Profit after tax, also known as net income or net profit, is a key financial metric that companies use to measure performance and profitability. PAT refers to the total earnings remaining after deducting all expenses, taxes, and other mandatory payments from revenues generated over a period of time, usually a quarter or financial year. Calculating PAT involves determining a company’s earnings before interest and taxes (EBIT) first, which reflects profits from core business operations. From the EBIT figure, total tax expense is then deducted, which includes income tax, corporate tax, and other taxes paid. The remaining amount is the profit after tax or net profit.

PAT provides an indication of how much money a company is left with after meeting all its financial obligations. A higher PAT shows the company is more profitable and better equipped to reward shareholders through dividends or fuel future growth. This article delves into the PAT formula, calculation methodology, and factors affecting it through worked examples. It explains how PAT is derived step-by-step and where to find it disclosed in company financial statements.

What is profit after tax (PAT)?

Profit after tax (PAT), also called net income or net profit, refers to a company’s total earnings after accounting for all expenses, interest, taxes, and dividends paid. PAT is a key metric used to evaluate a company’s financial performance and profitability over a specific period of time, usually a quarter or fiscal year.

Profit after tax is calculated by taking a company’s earnings before interest and tax (EBIT) and subtracting the tax expense. EBIT is the profit earned from a company’s normal core operations, excluding any income from other sources like investments. From EBIT, tax expense is deducted to arrive at PAT. Tax expense includes all types of taxes that a company pays, including income tax, corporate tax, dividend distribution tax, etc. A higher PAT indicates greater profitability and financial health of the company.

What is the formula of PAT?

Profit after tax (PAT) is calculated by taking a company’s earnings before taxes and subtracting the total tax expense. The formula can be expressed as

PAT = Net profit before tax – Total tax expense

Where,

Net profit before tax is the company’s earnings from operations before accounting for taxes. It is calculated by taking total revenues and subtracting all operating expenses, interest, depreciation, and other non-tax expenses.

Total tax expense includes all different types of direct and indirect taxes the company must pay. This includes corporate income tax, payroll taxes, property taxes, goods and services tax, dividend distribution tax, and any other taxes levied on the company.

How do you calculate a company’s PAT?

The first step is to identify the company’s total revenues earned from all business activities during the period. This includes sales revenue from the company’s products and services, interest income, dividend income, and any other income generated from regular business operations. Non-recurring income, like profit from asset sales, is excluded.

The next step is to itemize all the operating expenses and deduct them from total revenues. Operating expenses include the costs of goods sold, employee salaries, sales and marketing costs, research and development expenses, administrative costs, and all other expenditures related to daily business operations.

In addition, non-operating expenses such as interest paid on loans and bonds, losses from foreign exchange fluctuations, expenses on corporate social responsibility activities, etc., need to be subtracted. Depreciation and amortization, which are non-cash expenses, are also deducted.

How do you know the PAT of a company?

The most direct way is to look at the company’s published financial statements, specifically the income statement or profit and loss statement. Public listed companies are mandated to publish their quarterly and annual financial statements. These statements will have a line item for profit after tax or PAT under the net profit section. Sometimes, it may be labeled as net income or net earnings as well. This shows the PAT for that reporting quarter or fiscal year.

One can also calculate the PAT oneself from the income statement figures. First, identify the company’s revenues from sales of products and services, which is the initial strike point in the calculation. Then, look at the expense items listed – costs of goods sold, employee costs, operating and administrative expenses, depreciation, etc. Deducting all these expenses from revenues gives you gross profit. The second strike in this process involves further deducting non-operating expenses like interest paid and taxes, which ultimately gives you the PAT number. Cross-check your manual calculation against the PAT figure reported to ensure accuracy. You can use Strike to know PAT of any company.

What is an example of PAT calculation?

First, we need the key financial data for the company. In this example, the company had revenue of Rs. 1,000,000 for the quarter. Its operating expenses during the same period were Rs. 750,000.

To calculate Profit Before Tax (PBT), we take the revenue and subtract the operating expenses. So, for this company, PBT would be

PBT = Revenue – Operating Expenses

PBT = Rs. 1,000,000 – Rs. 750,000

PBT = Rs. 250,000

Now, we need to factor in taxes. The income tax rate given is 30%. To calculate the income tax expense, we take the PBT and multiply it by the tax rate.

Income Tax Expense = PBT * Tax Rate

Income Tax Expense = Rs. 250,000 * 30%

Income Tax Expense = Rs. 75,000

Finally, to determine the Profit After Tax (PAT), we take the PBT and subtract the income tax expense.

PAT = PBT – Income Tax Expense

PAT = Rs. 250,000 – Rs. 75,000

PAT = Rs. 175,000

Therefore, using the financial information provided and applying the calculations, the PAT for this Indian company for the quarter works out to Rs. 175,000.

What does a positive PAT indicate?

A positive PAT shows that the company’s revenues were high enough to cover all of its expenses as well as the taxes payable on its earnings. It demonstrates that the company operated profitably during the period under review. A positive PAT means shareholders will usually receive returns in the form of dividends as the company has cash profits remaining after fulfilling its tax obligations. It also implies the company is financially solid, as it was able to generate profits even after accounting for all pre-tax expenses and post-tax taxation impact.

Can PAT be negative?

Yes, a company’s profit after tax or PAT figure can be negative, indicating a loss instead of a profit. This happens when a company’s operating expenses and cost of goods sold exceed its revenues earned from sales and other operating activities. Operating losses at the EBIT (earnings before interest and tax) level flow through to negative PAT.

What is a good PAT?

The PAT margin or PAT as a percentage of total revenues reflects operational efficiency. PAT margins above 10% are considered financially healthy. Companies in sectors like technology, pharmaceuticals, and consumer products strive for PAT margins of over 20%.

PAT accounts for all tax liabilities. Optimally minimizing tax expenses through careful tax planning improves net earnings. PAT that is reduced significantly by taxes signals the scope to manage tax expenses better. Return on equity (ROE) measures the return PAT generates on shareholders’ equity. ROE of over 15% is desirable. Higher ROE indicates capital efficiency in converting shareholders’ investments into profits.

What are the factors influencing PAT?

One of the most significant influences is the level of revenues or sales that the business generates from its operations during an accounting period. Higher revenues provide more funds available to cover costs and expenses, thereby positively impacting the PAT. On the other hand, the various costs incurred, like the cost of goods sold, wages, rent, utilities, etc., work to reduce the PAT figure. Another important determinant is the applicable corporate tax rates as determined by the country or state in which the company is domiciled.

Higher tax rates mean more taxes are to be paid from pre-tax profits, lowering the post-tax PAT. Depreciation expenses, subsidies or incentives from governments, any exceptional one-time gains or losses, and foreign exchange fluctuations affecting overseas tax liabilities can also influence the final PAT value reported. Even accounting policies around items like inventory valuation methods and periods for depreciation of fixed assets have some role to play.

Why is PAT important?

Profit after tax is important because it indicates how much money is left for the company’s owners or shareholders after meeting all expenses. A healthy PAT shows that the business is financially stable and profitable. It demonstrates the company’s ability to generate returns for investors even after paying taxes to the government. Knowledge of a firm’s PAT allows shareholders and analysts to calculate important metrics like earnings per share and returns.

It helps assess the business performance and compare it with competitors in the industry. Higher PAT also provides scope for growth through reinvestment of profits in new opportunities or repayment of debts. It lets owners draw bonuses or dividends from the remaining earnings. Positive PAT encourages existing investors to hold shares and attracts new ones, which reduces the company’s capital cost. During mergers and acquisitions as well, PAT is an important criterion considered by buyers.

What are the limitations of PAT?

The main five limitations of PAT include that it does not account for non-cash expenses, Inflationary gains/losses, one-time losses or gains, capital expenditures, and sustainability. PAT does not consider non-cash expenses like depreciation, which are deducted from pre-tax profits but do not immediately affect profitability. It also fails to recognize the effects of inflation, where rising costs may reduce real profits over time.

Exceptional one-time losses or gains in a period may distort PAT, not reflecting actual performance. PAT excludes cash outflows for capital expenditures which are needed to maintain operations. Finally, past PAT figures may not be reliable indicators of future sustainability as the business environment constantly changes. Other key limitations are that PAT is subject to accounting policies and tax planning strategies, which reduce its comparability. Figures can also be manipulated using provisions or reserves. PAT also does not provide insights into operational efficiencies and cash flows.

Why does profit decrease after tax?

Profit decreases after tax because companies are required to pay income taxes on their earnings. The applicable corporate tax rate is levied on the taxable income or profit of a business before accounting for taxes. Based on the slab, a portion of the pre-tax profits get paid out as taxes to tax authorities. Hence, whatever the gross profit amount before taxes, it is reduced after deducting the tax outgo. The tax expense shows up separately on the income statement to arrive at the net income or profit after tax.

Higher tax rates imply more taxes are to be paid, therefore leaving less profits for the company’s use. Additionally, deferred tax accounting for timing differences between book profits and taxable profits also impacts the post-tax net amount. Any changes in tax slabs and policies across jurisdictions further influence the reduction in profits once tax outflows are deducted.

Is PAT the same as net profit?

No. PAT specifically refers to profit after tax, directly capturing the company’s tax obligation and its impact on final profits. Net profit is a broader term denoting overall profitability after expenses. Net profit may exclude tax expense if it is calculated below the tax line.

However, in most cases, the terms PAT and net profit are used interchangeably. A company’s PAT is equal to its net earnings after tax. The net profit figure reported in financial statements is the PAT or net income after tax.

What is the PAT margin?

The profit after tax (PAT) margin measures a company’s net profit as a percentage of its total revenue. It is calculated by dividing net income by total revenue.

A high PAT margin indicates a company is efficiently converting revenue into bottom-line profits. It is an important metric to assess profitability. Companies aim to maximize their PAT margins over time through solid execution.

There are a few key drivers of PAT margin. First, pricing power allows companies to charge higher prices relative to costs, expanding the PAT margin. Second, operating leverage means fixed costs are spread over higher revenue as sales grow. This improves the PAT margin at higher volumes. Third, disciplined cost management keeps expenses in check as revenue rises. Fourth, economies of scale let large firms spread fixed costs widely, improving margins. Finally, efficient working capital means more revenue is converted into cash earnings and PAT.

How does PAT help in fundamental analysis?

Profit after tax (PAT) is a key metric that provides insights into a company’s profitability and helps guide fundamental analysis.

Analyzing the trend in PAT over recent years reveals the earnings growth trajectory of a company. Rising PAT indicates the company is fundamentally sound and expanding profits through solid execution. However, PAT may fluctuate year-to-year based on business cycles or one-time gains/losses. It is important to distinguish between temporary blips versus permanent shifts in profitability. A consistently rising PAT trend signals strong business fundamentals.

Examining PAT as a percentage of revenues (the PAT margin) gauges a company’s profitability per dollar of sales, a crucial aspect of fundamental analysis. Fundamental analysis involves comparing PAT margins over time and against industry peers to measure relative operating efficiency. Expanding PAT margins implies the company is improving profitability drivers like pricing power, cost control, economies of scale, and working capital management, which are key focus areas in fundamental analysis. Conversely, eroding PAT margins suggest challenges in defending pricing, managing costs, or creating operating leverage, indicating areas of concern identified through fundamental analysis.

Is PAT a financial ratio?

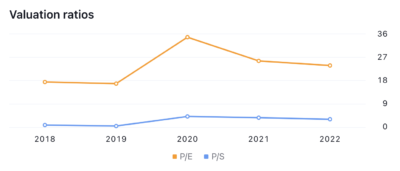

No. Profit after tax (PAT) is not a financial ratio but rather an absolute financial metric measuring a company’s bottom-line net income. However, PAT is used to construct several useful financial ratios that evaluate profitability, margins, earnings quality, and valuation.

Financial ratios make it easier to compare companies of different sizes. They standardize metrics like profit using percentages or rates. PAT itself is not a ratio or rate – it is the raw profit number reported on a company’s income statement. However, incorporating PAT into key ratios provides helpful insights.