Bear markets, characterized by sustained price declines, can be daunting for even seasoned traders. But fear not! By understanding the hallmarks of a bear market and the unique opportunities it presents, you can develop strategies to navigate these downturns and potentially emerge victorious.

A bear market is a period where a currency pair experiences a significant and prolonged price decline. Imagine a bear, claws outstretched, swiping prices downwards. This decline can be triggered by various factors, like negative economic data, political instability, or a general flight to safe-haven currencies. As pessimism grips the market, investors begin selling their riskier assets, leading to a domino effect that pushes prices lower. While a bear market might seem like a time to simply wait things out, there are, in fact, both advantages and disadvantages to consider.

Table of Contents

What is a Bearish Market in Forex Trading?

A Bear market is a period where a currency pair experiences a significant and sustained drop in value. Imagine a bear relentlessly swiping its paws, pushing prices downward.

These declines can be triggered by various factors, like negative economic data, political instability, or a general flight to safe-haven currencies. As pessimism engulfs the market, investors begin selling riskier assets, leading to a domino effect that pushes prices even lower. While a bear market might seem like a waiting game, there are both advantages and disadvantages to consider, which we’ll explore further.

How does a Bear Market differ from a Bull Market?

Understanding the distinct characteristics of Bull markets and bear markets equips traders to navigate these opposing market conditions and potentially capitalize on the opportunities they present.

Bull Market: A bull market is a period of sustained price appreciation in a currency pair. Imagine a bull, horns held high, propelling prices upwards. This optimism is often fueled by a combination of factors:

- Strong Economic Performance: Positive economic data like rising GDP, low unemployment, and stable inflation paint a rosy picture of a nation’s economic health. This attracts foreign investment, which increases demand for the currency, driving its value higher.

- Rising Interest Rates: Central banks raise interest rates to combat inflation or stimulate economic growth. Higher interest rates incentivize foreign investment, as investors are drawn to the potential for higher returns on their holdings. This surge in foreign investment bolsters demand for the currency, pushing its value upwards.

- Risk-On Sentiment: A generally optimistic outlook pervades the market, encouraging investors to take on more risk. This can lead to increased investment in riskier assets like stocks and currencies of developing economies, further fueling the upward momentum.

Bear Market: In stark contrast, a bear market is characterized by a prolonged decline in currency prices. This negativity can be triggered by various factors, as discussed earlier:

- Weakening Economies: Negative economic data like a declining GDP, rising unemployment, or high inflation can erode confidence in a currency’s value. Investors, fearing a potential recession, may start selling their holdings of that currency, driving its price down.

- Political Instability and Geopolitical Tensions: Political turmoil within a country or escalating geopolitical tensions can create uncertainty and risk aversion in the market. Investors may seek refuge in safe-haven currencies like the US dollar or Japanese yen, causing the currencies of these politically unstable regions to depreciate.

- Market Psychology: Even whispers of negativity can snowball into a full-blown bear market. If enough investors believe a currency’s value is headed downwards, they may start selling in anticipation of further losses. This selling pressure can create a self-fulfilling prophecy, driving the price even lower.

What are some key characteristics that distinguish a Bearish Trend in a Currency Pair?

Distinguishing between a healthy correction within a bull market and a full-blown bear market is crucial for making informed trading decisions. Here’s a quick rundown of some key characteristics that signal a potential bearish trend:

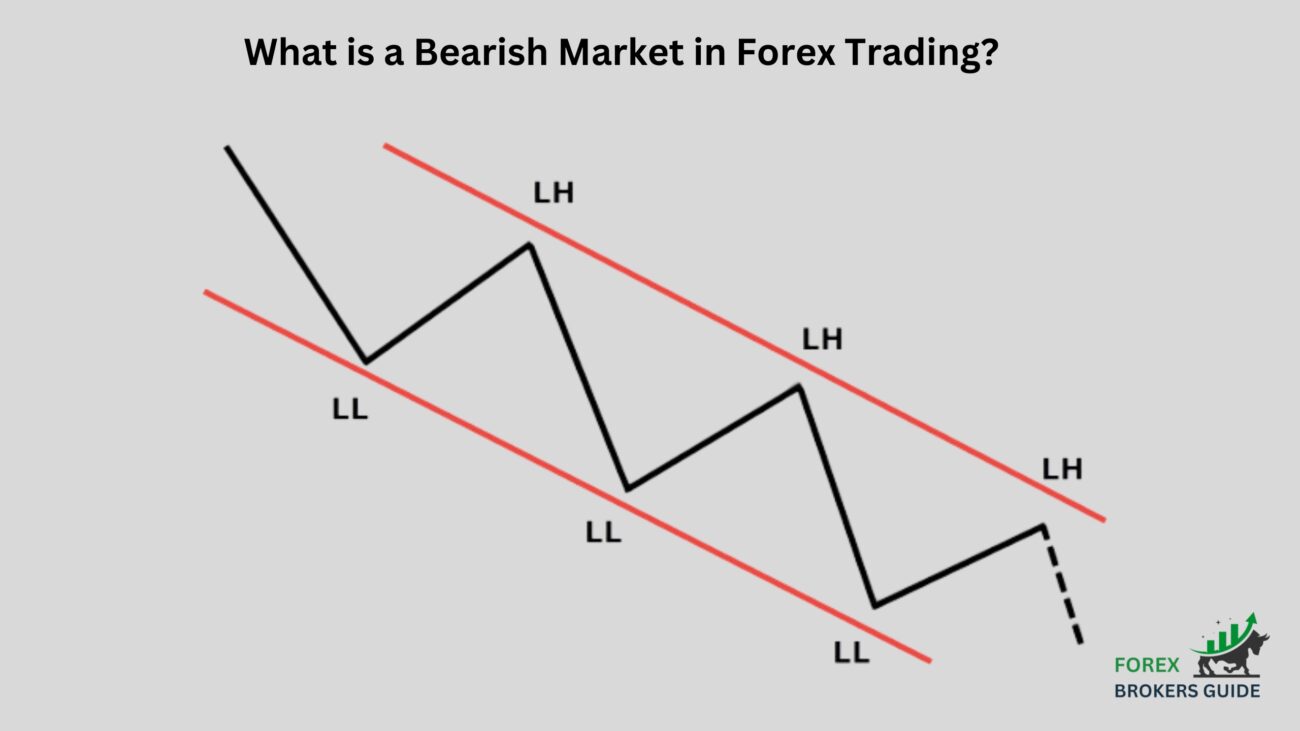

- Price Chart in Decline: The most fundamental indicator is a sustained decline in the price chart of a currency pair. Look for a series of lower lows and lower highs, forming a downward trend. Imagine a bear relentlessly swiping its paws, pushing the price chart consistently downwards. This persistent decline suggests a shift in market sentiment towards pessimism, potentially marking the beginning of a bear market.

- Technical Indicators Flashing Red: Technical indicators, while not foolproof, can provide valuable clues about potential trend reversals. Look for indicators like moving averages that are trending downwards, falling Relative Strength Index (RSI) values, and bearish candlestick reversal patterns like bearish engulfing or head and shoulders patterns. These signals suggest a weakening in buying pressure and a potential increase in selling pressure, both of which can contribute to a bear market.

- Negative Economic Data: Economic data releases can significantly impact currency valuations. A string of negative economic reports, such as declining GDP figures, rising unemployment rates, or persistent inflation, can erode confidence in a currency’s future prospects. This can lead to investors selling their holdings of that currency, driving its price down and potentially triggering a bear market.

- Political Instability and Geopolitical Tensions: Political turmoil within a country or escalating geopolitical tensions can create uncertainty and risk aversion in the market. Investors may seek refuge in safe-haven currencies, causing the currencies of these politically unstable regions to depreciate and signaling a potential bear market.

- Shifting Market Sentiment: Market psychology plays a significant role in forex trading. Even whispers of negativity can snowball into a full-blown bear market. If enough investors believe a currency’s value is headed downwards, they may start selling in anticipation of further losses. This selling pressure can create a self-fulfilling prophecy, driving the price even lower and solidifying the bear market.

How can Technical Analysis Tools help identify Bearish Signals?

Technical analysis offers a valuable toolkit for forex traders to identify potential bearish signals. While not a foolproof predictor, it equips them to decipher the whispers of a downtrend. Price trends and chart patterns provide the foundation. A sustained decline with lower lows and lower highs suggests a weakening uptrend or a bear market if it persists. Specific bearish candlestick patterns like engulfing bars or head and shoulders can also signal a shift in power from buyers to sellers. Additionally, technical indicators like the RSI and MACD can offer further clues. A falling RSI below 30 might indicate an oversold currency, potentially foreshadowing a bear market. Similarly, a bearish crossover on the MACD can suggest a weakening uptrend. Remember, technical analysis is most effective when used in conjunction with other factors, but by understanding these tools and their interplay, traders can gain a valuable edge in spotting potential bear markets.

How does a Bearish Market develop and Progress in Forex Trading?

Forex markets, like any other financial market, experience periods of both growth and decline. Bear markets, characterized by sustained price depreciation in a currency pair, can be daunting for traders. However, understanding the stages of a bear market’s development can equip you to navigate these downturns and potentially identify trading opportunities.

The Trigger: The spark that ignites a bear market can vary. It could be triggered by a series of negative economic data releases, such as declining GDP figures or rising unemployment rates, which erode confidence in a currency’s future value. Political turmoil, escalating geopolitical tensions, or even a global flight to safe-haven currencies can also act as catalysts. These events trigger a shift in market sentiment, with pessimism replacing optimism.

The Downtrend Takes Hold: As negative sentiment spreads, investors begin selling their holdings of the affected currency. This selling pressure pushes the price downwards. Technical indicators, like moving averages trending downwards or falling RSI values, may also start flashing bearish signals, reinforcing the downtrend. This initial decline can snowball as more investors, fearing further losses, join the selling frenzy.

The Cycle of Fear: As the bear market progresses, a self-fulfilling prophecy can take hold. The declining price fuels further pessimism, leading to even more selling. This creates a vicious cycle where the price falls due to selling, and the selling intensifies due to the falling price. News and events are often interpreted through a bearish lens, further amplifying the negative sentiment.

Finding the Bottom: Bear markets don’t last forever. Eventually, a combination of factors, such as oversold conditions indicated by technical indicators, bargain-hunting by value investors, or positive economic data releases, can signal a potential bottom. Selling pressure may start to ease, and the price may begin to stabilize or even show signs of a reversal.

The Road to Recovery: The transition from a bear market to a bull market isn’t always a smooth one. There can be periods of consolidation or even false breakouts before a sustained uptrend emerges. However, by understanding the stages of a bear market and staying informed about economic data and global events, traders can position themselves to capitalize on opportunities that may arise during this period, such as short-selling or strategic buying at potentially undervalued prices.

What factors can drive a Currency Pair’s value downwards?

Some factors propel a currency pair upwards, others can trigger a downward spiral. Here, we explore some key drivers that can push a currency’s value lower:

- Weakening Economic Performance: A nation’s economic health significantly impacts its currency’s value. A series of negative economic data releases, such as declining GDP figures, rising unemployment rates, or persistent inflation, can erode confidence in a currency’s future prospects. Investors may become hesitant to hold or invest in that currency, leading to selling pressure and a decline in its value. Imagine a report card filled with failing grades – this is how such negative economic data can be perceived by the market, leading to a loss of faith in the currency.

- Political Instability and Geopolitical Tensions: Political turmoil within a country or escalating geopolitical tensions in a region can create uncertainty and risk aversion in the market. Investors often seek refuge in safe-haven currencies like the US dollar or Japanese yen during such periods. This flight to safety can lead to a sell-off of riskier currencies associated with the unstable regions, causing their values to depreciate. Imagine a news headline screaming about chaos and conflict – this kind of environment makes investors nervous, leading them to sell riskier currencies in favor of safer options.

- Interest Rate Divergence: Central banks use interest rates to influence inflation and economic growth. If a central bank lowers interest rates compared to other countries, it can make its currency less attractive to investors seeking higher returns. Just like with any investment, lower interest rates mean potentially lower returns, so investors may look elsewhere. This decreased demand can lead to a decline in the currency’s value.

These are just some of the major factors that can contribute to a currency’s decline. By understanding these drivers, forex traders can gain valuable insights into the potential movements of a currency pair. This knowledge can equip them to make informed decisions about entering or exiting trades, potentially mitigating risks and capitalizing on opportunities that may arise during periods of currency depreciation.

How can Forex Traders develop Strategies to profit or hedge Risks during Bearish Trends?

Bear markets, characterized by sustained price declines in currency pairs, can be daunting for forex traders. However, even during downturns, there are opportunities to be found. Here’s a breakdown of strategies that traders can employ to navigate bearish trends and potentially emerge victorious:

Short-Selling

While traditional trading involves buying a currency pair in hopes of its value appreciating (going long), bear markets open the door to profiting from a currency’s decline. This can be achieved through short-selling. By borrowing a currency pair from a broker and selling it at the current price, the trader aims to repurchase it later at a lower price, returning the borrowed currency and pocketing the difference.

Short-selling can be a lucrative strategy during a bear market, but it carries inherent risks. If the currency’s value unexpectedly rises (a short squeeze), the trader may be forced to buy back the borrowed currency at a higher price, incurring losses. Therefore, careful risk management and a solid understanding of the potential catalysts for a bear market are crucial for successful short-selling.

Hedging Existing Positions

For traders who already hold long positions (bought currency pairs) in anticipation of a price increase, a bear market can pose a significant threat. However, there are strategies to mitigate these risks. Hedging involves opening an opposing position to your existing one, essentially creating a form of insurance.

For example, if a trader holds a long position on EUR/USD, they might hedge by opening a short position on the same pair. If the euro weakens against the dollar as predicted, the losses on the long position would be offset by the profits on the short position. While hedging limits potential profits if the market goes as initially planned, it safeguards your capital from significant losses during a downturn.

Selective Buying and Strategic Timing

Not all currencies experience the same decline during a bear market. Some currencies may even strengthen as investors seek refuge. By carefully analyzing economic data, political landscapes, and technical indicators, traders can identify these potentially undervalued currencies. Strategic buying during a bear market can be a sound strategy, allowing investors to purchase currencies at a discount with the potential for future appreciation when the market recovers.

Are there any Specific Short-Selling Strategies applicable in a Bear Market?

While a bear market can be a time of fear for some forex traders, it also presents opportunities for profit through short-selling. This strategy involves borrowing a currency pair at the current price, selling it, and then repurchasing it later at a lower price to return the borrowed currency and pocket the difference. However, to maximize your chances of success and minimize risk, here are some specific short-selling strategies to consider during a bear market:

Identifying Strong Downtrends: The foundation of successful short-selling lies in correctly identifying a strong downtrend. Look for a sustained decline in the currency pair’s price chart, with a series of lower lows and lower highs. Technical indicators like moving averages trending downwards and falling RSI values can also provide confirmation of a bearish trend. Imagine a consistent downward slope on the chart – this is the kind of price movement you’re looking for to initiate a short-selling position.

Targeting Overvalued Currencies: Short-selling is most effective when targeting currencies that are considered overvalued. Analyze economic data, interest rates, and geopolitical factors to identify currencies whose strength may be unsustainable. Look for currencies that have recently experienced a rapid appreciation or those supported by weak fundamentals. By shorting these potentially overvalued currencies, you’re essentially betting on a correction in their price.

Employing Stop-Loss Orders: Short-selling inherently carries the risk of a short squeeze, where the currency’s value unexpectedly rises. To mitigate this risk, it’s crucial to employ stop-loss orders. A stop-loss order automatically exits your short position if the price reaches a predetermined level, limiting your potential losses. Think of it as an insurance policy for your short-selling ventures.

Short-Term vs. Long-Term Strategies: The appropriate timeframe for your short-selling strategy depends on your risk tolerance and market conditions. Short-term strategies might involve capitalizing on quick price swings within a confirmed downtrend. Look for technical signals indicating temporary overbought conditions to initiate short positions and close them relatively soon after profiting from a price decline. On the other hand, long-term short-selling strategies might target structural weaknesses in a currency’s value, potentially holding the short position for weeks or even months.

Combining Short-Selling with Other Techniques: Short-selling can be a powerful tool during a bear market, but it shouldn’t be your only strategy. Consider combining it with other techniques like hedging existing long positions or strategically buying undervalued currencies. This diversification can help you manage risk and potentially capitalize on different market movements.

What are some Key Considerations for Entry and Exit Points when Trading during a Bear Market?

Bear markets present opportunities through short-selling and strategic buying, navigating entry and exit points requires careful consideration. Don’t jump in blindly – confirmation is crucial. Look for sustained price declines with lower lows and lower highs, validated by technical indicators like downward sloping moving averages and falling RSI values. Imagine a consistent downward trajectory on the price chart – this suggests a bear market might be unfolding. Understanding the underlying factors driving the downturn, like weak economic data or political turmoil, can also help you time entry and exit points more effectively.

Technical indicators can provide valuable clues for entry during a bear market. Look for signals like bearish candlestick reversal patterns or overbought readings on indicators like RSI, suggesting a potential reversal and a good time to initiate short positions or wait for buying opportunities on potentially undervalued currencies. For exiting short positions, consider trailing stop-loss orders to lock in profits and be mindful of positive economic data or changing market sentiment that might signal a reversal. Remember, hedging existing long positions with short positions can act as insurance against potential losses during a downturn. By carefully considering these factors and employing a combination of analysis techniques and risk management, you can increase your chances of making informed entry and exit decisions throughout the bear market. Patience and discipline are key when navigating these downturns.