Operating ratio is a financial metric that provides insights into a company’s operational efficiency and profitability. The operating Ratio measures how much of each rupee of a company’s revenues is spent on operating expenses. A lower operating ratio indicates a company is more efficient at converting sales into profits.

The operating Ratio is calculated by dividing total operating expenses by net sales or revenues. Operating expenses include cost of goods sold, selling, general and administrative costs, depreciation, and other operating costs. An operating ratio of less than 100% means the company is generating operating profits, while a ratio above 100% indicates operating losses.

Analysts use trends in a company’s operating Ratio over multiple years to evaluate how well management is controlling costs as revenues grow. They also compare ratios to industry benchmarks to assess relative efficiency. A consistently low or declining operating ratio signals a company is becoming more profitable through improved cost management. This article will explore how the operating Ratio is calculated and analyzed and what it reveals about a company’s financial performance.

What is the operating Ratio?

Operating ratio is an important financial metric used to evaluate the efficiency and profitability of a company. The operating Ratio measures how much it costs a company to generate each rupee of revenue.

The operating Ratio is calculated by dividing operating expenses by net sales or revenue. Operating expenses include the cost of goods sold, selling, general and administrative expenses, depreciation, and other operating expenditures. The lower the Ratio, the better it is for the company, as it indicates the company is spending less to generate each rupee of revenue.

An operating ratio of less than 1.0 means the company is generating an operating profit, while a ratio higher than 1.0 means the company is operating at a loss. An organization’s operational Ratio, for instance, would be 0.80 (Rs. 80 million / Rs. 100 million) if its income was Rs. 100 million and its operating costs were Rs. 80 million. This indicates that for every Rs. 1 of revenue, the company spends Rs. 0.80 in operating costs and earns Rs. 0.20 in operating profit.

Analysts use operating ratios to evaluate and compare the operational efficiency and profitability of companies within the same industry. The operating Ratio provides insights into how well a company manages costs and utilizes its resources to generate profits.

A consistently low or declining operating ratio indicates a company is becoming more efficient at controlling expenses and generating profits from its operations. This reflects positively on management’s ability to run the business efficiently and usually leads to a higher stock valuation. On the other hand, a high or increasing operating ratio suggests inefficient operations and excessive spending, which raises concerns over the company’s profitability.

It is crucial to compare businesses within the same industry when utilizing operating ratios because permissible ratios might differ significantly between industries. For example, grocery stores typically have low margins and high operating ratios, while software companies have higher margins and lower operating ratios. Comparing the operating ratios of companies in different sectors does not provide an accurate benchmark.

As with any financial metric, the operating Ratio has limitations. It relies on the accuracy of a company’s financial reporting, and variations in accounting methods distort comparisons between firms. Business factors like economies of scale or regulatory costs that are outside management’s control also influence the Ratio. Despite these limitations, analyzing trends in operating ratios remains a quick and useful way for stock investors to gauge a company’s operational efficiency and management effectiveness over time.

What are the uses of operating ratios?

The key ways operating ratios are used by stock analysts and investors include assessing profitability, measuring efficiency, estimation valuation, assessing management performance, identifying issues, etc.

One of the most basic uses of the operating Ratio is gauging profitability. By dividing operating expenses by revenue, the Ratio quantifies what proportion of revenue is left over after operating costs are covered. A low ratio indicates a high-margin business with room to pay expenses like interest and taxes and still deliver profits. A high ratio suggests thin margins and less profitability. Comparing operating ratios over time shows if margins are expanding or shrinking.

By tracking operating expenses as a percentage of revenue, operating ratios provide a sense of how efficiently a company is running its business. Declining operating ratios indicate improving efficiency, while increases suggest inefficiencies or waste. Comparing operating ratios to industry benchmarks also measures efficiency relative to peers.

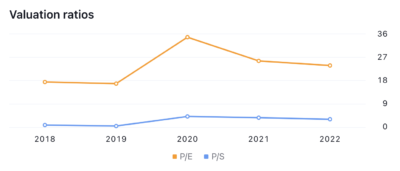

Trends in operating ratio factor into valuation models like discounted cash flow analysis. Forecasting future cash flows requires reasonable assumptions for expenses and margins. The operating Ratio provides a baseline for projecting operating costs and, ultimately, net profit. Stable and improving ratios support higher valuations.

Since the operating Ratio reflects operational decisions under management’s control, it serves as a scorecard for management execution. Skillful managers find ways to smoothly run operations, while inept managers allow expenses to balloon. Steady or declining operating ratios signal capable management.

Special items or one-time events that cause sudden changes in operating Ratio reveal issues like production bottlenecks, supply chain problems, lawsuits, or restructuring costs. Investors must dig deeper to understand inflections in the operating ratio trendline.

Dividing operating expenses by assets rather than revenue measures capital intensity or how efficiently a firm uses assets to drive revenue. Comparisons to peers show capital utilization relative to competitors. High capital intensity implies wasted resources.

Expectations for future stock performance are based on previous trends and predicted changes since the operating Ratio affects profitability, efficiency, and management perception. An improving ratio outlook supports a bullish stock view, while a deteriorating outlook translates to weaker expectations.

Operating ratios are commonly used as a screening factor when searching for stock prospects. An investor might screen for stocks with operating ratios below 1.0 or that have improved by a certain percentage in the past year. The goal is to surface companies with metrics suggesting upside potential.

Prudent investors will examine operational ratios in-depth when investigating a stock investment. The goal is to understand the business dynamics driving the Ratio and gain confidence that current trends are sustained. This helps assess downside risk.

For conglomerates, calculating operating ratios for individual business segments provides deeper insight than just looking at consolidated figures. The ratios highlight which divisions are generating strong margins and which are underperforming.

Operating ratios indicate how strategic moves like acquisitions, expansions, marketing initiatives, and product introductions affect efficiency. Analysts look for ratios returning to normalized levels after initial impacts subside.

Multi-period trends in operating ratios help determine ideal investment entry and exit points. For example, an elevated ratio sometimes signals a stock is overvalued and set to decline, prompting an investor to delay purchase.

Lenders analyze operating ratios to gauge risk. High or unstable ratios raise doubts over a company’s ability to repay loans with operating income. This influences interest rates and debt limits granted to borrowers.

What is the formula for operating ratios?

The operating Ratio is calculated by dividing a company’s operating expenses by its net sales or revenue over a specified time period. The formula is expressed as stated below.

Operating Ratio = Operating Expenses / Net Sales (or Revenue)

Operating ratios are calculated for different periods of time – annually, quarterly, monthly, or trailing twelve months. Analysts look at operating ratios over several time periods to spot trends. Comparing current ratios to historical norms also offers perspective on how efficiently the company is running. Using consistent time periods, such as the last twelve months, allows for reliable apples-to-apples comparisons.

The denominator should be a company’s net sales or revenue over the defined time interval. This represents the total top-line sales or revenue after adjustments for returns, discounts, and allowances. Gross sales or revenue before adjustments would distort the Ratio. Net sales captures the true volume of goods and services sold to customers.

The numerator of the operating Ratio consists of all the expenses tied directly to a company’s core business operations during the period being measured, including the cost of goods sold (direct costs like labor and materials), selling, general and administrative expenses (SG&A) like salaries and marketing, depreciation and amortization (allocation of capital asset costs), and other expenditures such as insurance, supplies, repairs, and maintenance. One-time or non-operating expenses like interest, taxes, and extraordinary items are excluded to isolate the normal recurring costs of running the business.

What are the components of the operating Ratio?

The components of the operating Ratio used in the stock market analysis are operating expenses like accounting, marketing, and wage costs and cost of goods sold like materials, labor, and production facility expenses divided by net sales revenue.

Operating expenses

Operating expenses, as a component of operating ratios used to evaluate a company’s efficiency and performance, represent the necessary day-to-day costs of running the business that drive revenue generation but are distinct from capital expenditures.

Accounting and legal fees

Accounting and legal fees, though necessary operational costs, reduce operating profit margins and overall profitability ratios that stock market analysts examine when evaluating a company’s financial health and value.

Bank charges

Bank service fees and interest expenses, viewed through the lens of operating ratios, diminish working capital available for core business operations and weigh on a company’s expense management efficiency as scrutinized by stock market investors.

Sales and marketing costs

Expenditures on salesforce payroll, advertising, and promotions, while vital for revenue generation, depress operating margins and return-on-sales ratios that stock market analysts weigh when judging a company’s sales execution and market growth prospects.

Non-capitalized research and development expenses

Non-capitalized research and development spending, viewed through operating ratios, represents an operating expense that squeezes margins but sometimes boosts future competitiveness, a dynamic stock market investor’s balance when evaluating a company’s innovation pipeline, and intangible assets.

Office supply costs

Office supply expenses, while essential for business operations, diminish operating profitability ratios weighed by stock market analysts judging a company’s expense discipline and working capital management.

Rent and utility expenses

Rent and utility costs, though basic operating necessities, depress return on assets and other profitability ratios weighed by stock market investors evaluating a company’s expense control and facility efficiency.

Repair and maintenance costs

Repair and maintenance expenses, while often critical to sustaining operations, reduce operating margins and asset turnover ratios that stock market analysts factor when gauging a company’s expense discipline and capital stewardship.

Salary and wage expenses

Labor costs consume operating budgets and depress profitability ratios weighed by stock market investors, yet sometimes also reflect investments in talent crucial for execution that boost revenues evaluated through operating metrics.

Cost of goods sold

The cost of goods sold, representing the direct costs attributable to the production of goods sold by a company, is a key figure that impacts gross profit margin and other operating ratios used by stock market analysts to assess the financial performance and profitability of manufacturing and retail companies.

Direct material costs

Direct material costs, the costs of raw materials or components that are easily traced to individual units of output, are an important component of the cost of goods sold that affects gross margin and operating ratios, which stock market analysts examine to evaluate the profitability and valuation of manufacturing companies.

Direct labour

Direct labor refers to workers directly involved in producing a company’s goods or services, whose wages are closely watched by analysts to gauge impacts on operating ratios and stock prices.

Rent of the plant or production facility

The cost of leasing manufacturing plants or production facilities affects operating ratios like the operating expense ratio, and analysts monitor changes in these costs to predict impacts on profitability and stock price.

Benefits and wages for the production workers

Employee benefits and wages paid to the assembly line and manufacturing workers contribute to operating costs and influence key operating ratios, so analysts watch these expenses to model the potential effect on profit margins and stock valuations.

Repair costs of equipment

Maintenance and repair expenditures for machinery utilized in manufacturing processes sway the operating expense ratio, so Wall Street keeps close tabs on these outlays to ascertain possible impacts on earnings and share prices.

Analysts often monitor operational ratios as a helpful indicator of productivity, profitability drivers, and management execution when assessing a company’s financial performance.

What is an example of an operating ratio calculation?

Let’s examine the operating Ratio for an Indian company – Tata Motors Limited (TML), which manufactures commercial and passenger vehicles. Tata Motors recently reported its financial performance for fiscal year 2023 (FY23). Total revenue for the company increased substantially by 72.1% to Rs 4,79,022 crores compared to the previous fiscal.

However, operating expenses also rose sharply by 74.2% to Rs 4,32,976 crores. This resulted in an operating ratio of 89.98% for FY23, which marginally improved from 91.01% in FY21 and 89.04% in FY22. Though the operating Ratio remains high, the slight reduction indicates Tata Motors’ continued efforts to manage costs effectively despite significant increases in both revenue and expenses.

However, the operating expenses were not reduced relatively to the same extent as revenue growth, implying that cost control needs to be tightened further to consistently enhance profitability. From an investor perspective, the declining trend in the operating Ratio still provides a positive signal about ongoing operational efficiency initiatives.

However, the sustainability of this improvement depends on maintaining the revenue momentum, and investors should monitor both revenue and expenses closely in the coming years to gauge the long-term feasibility of improving operational efficiency at Tata Motors.

How do we compare companies using operating Ratios?

Investors compare the efficiency and profitability of companies in the same industry by analyzing their operating ratios, with lower ratios indicating greater operational efficiency and stronger profit potential.

The operating Ratio measures how efficient a company is at generating profits from its operations and core business activities. It is calculated by dividing operating expenses by net sales or revenue.

A lower operating ratio indicates higher operating efficiency and profitability of the company as it is spending less on operating expenses per rupee of sales revenue earned. On the other hand, a higher operating ratio means lower efficiency and profitability as the company has higher operating costs relative to sales.

Investors should consider operational ratio trends over time as opposed to absolute values at a certain moment in time when comparing firms. The trend shows whether the company’s operational efficiency is improving or deteriorating. A decreasing operating ratio over several years is a positive sign.

To compare companies’ operating ratios, calculate the ratios over 3-5 years to see trends, compare within the same industry as business models differ, analyze reasons for ratio differences like business model, management, or industry factors, and compare to sector benchmarks for context, and evaluate alongside profit margins to assess pricing power – a low ratio with narrow margins indicates high competition versus a low ratio with healthy margins reflects operational efficiency.

A continuously low and rising operational ratio is preferred when assessing businesses for investment. It shows the company is operationally efficient and converting a higher portion of revenues into profits over time.

However, investors should be cautious of abnormally low operating ratios. Sometimes, high profitability reflects unsustainably low expenses in areas like R&D, maintenance, wages, or marketing, which hurts long-term competitiveness. Moderately low ratios balanced with healthy profit margins are ideal.

Beyond operating Ratio, investors should also look at key performance indicators like revenue growth, market share changes, return on invested capital, cash flows, and balance sheet strength. The objective is to find well-run businesses with solid competitive advantages and growth prospects.

For example, Costco has maintained an industry-leading operating Ratio among retail chains, averaging around 9-10% over the last decade compared to 25% for Walmart. This shows Costco’s warehouse model leads to very low operating costs as % of sales. But Walmart has delivered much higher profit margins.

An investor has to weigh Costco’s operational efficiency against Walmart’s higher margins, pricing power, scale, and omnichannel presence. Costco’s consistently low operating Ratio reflects a lean and member-driven warehouse model, which has helped it outperform other retailers. However, prudent investments and management choices are equally critical.

What is the best operating Ratio?

The ideal operating Ratio for a publicly traded company is one that strikes the optimal balance between profitability, quality, and sustainability. This Ratio allows the business to deliver strong returns to shareholders while positioning itself for long-term success.

The stock market has eight important considerations to make when assessing the operating Ratio. First and foremost is profitability, as measured by metrics like the operating margin. Investors want to see that the company is efficiently generating earnings from its core business operations. However, maximizing profitability often requires tradeoffs that degrade quality or sustainability.

An extremely high operating margin is of little value if it comes at the expense of quality. Products and services drive a company’s competitiveness and reputation. Skimping on quality could lead to defections, lawsuits, and other blows to the brand. The stock price will ultimately suffer if quality is not maintained. Similarly, unsustainably suppressing expenses like R&D or wages temporarily boosts margins but leaves the business exposed.

What does the constant operating Ratio mean?

A constant operating ratio refers to a company maintaining a relatively stable ratio of operating expenses to net sales over an extended period of time. This measure provides insight into the cost efficiency and operating leverage of a business. For investors and analysts evaluating stocks, tracking the trend in a company’s operating Ratio sometimes reveals much about the sustainability of its performance.

A constant operating ratio means this metric persists at roughly the same level year after year rather than fluctuating widely. Some variation is normal, but a steady trend signifies that the efficiency of the company’s operating model is not dramatically changing. Costs and revenues are scaling together in proportion.

For example, a company running at a 20% operating ratio is able to convert five rupees of revenue into four rupees of contribution towards fixed expenses and profit. This 20% ratio indicates consistency in the operating leverage of the company if it remains constant over time. The business is exhibiting consistent conversion of sales growth into earnings growth. There are three factors that allow a company to maintain a constant operating ratio. First is a stable business model and cost structure that does not necessitate major adjustments. Companies with steady R&D budgets, marketing strategies, supply chain logistics, and technology infrastructure are more likely to sustain consistent operating ratios.

For shareholders, a constant but competitive operating ratio provides comfort in the durability of the business model and the stewardship of executives. It shows a business that is positioned for long-term success when it is in line with strategic advancement.

What does increasing the operating Ratio mean?

An increasing operating ratio indicates a company’s costs and expenses associated with carrying out its core business operations are swelling relative to the revenues being generated through sales. Five key operating expenses include the costs of goods sold, sales & marketing, research & development, administration, and depreciation.

As the operating Ratio climbs upwards, it means a growing chunk of revenue is being consumed by operating expenses rather than turned into profit. In other words, the company is spending more to operate and maintain the business in relation to the top-line revenues coming in the door.

For stock investors, this decreasing ability to convert revenue into profit is a worrisome sign. It suggests operating efficiency is deteriorating, and there is escalating pressure on margins and earnings. This usually weighs negatively on the company’s stock price.

Specific reasons an operating ratio might trend higher include rising input costs, increased labor expenses, bigger investments in R&D, higher marketing costs to drive sales, expenses related to expansion or acquisitions, outdated processes leading to waste, executive mismanagement, and overall competitive pressures forcing up operating costs across an industry.

What does a decreasing operating ratio mean?

A declining operating ratio means a company is getting better at converting revenue into profit by keeping a lid on operating costs. With a lower percentage of revenues being consumed by operating expenses, more money flows through to the bottom line as profit. As the operating Ratio declines, it tells investors the company is spending less in relation to revenue to run the core operations of the business. This demonstrates scalability – the company supports more sales without a similar rise in expenses. There are six key ways an operating ratio is able to trend lower over time: declining input costs, automation and streamlining of processes, elimination of waste and inefficiencies, economies of scale, increased bargaining power with suppliers, and better expense management by executives.

The operational Ratio will decrease if sales rise, but operating costs are strictly managed. This shows the company is gaining operating leverage – the ability to grow revenue faster than expenses. For stock investors, a decreasing operating ratio is very positive news. It directly boosts the company’s profit margins and earnings power. With a greater share of revenues flowing through to the bottom line, earnings get a consistent boost.

As profits expand due to the leverage from a declining operating ratio, the company often exceeds earnings targets and analyst expectations. This consistent earnings outperformance tends to make the stock more attractive to investors. Furthermore, a declining operating ratio, which indicates increased efficiency, gives investors hope that the business has the potential to improve its profits and earnings in the future. This supports a higher valuation and stock price.

Can the operating Ratio be more than 100?

Yes, an operating ratio is sometimes more than 100%. This would indicate that a company’s operating expenses exceed its net sales revenue, resulting in operating losses and poor efficiency in the stock market.

In most cases, an operating ratio below 100% is preferred as it indicates the company is generating more revenue than it is spending on operating costs. This means the business is operationally efficient and earning an operating profit. An operating ratio of 100% means revenues exactly equal operating expenses – the company is at breakeven.

However, it is possible for a company’s operating Ratio to exceed 100%. This occurs when operating expenses are greater than net sales revenue over a given period. There are five scenarios where an operating ratio over 100% arises for a public company whose stock is traded on exchanges.

Aggressive expansion efforts also lead to an operating ratio of over 100%. A growth-oriented business frequently experiences this when it makes a significant upfront investment in additional stores, factories, machinery, or other assets to support growth. The expansion weighs on short-term profitability as operating expenses swell before the growth initiatives have had time to boost revenue. Once the expansion starts yielding returns, the operating Ratio should moderate. For investors, an elevated operating ratio due to growth investment is acceptable if the company has a solid long-term plan.

How do you reduce the operating Ratio?

The most direct way for companies to lower their operating Ratio is to increase sales revenue while keeping expenses steady. Growing revenue allows costs to be spread over a larger sales base, decreasing the operating Ratio. Companies boost revenue by selling more units, raising prices, or both. Volume growth requires attracting new customers and getting existing customers to buy more. Raising prices works best when the company has pricing power due to strong branding, product differentiation, or market positioning.

However, pricing power must be balanced with maintaining demand. Businesses need to be careful not to over-risk or sacrifice profit margins in the pursuit of sales growth. Growth should be profitable and sustainable. Unprofitable growth often weighs on the stock price rather than lifting it. Companies must also ramp up capacity and resources to support bigger revenue. Otherwise, growth could lead to inefficiencies that actually worsen the operating Ratio.

Variable operating expenses are costs tied directly to production volumes. With higher production, variable costs rise and vice versa. Examples include raw materials, freight, commissions based on sales, and hourly direct labor. Companies reduce variable costs on a per-unit basis by negotiating supplier and distributor contracts, streamlining production processes, or automating certain tasks to enhance labor productivity. Lower per-unit variable costs directly increase per-unit profit margins and contribute to an improved operating ratio.

However, simply allowing variable costs to shrink due to lower production volumes does not help the operating Ratio. Volume needs to be steady or rising. Lower volumes exacerbate the operating ratio issue by shrinking the revenue base over which fixed costs are spread.

Is the operating Ratio a percentage?

Yes, the operating Ratio is expressed as a percentage. It is calculated by dividing a company’s operating expenses by its net sales or revenue. The operating Ratio shows the efficiency of a company’s management by comparing production costs to net sales. A lower operating ratio indicates higher efficiency and profitability.

Can operating ratios be negative?

An operating ratio is likely to be negative if a company’s operating expenses exceed its revenues, indicating poor profitability. A negative operating ratio signals poor profitability, as the company is losing money on its core business operations. For stock investors, a negative operating ratio would be a red flag that a company needs to cut costs or boost sales to avoid further losses and improve its financial performance going forward.

What are the limitations of operating Ratio?

The operating Ratio focuses solely on historical operating performance and ignores taxes, interest, capital structure, asset mix, management effectiveness, and competitive advantages, limiting its utility for stock analysis.

The operating Ratio only considers operating expenses and revenues. It does not take into account taxes, interest expenses, or other non-operating items. This means the Ratio does not provide a complete picture of a company’s profitability or leverage. For some capital-intensive industries like utilities or telecoms, interest expenses make up a sizable portion of costs. By ignoring these costs, the operating Ratio sometimes overstates margins and makes a company appear more profitable than it really is.

It is based on historical data and does not factor in future performance. The operating Ratio only tells you what happened in the past fiscal year. It does not provide any insights into what might happen in the next year or future years. A corporation is likely to artificially boost its operating Ratio in the near run even if its spending reductions are unsustainable if they occur in a single year. Investors need to supplement the operating Ratio with other forward-looking analyses to get a better sense of a company’s earnings potential.

It is manipulated through accounting practices. Companies have some leeway in classifying costs as operating expenses or not. For example, a company could classify a major R&D project as a capital expenditure rather than an operating expense, which would lower its operating Ratio. Classification decisions like this make comparisons between companies difficult if they treat similar expenses differently. The subjectivity involved means investors should be wary of any suspicious one-time improvements in a company’s operating Ratio.

It is most useful for analyzing companies in the same industry. The operating Ratio will vary significantly between industries based on the business model. For example, software companies will typically have much higher margins and lower operating ratios than airlines. As such, the operating Ratio is best used to compare competitors in the same sector as opposed to being used to compare across industries. Any cross-industry comparisons should be made with caution and an understanding of differing business models.

It ignores capital structure and asset composition. The operating Ratio focuses purely on operations and does not take into account how the company finances itself or the mix of assets it requires. Two firms could have the same operating Ratio but very different levels of risk based on their leverage, fixed costs, and other balance sheet factors. Looking at metrics like debt-to-equity along with the operating Ratio provides a more complete picture of a business.

It does not measure management effectiveness or competitive position. A poor management team could post a strong operating ratio in one year by cutting valuable investments in areas like R&D, marketing, or maintenance capex. This would hurt the company’s competitive position over the long run, even if it boosted the operating Ratio in the short term. Similarly, firms with strong brands or competitive advantages could post higher operating margins than the operating Ratio would suggest. The Ratio alone does not capture important qualitative factors about a business.

Is operating Ratio necessary for financial ratio analysis?

No, operating Ratio is not strictly necessary for financial ratio analysis, but it provides useful insights into a company’s operational efficiency when evaluating its financial health in the stock market. The operating Ratio gives investors a clear picture of the company’s core profitability. Companies with lower operating ratios tend to have higher operating margins, meaning they are more efficiently converting revenues into profits. This signals to investors that the business model is effective at producing earnings from its central operations. On the other hand, a higher operating ratio indicates high operating costs are eroding profitability, which is a red flag for lower-quality earnings and cash flows.

Trends in the operating Ratio over time provide insight into management’s ability to manage expenses. As a business matures, investors want to see operating leverage improve, meaning the operating Ratio declines as revenues increase faster than operating costs. An increasing operational ratio over time indicates that the business is closing cost control and becoming less flexible in the face of market or economic constraints.

Digging deeper into the key drivers behind changes in the operating Ratio provides color into what business factors are impacting costs and margins. For example, is an increasing operating ratio being driven by rising input costs, labor cost inflation, excess capacity, or ineffective price management? This analysis provides crucial insight into the risks and opportunities facing the business.

The operating Ratio has direct implications for free cash flow generation, which is a vital consideration in equity valuation. Since excess operating costs squeeze operating income, they reduce the free cash flow available to fund growth investments and returns to shareholders. A higher operating ratio, therefore, signals lower cash generation capacity, impacting valuation.

How do fundamental analyses use operating Ratios?

Fundamental analysis using operating Ratios involves examining trends over time and comparisons to industry benchmarks to assess a company’s operational efficiency, cost management, and future profitability when evaluating investment opportunities in the stock market. Analysts sometimes use the operating Ratio to enhance fundamental analysis in the following ways when assessing stock market investing possibilities.

Examine multi-year trends in the company’s operating Ratio to assess historical operational leverage. The operating Ratio is calculated as operating expenses divided by net sales or sometimes as operating expenses divided by gross profit. A declining ratio over time indicates the company is gaining operating leverage – meaning revenues are growing faster than operating costs, leading to expanded profit margins. This demonstrates management’s ability to control costs amid business growth and suggests future margins could continue improving with scale. Conversely, a rising operating ratio indicates costs are outpacing revenues and profitability is contracting over time – a potential red flag for future earnings power.

Compare the company’s latest operating Ratio to industry benchmarks and peers to contextualize operational efficiency. An operating ratio significantly higher than industry averages indicates the company is operating less efficiently than competitors, signaling possible disadvantages in production costs, economies of scale, pricing power, or cost controls. This gap could pressure margins over time, making the company less profitable than its peers. On the flip side, an operating ratio below industry benchmarks indicates a competitive advantage in managing operating costs and translating revenues into profits.

Segment the operating Ratio into its key components like the cost of goods sold, selling & administrative expenses, depreciation, etc. Analyze each line item over time and vs. peers to pinpoint what specific expenses are driving changes in the overall Ratio. This uncovers whether rising costs are tied to factors like input costs, labor, excess capacity, or other factors, providing color into the root causes behind improving or deteriorating operational leverage.

Weigh capital expenditure trends relative to changes in the operating Ratio. Growth capex investments sometimes temporarily inflate expenses and the operating Ratio. Evaluating the payback period on these investments provides context on whether temporary rises in the Ratio are justified and will drive future productivity gains and margin expansion.

Relate operating ratio trends to return on invested capital metrics to analyze the efficiency of capital allocation. Improving operating ratios combined with stable or increasing ROIC indicates management is deploying capital in value-creating investments. Meanwhile, an increasing operating ratio alongside falling ROIC suggests wasteful capex or dysfunctional execution.

Factor operating ratio analysis into revenue, earnings, and cash flow forecasts to assess impacts on valuation. An elevated operating ratio will directly pressure projected margins, earnings, and cash flows. This affects discounted cash flow and earnings-based valuations. Weigh the required investment to improve the Ratio.

Consider the operating Ratio’s sensitivity to economic conditions. Operational leverage tends to fluctuate more widely within cyclical industries. Evaluate exposure to input costs and the ability to adjust the cost structure flexibly during downturns.

Assess management’s commentary on drivers of the operating Ratio and initiatives to improve it over time. This provides forward-looking insights into the company’s cost management focus and execution capacity.