Buy Orders are the cornerstone of a bullish strategy. Simply put, a buy order instructs your forex broker to purchase a specific currency pair at a predetermined price or at the best available price in the market. This action essentially reflects your belief that the value of the base currency (the first currency listed in the pair) will appreciate compared to the quote currency (the second currency listed in the pair).

Placing a buy order is akin to making a purchase decision in any other market. You’re essentially speculating that the currency you’re buying will become more valuable in the future, allowing you to sell it later at a profit. The execution of a buy order can happen in two main ways: at a specific price you set (known as a limit order) or at the current market price (known as a market order). Each method offers advantages and disadvantages depending on your trading goals and risk tolerance.

What is a Buy Order in Forex Trading?

A Buy Order, at its core, is an instruction given to your forex broker to purchase a specific currency pair. This instruction can be at a predetermined price you set, or at the best available price currently offered in the market. By placing a buy order, you essentially express your belief that the value of the base currency (the first currency listed in the pair) will increase compared to the quote currency (the second currency listed in the pair).

The significance of buy orders in forex trading cannot be overstated. They are the fundamental building block for capitalizing on rising currency values. Imagine you believe the Euro (EUR) will strengthen against the US Dollar (USD) in the coming months. By placing a buy order on the EUR/USD pair, you’re essentially taking a position that aligns with this expectation. If your prediction proves correct, and the Euro does appreciate relative to the Dollar, you can then sell your EUR/USD holding at a profit. This ability to profit from potential currency appreciation makes buy orders a cornerstone of any forex trader aiming to benefit from rising markets.

How does a Buy Order differ from a Sell Order in a Currency Pair?

A buy order and a sell order represent two opposing sides of a trade, essentially reflecting your expectations for the future movement of a currency pair.

A Buy Order signifies your belief that the base currency (the first currency listed in the pair) will strengthen compared to the quote currency (the second currency listed in the pair). Imagine you buy EUR/USD – this means you’re buying Euros with the expectation that their value will increase relative to the US Dollars you used to purchase them. Therefore, by placing a buy order, you’re aiming to profit by selling your Euros at a higher price later.

On the other hand, a Sell Order reflects the opposite expectation. When you place a sell order on a currency pair, you’re essentially betting that the base currency will weaken against the quote currency. For instance, selling EUR/USD indicates that you believe the Euro will depreciate compared to the US Dollar. The goal here is to profit by selling your Euros at a currently higher price and repurchasing them later at a lower price with the US Dollars you receive.

Several factors influence a trader’s decision to place a buy or sell order. These include:

- Fundamental Analysis: This involves analyzing economic data, political events, and interest rates to assess the overall health and future prospects of a particular currency. Strong economic data or rising interest rates might suggest a potential appreciation for that currency, making a buy order more attractive.

- Technical Analysis: Technical analysts study historical price charts and market indicators to identify trends and predict future price movements. Technical analysis can help determine entry and exit points for both buy and sell orders.

- Risk Tolerance: Some traders are more comfortable with potential profits but also higher risks, while others prioritize capital preservation. Buy orders generally align with a bullish outlook and potentially higher returns, while sell orders may be preferred by those seeking to profit from a bearish trend or hedge existing positions.

How are Buy Orders Executed in Forex Trading?

Placing a buy order essentially instructs your forex broker to purchase a specific currency pair on your behalf. But how exactly does that order translate into an actual transaction?

There are two main methods for executing buy orders:

- Market Orders: This is the simplest and fastest way to execute a buy order. When you place a market order, you’re essentially instructing your broker to purchase the desired currency pair at the best available price currently offered in the market. Imagine yourself at a crowded auction, raising your hand to buy a specific item. The auctioneer will then sell it to you at the highest price someone is willing to pay at that very moment. Similarly, a market order gets you into the trade immediately, but the exact price you pay can fluctuate slightly depending on real-time market conditions.

- Limit Orders: This method offers more control over the execution price of your buy order. With a limit order, you specify a predetermined price at which you’re willing to purchase the currency pair. Think of it like setting a price limit at the auction – you won’t get the item unless someone is willing to sell it to you for your designated price or lower. Limit orders can be beneficial if you want to ensure you buy at a specific price or lower, but there’s a chance your order might not be filled if the market price doesn’t reach your desired level.

Beyond market and limit orders, there are more advanced order types that can be used for buy orders, such as stop-loss orders and trailing stop-loss orders. These can help manage risk by automatically exiting your position if the price moves against you.

Another factor to consider is order slippage. This occurs when the actual price you pay differs slightly from the price quoted at the time you placed the order. Slippage is more likely in volatile market conditions, where prices can fluctuate rapidly. Market orders are generally executed faster than limit orders, as they don’t require waiting for a specific price to be met.

What factors influence the price at which a Buy Order might be filled?

The very method you choose for executing your buy order has a significant influence on the fill price. Market orders, for instance, prioritize speed and get you into the trade immediately. Imagine a bustling marketplace – a market order gets you in quickly, but the exact price you pay can fluctuate slightly depending on the prevailing supply and demand for the currency pair you’re buying. If there are more sellers than buyers at that moment, you might get a slightly better price than the quoted price. Conversely, if there are more buyers than sellers, you might end up paying a touch more.

On the other hand, limit orders offer more control over the fill price. With a limit order, you specify a predetermined price at which you’re willing to buy. The order will only be filled if the market price reaches your designated price or dips lower. Think of it like setting a buying limit at an auction – you won’t get the currency pair unless a seller emerges who’s willing to accept your price. While limit orders can ensure you buy at your desired price or lower, there’s a chance your order might not be filled at all if the market price doesn’t move in your favor.

Beyond the order type, other market factors can influence your buy order fill price. Market liquidity, for instance, refers to the ease with which a currency pair can be bought or sold. Highly liquid currency pairs, like EUR/USD or USD/JPY, generally have tighter spreads (the difference between the bid and ask price) and are easier to enter and exit positions at the desired price. Conversely, less liquid currency pairs might have wider spreads and could experience larger price fluctuations when you place a buy order, potentially affecting the fill price. Imagine a well-stocked supermarket versus a small convenience store – the supermarket’s higher liquidity allows for smoother transactions at more stable prices.

Market volatility, characterized by rapid price swings, can also impact buy order fills. During periods of high volatility, the spread between the bid and ask price can widen, potentially leading to a slightly different fill price than anticipated. Think of a rollercoaster ride – during sharp climbs or dips, it might be difficult to get on or off at the exact price you were aiming for. Careful monitoring of market conditions and potentially using limit orders can help mitigate the impact of volatility on your buy order execution.

The size of your buy order, relative to the overall market depth for that currency pair, can also play a role. Large buy orders placed in a market with lower liquidity might have a slightly larger impact on the ask price, potentially pushing it up a tad. Imagine buying a large quantity of a specific item from a small store – your purchase might deplete their stock and cause them to adjust the price for subsequent buyers. However, for most retail forex traders, the impact of order size on fill price is usually negligible.

When might a Forex Trader use a Buy Order?

Forex traders uses buy orders when they anticipate an increase in the value of a specific currency pair. This essentially means they believe the base currency (the first currency listed in the pair) will strengthen compared to the quote currency (the second currency listed in the pair). By placing a buy order, the trader is essentially purchasing units of the base currency with the expectation of selling them later at a higher price, profiting from the currency’s appreciation. This strategy aligns with a bullish outlook on the forex market.

How can Buy Orders be integrated into different Trading Strategies?

Buy orders are a foundational tool for various forex trading strategies. Here’s how they can be integrated:

- Trend Following: Traders identify an uptrend in a currency pair and use buy orders to capitalize on it. They buy low within the uptrend, aiming to sell later at a higher price as the uptrend continues.

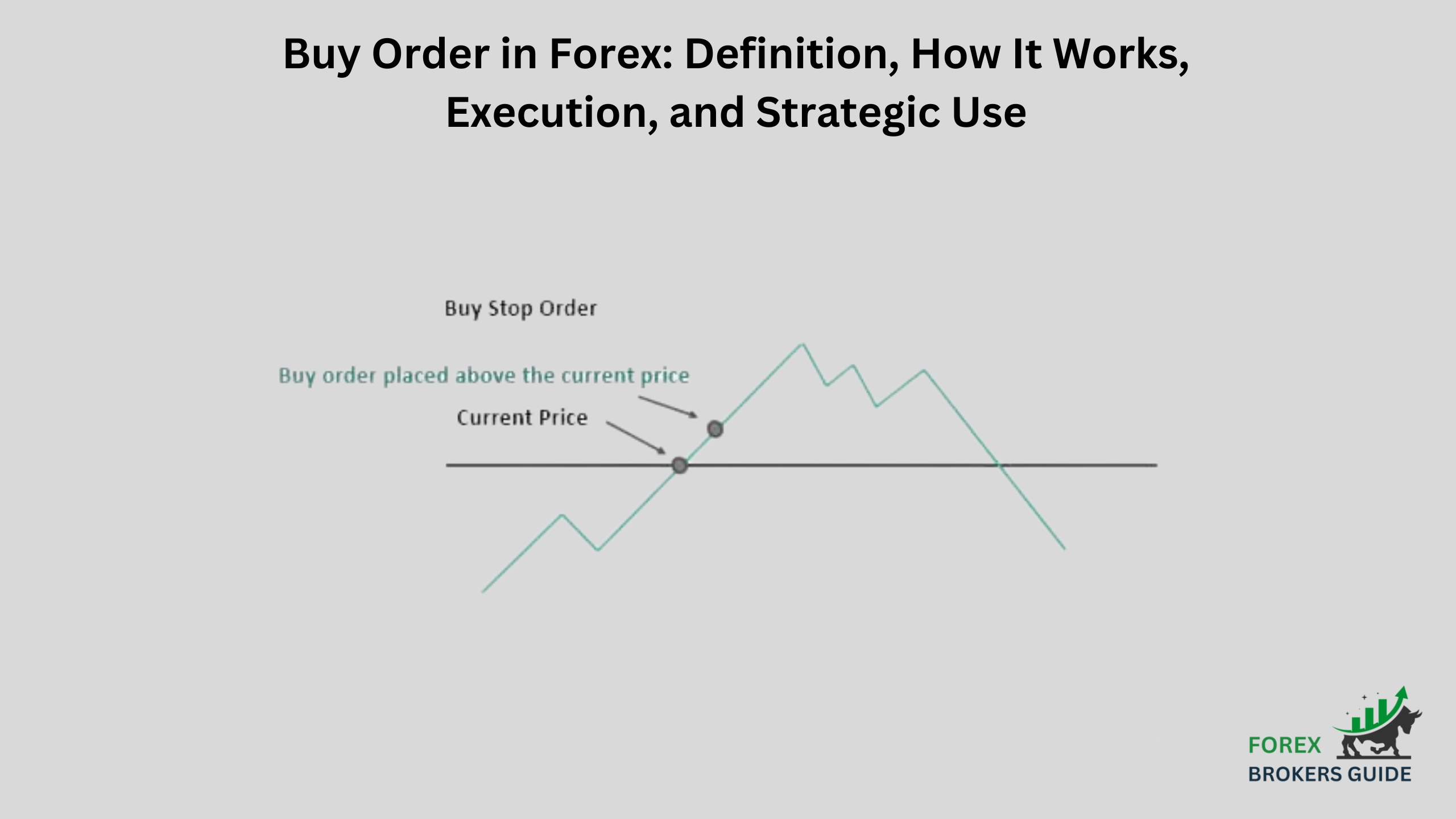

- Breakout Trading: This strategy involves buying when the price breaks above a key resistance level, potentially signaling a trend reversal to the upside. A buy order here positions the trader to benefit from the anticipated price increase.

- Carry Trade: This strategy involves buying a currency with a high interest rate and funding the purchase with a currency with a lower interest rate. Buy orders are used to enter the position, and the trader profits from the interest rate differential while potentially benefiting from any appreciation in the high-interest rate currency.

- Scalping: This involves profiting from small, short-term price movements. Buy orders are used to enter positions when a quick price increase is anticipated, followed by a swift sell order to lock in the profits.

Are there any specific Order Types used in conjunction with Buy Orders for Risk Management?

Buy orders are a cornerstone of bullish forex trading strategies, but using them effectively requires a focus on risk management. Several order types can be used alongside buy orders to achieve this. Stop-loss orders act as a safety net, automatically selling your position if the price falls below a set level, limiting potential losses. Trailing stop-loss orders offer a dynamic approach, automatically adjusting the stop-loss price upwards as the market moves in your favor, locking in profits while protecting against sudden reversals. Finally, take-profit orders, while not strictly for risk management, can be used to automatically sell your position at a predetermined price level, ensuring you don’t miss out on a profitable opportunity. By integrating these order types with buy orders, forex traders can create a more well-rounded approach, safeguarding their capital while still pursuing potential market gains.

Sell Order: Definition, Process, How It Works in Forex, and Trading Insights

11 May 2024[…] two fundamental pillars of forex trading, essentially acting as opposite sides of the same coin. A buy order instructs your broker to purchase a currency pair, anticipating that the value of the base currency […]