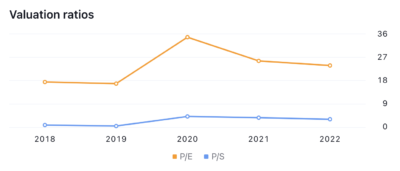

Valuation ratios are key metrics used by investors to evaluate the fair value of a company’s stock price relative to its financial performance. Valuation ratios like price-to-earnings, price-to-book value, and price-to-sales allow investors to compare a stock’s market price against metrics like earnings, assets, and revenues. This helps determine if a stock appears undervalued, overvalued, or fairly valued compared to its history, competitors, and the overall market.

The price-to-earnings Ratio is one of the most important valuation ratios, using earnings per share to gauge how much investors are paying for each rupee of corporate profits. Other fundamental ratios provide further perspectives, such as the price-to-book value ratio assessing the premium or discount to a company’s net assets. Additional ratios like enterprise value to EBITDA incorporate debt and remove accounting distortions.

Investors identify stocks trading below typical benchmarks relative to profitability and growth prospects using valuation rations. Comparing ratios over time also indicates changes in market sentiment. While ratios have limitations and require context, they are crucial tools for determining value in fundamental analysis.

What are valuation ratios?

Valuation ratios are financial metrics used by investors to evaluate the worth of a company’s stock compared to its earnings, assets, or Revenue. Valuation ratios allow investors to determine if a stock is undervalued or overvalued compared to historical norms, its peers, or the overall market. They are calculated by dividing one financial metric by another. There are 18 types of key valuation ratios, including Price-to-Earnings Ratio (P/E), Price-to-Book Ratio (P/B), Price-to-Sales Ratio (P/S), PEG Ratio, etc.

Each of the above ratios provides a different approach to valuing a stock by comparing market value to financial fundamentals like earnings, book value, sales, cash flows, and dividends. While these ratios offer standardized ways to measure value, no single ratio determines full stock valuation on its own. Investors must consider multiple ratios, qualitative factors, growth prospects, and market context when evaluating stock prices.

What are the popular types of valuation ratios?

The most common valuation ratios are Price to Earnings (P/E), Cyclically-Adjusted P/E (CAPE), Earnings Yield, Price/Earnings to Growth (PEG), Price to Cash Flow (P/CF), Price to Sales (P/S), Price to Book Value (P/BV), Enterprise Value to EBITDA (EV/EBITDA), EV to Sales, EV to Cash Flow from Operations (EV/CFO), EV to Free Cash Flow to Firm (EV/FCFF), and Justified P/E. These ratios compare a company’s share price to earnings, cash flow, sales, book value, and other financial metrics to assess relative valuation and growth potential.

1.Price to earnings (P/E) ratio

The price-to-earnings ratio (P/E ratio) is a valuation measure used to compare a company’s current share price to its per-share earnings. The P/E ratio gives investors an idea of how much they are paying for each dollar of the company’s earnings. A higher P/E ratio means investors are paying more per dollar of earnings, which implies the stock is overvalued. A lower P/E ratio suggests the stock is undervalued.

P/E Ratio = Share Price / Earnings Per Share

For example, suppose a company’s stock is trading at Rs.50 per share, and its EPS for the last 12 months was Rs.5.

P/E ratio = Rs.50 / Rs.5 = 10

Comparing the P/E ratios of companies in the same industry helps determine relative valuations. The P/E ratio is a widely used valuation metric that helps investors assess a stock’s valuation and compare different stocks. However, it should be used along with other metrics to build a complete view of a stock’s potential value.

2. Cyclically-Adjusted Price-to-Earnings (CAPE)

The Cyclically Adjusted Price-to-Earnings ratio, or CAPE ratio, is a valuation measure that uses an inflation-adjusted average of earnings over the past 10 years to smooth out fluctuations in profitability. A high CAPE ratio suggests a stock is overvalued, while a low CAPE ratio indicates undervaluation.

CAPE Ratio = Inflation-Adjusted Stock Price / 10-Year Average Inflation-Adjusted Earnings

For example, suppose a company’s inflation-adjusted stock price is Rs.50 and its 10-year average inflation-adjusted earnings per share is Rs.5

CAPE ratio = Rs.50 / Rs.5 = 10

The CAPE ratio provides a more stable view of valuations than the traditional P/E ratio, which uses just the past year’s earnings. This helps investors identify overvalued and undervalued stocks over a full business cycle.

The CAPE ratio gives investors a broad view of valuations to make more informed investment decisions. However, it should be used along with other metrics as part of a robust analysis.

3. Average ROE CAPE

The Average ROE CAPE (Return on Equity Cyclically Adjusted Price-to-Earnings) is a valuation metric that incorporates a company’s earnings power and current share price. The higher the Average ROE CAPE, the greater the implied value of the stock. This metric allows investors to assess if a stock’s valuation properly reflects its earning power.

Average ROE CAPE = 10-Year Average ROE / CAPE Ratio

Where,

ROE = Net Income / Shareholder’s Equity

CAPE Ratio = Stock Price / 10-Year Average Earnings

For example, suppose a company’s 10-year average ROE is 15%, and its current CAPE ratio is 12.

Average ROE CAPE = 15% / 12 = 1.25

Comparing the Average ROE CAPE across companies identifies undervalued or overvalued stocks. It provides a more complete view of valuation than just CAPE alone by incorporating profitability. However, it should be used with other metrics as part of a comprehensive analysis.

4. Earnings Yield

The earnings yield is a valuation measure used to compare a company’s earnings to its stock price. A higher earnings yield indicates the stock is undervalued compared to one with a lower earnings yield. It is compared to bond yields to assess relative valuation.

Earnings Yield = Earnings Per Share / Stock Price

For example, suppose a company has an EPS of Rs.2 and its stock price is Rs.40.

Earnings yield = Rs.2 / Rs.40 = 5%

The earnings yield is the inverse of the price-to-earnings (P/E) ratio. It tells you how much earnings you are getting for each dollar invested in the stock.

The earnings yield provides a useful perspective on valuation along with other metrics. Comparing a stock’s earnings yield to historical averages or industry peers helps identify overvalued or undervalued situations. It quantifies the earnings component of the total return from owning a stock.

However, the earnings yield should not be used in isolation. It is best used as part of a holistic analysis to determine if a stock’s price properly reflects its earnings potential. Looking at earnings growth prospects and risk factors provides an important context when using the earnings yield.

5. Price/earnings-to-growth (PEG) ratio

The PEG ratio is a valuation metric used to determine a stock’s value by incorporating earnings growth into the price-to-earnings (P/E) Ratio. A lower PEG indicates a stock is undervalued, given its growth rate, while a higher PEG suggests potential overvaluation.

PEG Ratio = P/E Ratio / Projected Earnings Growth Rate

For example, suppose a company has a P/E of 20 and expected earnings growth of 10%

PEG ratio = 20 / 10 = 2

The PEG ratio provides a more complete picture of valuation than just the P/E ratio. It shows whether the P/E is justified by higher expected growth. Comparing PEG ratios identifies stocks with reasonable valuations for their growth potential.

However, the PEG ratio relies on estimated future earnings growth, which is volatile. It should be used along with other metrics as part of an overall analysis of a stock’s fair value. The PEG helps incorporate future expectations into current valuations. However, earnings projections do not always materialize as expected.

6. Justified P/E Ratio

The justified P/E ratio is a valuation approach that calculates the price-to-earnings ratio a stock should trade at based on its expected future performance.

Justified P/E = (RoE x Growth Rate) / (Long-term Interest Rates – Growth Rate)

Where,

RoE = Return on Equity

Growth Rate = Expected Earnings Growth Rate

For example, suppose a company has a 15% RoE, an expected 8% earnings growth, and a long-term interest rate of 5%.

Justified P/E = (15% x 8%) / (5% – 8%) = 24

The justified P/E uses projected earnings and growth to determine what P/E multiple is reasonable for a stock’s valuation. Comparing the current P/E to the justified P/E reveals if a stock is overvalued or undervalued.

This method accounts for earnings power, growth expectations, and interest rates. However, the inputs are forecasts which do not materialize. It should be used along with other valuation techniques as part of a robust analysis of a stock’s fair value range.

The justified P/E provides a framework for evaluating whether a stock’s valuation aligns with fundamental performance projections. But the future remains uncertain, so it is one tool among many to assess valuations.

7. Price to cashflow (P/CF) ratio

The price-to-cash flow ratio (P/CF) is a valuation metric that compares a company’s market capitalization to its total cash flow from operations. A higher P/CF ratio indicates that a stock is trading at a premium to its cash flow generation. A lower ratio suggests the stock is undervalued relative to cash flow.

P/CF Ratio = Market Capitalization / Operating Cash Flow

For example, suppose a company has a market capitalization of Rs.2 billion and Rs.400 million in cash flow from operations.

P/CF ratio = Rs.2,000,000,000 / Rs.400,000,000 = 5

The P/CF ratio provides an alternative to P/E for valuing stocks, using cash flow instead of earnings. This helps avoid distortions from non-cash expenses. Comparing P/CF ratios of similar companies identifies valuations that are out of sync with cash generation.

However, cash flow fluctuates significantly. So, the P/CF ratio should be viewed over a multi-year period rather than a single year. It should be used together with other metrics in a holistic assessment to determine if a stock is fairly valued relative to its cash flow.

8. Price to sales (P/S) ratio

The price-to-sales Ratio (P/S ratio) is a valuation metric that compares a company’s market capitalization to its total sales or Revenue. A higher P/S ratio suggests a stock is overvalued relative to its Revenue, while a lower ratio indicates potential undervaluation.

P/S Ratio = Market Capitalization / Total Revenue

For example, suppose a company has a market capitalization of Rs.5 billion and Rs.2 billion in annual Revenue.

P/S ratio = Rs.5,000,000,000 / Rs.2,000,000,000 = 2.5

The P/S ratio provides a valuation assessment using sales figures, which are harder to manipulate than earnings or cash flows. It is useful for evaluating early-stage companies that have not achieved profitability. Comparing P/S ratios helps determine if revenue growth trajectories are fairly reflected in market capitalization.

However, Revenue fluctuates significantly too. The P/S ratio should be considered over a period of years, not just one quarter or year. It should be used with care for companies in industries with wildly different profit margins. The P/S ratio is best used alongside other valuation metrics for a comprehensive analysis.

9. Price to book value (P/BV) ratio

The price-to-book value ratio (P/BV ratio) is a valuation measure used to compare a company’s market value to its book value. Book value reflects the company’s assets and liabilities as recorded on its balance sheet. A lower P/BV ratio could mean the stock is undervalued, while a higher ratio suggests overvaluation. Comparing P/BV ratios helps identify stocks trading at a discount or premium to book value.

P/BV Ratio = Market Capitalization / Book Value

For example, suppose a company has a market cap of Rs.2 billion and its book value is Rs.1 billion.

P/BV ratio = Rs.2,000,000,000 / Rs.1,000,000,000 = 2

The P/BV ratio is useful for capital-intensive industries where assets are a major factor. However, it is less meaningful for technology companies and other businesses where intangible assets make up a larger portion of value. The Ratio should be used together with other metrics as part of a complete valuation analysis.

10. EV to EBITDA

The EV to EBITDA ratio (Enterprise Value to Earnings Before Interest, Taxes, Depreciation, and Amortisation) is a valuation metric used to compare a company’s value to its earnings. A lower EV to EBITDA ratio indicates the company is undervalued. Comparing the Ratio to industry peers helps identify relatively undervalued or overvalued stocks.

Enterprise Value (EV) is calculated as market capitalization plus debt, minority interest, and preferred shares minus total cash and cash equivalents.

EBITDA measures a company’s operational profitability.

EV to EBITDA = Enterprise Value / EBITDA

For example, suppose a company has an EV of Rs.500 million and EBITDA of Rs.100 million.

EV to EBITDA ratio = Rs.500,000,000 / Rs.100,000,000 = 5

The EV to EBITDA ratio allows comparisons of value across companies with different capital structures. It provides a more complete picture than just P/E ratios. However, EBITDA has limitations, and adjustments are needed for an accurate valuation. The Ratio should be used in conjunction with other metrics for robust analysis.

11. EV to sales

The EV to Sales ratio (Enterprise Value to Sales) is a valuation metric that compares a company’s enterprise value to its total sales or Revenue. A lower EV to Sales ratio indicates a company is undervalued relative to its Revenue generating ability. Comparing the Ratio to industry peers helps identify bargain stocks.

Enterprise Value (EV) is calculated as market capitalization plus debt, minority interest, and preferred shares minus total cash and cash equivalents.

EV to Sales = Enterprise Value / Annual Sales

For example, suppose a company has an EV of Rs.5 billion and annual sales of Rs.2 billion.

EV to Sales ratio = Rs.5,000,000,000 / Rs.2,000,000,000 = 2.5

The EV-to-sales ratio provides a valuation assessment independent of the capital structure, using Revenue, which is harder to manipulate. However, Revenue cannot assess profitability. The Ratio should be used together with margins, earnings, and other metrics to perform a robust valuation analysis.

It is useful for early-stage companies not yet profitable. However, growth expectations must be considered. Overall, EV to Sales provides an additional perspective on valuation but has limitations if used alone.

12. EV/CFO

The EV/CFO ratio (Enterprise Value to Cash Flow from Operations) is a valuation metric that compares a company’s enterprise value to its cash flow from operations. A lower EV/CFO ratio indicates a company is undervalued relative to its cash flow generation. Comparing the Ratio to industry peers helps identify bargain stocks.

Enterprise value (EV) is calculated as market capitalization plus debt, preferred shares, and minority interests minus cash and cash equivalents.

Cash flow from operations (CFO) measures the cash a company generates from its normal business operations.

EV/CFO = Enterprise Value / Cash Flow from Operations

For example, suppose a company has an EV of Rs.5 billion and a CFO of Rs.1 billion.

EV/CFO ratio = Rs.5,000,000,000 / Rs.1,000,000,000 = 5

The EV/CFO ratio provides an additional valuation perspective by incorporating cash flow. However, the CFO fluctuates significantly. The Ratio should be used alongside other valuation metrics like P/E and P/B ratios to properly determine if a stock is over, under, or fairly valued.

13. EV/FCFF

The EV/FCFF ratio (Enterprise Value to Free Cash Flow to Firm) is a valuation metric that compares a company’s enterprise value to its free cash flow to the firm. A lower EV/FCFF ratio indicates a company is undervalued relative to its free cash flow generating ability. Comparing the Ratio to industry peers helps identify bargain stocks.

Enterprise value (EV) is calculated as market capitalization plus debt, preferred shares, and minority interests minus cash and cash equivalents.

Free cash flow to firms (FCFF) represents the amount of cash flow available to all providers of capital, both debt and equity.

EV/FCFF = Enterprise Value / Free Cash Flow to Firm

For example, suppose a company has an EV of Rs.5 billion and FCFF of Rs.500 million, its

EV/FCFF ratio = Rs.5,000,000,000 / Rs.500,000,000 = 10

The EV/FCFF ratio provides insight into valuation from a free cash flow perspective. However, FCFF varies significantly year-over-year. The Ratio should be used together with other metrics like P/E and P/B ratios to determine properly if a stock is over, under, or fairly valued.

14. Dividend yield

The dividend yield is a valuation metric that shows how much a company pays out in dividends each year relative to its share price. A higher dividend yield indicates a stock is undervalued, while a lower yield suggests potential overvaluation. Comparing dividend yields between stocks in the same sector helps identify valuations.

Dividend Yield = Annual Dividends per Share / Price per Share

For example, suppose a stock pays Rs.1 in dividends per share and trades at Rs.25.

Dividend yield = Rs.1 / Rs.25 = 0.04 or 4%

Dividend yield provides an easy way to value stocks based on income rather than earnings or assets. It measures the cash return being generated for shareholders. However, dividends are reduced or suspended while stock prices fluctuate widely.

The dividend yield should be used alongside other fundamental and technical analyses. It provides just one piece of the overall valuation picture. Looking at earnings payout ratios and dividend growth trajectories provides important context on the sustainability of yields.

15. Dividend payout

The dividend payout ratio is a metric that shows the percentage of earnings paid out to shareholders in dividends.

Dividend Payout Ratio = Dividends per Share / Earnings per Share

For example, suppose a company pays Rs.1 per share in dividends and has Rs.2 in earnings per share.

Payout ratio = Rs.1 / Rs.2 = 0.5 or 50%

A payout ratio of less than 1 or 100% indicates some earnings are being retained in the business. A high ratio near 100% indicates limited reinvestment in growth.

The dividend payout ratio helps assess the sustainability of dividend payments. Comparing the Ratio to industry averages determines if it is relatively high or low. Examining the payout trend over time shows the consistency of dividends.

However, the Ratio should be considered along with earnings growth rates. Fast-growing companies have lower ratios but higher dividend growth. The payout ratio provides context on how dividends align with the company’s fundamental performance.

16. Earnings per share

Earnings per share (EPS) is a metric that shows the portion of a company’s net profit that is allocated to each outstanding share of common stock. A higher EPS indicates greater value creation for shareholders on a per-share basis. Comparing EPS growth rates helps assess profit trends over time.

EPS = (Net Income – Dividends on Preferred Stock) / Average Outstanding Shares

For example, suppose a company has Rs.100 million in net income, Rs.10 million in dividends on preferred shares, and 50 million average outstanding shares.

EPS = ( Rs.100,000,000 – Rs.10,000,000) / 50,000,000 = Rs.1.80

EPS helps investors evaluate stock valuations based on earnings. The price-to-earnings (P/E) ratio uses EPS in its calculation. However, EPS does not account for dividends and share buybacks, which also provide value to shareholders.

EPS should be used together with other metrics like revenue growth, profit margins, and cash flows for a comprehensive analysis. It provides an important baseline for assessing fundamental performance and shareholder value generation. But the full picture requires a broader set of indicators.

17. Enterprise market value

Enterprise market value (EMV) is a measure of a company’s total market value, incorporating both equity and debt capital.

EMV = Market Capitalization + Value of Debt + Preferred Shares + Minority Interests – Cash and Cash Equivalents

For example, suppose a company has,

Market Capitalization = Rs.5 billion

Debt = Rs.2 billion

Preferred Shares = Rs.1 billion

Minority Interests = Rs.100 million

Cash = Rs.500 million

Enterprise market value = Rs.5 billion + Rs.2 billion + Rs.1 billion + Rs.100 million – Rs.500 million = Rs.7.6 billion

EMV provides a more comprehensive view of a company’s true market value than just its equity capitalization. It allows comparisons of value across companies with different capital structures.

However, EMV is based on market values of equity and debt, which fluctuate. It should be used together with valuation metrics like EV/EBITDA and P/E ratios to properly assess valuation. EMV provides additional context but has limitations if used alone.

18. Market Cap to Sales

The market capitalization to sales ratio compares a company’s market value to its total sales or Revenue. A higher ratio indicates the company is overvalued relative to its Revenue, while a lower ratio suggests potential undervaluation.

Market Cap to Sales Ratio = Market Capitalization / Total Revenue

For example, suppose a company has,

Market Capitalization = Rs.5 billion

Annual Revenue = Rs.2 billion

Market cap to sales ratio = Rs.5 billion / Rs.2 billion = 2.5

The market cap-to-sales ratio helps assess valuation relative to top-line sales rather than bottom-line profitability. It is useful for evaluating early-stage companies that are not yet profitable. Comparing the Ratio to industry averages and historical norms provides context.

However, Revenue does not reflect profitability or growth potential. The Ratio should be used in conjunction with other metrics like P/E ratios for a more complete valuation analysis. It provides one perspective on value but has limitations if used alone without accounting for profit margins and earnings.

What are the uses of valuation ratios?

The main use of valuation ratios in stock marketing is to assess the value of a company’s stock price compared to factors like earnings, assets, sales, and growth potential. Valuation ratios provide metrics that investors use to evaluate whether a stock is overvalued or undervalued. One of the most widely used valuation ratios is the price-to-earnings or P/E ratio. The P/E ratio compares a company’s current share price to its earnings per share. A high P/E ratio could mean a stock is overvalued, while a low P/E ratio could indicate it is undervalued. Investors compare a stock’s P/E to the overall market’s average P/E or to P/E ratios within the same industry. This helps determine if the stock is relatively expensive or cheap. The P/E ratio gives a sense of how much investors are willing to pay for the company’s earnings potential.

The price-to-book Ratio or P/B ratio is another key valuation metric. The P/B ratio compares the market value of a company’s shares to its book value or the accounting value of shareholders’ equity. A lower P/B ratio could mean a stock is undervalued compared to its fundamentals, while a higher ratio indicates it is trading at a premium. Investors analyze the P/B ratio to determine if a stock is priced fairly in relation to assets recorded on the company’s balance sheet. The P/B ratio provides a perspective on how much shareholders are theoretically paying for the company’s net assets.

Another useful valuation ratio is the price-to-sales Ratio or P/S ratio. This evaluates a company’s market capitalization in relation to its Revenue. A stock with a lower P/S ratio is considered undervalued, while a higher ratio could signal overvaluation. Investors compare P/S ratios across the same industry to identify stocks with attractive valuations relative to the Revenue they generate. The P/S ratio gives a sense of the value the market assigns to each dollar of the company’s sales or revenues.

Beyond common ratios like P/E, P/B, and P/S, some other useful valuation metrics are EV/EBITDA, which compares enterprise value to operating cash flow; price-to-FCF, showing investor sentiment about future cash generation; forward P/E, which incorporates expected earnings vs. trailing earnings; and PEG ratio, which accounts for priced-in future growth expectations. These additional ratios provide further perspectives on how a stock’s price aligns with financial performance and growth prospects.

What is an example of valuation ratio calculation?

Let us take the example of Reliance Industries Limited (RIL). RIL has continued its strong performance, with several valuation metrics seeing positive changes since earlier this year. As of October 26, 2023, RIL’s market capitalization stands at Rs. 19.36 lakh crore, higher than the Rs. 17.6 lakh crore mentioned previously. This increase reflects the company’s robust results and positive investor sentiment. For the full year ending March 31, 2023, RIL reported consolidated earnings per share (EPS) of Rs. 109.48 per share, beating the earlier stated figure of Rs. 94.76. With the updated EPS, RIL’s current price-to-earnings (P/E) ratio is approximately 22.7x compared to 26.17x mentioned earlier. While still relatively high versus its historical average of around 19x, it indicates a moderation in valuation.

RIL’s shareholders’ equity increased to Rs. 3,95,296 crore as of March 2023. This translates to a book value per share of Rs. 617, higher than estimated before. Consequently, RIL’s price-to-book (P/B) ratio is now around 4.02x versus the earlier stated 4.72x, showing a slight correction in valuation relative to net assets.

Consolidated revenues for FY2023 came in higher at Rs. 9.75 lakh crore versus the previous estimate of Rs. 7.92 lakh crore. This brings RIL’s price-to-sales (P/S) ratio to approximately 1.98x compared to 2.22x, as cited earlier, signifying a modest decrease relative to sales.

Operating cash flows were stronger for FY2023 at Rs. 1.54 lakh crore versus Rs. 1.25 lakh crore estimated previously. As a result, RIL’s price-to-cash flow (P/CF) ratio is now approximately 12.57x versus the earlier 14.1x, demonstrating an improved valuation versus cash generation.

RIL’s valuation ratios remain at premiums, but most have seen a slight moderation on the back of robust earnings, reflecting a healthier risk-reward profile for investors. Continued monitoring is prudent to evaluate the stock’s investment case.

Where can you find a company’s valuation ratios?

Strike allows users to look up key statistics and metrics for publicly traded companies. Among the metrics available on Strike are various valuation ratios that provide important indicators of a company’s stock valuation. These ratios include the price-to-earnings Ratio, price-to-book Ratio, and more, making Strike a useful tool for finding a company’s valuation ratios.

How do we compare the valuation ratios of two companies?

Tata Consultancy Services (TCS) and Infosys are two of the leading IT companies in India. As of January 2024, TCS has a price-to-earnings (P/E) ratio of 36.25, while Infosys has a P/E of 30.03. Both of these are lower than the industry average P/E of 40.66, suggesting they may be undervalued. However, TCS’s higher P/E indicates the market has greater expectations for its earnings growth going forward compared to Infosys.

In terms of price-to-book (P/B) ratio, TCS has a value of 13.07 compared to Infosys’ 7.19. This significantly higher P/B for TCS implies investors are paying more in relation to the value of its assets. It could be seen as overvalued relative to its book value. TCS also has higher price-to-sales (P/S) and price-to-cash flow (P/CF) ratios, again signaling the market’s stronger belief in its revenue and cash flow generation potential.

Both companies have EV/EBITDA ratios above industry averages, hinting at potential overvaluation based on earnings before interest, taxes, depreciation, and amortization. However, TCS offers a significantly higher dividend yield of 2.80% versus 1.16% for Infosys, making it more attractive for income-seeking investors. Infosys also has a lower debt-to-equity ratio, indicating stronger financial health. Below is a table of comparison.

| Ratio | TCS | Infosys | Interpretation |

| Price-to-earnings (P/E) | 36.25 | 30.03 | Both TCS and Infosys have P/E ratios lower than the industry average, suggesting potential value. However, TCS’s higher P/E hints at greater investor expectations for its growth. |

| Price-to-book (P/B) | 13.07 | 7.19 | TCS has a significantly higher P/B than Infosys, implying that investors value its assets more, though it might be considered overvalued compared to book value. |

| Price-to-sales (P/S) | 5.95 | 4.52 | Both companies have P/S ratios above the industry average, suggesting that investors are paying a premium for their revenue. Again, TCS has a higher ratio, indicating a greater belief in its revenue potential. |

| Price-to-cash flow (P/CF) | 27.87 | 22.29 | TCS’s higher P/CF ratio implies that investors expect it to generate more cash flow per share compared to Infosys. |

| EV/EBITDA | 21.59 | 19.43 | Both companies have EV/EBITDA ratios above the industry average, suggesting potential overvaluation based on their earnings before interest, taxes, depreciation, and amortization. |

| Dividend yield | 2.80% | 1.16% | TCS offers a significantly higher dividend yield, making it more attractive for income-oriented investors. |

What are the limitations of valuation ratios?

The limitations of valuation ratios include that they rely on historical data, ignore qualitative factors, are manipulated, might not reflect growth potential, and have less relevance for some industries. Valuation ratios like the price-to-earnings (P/E) ratio and price-to-book (P/B) Ratio are based on a company’s historical financial performance. However, past results do not guarantee future performance. A company’s profits or book value could substantially change going forward in ways that valuation ratios cannot predict. The historical P/E ratio of a stock does not necessarily dictate its future P/E trading levels.

Another major limitation is that valuation ratios ignore qualitative factors about a company. The ratios simply look at numbers without considering competitive advantages, management quality, industry trends, and other qualitative factors that affect a company’s future prospects. The two companies have similar valuation ratios but completely different qualitative outlooks. An investor relying solely on the ratios would miss these crucial qualitative distinctions.

Valuation ratios are also manipulated through financial engineering. Companies take one-time charges, delay expenditures, sell assets, and make other maneuvers to boost near-term earnings and, thus, lower P/E ratios temporarily. Similarly, buying back shares quickly boosts EPS and lower P/E without any real improvement in fundamentals. The ratios look attractive due to such maneuvers, even if the fundamentals remain weak. Savvy investors have to look below the surface ratios to determine the sustainability of earnings.

Valuation ratios say nothing about future growth potential. Two stocks have the same P/E, but one could be poised for much stronger growth and capital appreciation. Ratios look backward and do not incorporate expectations of growth. Investors have to make their own assessments of future growth prospects. Legacy ratios will not signal which companies have the best growth outlooks.

Is a valuation ratio required for financial ratio analysis?

Yes, valuation ratios are an important part of financial ratio analysis as they allow investors to assess the value of a stock by comparing metrics like share price, earnings, sales, cash flows, and dividends. They provide important insights that other financial ratios cannot. Ratios like price-to-earnings (P/E), price-to-book (P/B), and price-to-sales (P/S) incorporate share price, which is the ultimate metric of interest for shareholders. Other financial ratios, like profit margins, revenue growth, and return on equity, do not directly take into account share price or market value.

How does the valuation ratio help in fundamental analysis?

Yes, valuation ratios help in fundamental analysis by providing a quantitative measure to determine if a stock is undervalued or overvalued compared to similar companies or the overall market. Ratios like the price-to-earnings ratio (P/E), price-to-book Ratio (P/B), and price-to-sales ratio (P/S) allow investors to compare the current share price of a stock to financial metrics like earnings, book value, and sales.

A lower P/E, P/B, or P/S ratio could indicate a stock is undervalued compared to its peers. Analyzing valuation ratios over time also shows if a stock is becoming more or less expensive. Using valuation ratios as part of fundamental analysis helps investors identify stocks that are good value investments based on financial performance rather than just share price.