Nasdaq FintechZoom is a financial platform that provides real-time market data, news, and analysis, specifically focusing on the Nasdaq stock market. It serves as a comprehensive resource for investors, traders, and financial professionals who need up-to-date information on Nasdaq-listed companies and their performance. Through its advanced tools, Nasdaq FintechZoom helps users track stock prices, market trends, and economic indicators, enabling them to make informed decisions. The platform is particularly useful for those looking to dive deeper into Nasdaq stocks, offering detailed insights into trading volumes, historical data, and forecasts.

Nasdaq FintechZoom integrates fintech innovations such as AI-powered analytics and blockchain technology to enhance the user experience. By leveraging these cutting-edge tools, the platform provides a more streamlined, accurate, and efficient way of analyzing market movements. Its ability to offer both novice and experienced investors valuable insights into the Nasdaq market makes it a go-to platform for anyone involved in the stock market. Whether you are looking for the latest financial news or developing investment strategies, Nasdaq FintechZoom is positioned as a critical resource for understanding and navigating the complex world of Nasdaq trading.

Table of Contents

What is Nasdaq FintechZoom?

Nasdaq FintechZoom is an online financial platform dedicated to providing comprehensive insights into the Nasdaq stock market. It serves as a one-stop solution for investors and traders looking to access real-time market data, stock analysis, and news specific to Nasdaq-listed companies. With its user-friendly interface, Nasdaq FintechZoom allows individuals to track stock performance, identify key market trends, and make informed investment decisions. The platform covers a wide range of financial information, including stock prices, market indices, and trading volumes, which are essential for both novice and seasoned investors who focus on the Nasdaq market.

One of the standout features of Nasdaq FintechZoom is its integration of advanced financial technologies (fintech), such as artificial intelligence (AI) and machine learning algorithms. These innovations enable users to analyze vast amounts of financial data quickly and accurately. Nasdaq FintechZoom also offers tools that provide predictive analysis and financial forecasting, helping investors anticipate market shifts and optimize their portfolios. Additionally, the platform delivers up-to-the-minute news and updates about Nasdaq stocks, keeping users informed of any developments that could impact the market.

Nasdaq FintechZoom offers an educational aspect, providing resources and tutorials for users who want to enhance their financial knowledge and trading skills. Whether you’re a day trader looking for quick insights or a long-term investor interested in Nasdaq-listed companies’ performance, Nasdaq FintechZoom equips you with the tools and information needed to succeed in the dynamic world of stock trading. Its focus on innovation and accurate reporting has made it a trusted name among financial platforms specializing in the Nasdaq stock market.

How does Nasdaq FintechZoom track market trends?

Nasdaq FintechZoom tracks market trends by leveraging real-time data analytics and advanced financial technologies to monitor shifts in stock prices, trading volumes, and overall market performance on the Nasdaq exchange. The platform continuously collects and updates data from a variety of financial sources, including Nasdaq-listed companies, economic reports, and global market activities. This allows Nasdaq FintechZoom to provide users with up-to-the-minute information on market movements, making it a valuable resource for investors looking to identify short-term fluctuations and long-term trends in the Nasdaq market.

One of the key methods used by Nasdaq FintechZoom to track market trends is through its AI-driven analytics and machine learning tools. These technologies analyze historical market data and current market conditions to generate predictive models. By identifying patterns and correlations, Nasdaq FintechZoom can forecast potential market shifts and alert users to emerging trends. These insights are particularly useful for traders looking to capitalize on short-term opportunities, as well as long-term investors who need to adjust their strategies based on anticipated market developments.

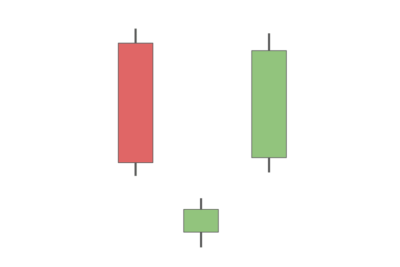

Nasdaq FintechZoom provides users with customizable charts, graphs, and dashboards that visually represent market trends. These tools enable investors to track the performance of specific Nasdaq stocks, sectors, or the overall index, allowing them to make data-driven decisions. The platform also offers news and expert commentary on market conditions, helping users stay informed about economic events, company earnings reports, and other factors that could influence Nasdaq trends. By combining real-time data with sophisticated analytics, Nasdaq FintechZoom ensures that its users are well-equipped to navigate the ever-changing landscape of the stock market.

Key Nasdaq stocks on FintechZoom?

Nasdaq FintechZoom highlights a range of key Nasdaq stocks that are essential for investors to monitor, providing detailed data and insights on some of the largest and most influential companies listed on the Nasdaq exchange. These stocks typically belong to the technology, healthcare, and consumer services sectors, which dominate the Nasdaq market. Tech giants like Apple (AAPL), Microsoft (MSFT), and Amazon (AMZN) are often featured prominently on Nasdaq FintechZoom, as they significantly impact overall market performance. Investors rely on the platform to track these companies’ stock movements, analyze their earnings reports, and stay updated on the latest developments affecting their market value.

Nasdaq FintechZoom also focuses on emerging companies and high-growth stocks within the Nasdaq. This includes companies in sectors such as biotech, electric vehicles, and financial technology (fintech). Stocks like Tesla (TSLA) and PayPal (PYPL) are often among the most watched due to their volatility and growth potential. Nasdaq FintechZoom provides real-time updates and expert analysis on these companies, helping investors identify opportunities for both short-term gains and long-term investments.

Nasdaq FintechZoom offers investors comprehensive information about Nasdaq’s most influential indices, such as the Nasdaq-100 and the Composite Index. These indices track the performance of the top 100 non-financial companies on the Nasdaq exchange, many of which are frequently analyzed on the platform. Investors can use Nasdaq FintechZoom to assess how individual stocks contribute to the broader market trends and make informed decisions based on index movements. By covering both established market leaders and emerging growth stocks, Nasdaq FintechZoom ensures its users have a complete picture of the key players driving the Nasdaq market.

Nasdaq FintechZoom real-time data features?

Nasdaq FintechZoom offers a suite of real-time data features that provide investors with up-to-the-minute information on the performance of Nasdaq-listed stocks. One of the platform’s standout features is its live stock price tracking, which allows users to see price fluctuations as they happen. This real-time tracking is critical for traders and investors who need to react quickly to market changes, particularly during periods of high volatility. Nasdaq FintechZoom’s data feed is constantly updated, ensuring that users have access to the most current stock prices, market indices, and trading volumes.

Nasdaq FintechZoom provides real-time charts and technical indicators that help users visualize market trends and analyze stock movements. These charts can be customized to display different timeframes, from intraday trading to long-term trends, enabling investors to make informed decisions based on their specific investment strategies. The platform’s technical indicators, such as moving averages and relative strength index (RSI), offer deeper insights into market conditions, helping investors identify potential buy or sell signals. This combination of real-time data and advanced analysis tools makes Nasdaq FintechZoom a powerful resource for tracking the Nasdaq market.

Another key aspect of Nasdaq FintechZoom’s real-time data features is its live news updates and market alerts. The platform curates financial news from trusted sources and delivers it to users in real-time, ensuring they are informed about any events that could impact Nasdaq stocks. From earnings reports and mergers to global economic news, these updates allow investors to stay ahead of the market. Additionally, users can set up personalized alerts for specific stocks or market conditions, receiving notifications when key thresholds are met, such as price changes or trading volume spikes. This real-time data integration helps investors act swiftly and confidently in a fast-paced market environment.

How to analyze Nasdaq using FintechZoom?

To effectively analyze Nasdaq using Nasdaq FintechZoom, the platform provides users with an array of data and tools that allow for in-depth stock analysis. The first step in analyzing Nasdaq on FintechZoom is to utilize the real-time stock price tracking feature. This enables investors to monitor the current prices of Nasdaq-listed stocks and observe their fluctuations throughout the trading day. By analyzing these price movements, traders can identify patterns or trends that might indicate potential buying or selling opportunities. Additionally, Nasdaq FintechZoom offers historical data that can help investors compare current performance with past trends, which is critical for long-term analysis.

Another powerful tool for analyzing Nasdaq on Nasdaq FintechZoom is the platform’s technical analysis features. FintechZoom provides users with customizable charts and indicators such as moving averages, Bollinger Bands, and relative strength index (RSI). These technical tools help investors assess the momentum, volatility, and strength of Nasdaq stocks. For instance, the moving averages can be used to spot trends, while the RSI can help determine whether a stock is overbought or oversold. By combining these indicators, investors can develop a well-rounded analysis of individual stocks or the broader Nasdaq market, making it easier to execute data-driven trades.

Nasdaq FintechZoom also offers real-time news updates and expert insights that are crucial for fundamental analysis. Investors can access financial reports, earnings announcements, and news on key market events, such as mergers or regulatory changes. This fundamental analysis helps investors understand the broader context influencing Nasdaq stocks, beyond price movements. FintechZoom’s combination of real-time data, technical analysis tools, and fundamental insights makes it an invaluable platform for thoroughly analyzing the Nasdaq market and making informed investment decisions.

Latest Nasdaq market news on FintechZoom?

Nasdaq FintechZoom is a reliable platform for accessing the latest Nasdaq market news, offering real-time updates that keep investors informed of key events and developments. One of the primary features of the platform is its news feed, which aggregates financial news from credible sources worldwide. This includes updates on corporate earnings, mergers and acquisitions, regulatory changes, and economic reports that affect Nasdaq-listed companies. Whether it’s a major tech giant like Apple announcing its quarterly earnings or news of a sudden market correction, Nasdaq FintechZoom ensures that users are promptly informed of the most relevant market events.

Nasdaq FintechZoom also provides detailed analysis and expert commentary on how these developments impact the Nasdaq market. For instance, when a significant event such as an interest rate hike or global economic uncertainty arises, FintechZoom offers expert insights into how these factors may influence the performance of Nasdaq-listed stocks. This analysis helps investors understand the broader implications of market news and adjust their investment strategies accordingly. FintechZoom’s ability to provide not only real-time updates but also in-depth analysis makes it a critical tool for investors aiming to stay ahead in a fast-paced financial environment.

Nasdaq FintechZoom allows users to personalize their news feed to focus on specific sectors or stocks they are interested in. Investors can set up alerts for specific companies or industries, ensuring they receive timely notifications about any news that could impact their portfolios. This feature is particularly valuable for active traders who need to respond quickly to market movements. By providing a combination of real-time news, expert insights, and customizable alerts, Nasdaq FintechZoom ensures that its users are well-equipped to navigate the constantly evolving Nasdaq market.

Nasdaq FintechZoom investment strategies?

Nasdaq FintechZoom provides investors with a variety of tools and data that can be leveraged to create effective investment strategies tailored to the dynamic nature of the Nasdaq market. One of the most important aspects of building a strategy on FintechZoom is using its real-time data features to track stock performance and market trends. Investors can monitor Nasdaq-listed companies in real-time, identifying patterns and potential entry or exit points. Whether it’s a short-term trading strategy based on daily price fluctuations or a long-term investment approach focused on growth stocks, Nasdaq FintechZoom offers the data necessary to make informed decisions.

Another key element in developing Nasdaq FintechZoom investment strategies is the platform’s advanced technical analysis tools. FintechZoom offers a range of technical indicators, such as moving averages, support and resistance levels, and relative strength index (RSI), which are crucial for timing trades and identifying market trends. For example, traders can use these indicators to spot breakouts or reversals in stock prices, allowing them to capitalize on short-term opportunities. Long-term investors can also benefit by using these tools to confirm trends and avoid market noise, enabling a more strategic approach to managing their Nasdaq portfolios.

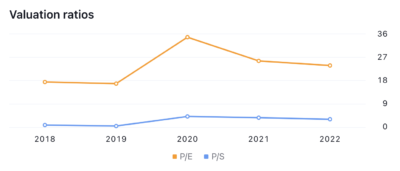

Nasdaq FintechZoom supports fundamental analysis, which is critical for investors who focus on the long-term potential of companies. The platform provides access to financial statements, earnings reports, and key financial metrics that allow investors to evaluate the intrinsic value of Nasdaq stocks. By combining this fundamental data with real-time market news and trends, investors can create a balanced investment strategy that takes into account both market conditions and company performance. FintechZoom’s comprehensive approach, which integrates both technical and fundamental analysis, makes it an ideal platform for developing well-rounded Nasdaq investment strategies.

Is Nasdaq FintechZoom reliable for stock analysis?

Nasdaq FintechZoom is widely regarded as a reliable platform for stock analysis, particularly for investors focusing on the Nasdaq market. One of the key reasons for its reliability is the platform’s real-time data feed, which provides accurate and up-to-the-minute information on stock prices, market trends, and trading volumes. This real-time access is crucial for traders and investors who need to make quick, data-driven decisions. Whether tracking short-term price movements or analyzing longer-term trends, Nasdaq FintechZoom ensures that users have the most current and reliable data to guide their stock analysis.

Another factor that contributes to the reliability of Nasdaq FintechZoom is its array of advanced analytical tools. The platform offers a comprehensive suite of technical indicators, such as moving averages, Bollinger Bands, and relative strength index (RSI), which help investors analyze market patterns and forecast stock movements. These tools are essential for identifying potential entry and exit points in trades, as well as for understanding the overall momentum of Nasdaq-listed stocks. Additionally, Nasdaq FintechZoom allows users to customize their charts and analysis settings, providing flexibility and precision in stock analysis.

Nasdaq FintechZoom enhances reliability through its integration of financial news and expert commentary. By offering real-time updates on earnings reports, mergers, and other market events, the platform ensures that users stay informed of any developments that could impact stock prices. The combination of real-time data, advanced technical tools, and expert insights makes Nasdaq FintechZoom a trusted resource for investors looking to perform thorough and accurate stock analysis. Whether you’re a day trader or a long-term investor, Nasdaq FintechZoom provides the depth and reliability needed for effective stock analysis.

Nasdaq FintechZoom tools for investors?

Nasdaq FintechZoom offers a variety of powerful tools designed to support investors in making informed decisions within the dynamic Nasdaq market. One of the most essential tools is the platform’s real-time stock tracking feature, which provides live updates on stock prices, trading volumes, and market trends. Investors can monitor these movements throughout the trading day, allowing them to quickly react to changes in the market. This feature is especially valuable for day traders who need precise, up-to-the-minute information to execute their trades effectively. In addition, historical data is available to help investors analyze past trends and compare them with current market conditions.

Another key set of tools on Nasdaq FintechZoom includes its customizable charts and technical analysis indicators. These charts allow investors to visualize stock performance over various timeframes, from intraday data to long-term trends. With technical indicators such as moving averages, Bollinger Bands, and relative strength index (RSI), investors can conduct a thorough technical analysis to identify patterns and potential buy or sell signals. These tools are critical for both short-term traders seeking quick profits and long-term investors looking to identify trends and make strategic decisions based on deeper market insights.

Nasdaq FintechZoom equips investors with personalized alerts and news updates, keeping them informed of market developments in real-time. Investors can set specific criteria for their alerts, such as stock price changes or news related to certain companies, allowing them to stay ahead of market shifts. This feature is complemented by FintechZoom’s real-time news feed, which provides expert analysis and financial reports on Nasdaq-listed companies. Together, these tools empower investors with the knowledge and insights they need to make data-driven decisions, manage their portfolios effectively, and capitalize on market opportunities.

How does Nasdaq FintechZoom help manage risks?

Nasdaq FintechZoom helps investors manage risks by providing real-time data and analytical tools that allow for timely decision-making and comprehensive risk assessment. One of the key features that support risk management is the platform’s live market updates, which offer real-time stock prices, trading volumes, and market movements. This enables investors to closely monitor their investments and quickly react to any sudden changes in market conditions. By having access to up-to-the-minute data, investors can minimize the risk of being caught off-guard by volatile market shifts, particularly in the fast-moving Nasdaq market.

Nasdaq FintechZoom provides advanced technical analysis tools that help investors identify potential risk factors in their investments. With indicators like moving averages, relative strength index (RSI), and Bollinger Bands, investors can analyze trends and market signals to gauge stock volatility and predict price movements. These tools allow users to spot patterns of instability or overbought/oversold conditions, which can be early warnings of increased risk. By applying these technical tools, investors can make more informed decisions about when to enter or exit positions, reducing exposure to unnecessary risks.

Nasdaq FintechZoom supports risk management through personalized alerts and financial news updates. Investors can set custom alerts for specific stocks or market conditions, ensuring they are immediately notified of any significant changes that might pose risks to their portfolio. For example, alerts can be triggered when a stock reaches a certain price or experiences a sharp change in volume, prompting the investor to take action. Coupled with timely financial news updates, these alerts provide a proactive approach to risk management, allowing investors to stay ahead of market developments and mitigate potential losses before they escalate.

Emerging technologies on Nasdaq FintechZoom?

Nasdaq FintechZoom is at the forefront of integrating emerging technologies to enhance its stock market analysis and data capabilities. One of the most prominent technologies employed on the platform is artificial intelligence (AI). By leveraging AI, Nasdaq FintechZoom can process vast amounts of real-time and historical data to generate predictive insights and detect patterns that would otherwise be difficult for investors to identify manually. AI-driven tools allow the platform to provide accurate forecasts on stock price movements, helping investors make informed decisions based on data-backed predictions. This technology enables users to stay ahead of market trends and capitalize on potential opportunities.

Another cutting-edge technology featured on Nasdaq FintechZoom is blockchain, which is increasingly being used for secure and transparent financial transactions. Blockchain technology enhances the trustworthiness of Nasdaq FintechZoom’s data by ensuring that market information is immutable and tamper-proof. In addition, blockchain’s decentralized nature makes it easier for the platform to support fintech innovations, particularly in areas such as digital assets and cryptocurrency tracking. As more Nasdaq-listed companies explore blockchain-based solutions, Nasdaq FintechZoom ensures that investors have access to the latest insights into this evolving technology and its impact on stock performance.

Machine learning is another emerging technology utilized by Nasdaq FintechZoom to refine its data analysis and improve user experience. Through machine learning algorithms, the platform continuously learns from user interactions and market data to optimize its recommendations and stock insights. This technology allows Nasdaq FintechZoom to deliver more personalized content and alerts, tailored to each investor’s preferences and trading patterns. With machine learning, the platform can also improve the accuracy of its market predictions over time, making it an indispensable tool for investors who rely on cutting-edge technology to manage their portfolios in a rapidly changing market.

Nasdaq FintechZoom predictions for market trends?

Nasdaq FintechZoom provides valuable predictions for market trends by utilizing advanced data analytics, AI-driven tools, and historical market data. The platform continuously monitors real-time stock movements, economic indicators, and market sentiment to generate forecasts that help investors anticipate shifts in the Nasdaq market. These predictions are particularly beneficial for short-term traders who need to respond quickly to price fluctuations, as well as long-term investors looking to adjust their portfolios based on anticipated trends. Nasdaq FintechZoom’s ability to deliver accurate market predictions makes it a vital resource for those looking to stay ahead of market changes.

Nasdaq FintechZoom uses machine learning algorithms to identify patterns and correlations in historical market data. These algorithms learn from past market behaviors to predict future performance, allowing the platform to provide insights into how current events might influence stock movements. For instance, by analyzing previous earnings reports and how they impacted stock prices, FintechZoom can offer predictions on how similar future reports may affect Nasdaq stocks. This predictive capability is essential for investors seeking to position themselves strategically ahead of major market events.

Nasdaq FintechZoom leverages macroeconomic data and global financial trends to provide broader predictions about the direction of the Nasdaq market. The platform tracks key economic indicators such as interest rates, inflation, and geopolitical events, all of which can have a significant impact on stock performance. By integrating this data with its market analysis tools, FintechZoom offers a comprehensive view of potential market trends, helping investors navigate both opportunities and risks. Whether predicting a market rally or warning of potential volatility, Nasdaq FintechZoom equips investors with the foresight they need to make informed investment decisions.