The advance-decline line is a market indicator that traders use to estimate the overall strength or weakness and the breadth of the stock market. The advance-decline line helps in monitoring how many stocks are presently trading above or below the close of the previous day.

Advance-decline line chart serves as a suitable indicator for determining the current market trend for traders who wish to have a deeper insight into the market trend analysis. It also helps in understanding the direction of the market in the short term and how strong is the current trend.

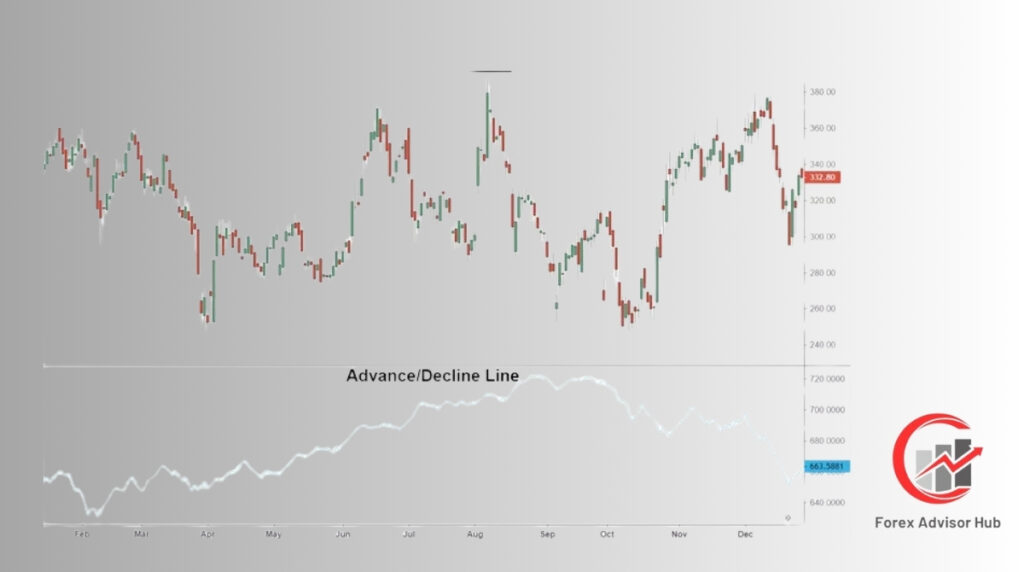

The advance-decline indicator is usually produced for a single stock index or the whole market and may be shown on a chart as a line that rises when the number of advancing stocks exceeds the number of sinking stocks and falls when the reverse occurs.

This article elaborates on the fundamentals of the advance-decline line, its uses, benefits, limitations, how it works, its formula, and its calculations.

What is Advance-Decline Line?

The Advance-Decline Line is a technical analysis tool that tracks the net number of advancing stocks (those that close higher than the previous day) minus the net number of falling equities (those that finish lower than the previous day) over a certain period.

This indicator is cumulative with a positive number that is added to the previous number or subtracted from the previous number if the number is negative. Advances and declines in the stock market refer to the number of stocks that are closed at a higher and that closed at a lower price respectively than the previous day.

Stocks go up and down in certain indexes. However, it does not refer to the fact that all stocks will move in a similar direction, just because some stocks are moving in one direction. Sometimes it gets difficult for investors to determine whether the market direction is being influenced by a majority of stocks pushing the markets in one particular direction or by larger stocks holding more weight in an index.

Let, the capitalization-weighted stock index shows a rise of 3%. Then it becomes important for investors to understand whether the rise of the index was because of a majority of increasing stocks or if it’s driven by a company’s strong performance with a large weight on the index when.

The purpose of the A/D line is to check how it correlates with the index’s price movement that the investors compare. Traders follow these changes over time to forecast the stock market’s direction.

How does Advance-decline Line work?

The Advance-Decline Line (ADL) is a technical analysis technique that works by comparing the number of advancing stocks to the number of falling stocks to determine market breadth. The ADL is computed by subtracting the number of advancing issues from the number of declining issues and adding this value to the previous day’s ADL.

Here’s a breakdown of how it works:

- Identifying Number of Stocks: Determine the number of stocks that are advancing and the number of stocks that are dropping for a specific index or market. For example, you might look at the NYSE Composite Index for the day and tally the number of stocks that climbed in price (advancing) and those that declined in price (declining).

- Difference Between the Stocks: Determine the difference between the number of stocks that are rising and those that are falling. The difference between 1500 advancing stocks and 1000 falling stocks is 500.

- Determining the New ADL Value: Add the difference to the ADL value from the previous day. If the ADL value the previous day was 10,000 and the change today is 500, the new ADL value is 10,500.

- Drawing ADL: Draw the Advance-Decline Line using the ADL values on a chart. The ADL line can be used to identify market trends. If the ADL line is rising, it implies that there are more advancing stocks than sinking stocks, indicating a healthy market.

If the ADL line is dropping, it indicates that there are more declining equities than advancing stocks, indicating a worse market. Traders and investors may use the ADL to corroborate other technical indicators like moving averages and momentum indicators. If the ADL moves in the same way as these indicators, it might lend confirmation to a trend or indication.

What is the Formula for Advance-decline Line?

The Advance-Decline Line formula is straightforward, involving the computation of the difference between advancing and declining stocks, added to a running total.

The formula is A/D = Net Advances + PA, where PA is the previous indicator reading and Net Advances is the difference between daily advancing and declining stocks.

The Advance-Decline ratio is determined by comparing the number of advancing stocks to declining stocks. The formula for ADR is Advance-decline ratio = Number of advancing stocks / Number of declining stocks.

Investors use this ratio to assess market and company trends, aiding in decision-making for buying or selling securities.

What is Real World example of Advance-decline Line?

let’s consider a simplified example to illustrate the calculation of the Advance-Decline Line (ADL).

Suppose, on a given day:

- Number of Advancing Stocks = 1,500

- Number of Declining Stocks = 1,000

- Previous ADL Value (PA) = 10,000

Now, using the formula:

ADL=Net Advances+PAADL=Net Advances+PA

Net Advances=Number of Advancing Stocks−Number of Declining StocksNet Advances=Number of Advancing Stocks−Number of Declining Stocks

Net Advances=1,500−1,000=500Net Advances=1,500−1,000=500

ADL=500+10,000=10,500ADL=500+10,000=10,500

So, the new ADL value for that day would be 10,500. Traders would then continue this process for each subsequent day, updating the ADL based on the advancing and declining stocks.

This value is plotted on a chart over time, creating the Advance-Decline Line. The direction of the line provides insights into market breadth and potential trends. If it rises, it suggests more advancing stocks, indicating a healthy market, and if it falls, it suggests more declining stocks, indicating a weaker market.

How to Calculate the Advance-decline Line?

To calculate the Advance-Decline Line (ADL), follow these steps:

- Calculate Net Advances for the first day: Subtract the number of stocks that finished lower on a specific day from the number of stocks that finished higher on that day. This result is the Net Advances. It acts as the initial value for the indicator if this is the first time calculating the average.

- Calculate Net Advances for the next day: On the following day, calculate the Net Advances for that day. Add this value to the total from the previous day if it is positive. If the value is negative, subtract it from the previous day’s total.

- Repeat the process daily: Continue this process for each trading period to create a time-series of the Advance-Decline Line. This time-series can be plotted on a chart to identify trends and reversals in the market’s breadth.

By following these steps, traders can monitor the market’s breadth and assess the overall strength or weakness in stock market trends. The Advance-Decline Line provides valuable insights for investors seeking to understand the direction and strength of the current market trend.

What are the benefits of the Advance-decline Line?

The Advance-Decline Line (AD Line) offers several benefits to traders and investors:

- Broad market perspective: By measuring the difference between advancing and declining stocks in a market index, the AD Line provides a comprehensive view of the overall market trend, going beyond individual stocks or sectors.

- Indication of trend reversals: Traders can use the AD Line to identify potential trend reversals. For instance, a rising AD Line during a market decline might suggest an imminent turnaround and the start of an upward trend.

- Confirmation of trend strength: The AD Line serves as a tool to confirm the strength of an existing trend. If the AD Line rises in alignment with the market, it indicates a robust and likely continuing trend. Conversely, a declining AD Line amid a rising market could signal a weakening trend with potential for reversal.

Traders often combine the AD Line with other technical indicators such as moving averages or momentum oscillators to gain a more comprehensive understanding of market conditions. Overall, the AD Line proves valuable for those looking to assess the strength of a market trend and identify possible reversals.

What are the limitations of the Advance-decline Line?

The Advance-Decline Line (AD Line) has certain limitations that traders and investors should consider:

- May miss market nuances: The AD Line focuses solely on advancing and declining stocks, potentially overlooking other market nuances such as sector-specific trends or shifts in investor sentiment.

- May give misleading indications: Like any technical indicator, the AD Line can produce false signals, especially in volatile or uncertain market conditions. To enhance accuracy, traders should use the AD Line in conjunction with other indicators.

- Limited applicability in highly concentrated markets: In markets where a few stocks or sectors heavily influence overall performance, the AD Line may offer limited insights into market strength or weakness.

- Restricted historical data: Rapidly changing market conditions may constrain the predictive value of the AD Line.

Traders and investors should be mindful of these limitations and complement the AD Line with other technical indicators and fundamental analysis for more informed investment decisions.

What are examples of Advance-decline Line?

Traders utilize the A/D line to inform their trading decisions. For instance, if more stocks are declining than advancing, it signals a bearish market trend, prompting traders to consider selling.

The A/D line provides a level playing field, indicating whether a market rise is driven by a majority of stocks or a select few with greater weight in the index.

Examples of A/D line usage in practice include:

- Bullish Divergence: During the March 2020 market slump, the S&P 500’s AD Line exhibited a bullish divergence, suggesting a potential market recovery.

- Market Trend Confirmation: If the AD Line for the NASDAQ Composite Index rises alongside the market, it confirms a strong and likely continuing trend.

- Possible Market Reversals: A declining Dow Jones Industrial Average AD Line amid a rising market may indicate a weakening trend with potential for reversal.

- Sector Analysis: Examining the AD Line for specific sectors, like technology, can reveal sector outperformance compared to the broader market.

How to use Advance-decline Line in Technical Analysis?

Utilizing the Advance-Decline Line (AD Line) in technical analysis involves several key steps:

- Determine the AD Line: Calculate the AD Line by dividing the number of decreasing stocks by advancing stocks and adding the result to the previous day’s AD Line value.

- Plot the AD Line: Display the AD Line on a chart alongside the market index, illustrating its changes relative to the market.

- Identify Divergences: Look for divergences between the AD Line and the market index, especially when the market reaches new highs but the AD Line does not, indicating potential weakness and a reversal.

- Validate Trend Strength: Confirm the strength of a market trend by observing if the AD Line rises with the market, signaling a robust and continuing trend.

- Combine with Other Indicators: Enhance market analysis by combining the AD Line with other technical indicators like moving averages or momentum oscillators for a comprehensive view.

- Regular Monitoring: Given its dynamic nature, regularly monitor the AD Line, adapting your trading strategy based on its fluctuations and market conditions.

In summary, the AD Line serves as a valuable tool, offering insights into market patterns and aiding traders in making well-informed investment decisions. It helps identify divergence between an index and its components, distinguishing between a healthy market with broad participation and an unhealthy one where a few stocks drive index prices higher.

How to read the Advance-decline Line chart?

Reading the Advance-Decline Line (AD Line) chart involves several key steps:

- Examine the Scale: Check the vertical axis scale on the AD Line chart to understand the range of values and their distribution.

- Monitor Trends: Observe patterns in the AD Line chart, such as upward or downward movements, to grasp how the market is functioning.

- Detect Divergences: Identify divergences between the AD Line and the market index, as opposite movements may indicate potential market reversals.

- Search for Crossovers: Look for crossovers with other technical indicators like moving averages, interpreting upward crossovers as bullish and downward crossovers as bearish signals.

- Observe the Slope: Analyze the slope of the AD Line; a sharp rise suggests a strong market likely to continue upward, while a steep decline indicates potential weakness and a possible downturn.

In summary, interpreting an AD Line chart involves close attention to trends, divergences, crossovers, and the slope of the AD Line. Utilizing the AD Line in conjunction with other technical tools provides valuable insights for making informed investment decisions.

What are the other Technical Indicators besides Advance-decline Line?

Traders use various technical indicators to analyze financial markets and guide their investment decisions. Here are examples of popular technical indicators:

Moving Averages: This tool smoothens price data by calculating a continuously updated average. On a price chart, it appears as a flat line, eliminating variations from random price fluctuations.

Moving Average Convergence Divergence (MACD): An oscillating indicator showing both momentum and trend-following aspects. MACD fluctuates above and below zero, with traders focusing on which side of zero the lines are and potential crossovers.

Relative Strength Index (RSI): An oscillating indicator measuring price change, ranging from 0 to 100. Traders watch for divergence, crossovers of the centerline, and consider the market overbought above 70 and oversold below 30.

On-Balance-Volume (OBV): This indicator condenses volume information into a single line, reflecting cumulative buying and selling pressure. It adds volume on ‘up’ days and subtracts volume on ‘down’ days.

Is the Advance-decline Line indicator the most popular Market Breadth Indicator?

Certainly, the Advance-decline Line (AD Line) stands as one of the most popular, respected, and extensively utilized market breadth indicators. Traders and analysts often rely on the AD Line to evaluate the strength of a market trend by examining the number of advancing stocks in comparison to those that are declining.

Is Advance-decline Line accurate?

The accuracy of the Advance-Decline Line (AD Line) as a technical indicator depends on various factors, such as the quality of the data used, the time frame analyzed, and the prevailing market conditions. Widely considered a reliable measure of market breadth, the AD Line offers valuable insights into the overall strength or weakness of the market by comparing the number of advancing stocks to declining ones.

Despite its reputation, the AD Line, like any technical indicator, is not infallible. Its reliability can be enhanced by complementing it with other tools and strategies to corroborate market trends and identify potential entry and exit points. It’s important to note that the AD Line operates as a lagging indicator, meaning it may not provide real-time information on market changes.

In conclusion, the accuracy of the AD Line is contingent on its careful and context-specific utilization. Traders should thoroughly assess their trading methods and objectives, incorporating a mix of indicators and tools to make well-informed investment decisions.

What is the difference between Advance-decline Line and the Advance-decline Line ratio?

The advance-decline line (A/D line) is a cumulative technical indicator that assesses the daily difference between advancing and declining stocks. This indicator provides a cumulative perspective on market sentiment by adding a positive number to the previous day’s value or subtracting it if negative. It effectively indicates whether more stocks are experiencing upward or downward movements.

In contrast, the advance-decline ratio is a stock market trend analysis tool calculated by dividing the number of advancing shares by the number of declining shares. This ratio can be calculated over various periods, such as one month, one week, or one day. When viewed independently, the advance-decline ratio signals whether the market is in an overbought or oversold condition. Observing the trend of the A/D ratio further helps in determining whether the market is in a bullish or bearish trajectory.