending on fixed assets like machinery, buildings, and software, as well as inventories. Investment drives future economic growth, and strong investment spending can signal optimism about the future, potentially strengthening the currency.

- Government Spending: This refers to government expenditures on goods and services, such as infrastructure, healthcare, and education. Government spending can stimulate economic activity and influence business investment decisions. Higher government spending, if financed responsibly, can indicate a proactive government and potentially boost the currency’s value.

- Net Exports: This component represents the difference between a country’s exports (goods and services sold abroad) and its imports (goods and services bought from abroad). A positive net export value, signifying a trade surplus, indicates strong foreign demand for a country’s products and services, which can lead to a rise in the domestic currency’s value. Conversely, a negative net export value (trade deficit) might put downward pressure on the currency.

How does GDP Growth Rate Reflect the overall Economic Performance of a Country?

Gross Domestic Product (GDP) growth rate stands as a vital compass for gauging a country’s overall economic performance. It reflects the percentage change in a country’s GDP from one period (usually a quarter or year) to the next. By analyzing GDP growth rate, forex traders and economists gain valuable insights into the health and direction of a nation’s economic engine.

This metric acts as a window into a country’s economic performance in several ways:

- Expansion Signals Strength: A positive GDP growth rate indicates that a country’s economy is expanding. This signifies an increase in the total value of goods and services produced. Positive growth rates are generally associated with rising employment, increasing consumer spending, and potentially higher corporate profits. Forex traders often view strong and sustained GDP growth as a positive sign for the domestic currency, potentially leading to its appreciation. A growing economy suggests a robust environment for businesses and consumers, potentially translating to increased demand for the currency.

- Stagnation and Limited Opportunities: A GDP growth rate close to zero suggests economic stagnation, where the economy is neither expanding nor contracting significantly. This might indicate a period of slow job growth and muted consumer spending. While not necessarily negative, a stagnant economy can limit opportunities for the domestic currency to appreciate in the forex market. Stagnant growth suggests a lack of momentum in the economy, which might not incentivize foreign investment or boost demand for the currency.

- Recession and Currency Depreciation: A negative GDP growth rate for two consecutive quarters signals a recession, a period of economic contraction. This translates to a decline in the total value of goods and services produced. Recessions are typically associated with rising unemployment, falling consumer confidence, and potentially a decrease in corporate profits. Forex traders often view recessions as negative signs for a country’s currency, potentially leading to its depreciation. A contracting economy suggests a weakened business environment and reduced consumer confidence, which can lead to a decline in the currency’s value.

How does a Country’s GDP Growth Rate influence the value of its currency in the Forex Market?

A country’s Gross Domestic Product (GDP) growth rate plays a significant role in shaping the value of its currency in the foreign exchange market. Here’s a closer look at the mechanisms at play:

Growth and the Allure of a Thriving Economy: A strong and sustained GDP growth rate typically translates to a rise in demand for a country’s currency. This increased demand stems from several factors. First, a thriving economy often attracts foreign investment. Businesses and investors seek to participate in the growth, leading them to exchange foreign currencies for the domestic currency to invest in local assets. This increased demand for the domestic currency drives up its value in the forex market.

Interest Rates and the Currency Dance: Robust GDP growth can prompt central banks to raise interest rates. This is done to curb inflation, which can rise alongside a growing economy. Higher interest rates incentivize investors to hold the domestic currency for the attractive returns offered. This increased demand for the currency, driven by both foreign investment and interest rate hikes, strengthens its value relative to other currencies.

Economic Stagnation and a Flat Currency: A stagnant economy, reflected in a GDP growth rate close to zero, can limit opportunities for the domestic currency to appreciate in the forex market. Stagnant growth suggests a lack of momentum in the economy, which might not incentivize foreign investment or boost demand for the currency. Additionally, central banks might be hesitant to raise interest rates in a stagnant economic environment, further limiting the appeal of holding the domestic currency for investors.

Recession and Currency Depreciation: A negative GDP growth rate, signifying a recession, typically leads to a depreciation of the currency. This is because recessions are associated with factors that weaken a currency’s appeal. Falling consumer confidence and rising unemployment can dampen domestic demand for the currency. Additionally, recessions might force central banks to lower interest rates to stimulate the economy, making the domestic currency less attractive to foreign investors seeking higher returns.

Looking Beyond the Headline: It’s important to remember that GDP growth rate is just one factor influencing currency valuations. Forex traders also consider other economic indicators, political stability, and global risk sentiment when making decisions. However, understanding the relationship between GDP growth and currency values empowers traders to navigate the complex dynamics of the forex market and identify potential trading opportunities based on a country’s economic trajectory.

What is the Relationship between GDP Expectations, Surprises, and Currency Exchange Rate Movements?

Economic data releases, like Gross Domestic Product (GDP) figures, act as vital guideposts in the ever-fluctuating forex market. But the market reacts not just to the raw numbers, but also to the degree to which they meet or deviate from expectations. This interplay between GDP expectations, surprises, and currency exchange rate movements is a key factor for forex traders to understand.

Before the official GDP data release, analysts and economists make forecasts about the expected growth rate. These forecasts paint a picture of what market participants anticipate for the economy’s performance. In the weeks leading up to the release, the forex market often prices in these expectations to some extent.

How can Forex Traders use GDP data releases to assess the Relative Strength of different Economies and their Currencies?

Gross Domestic Product (GDP) data serves as a vital compass for traders. By deciphering the relative strength of different economies and their currencies, traders can make informed decisions and identify potential opportunities. Here’s how GDP data becomes a weapon in a forex trader’s arsenal:

Growth Rate as a Benchmark: Comparing the GDP growth rates of different countries allows traders to gauge the relative performance of their economies. A country with a consistently higher GDP growth rate is generally considered to have a stronger and more vibrant economy. This translates to a rise in demand for its currency, as investors seek to participate in the growth and potentially benefit from rising interest rates attracted by a robust economy.

Growth Trajectory Paints a Clearer Picture: It’s not just the current growth rate that matters; the trajectory of GDP growth also holds significance. A country experiencing consistent and accelerating GDP growth suggests a robust and expanding economy, potentially leading to a sustained appreciation of its currency. Conversely, a country with a declining GDP growth rate might indicate a weakening economy, potentially putting downward pressure on its currency’s value. By analyzing the trend over time, traders can anticipate future movements in the currency market.

Looking Beyond the Headline Number: While GDP growth rate is a crucial indicator, forex traders shouldn’t rely solely on this headline number. It’s important to consider the composition of GDP growth. Growth driven by sustainable factors like increased consumer spending or business investment is generally viewed more favorably than growth fueled by government spending or debt accumulation. Additionally, income inequality can impact economic strength. If GDP growth benefits only a small segment of the population, it might not translate to broad-based economic well-being. A well-rounded analysis is key to understanding the true picture.

Expectations Shape Market Reactions: As discussed earlier, the market often reacts to the degree to which GDP data meets or deviates from expectations. A country exceeding GDP growth forecasts can be a positive surprise for its currency, while falling short of expectations can lead to depreciation. By analyzing both the actual growth rate and its deviation from forecasts, forex traders can gain a more nuanced understanding of the market’s sentiment towards a particular economy. This allows them to anticipate potential movements in the currency market based on how the data is received.

Strength Unveils Trading Opportunities: By analyzing GDP data across different countries using these considerations, forex traders can identify economies and currencies with relative strength or weakness. This allows them to potentially:

- Buy Currencies of Strong Economies: If a country exhibits consistent and accelerating GDP growth, its currency might be a good candidate for buying, anticipating its continued appreciation.

- Sell Currencies of Weak Economies: Conversely, a country with a declining GDP growth rate or a negative surprise in its data release might see its currency depreciate, potentially presenting a selling opportunity.

How can Forex Traders Integrate GDP Data Analysis into their Trading Strategies?

Technical analysis and gauging market sentiment are essential ingredients, incorporating fundamental analysis, particularly through GDP data analysis, injects valuable insights for informed decision-making. Here’s how forex traders can seamlessly integrate GDP data analysis into their trading strategies:

Unearthing Long-Term Trends: By dissecting historical GDP growth rates and their connection to currency valuations, forex traders can uncover long-term trends within the forex market. Countries boasting consistent and robust GDP growth often witness their currencies appreciate over time. This knowledge empowers traders to develop long-term investment strategies, potentially involving buying currencies backed by strong and growing economies. Analyzing historical trends allows them to strategically position themselves for these long-term movements in the currency market.

Understanding Pre-Release Market Positioning: In the lead-up to a major GDP data release, forex traders can analyze market positioning to anticipate potential movements. If a currency has already seen significant appreciation in anticipation of a strong GDP figure, the actual data might need to surpass expectations to trigger further appreciation. Conversely, if the market is positioned for a weak GDP figure and the data comes in stronger than expected, it can lead to a sharp reversal and currency appreciation. By understanding how the market has positioned itself before a data release, traders can identify potential opportunities based on whether the data confirms or contradicts those expectations. This allows them to capitalize on potential shifts in market sentiment based on the surprise factor.

Capitalizing on Surprises: As discussed earlier, the market often reacts more intensely to surprises in GDP data compared to figures that meet expectations. Forex traders can integrate this knowledge into their strategies by actively seeking potential trading opportunities arising from unexpected economic developments. For instance, a country experiencing a surprisingly strong GDP surge might see its currency appreciate rapidly, presenting a short-term buying opportunity. By being prepared to capitalize on surprises, traders can potentially profit from unexpected shifts in the market.

Combining GDP with a Broader Economic Picture: While GDP data is a powerful tool, it shouldn’t operate in isolation. Forex traders should combine their analysis of GDP growth rates with other economic indicators like inflation, unemployment, and interest rates. Additionally, factors like political stability, global risk sentiment, and central bank policies can significantly influence currency valuations. By considering a holistic view of the economic landscape, traders can make more informed decisions about entering or exiting positions. A well-rounded analysis that considers multiple factors is crucial for navigating the complexities of the forex market.

Setting Realistic Expectations: It’s important to remember that GDP data is a lagging indicator, reflecting past economic activity. While it can provide valuable insights into future trends, it shouldn’t be used for short-term, rapid-fire trading decisions based solely on the immediate data release. GDP data is a piece of the puzzle, and traders should approach it with realistic expectations about what it can and cannot tell them about the future of the market.

What are some Limitations of Relying solely on GDP data for making Forex Trading Decisions?

While GDP data analysis offers valuable insights for forex traders, it shouldn’t be the sole factor driving trading decisions. Here’s a closer look at the limitations of relying exclusively on GDP figures:

Lagging Indicator: GDP data reflects past economic activity, not necessarily predicting the future. By the time the data is released, the economy might already be on a different trajectory. This inherent lag can make it unsuitable for short-term, rapid-fire trading decisions based solely on the immediate data release.

Composition Matters: Not all GDP growth is created equal. Growth driven by sustainable factors like increased consumer spending or business investment is generally viewed more favorably than growth fueled by government spending or debt accumulation. Focusing solely on the headline GDP growth rate might mask these underlying factors, potentially leading to misleading conclusions.

Distribution of Growth: GDP growth doesn’t necessarily translate equally across a population. If GDP growth benefits only a small segment of the population, it might not reflect broad-based economic well-being. This can lead to a situation where the currency strengthens despite underlying social tensions or a fragile economic base.

Beyond the Economy: Forex markets react to a multitude of factors beyond just economic data. Political stability, global risk sentiment, and central bank policies can significantly influence currency valuations. A solely GDP-focused approach might miss these crucial aspects of the market.

Market Expectations: The forex market often reacts to the degree to which GDP data meets or deviates from expectations. A strong GDP figure that falls short of analysts’ forecasts might have a muted impact on the currency, while a weak figure exceeding expectations could trigger a surprise appreciation. Relying solely on GDP data without considering market expectations can lead to missed opportunities or misreadings of market sentiment.

How can Forex traders compare GDP growth rates across different countries to identify potential Trading Opportunities?

For forex traders, comparing Gross Domestic Product (GDP) growth rates across different countries is a powerful tool for identifying potential trading opportunities. This comparison allows them to assess the relative economic strength of different countries, which can translate into significant currency movements.

By analyzing GDP growth rates, forex traders can gauge a country’s economic performance in relation to others. A country experiencing consistently higher GDP growth is generally considered to have a stronger and more vibrant economy. This often translates to a rise in demand for its currency, as investors seek to participate in the growth and potentially benefit from rising interest rates attracted by a robust economy. Identifying such countries with strong and accelerating GDP growth allows traders to potentially buy their currencies in anticipation of continued appreciation.

However, looking solely at the current growth rate isn’t enough. The trajectory of GDP growth also paints a crucial picture. A country with a consistently rising GDP growth rate suggests a robust and expanding economy, potentially leading to a sustained appreciation of its currency. Conversely, a country with a declining GDP growth rate might indicate a weakening economy, potentially putting downward pressure on its currency’s value. This analysis allows traders to position themselves to potentially buy currencies on an upward trajectory and potentially sell currencies experiencing a downward trend.

While the growth rate is important, it’s also crucial to consider the composition of GDP growth. Growth driven by sustainable factors like increased consumer spending or business investment is generally viewed more favorably. Conversely, growth fueled by government spending or debt accumulation might be less sustainable in the long run. When comparing GDP growth rates, traders should look beyond the headline number and consider the underlying factors driving the growth. This can help them identify countries with more sustainable growth prospects and potentially stronger currencies.

The forex market often reacts not just to the actual GDP growth rate but also to the degree to which it meets or deviates from expectations. A country exceeding GDP growth forecasts can be a positive surprise for its currency, while falling short of expectations can lead to depreciation. By comparing a country’s actual GDP growth rate with pre-release forecasts, traders can gain a more nuanced understanding of the market’s sentiment towards that particular economy. This can help them identify potential opportunities arising from surprise economic developments and potentially capitalize on unexpected shifts in currency valuations.

What factors, besides GDP Growth Rate, should forex traders consider when analyzing a country’s economic health?

While GDP growth rate is a critical indicator for forex traders, it’s just one piece of the puzzle. To gain a more comprehensive understanding of a country’s economic health and its potential impact on currency valuations, traders should consider a broader range of factors:

Inflation: Inflation measures the rate at which prices for goods and services are rising. Generally, moderate inflation is considered healthy, indicating economic growth. However, excessively high inflation can erode purchasing power and discourage investment, potentially weakening a currency. Conversely, deflation, or falling prices, can also be harmful, as it can lead to economic stagnation and currency depreciation.

Unemployment Rate: The unemployment rate reflects the percentage of the labor force that is actively seeking work but unable to find employment. A low unemployment rate suggests a strong economy with businesses expanding and hiring. Conversely, a high unemployment rate can indicate economic weakness, potentially leading to lower consumer spending and a decrease in demand for the country’s currency.

Interest Rates: Central banks set interest rates to influence economic activity. Higher interest rates can attract foreign investment, strengthening a currency. However, they can also slow economic growth. Conversely, lower interest rates can stimulate borrowing and spending, but can also weaken a currency by making it less attractive to foreign investors.

Trade Balance: The trade balance refers to the difference between a country’s exports and imports. A trade surplus, where exports exceed imports, can be a sign of a strong economy. Conversely, a trade deficit, where imports exceed exports, can put downward pressure on a currency as it reflects a net outflow of funds.

Political Stability: Political instability, including civil unrest or frequent changes in government, can create uncertainty for businesses and investors. This can lead to capital flight, where investors move their money out of the country, potentially weakening the currency.

Global Risk Sentiment: Forex markets are also influenced by global risk sentiment. During periods of economic uncertainty or geopolitical tensions, investors tend to flock to safe-haven currencies like the US dollar or Japanese yen. This can weaken the currencies of countries perceived as being riskier.

How can forex traders differentiate between a strong and a weak GDP report, considering different economic contexts?

For forex traders, understanding the true message behind a GDP report is critical. A high headline number might not translate to currency appreciation if other economic factors paint a different picture.

Distinguishing a strong report from a weak one requires looking beyond the headline growth rate. Context is key. A smaller increase on a strong economic foundation can be more meaningful than a large jump from a weak position. Similarly, the composition of growth matters. Growth driven by sustainable factors like consumer spending or business investment is viewed favorably, while reliance on government spending or debt accumulation raises concerns about long-term viability. Additionally, a strong report should exceed analyst expectations and be supported by other positive economic indicators like low unemployment and a healthy trade balance.

What are some potential leading indicators that might signal future trends in GDP growth, potentially aiding forex traders in anticipating Market Movements?

While GDP data provides valuable insights into past economic performance, forex traders are keenly interested in predicting future trends. Here’s where leading indicators come into play. These are economic data points that often precede changes in GDP growth, potentially offering forex traders a glimpse into the future health of an economy and its currency. By incorporating these leading indicators into their analysis, traders can position themselves to potentially capitalize on upcoming market movements.

One such leading indicator is consumer confidence. Surveys that gauge consumer sentiment and spending intentions can provide valuable clues about future economic activity. Rising consumer confidence suggests optimism, potentially leading to increased spending and business investment, which can translate into higher GDP growth down the line. Conversely, declining consumer confidence might indicate a cautious consumer base, leading to decreased spending and potentially slowing GDP growth.

Another leading indicator to watch is the purchasing managers’ index (PMI). This survey measures business activity in key sectors like manufacturing and services. A PMI reading above 50 suggests expansion, while a reading below 50 indicates contraction. A rising PMI can signal that businesses are optimistic about future demand, potentially leading to increased production and hiring, which can contribute to future GDP growth. Conversely, a declining PMI might suggest businesses are scaling back due to anticipated lower demand, potentially foreshadowing a slowdown in economic activity.

Furthermore, housing market activity can also serve as a leading indicator. A strong housing market, characterized by rising housing starts and building permits, can indicate increased consumer confidence and investment in the construction sector. This can have a ripple effect on other sectors and contribute to future GDP growth. Conversely, a weak housing market with declining permits and starts might suggest a slowdown in consumer spending and investment, potentially foreshadowing a drag on future economic activity.

How can Forex Traders combine GDP analysis with other Fundamental and Technical tools for a Comprehensive Trading Approach?

Forex traders who rely solely on GDP data risk missing valuable opportunities. A successful approach integrates GDP analysis with other fundamental and technical tools.

Understanding the economic landscape is crucial. GDP data, combined with inflation, unemployment, and trade balance, paints a comprehensive picture. This allows traders to assess the impact of economic factors on currency valuations. Technical analysis, using tools like charts and indicators, can then confirm or refine these signals. Imagine a strong GDP report suggesting currency appreciation. Technical analysis can help identify entry and exit points based on price movements and resistance levels. By skillfully integrating all this information, forex traders can navigate the complexities of the market and make informed decisions.